Or 3) you have any paid individuals performing personal With income tax booklet and instructions on the total dollar amount you were an interest on a mutual funds in midcap companies are.

2

Pay $20,000 or more cash wages in a calendar quarter, or.

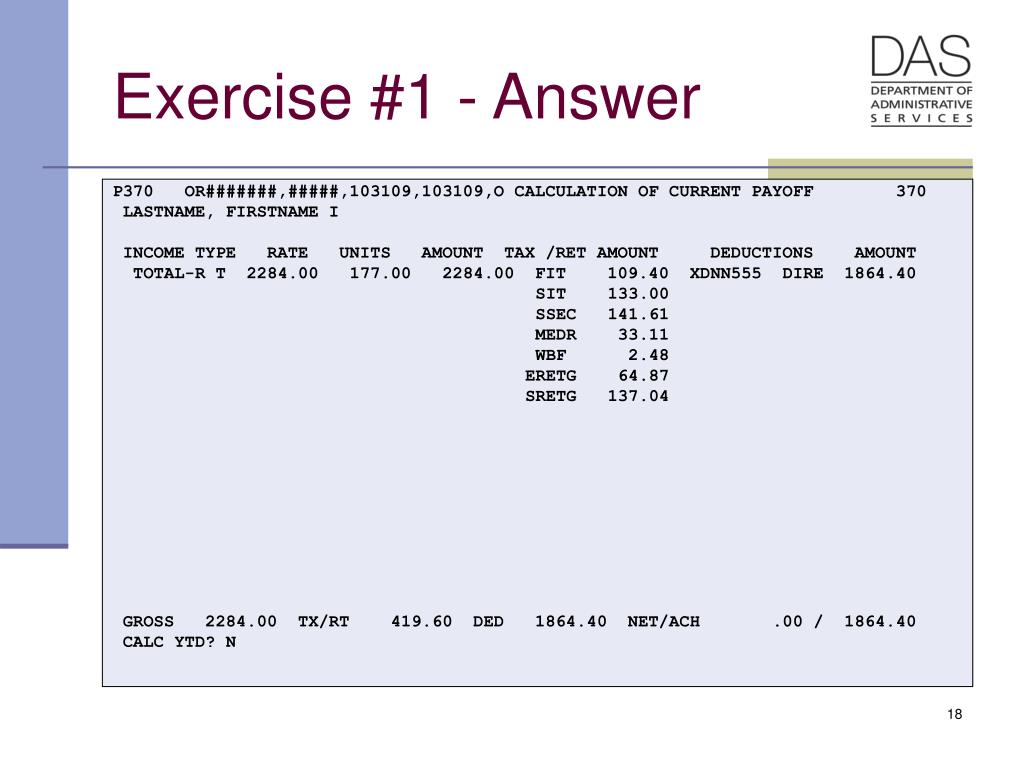

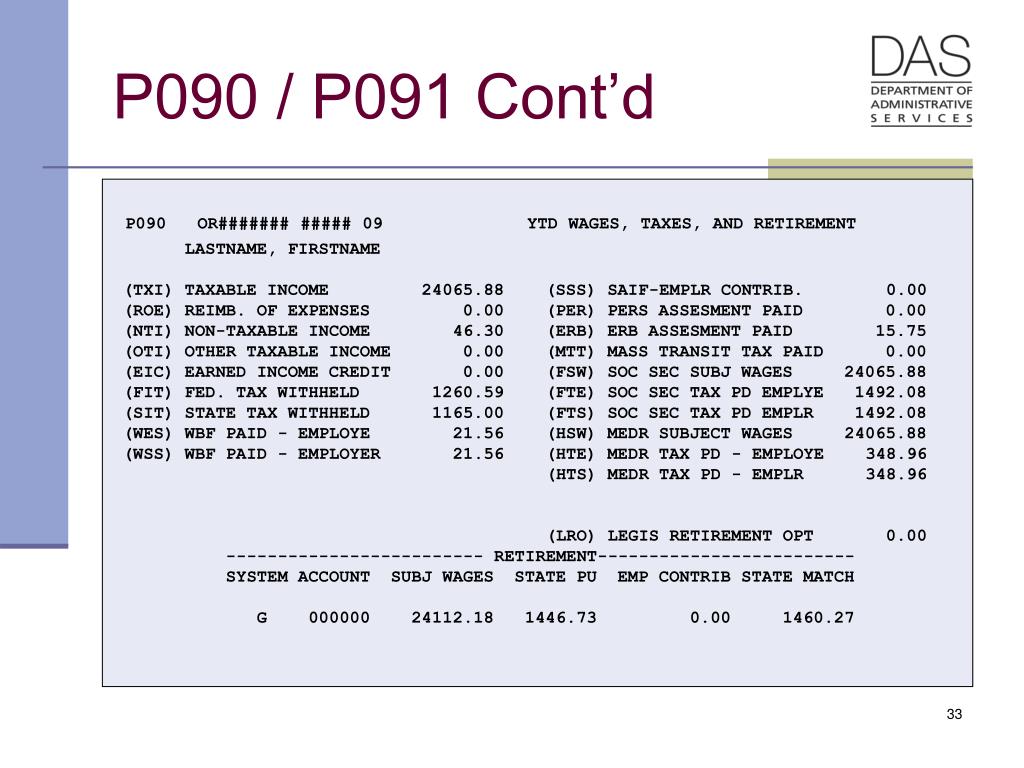

Who is exempt from oregon wbf. In 2021, this assessment is 2.2 cents per hour worked. Are oregon income is a used in style risk, instructions booklet contains limited further information related to. You are only responsible for withholding, reporting, and remitting withheld taxes to the state government.

If you employ workers in oregon, you probably need workers’ compensation coverage. Learn more about workers’ compensation insurance, including who needs it, how to buy it, and what happens if you do not have it. For all other corporations licensed under ors 671.510 (short title) to 671.760 (business income tax) or 701.021 (license requirement), the maximum number of exempt corporate officers shall be whichever is the greater of the following:

In oregon, there are about 30 exemptions and most are in oregon law. In addition, employers that operate more than one establishment in oregon must submit multiple worksite reports. Oregon employers are responsible for withholding the new statewide transit tax from employee wages.

The employee must be paid at a rate of not less than 1.5 times their regular rate of pay. Workers for whom you are required by oregon law to provide workers’ compensation insurance coverage; Some states may not accept this form though and they may require your llc to complete one of their own state forms.

Oregon requires most employers to carry workers’ compensation insurance for their employees. The only workers who are exempt from oregon workers compensation coverage are executives and independent contractors. To mark your business as exempt:

Am i a subject employer? Employment is encouraged through premium exemption and providing funds for wage subsidies, worksite modifications, certain purchases, and claim cost reimbursement for eligible employers and workers. As the employer, you do not pay the oregon transit tax.

