To fund the bbb, original drafts included widespread tax increases on individuals and corporations, including an increase in the capital gains rate for transactions occurring after september 13, 2021. Under the current proposal, “gains realized prior to sept.

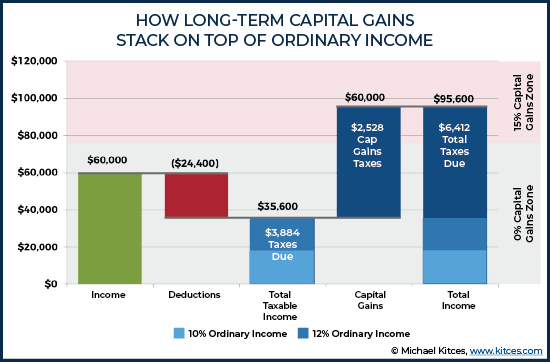

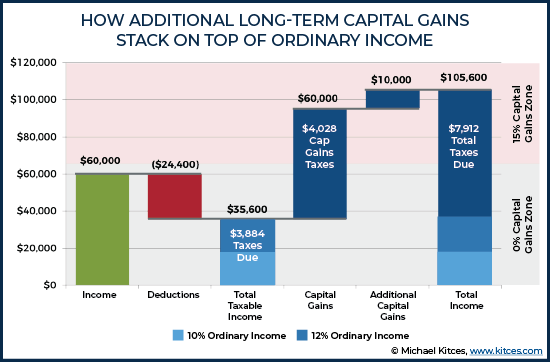

The Tax Impact Of The Long-term Capital Gains Bump Zone

A summary can be found here and the full text here.

When will capital gains tax increase in 2021. Gains realized after that date would be taxed at a. House democrats propose raising capital gains tax to 28.8% published mon, sep 13 2021 3:33 pm edt updated mon, sep 13 2021 4:06 pm edt greg iacurci @gregiacurci The effective date for this increase would be september 13, 2021.

Once again, no change to cgt rates was announced which actually came as no surprise. To address wealth inequality and to improve functioning of our tax system, tax rates on capital gains income should be increased. Understanding capital gains and the biden tax plan.

Biden proposed raising the top capital gains tax from 20% to 39.6% before a joint session of congress on april 28. Posted on january 7, 2021 by michael smart. The chancellor will announce the next budget on 3 march 2021.

Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is. Assuming you own $75,500 worth of bmo shares in your tfsa, your. Concerns that the tax law could change—and specifically that capital gains taxes will increase—is pushing investors to sell properties before the clock strikes 2022.

Currently, the capital gains tax rate for wealthy investors sits at 20%. In 2021, the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. The current tax preference for capital gains costs upwards of $15 billion annually.

Single filers with income over $523,600 The proposal is bumping this up to 39.6%. Earn as much as possible now while the tax rates have not increased and get those trust deeds in order to try and avoid the impact of the new surcharge (and the 3.8% niit).

Could capital gains taxes increase in 2021? It’s time to increase taxes on capital gains. There is a change on the horizon, which can take place as soon as 2022.

You’ll owe either 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year, depending on your annual taxable income (for more on how to calculate your long. An increase in capital gain rate. The proposal would increase the maximum stated capital gain rate from 20% to 25%.

Still another would make the change to capital gains tax retroactive, with a start date of april 2021.1,2 Historically, capital gains tax has sat around 20%. Ots proposals suggested bringing capital gains tax in line with income tax, currently charged at a basic rate of 20 percent, and rising to 40 percent for higher rate taxpayers.

13 will be taxed at top rate of 20%; There are exceptions to this, such as when it was 15% from 2004 to 2012. Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the nervousness that the chancellor would bring cgt more in line with income tax but again this did not materialise.

Bmo also outperforms the tsx, thus far, 2021 (+36.6% versus +19.35). For 2021 the top tax bracket includes the following taxpayers: The house ways and means committee released their tax proposal on september 13, 2021.

Whats In Bidens Capital Gains Tax Plan – Smartasset

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Tax 101

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

The Tax Impact Of The Long-term Capital Gains Bump Zone

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What You Need To Know About Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

What You Need To Know About Capital Gains Tax

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

The Proposed Changes To Cgt And Inheritance Tax For 20212022 – Bph

The Tax Impact Of The Long-term Capital Gains Bump Zone

The States With The Highest Capital Gains Tax Rates The Motley Fool

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy