2021 (taxes payable in 2022). 50% of the second installment payment is due by nov.

Lake County Il Property Tax Information

Delinquent taxes & prior years sold.

When are property taxes due in lake county illinois. Their next payment is due june 1. As a taxpayer, you have a right to the following: Lake county property tax appeal deadlines & due dates 2021.

According to the illinois compiled statues, 35 ilcs 200/15 the lake county collector is bound by state law to collect 1.5% penalty per month on any unpaid installment balance after the due dates. Lake county collects the highest property tax in illinois, levying an average of $6,285.00 (2.19% of median home value) yearly in property taxes, while hardin county has the lowest property tax in the state, collecting an average tax of $447.00 (0.71% of median home value) per year. The lake county treasurer's office will be sending notice of the deferred payment plan to lake county property owners through the mail.

50% of the second installment payment is due by sept. 8, now will not be considered late until nov. 2020 real estate tax calendar.

Learn how the county board has kept the tax levy flat for fiscal years 2020 and 2021. Under the new plan, only half of the first payment will be due at the time. Last day to submit ach withdrawal application for the 1st installment.

The median property tax in lake county, illinois is $6,285 per year for a home worth the median value of $287,300. See detailed property tax report for 580 s genesee st, lake county, il. Appealing your property tax appraisal.

50% (remainder) of first installment normally due on june 8; The first installment of property tax bills is due on june 8. Select tax year on the right:

The earliest you can submit a property tax appeal is the date listed as “open for filing” and no property tax appeal will be accepted after the “closed for filing” deadline. Cook county and some other counties use this. In most counties, property taxes are paid in two installments, usually june 1 and september 1.

Lake forest il 60045 : The first installment of property tax bills is due on june 8. The tax offices are working in the 2020 year, which corresponds to the property tax bill property owners will receive in early may of 2021.

If the tax bills are mailed late (after may 1), the first installment is due 30 days after the date on your tax bill. Please note, you only receive one bill in may. The lake county assessor is responsible for appraising real estate and assessing a property tax on properties located in lake county, illinois.

The state of illinois does not have a statewide property tax. The first installment of lake county property taxes is due thursday, june 2. Property taxes are determined at local levels, and pay for services such as schools, libraries, park districts, fire protection districts and others.

Likewise, the second installment, which had been due sept. Under the new plan, only half of the first payment will be due at the time. Under the ordinance, lake county property owners must still pay the full amount of property taxes due.

50% of second installment normally due in full. Property owners may pay their property taxes under the following schedule without penalty: The exact property tax levied depends on the county in illinois the property is located in.

Lake county collects, on average, 2.19% of a property's assessed fair market value as property tax. Property taxes are due in june and september. Lake county 18 n county street waukegan, il 60085:

And there is no money to pay it, said karpf. Checking the lake county property tax due date. Below is a listing of 2021 deadlines for appealing your lake county property taxes with the board of review.

The karpfs pay $10,000 a year in property taxes. You can contact the lake county assessor for: Below is a listing of 2020 deadlines for appealing your lake county property taxes with the board of review.

Yearly median tax in lake county. The second installment is due sept. Learn more about consolidation efforts and how your property tax dollars are used to help make lake county a great place to live, work and visit.

Lake county has one of the highest median property taxes in the united. The other 50 percent is due by aug. Lake county 18 n county street waukegan, il 60085:

Doors closed for tax sale the annual tax sale is scheduled to be held on monday, december 6, 2021, in the assembly room (10th floor) of the county administration building, 18 n. County boards may adopt an accelerated billing method by resolution or ordinance. 50% of first installment normally due in full on june 8;

Lake county property tax appeal deadlines & due dates 2020. For this year due dates are june 7th and september 7th, therefore the penalty is calculated on the 8th of each month and is not prorated by state law. Dates in green have been announced (the window to appeal is now open) dates in red have passed (the window to appeal has closed) dates in gray are estimated based on previous years

The other 50 percent is due by aug.

