For example, the wage base for washington state employers is $52,700 for 2020. The state’s suta wage base is $7,000 per employee.

Answered Garrison Shops Had A Suta Tax Rate Of Bartleby

The $10,000 is 3.3% of the $300,000.

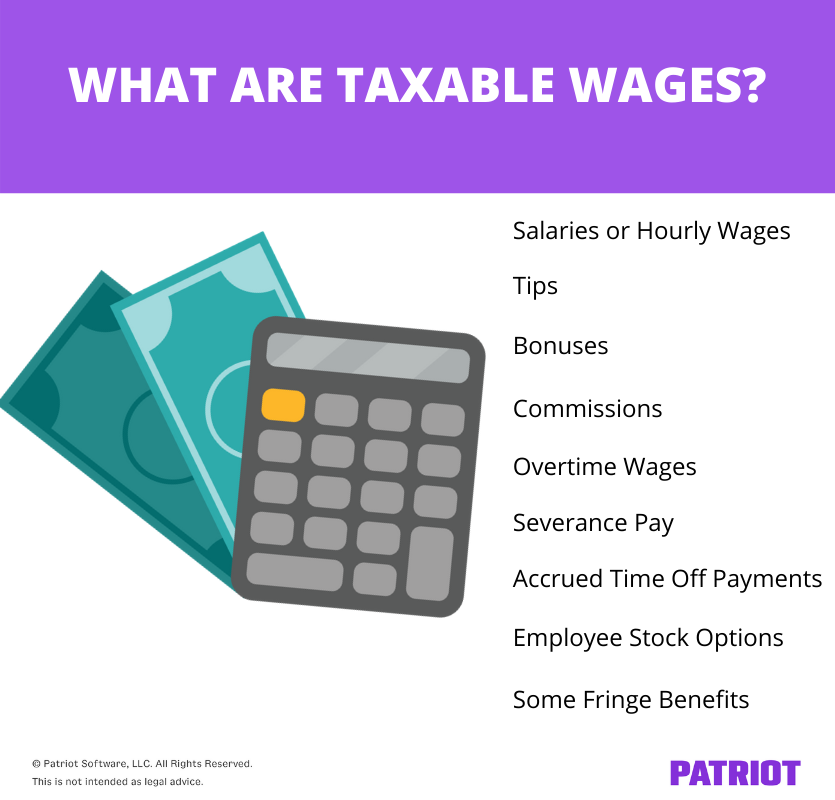

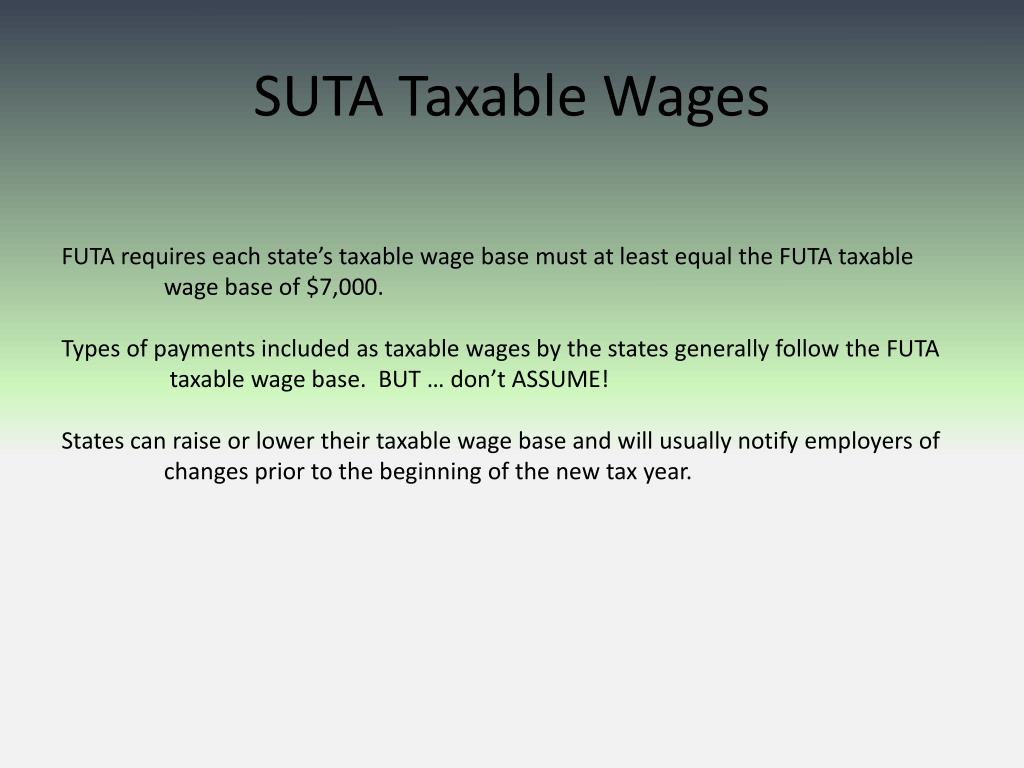

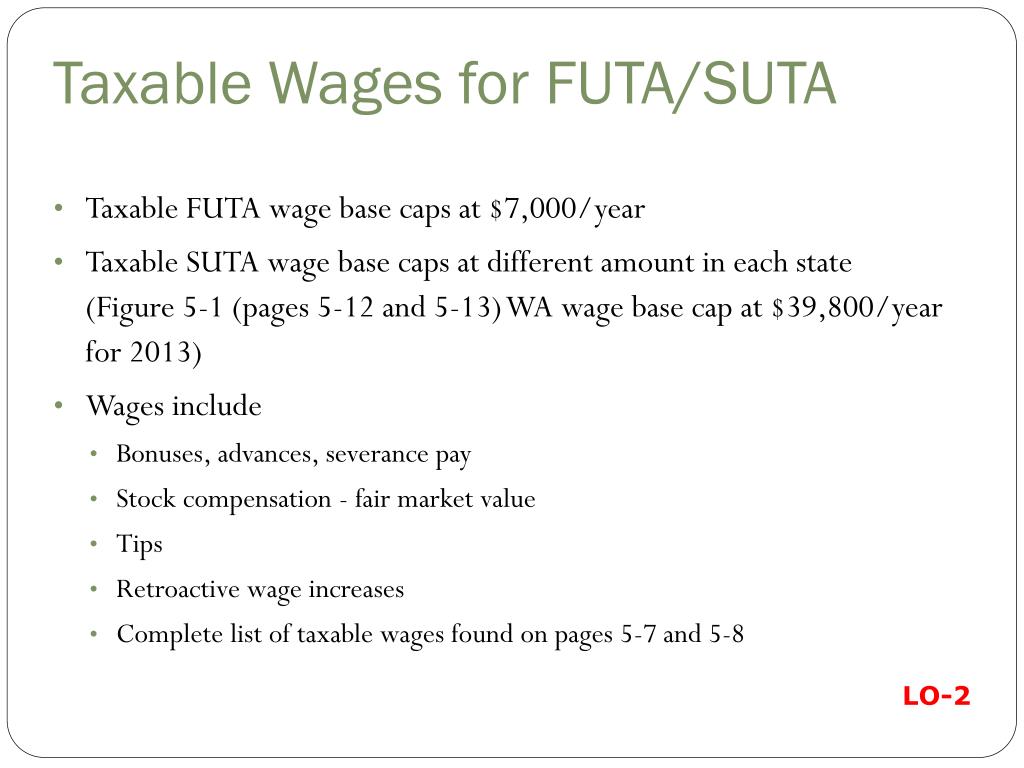

What is suta taxable wages. The taxable wage base applies to social security taxes because the amount of social security taxes withheld from each paycheck is determined by the employee’s taxable wage base. The $7,000 is often referred to as the federal or futa wage base. It serves the same purpose as the suta—collecting taxes from employers for the purposes of providing unemployment benefits.

Fortunately, most employers pay little suta tax if they haven’t had employees file unemployment claims. The taxable wage base is the maximum amount on which agents paid solely by commission students, if the employment is a recognized part of a program which combines academic instruction with work experience individuals performing services for a hospital in a clinical training program for a period of one year The 2021 employee sui withholding rate remains at 0.06% on total wages.

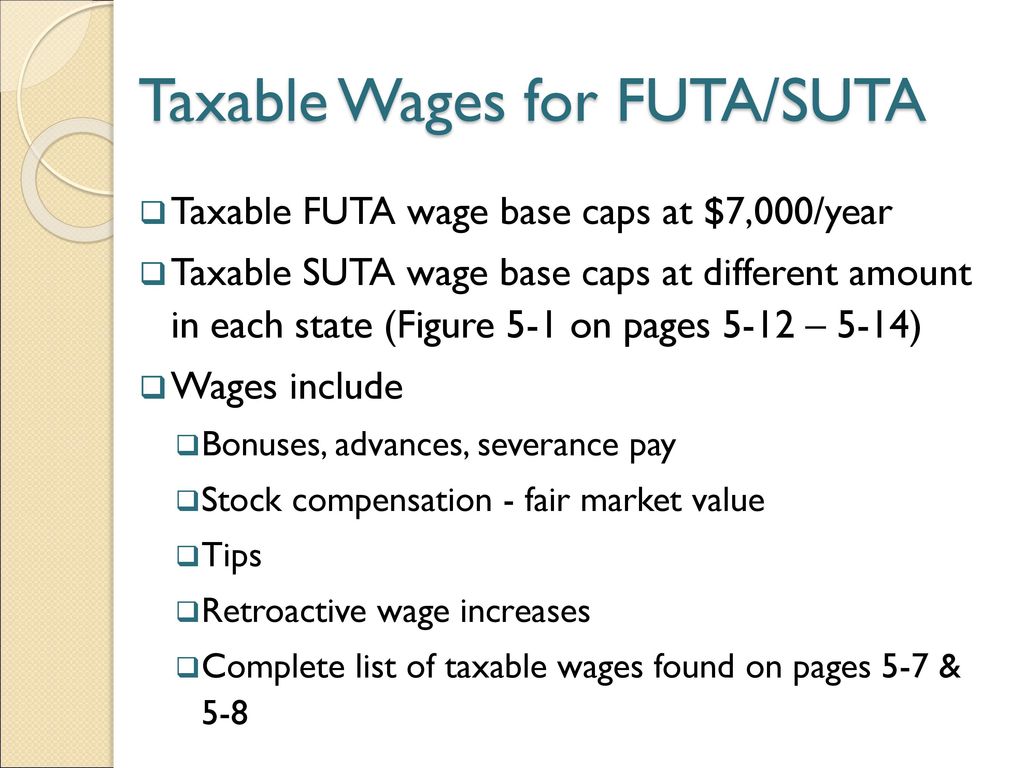

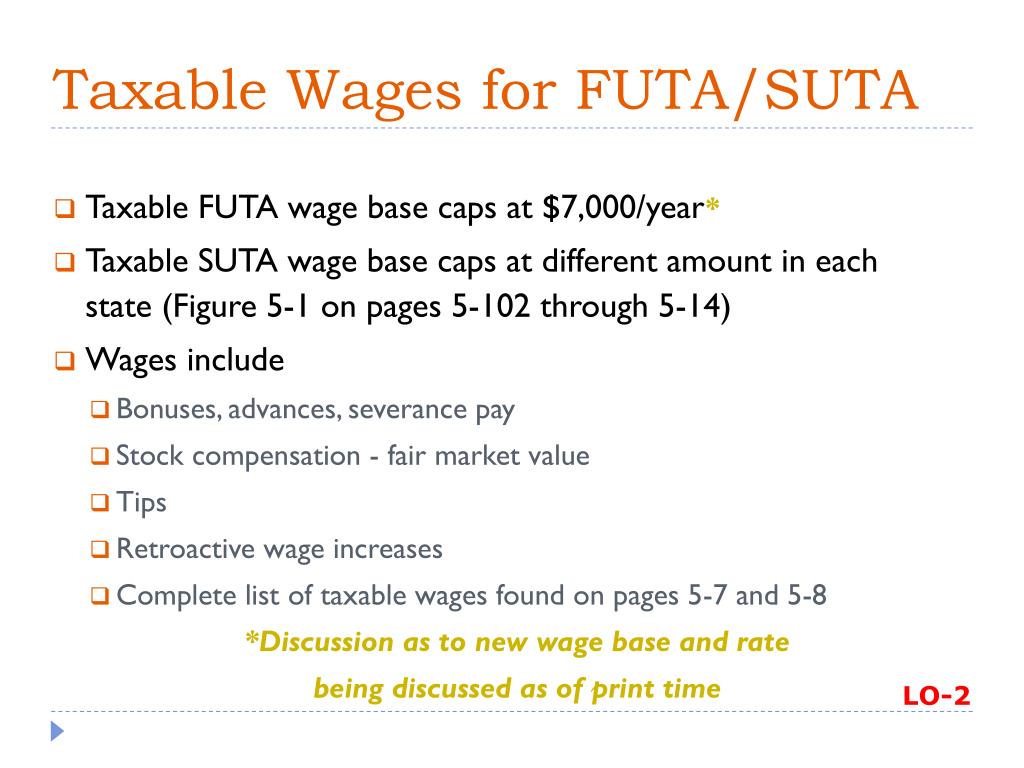

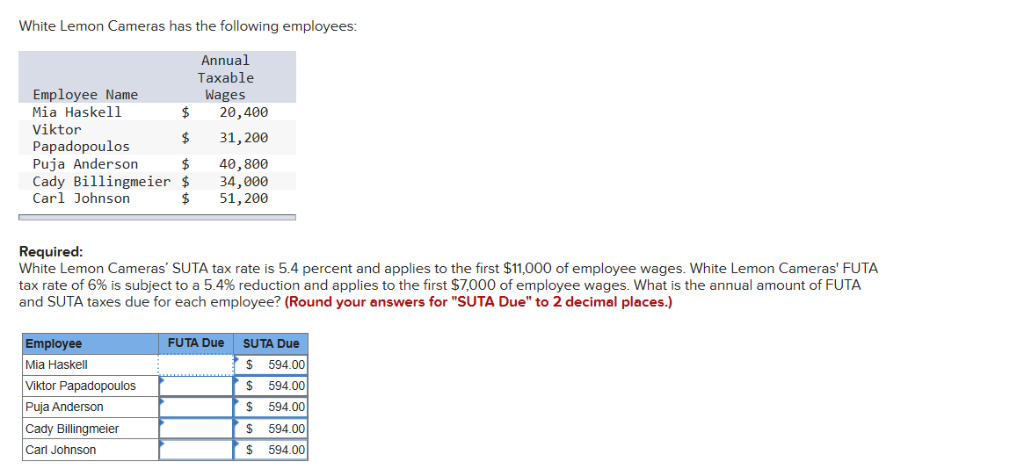

The futa tax rate is 6% and applies to the first $7,000 paid to each employee as wages during the year. Since your business has no history of laying off employees, your suta tax rate is 3%. Assume that your company receives a good assessment, and your suta tax rate for 2019 is 2.7%.

Suta subject wages depend on your state. Liable employers report employee wages and pay the unemployment tax based on state law under the texas unemployment compensation act (tuca). Some states use the same wage base as the federal wage base (of $7,000), others do not.

In florida in particular, the taxable wage base is among the lowest in the country. If you were not required to pay any state unemployment (suta) taxes on wages you paid throughout the quarter, there is no money credited to you within your state system, therefore you are required to pay an additional amount of futa tax. Check with your state’s taxation department to confirm the suta wage limit, or see our state tax account help page with specific state information.

Mailing of 2021 rate notices. Suta isn’t as cut and dry as the futa as it varies by state. Suta taxes are paid only on the first $7,000 of an employee’s annual wages (as of 2010).

Futa subject wages = medicare wages up to the first $7,000.00 of the employee’s annual earnings. Businesses usually file these taxes through their state anytime between october and december. In 2019, the taxable wage base for employees in texas is $9,000, and the tax rates range from.36% to 6.36%.

Some states apply various formulas to determine the taxable wage base, others use a percentage of the state’s average annual wage, and. The suta wage base is the same for all employers in the state. Using the formula below, you would be required to pay $1,458 into your state’s unemployment fund.

Assume that your company receives a good assessment, and your suta tax rate for 2019 is 2.7%. A taxable wage base, or threshold, is the maximum amount of an employee’s income that can be taxed. Wages are reported when they are paid rather than when they are earned or accrued.

State unemployment tax assessment (suta) is based on a percentage of the taxable wages an employer pays. Once you know the taxable wage base (demonstrated above), calculate how much social security tax is withheld from an employee’s paycheck by multiplying the taxable wage base by the social. Because of this feature, companies pay a fixed lump sum tax per worker they employ.

The benefit wage ratio is then referenced on the rate table in the oklahoma employment security act, using the state's current experience factor (50%) and conditional factor (d), which shows a. $7,000 per employee x 3 employees x 3.4% = $714 in suta tax The same limit applies to futa taxes.

Futa taxes are assessed on the first $7,000 of an employee’s wages as well. Employers can access their rate notice information in their ucms employer portal. This means all washington employers that.

In 2019, the taxable wage base for employees in texas is $9,000, and the tax rates range from.36% to 6.36%. 52 rows suta tax rates and wage base limit. Each state sets its own suta tax wage base.

Calculate the additional amount by multiplying 0.054 by the total taxable wages. The second unique feature of ui taxes under suta is that the taxable base is on average ~$10,000 per employee, much less than the average yearly earnings of a given worker. Using the formula below, you would be required to pay $1,458 into your state’s unemployment fund.

2020 state unemployment insurance taxable wage base That means that in 2020, you’ll pay: Employers pay state unemployment insurance contributions based on what they pay their employees, up to a certain state wage base.

The sui taxable wage base continues at $10,000 for 2021. Each state has its own suta tax. If you qualify for the maximum credit, the.

Employers are liable for vermont suta tax if they pay wages of at least $1,500 during a calendar quarter or employ at least one worker for some part of a day in 20 different weeks in a calendar year. If the employee has exceeded the limit, it is not necessary to calculate suta taxes. Employers report employee gross wages each quarter and pay taxes on the first $9,000 per employee, per year.

For 2020, the taxable wage base (or ‘taxable wage limit’) in california is$7,000 per employee, and the average suta tax is 3.4%. According to the irs, if you paid wages subject to state unemployment tax, you may receive a credit of up to 5.4% of futa taxable wages when you file your form 940. Once these wages are taxed, that person’s pay becomes their net pay.

“only the first $7,000 of wages paid to each employee by their employer in a calendar year is taxable.” applying and registering You have employees with the following annual earnings:

