There are a few different taxes involved when you place an order— sales tax: Instacart’s express membership fee and other fees are subject to applicable taxes.

Instacart Is A Service Where A Customer Selects And Orders Groceries Online Or Via A Web-based App When An Ordering Groceries Online App Brain Training Games

Gig platforms don’t withhold or take out taxes for you.

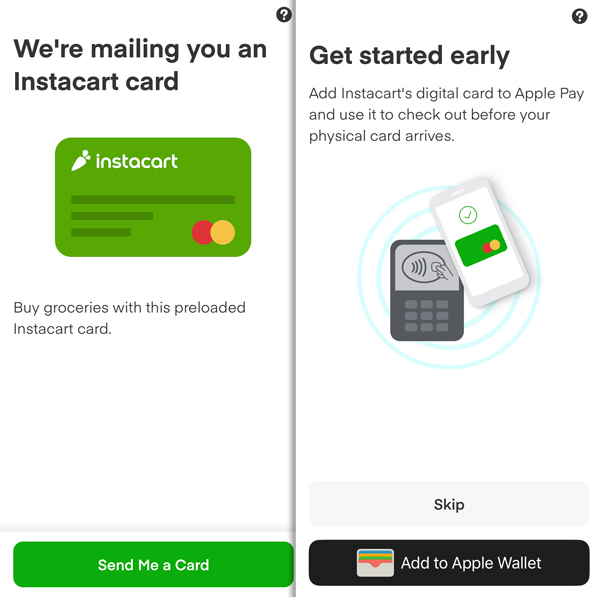

What tax form does instacart use. In canada, we usually get a tax form called a t4. This is because the irs does not require instacart to issue you a form if the company paid you under $600 in that tax period. New shoppers usually receive their cards within 5 to 7 business days.

The tax and/or fees you pay on products purchased through the instacart platform are calculated the same way as in a physical store. How to save for next year's taxes You won’t send this form in with your tax return, but you will use it to figure out how much business income to report on your schedule c.

For most shipt and instacart shoppers, you get a deduction equal to 20% of your net profits. The tax and/or fees you pay on products purchased through the instacart platform are calculated the same way as in a physical store. Except despite everything you have to put aside a portion of the cash you make every week to cover them.

How to fill out your schedule c; Instacart will review your application and notify you when you are approved. Progressive offers cheap commercial car insurance that covers using a personal vehicle for delivery services like.

Does instacart send tax forms. Four special tax deductions for self employed independent contractors; As you’re liable for paying the essential state and government income taxes on the cash you make delivering for instacart.

You don’t send the form in with your taxes, but you use it to figure out how much to report as income when you file your taxes. Does instacart take out taxes for its employees? You can calculate this by using our 1099 tax calculator.

Just fyi, prices are at least $0.40 more on instacart because the shopper is paid a commission on every item picked of $0.40 (as low as $0.20 in some markets). If you expect to owe more than $1000 in taxes per year, you’ll have to pay estimated taxes on a quarterly basis. You won’t send this form in with your tax return, but you will use it to figure out how much business income to report on your schedule c.