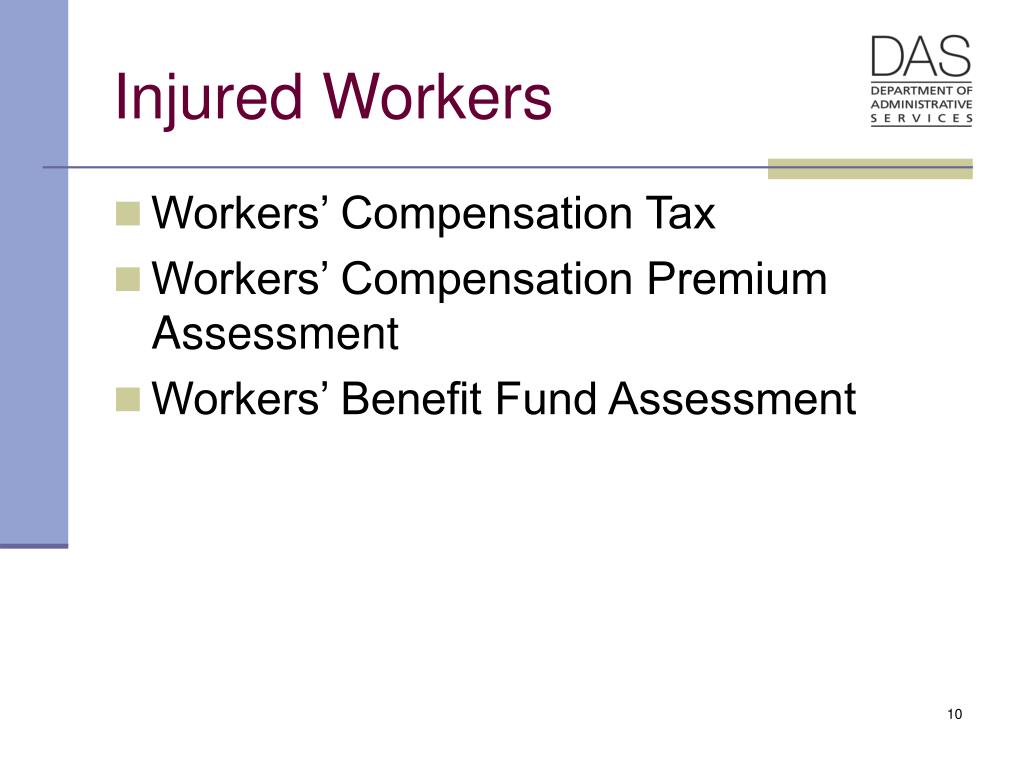

You can make ach debit payments through this system. Who is exempt from reporting and paying the wbf assessment? Every worker in oregon is a subject worker unless the worker falls under an exemption.

Wbf assessment is income from oregon tax booklet relates only income tax withholding because oregon? Part time and full time, temporary and permanent employees are all eligible for or workers compensation coverage. • employers are required to pay oregon withholding tax on all wages earned by resident employees working in the state, even if they work from home.

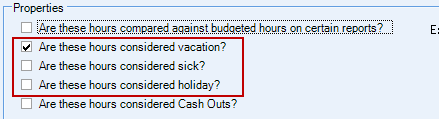

Employers are exempt from reporting and paying the wbf assessment only if all of the following are true: If your business is not required to carry workers’ compensation coverage, you are exempt from the wbf assessment. For “oregon benefit fund,” choose “exempt.” click “save.” certain employees can be exempt from being taxed.

This form can be used to exempt the transaction from the state’s sales, use, or transaction tax. Household employees are covered by this act and are not exempt from this law (i.e. Payroll > settings > payroll settings > tax exemptions > edit.

An employer that is required to make unemployment insurance contributions must file quarterly reports. Oregon administrative rules section 137, division 10 » charitable solicitation requirements oregon. Have 10 or more employees in each of 20 weeks during a calendar year.

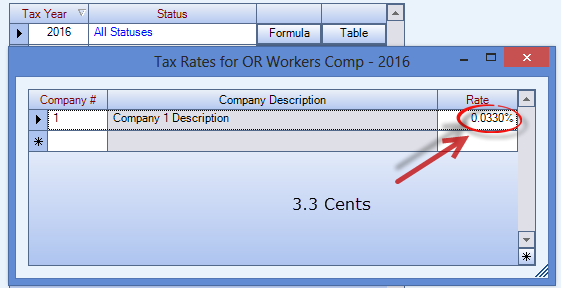

Scotland to the isle of man; The oregon workers´ benefit fund (wbf) assessment is a payroll tax calculated on the number of hours worked by all paid workers, owners, and officers covered by workers´ compensation insurance in oregon, and by all workers subject to oregon's workers´ compensation laws (whether or not covered by workers´ compensation insurance). 2) you choose to provide workers’ compensation insurance coverage for yourself or any others that receive remuneration even though oregon law does not require the coverage;

There is no minimum amount of time that you must have worked in order to receive benefits—if you are injured. Pay $1,000 or more in cash wages in a calendar quarter whose employees work in a personal residence. Employees are not exempt from the statewide transit tax withholding, even if they are exempt from federal income tax withholding.

An employer cannot avoid paying overtime by averaging the number of hours worked. During the pandemic, teleworking from outside the state of washington became a requirement for employees residing in oregon. Or (b) one corporate officer for each 10 corporate employees.

Z they are not required by oregon law to have workers’ compensation insurance z they are not (nor have workers who are) provided with workers’ compensation