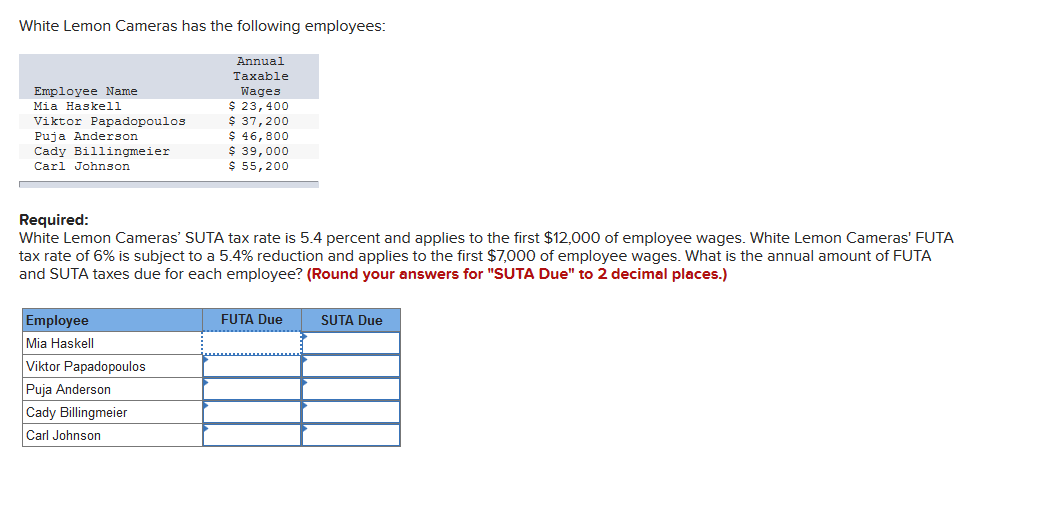

Solved White Lemon Cameras Has The Following Employees Cheggcom

Unemployment Taxes Federal Unemployment Tax Act – Futa – Ppt Video Online Download