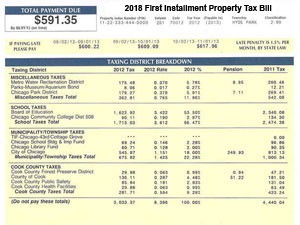

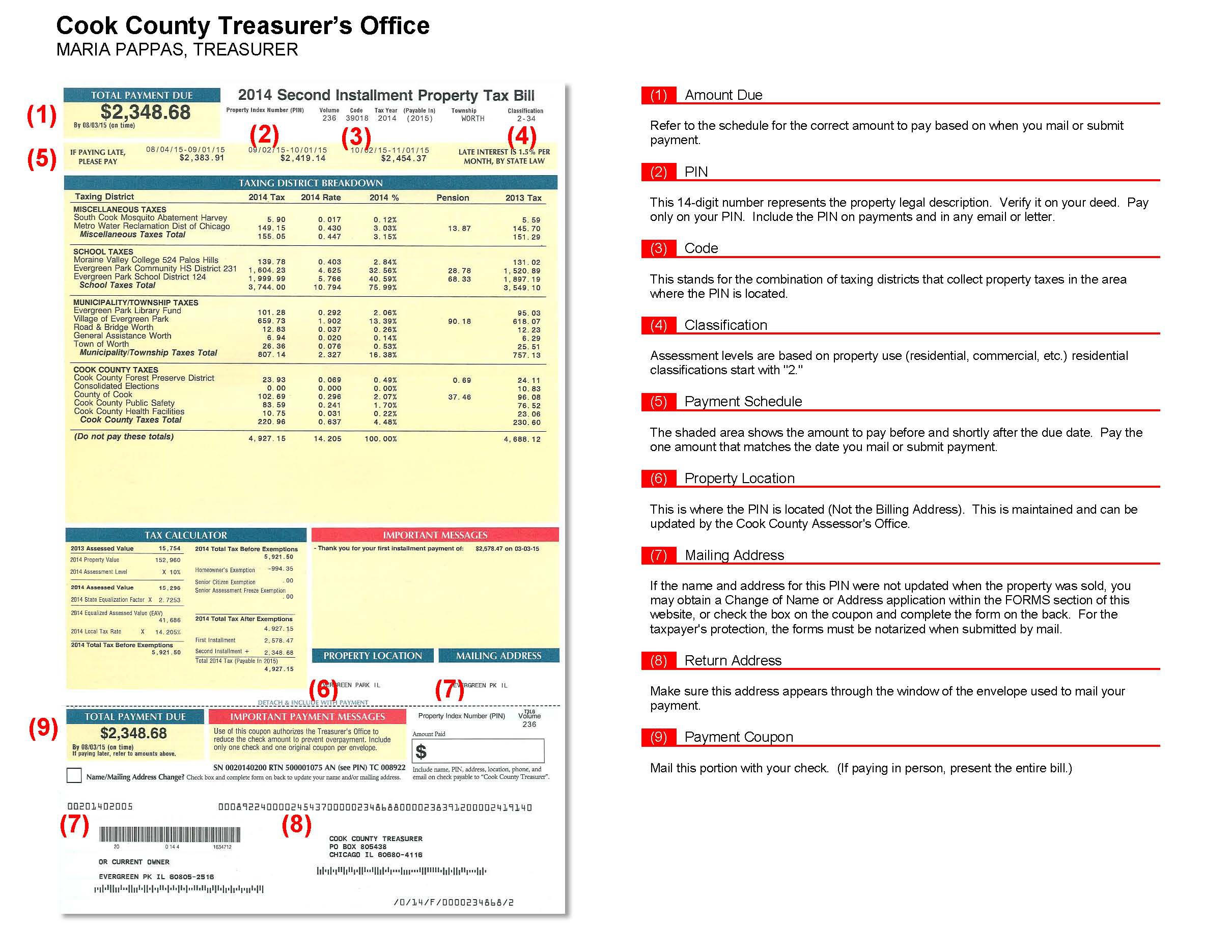

Cook County Property Taxes First Installment Coming Due Kensington

Cook County Property Tax Bill How To Read Kensington Chicago

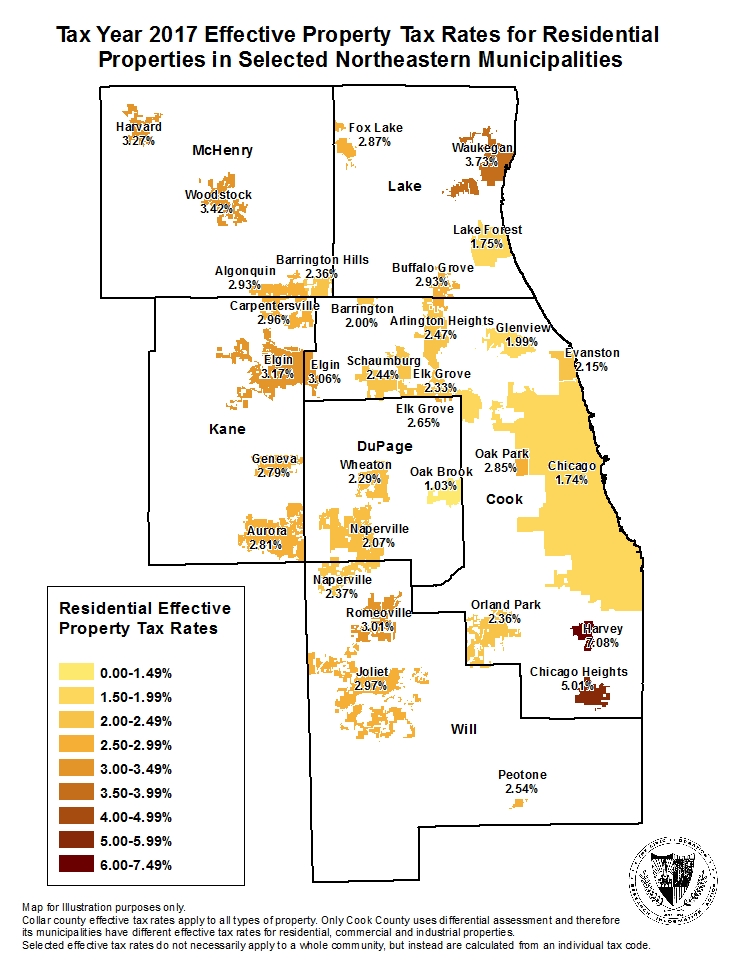

Ten-year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Lake County Il Property Tax Information

Lake County Appeal – Home Facebook

Amended 2019 Lake County Property Tax Bills Lake County Il

What Is The Right Tax Proration Amount In Chicago Closings – Chicago Real Estate Closing Blog