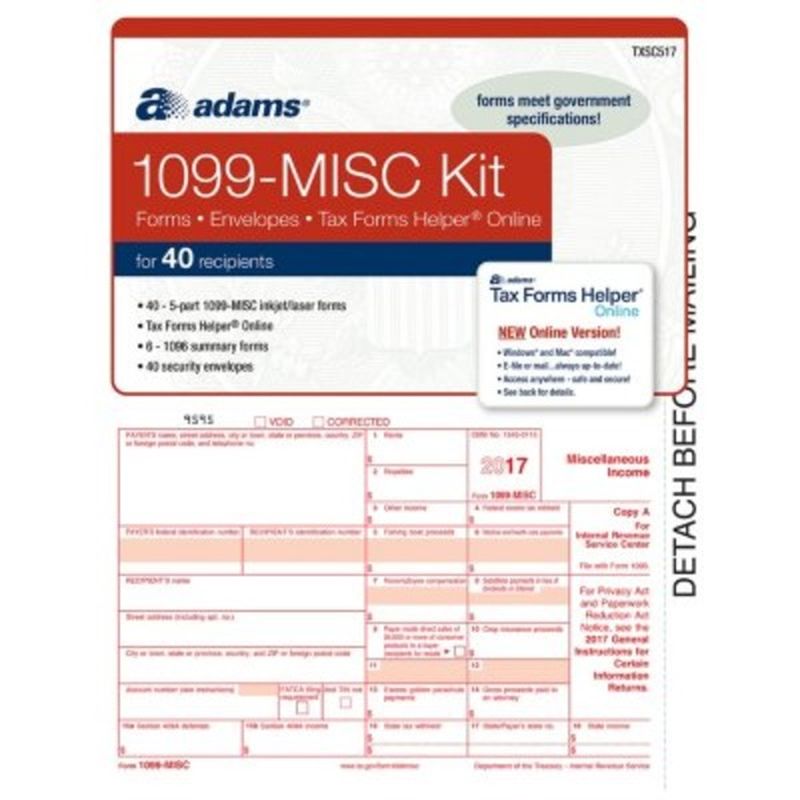

All companies, including instacart, are only required to provide this form if they paid you $600 or more in a given tax year. Get adams 1099 misc forms kit with tax forms helper online 2017 (each) delivered to you within two hours via instacart. Get adams 1099 misc forms kit with tax forms helper online 2017 (each) delivered to you within two hours via instacart.

Instacart shoppers use a preloaded card when they check out with a customer’s order. You need car insurance, but whether your personal policy will cover you depends. Once you are approved, you will see orders near your current location in the app.

If you have other business activities that are registered under a different business number, you file a separate t2125 form for it. Instacart 1099 tax forms by january 31st, instacart sends all their contractors 1099 forms and files a copy to the irs too, complying with the us tax law. Get your instacart payment card registered:

Contactless delivery and your first delivery is free! Whether you drive for instacart, doordash, postmates, shipt or another delivery driver service, this post is for you. Do instacart, shipt, postmates, doordash, or other platforms take out taxes?

I joined instacart in february 2018 and this is my first full year with instacart, which means it's time to do my taxes. This is because the irs does not require instacart to issue you a form if the company paid you under $600 in that tax period. All companies, including instacart, are only required to provide this form if they paid you $600 or more in a given tax year.

Filling out your income tax form 1040 for grubhub, instacart, doordash, uber eats contractors; You’ll include the taxes on your form 1040 due on april 15th. He should use the industry code for instacart in his t2125 form.

The taxes on your instacart income won’t be high since most drivers are making around $11 every hour. Today we're going to talk about the 1099 forms you receive and what they mean for you and your taxes. This is a standard tax form for contract workers.

How to file taxes for uber eats, grubhub, instacart, doordash, lyft etc. Instacart is a way to earn flexible income when you need it the most. The majority of instacart’s “profit” is from selling shopping trends and advertising space on their app.

The sales tax may be applied to some or all of the items in your order in accordance with local laws depending on the address of the store or your delivery address. Does instacart send tax forms. Progressive offers cheap commercial car insurance that covers using a personal vehicle for delivery services like.

How I Save 100 Per Month On Groceries With Instacart Eff The Joneses Shopping Hacks Money Saving Meals Frugal Living Tips

On-demand Grocery Delivery App Like Instacart Grocery Delivery App Instacart Delivery App

Adams 1099 Misc Forms Kit With Tax Forms Helper Online 2017 Each – Instacart

How Much Do Instacart Shoppers Make The Stuff You Need To Know

A Look Inside The Instacart Office In San Francisco Inneneinrichtung Innenausstattung Buero Bueroraumgestaltung

Becoming An Instacart Shopper In 2021 The Full Application Process – Ridesharing Driver

How To File Your Taxes As An Instacart Shopper – Contact-free Taxes

Instacart Taxes The Complete Guide For Shoppers Ridestercom

How To Add A Special Request To An Instacart Order 9 Steps

What You Need To Know About Instacart 1099 Taxes

Woman Struggles To Get Refund After Instacart Grocery Delivery Vanishes Amid Coronavirus In North Carolina – Abc7 Chicago

Instacart Fees Everything Youll Pay As A Customer Explained

Instacart Addresses Tip-baiting Instacart Alcohol Store Venture Capital

Does Instacart Track Mileage – The Ultimate Guide For Shoppers

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Illinois Coronavirus Instacart Other Online Shopping Apps May Include Markups In Grocery Delivery – Abc7 Chicago

How To Rate Your Shopper And Delivery Driver For Instacart

How To Get Instacart Tax 1099 Forms – Youtube

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors – Youtube