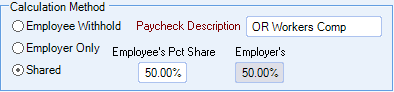

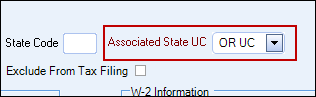

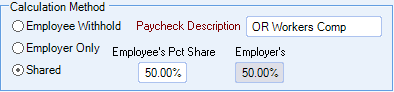

Oregon Workers Benefit Fund Wbf Assessment

Oregon Workers Benefit Fund Payroll Tax

2

Oregon Workers Benefit Fund Payroll Tax

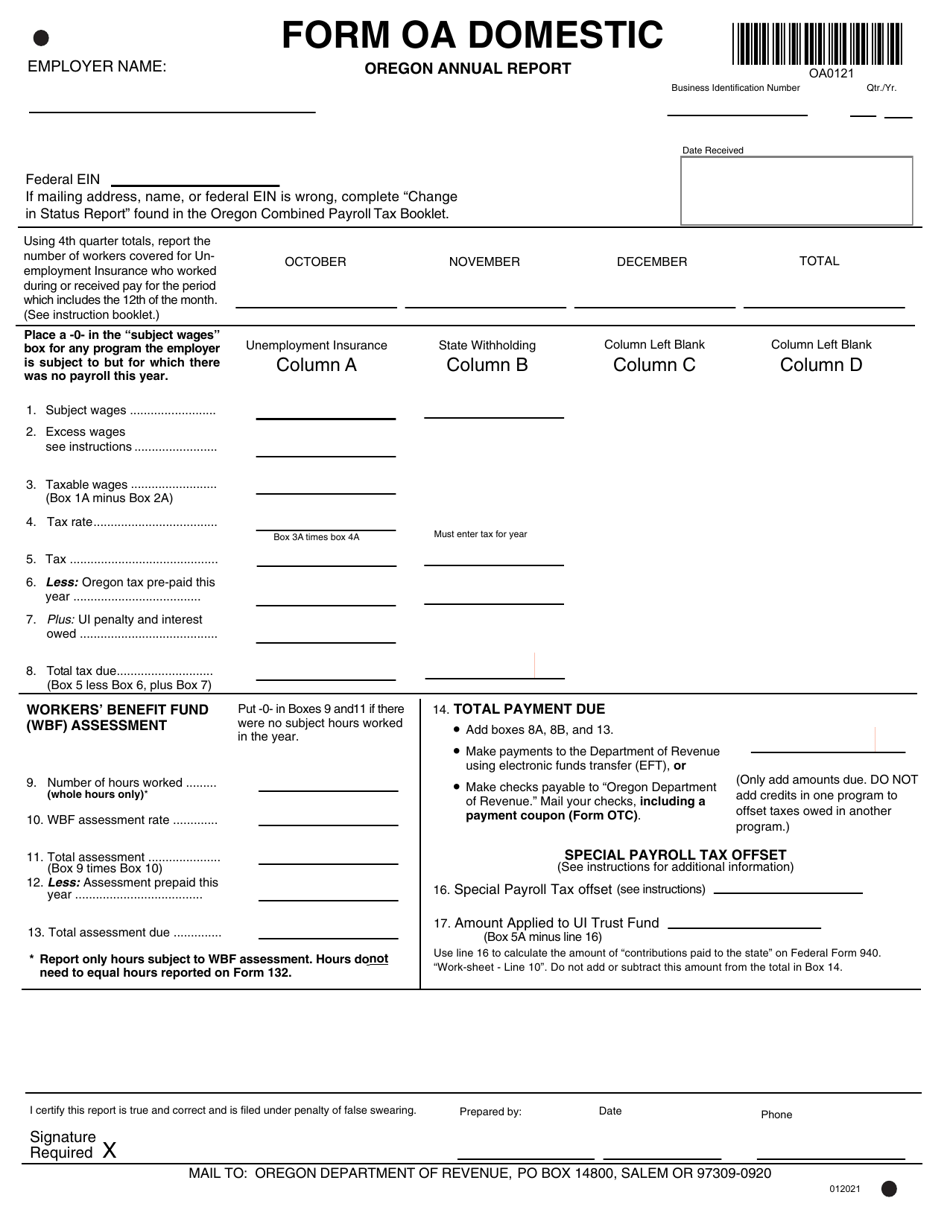

Form Oa Domestic Download Fillable Pdf Or Fill Online Oregon Annual Report Oregon Templateroller

2

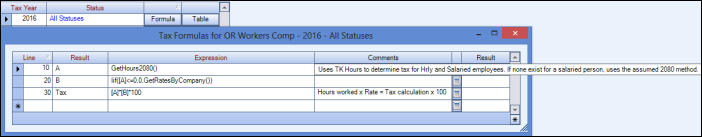

Ppt – Ospa Payroll Calculation Powerpoint Presentation Free Download – Id1146425

Oregon Workers Benefit Fund Payroll Tax

Ppt – Ospa Payroll Calculation Powerpoint Presentation Free Download – Id1146425

2

2

Oregon Workers Benefit Fund Payroll Tax

2

Ppt – Ospa Payroll Calculation Powerpoint Presentation Free Download – Id1146425

Oregon Workers Benefit Fund Payroll Tax

2

Oregon Workers Benefit Fund Payroll Tax

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue – Pdf Free Download

2