Tax Extension Lake County Il

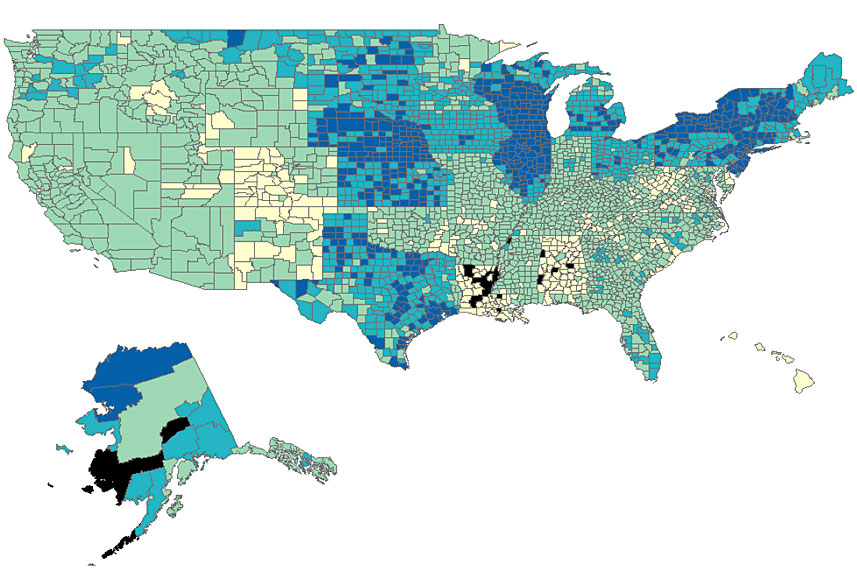

Illinois Now Has The Second-highest Property Taxes In The Nation Chicago Magazine

Property Tax – City Of Decatur Il

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

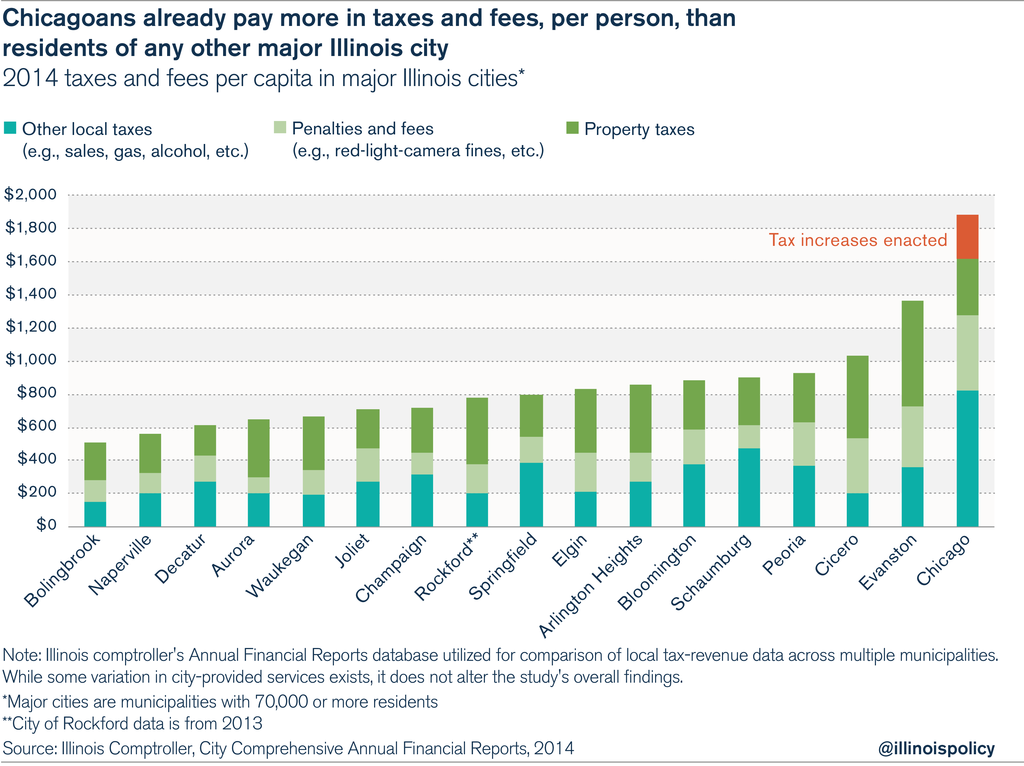

The Chicago Squeeze Property Taxes Fees And Over 30 Individual Taxes Crush City Residents

Estimated Effective Property Tax Rates 2008-2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Understanding The Tax Cycle Lake County Il

Property Taxes Lake County Il

Ten-year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Where Do Cook County Property Taxes Go Kensington

The Cook County Property Tax System Cook County Assessors Office

Property Taxes Lake County Il