Property owners must apply for an estimate of redemption, and the amount they pay will include the unpaid taxes, interest, and penalties. Learn more about mydec or to find.

Percentage Of Married Couple By Us County – Vivid Maps United States Map Map United States History

For more information about property taxes visit:

When are house taxes due in illinois. Yearly median tax in champaign county. The first installment of real estate tax is due june 16, 2021 with the second installment due date on september 1, 2021. Questions answered every 9 seconds.

The median property tax in champaign county, illinois is $2,905 per year for a home worth the median value of $145,200. In illinois, homeowners pay property taxes to the county tax collector of the county where the property is located. If the taxes remain delinquent, they will be offered for sale at the 2018 annual tax sale, which begins november 5, 2021.

The second payment is due september 1, 2021. The tax amount plus a fee must be paid to the county within 30 months of the sale (24 months for commercial or vacant property) or the property will be turned over to the tax buyer. (late payment interest waived through monday, may 3, 2021) tax sales.

A tax year is the year of assessment and reflects the value of real property as of january 1 of that year. The county collector holds a tax sale at the end of every tax year to sell the tax on every parcel that remains unpaid. Tax year 2020 first installment due date:

Illinois, new jersey, ohio, pennsylvania, wisconsin and washington: Before the county sells unpaid taxes it sends the taxpayer. Sangamon county taxes normally due june 12 can be paid through september 12.

Ad a tax advisor will answer you now! The county collector is usually the county assessor or treasurer. Sangamon county committed to moving due dates on property taxes to june 12 and sept.

What is illinois’ property tax cycle? If you are considering buying or selling a home in the state of illinois, you'll find it helpful down the road to know about every single fee that will inevitably make an appearance before closing — including transfer taxes. The actual tax bills are paid in the year following the tax year.

Property tax due dates for 2019 taxes payable in 2020: Your illinois filing period is the same as your federal filing period. If the tax bills are mailed late (after may 1), the first installment is due 30 days after the date on your tax bill.

View the treasurer's office tax year 2020 property tax bill analysis and statistics Tax bills were mailed april 30, 2021, and the first payment is due june 1, 2021. Tax year 2020 second installment due date:

12 to give residents extra time to obtain unemployment, stimulus checks or other relief. Champaign county collects, on average, 2% of a property's assessed fair market value as property tax. The statewide average effective tax rate is 2.16%, nearly double the national average.

In most counties, property taxes are paid in two installments, usually june 1 and september 1. Edwardsville — the final installment of this year's madison county property tax bills are due wednesday. Search by property index number (pin) search by property address

More states where real property tax breaks hinge on where exactly you live. Welcome to madison county, illinois. The typical homeowner in illinois pays $4,527 annually in property taxes.

For example, taxes on a 2021 assessment are paid in 2022. Champaign county has one of the highest median property taxes in. County boards may adopt an accelerated billing method by resolution or ordinance.

In some areas, this figure can be upwards of.

Pthe Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average Property Tax Chicago Tribune Income Tax Preparation

Millions Of Tax Dollars Improperly Refunded To Unauthorized Workers As Irs Insists Its Getting Better It Gets Better Irs Tax

Us States Target Corporate Cash Stashed Overseas Overseas Corporate Tax Haven

United States Map Of States With No Income Tax Alaska Washington Nevade Wyoming Texas South Dakota And Florida As Well As S Income Tax Income Retirement Budget

Chart 4 New Mexico Local Tax Burden By County Fy 2016jpg New Mexico Burden Tax

Su Reembolso De Impuestos Es La Clave Para Ser Propietario De Vivienda – Keeping Current Matters Tax Refund Home Ownership Equity

Reboot Illinois – Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax Dupage County County

Pin On Real Estate Is My Passion

Illinois Income Tax Calculator – Smartasset Income Tax Income Tax Return Federal Income Tax

How A Taxpayer May Obtain A Sales Tax Refund Zip2tax News Blog Tax Refund Sales Tax Refund

Illinois Property Taxes Danger Danger Property Tax Real Estate Infographic Real Estate Articles

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Low Taxes Tax

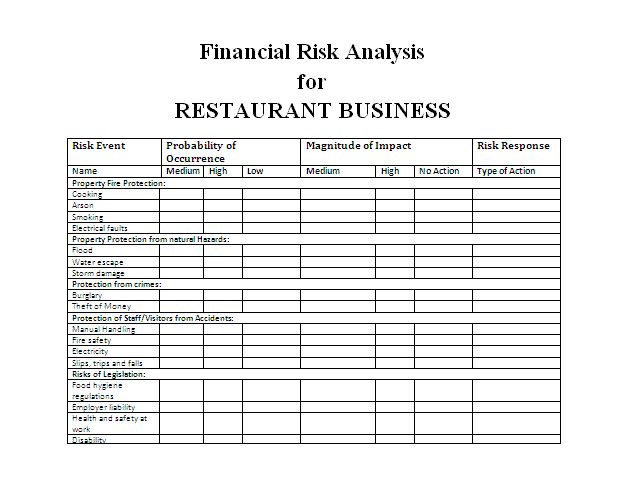

Financial Risk Analysis Risk Analysis Financial Statement Analysis Financial

Download Pdf The Complete Guide To Planning Your Estate In Illinois A Stepbystep Plan To Protect Your As How To Plan Estate Planning Attorney Estate Planning

The 10 Best States For Retirees When It Comes To Taxes Retirement Locations Retirement Retirement Advice

Before The Recent Tax Bill Was Passed There Was Some Discussion Around Lowering Contribution Limits On Preparing For Retirement Retirement Economic Indicator

South Carolina Property Tax Calculator – Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

Pin By Bobbie Persky Realtor On Finance – Real Estate Property Tax Tax Attorney Tax Lawyer

Cook County Il Property Tax Calculator – Smartasset Retirement Calculator Property Tax Retirement Strategies