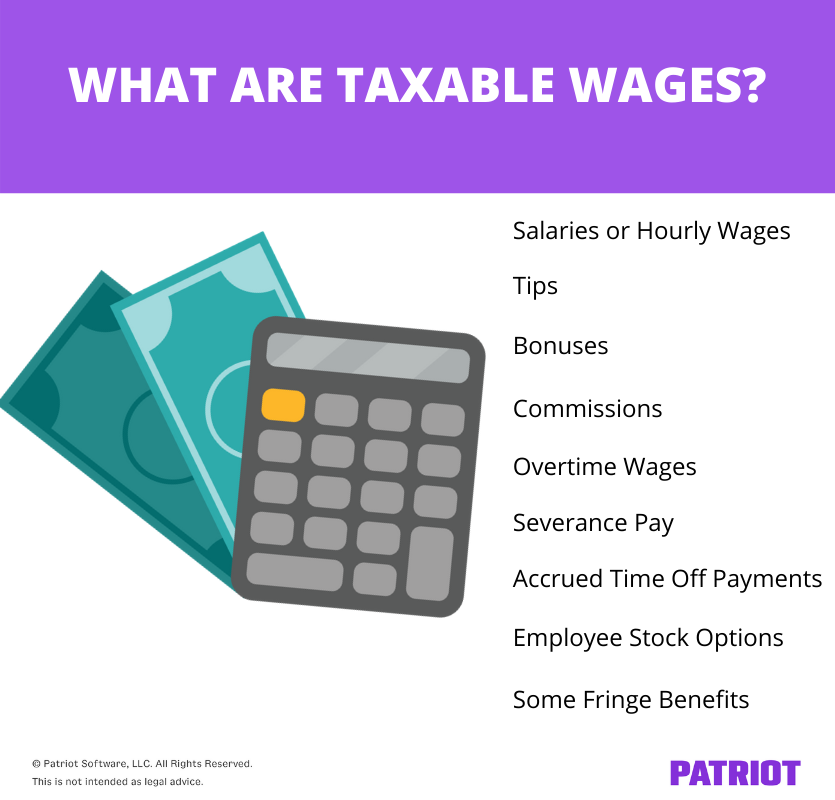

What You Need To Know About Taxable Wages 3 Things

Suta State Unemployment Taxable Wage Bases – Aps Payroll

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes – Ppt Download

What You Need To Know About Taxable Wages 3 Things

Ppt – Chapter 5 Powerpoint Presentation Free Download – Id5767532

Ppt – Unemployment Insurance Powerpoint Presentation Free Download – Id783186

What Is Suta Tax Definition Rates Example More

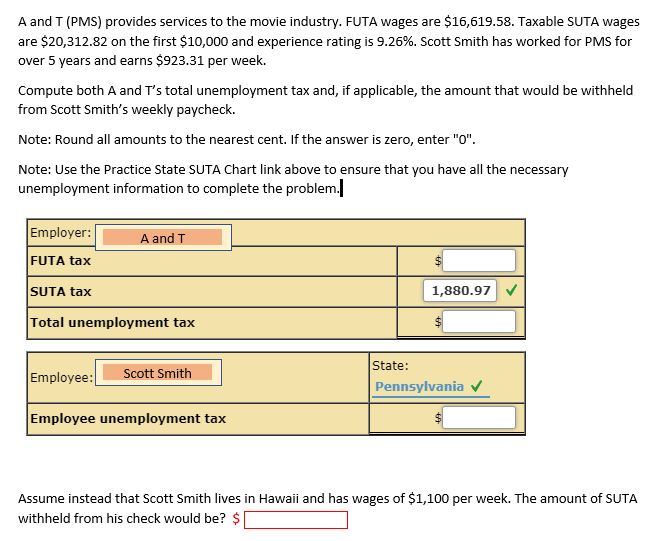

A And T Pms Provides Services To The Movie Cheggcom

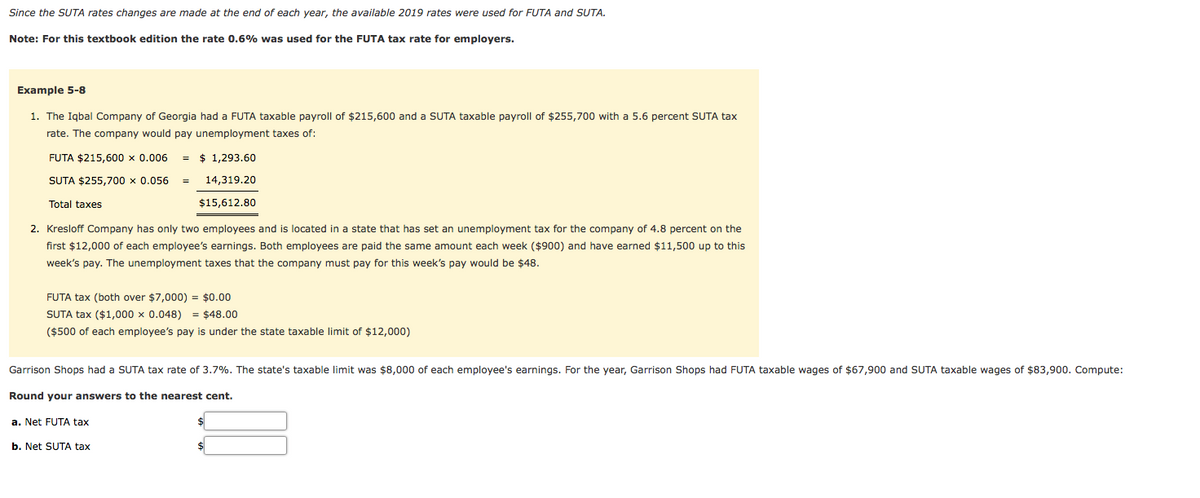

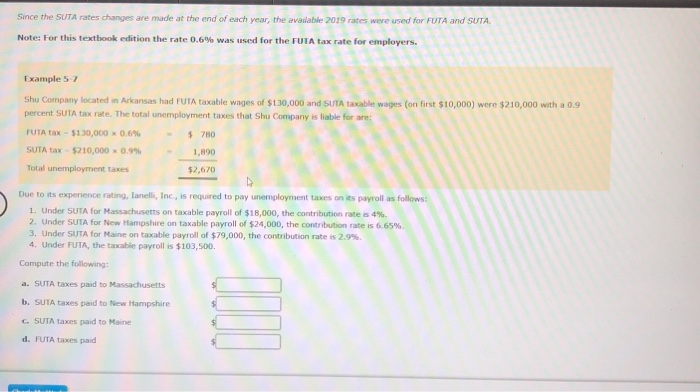

Solved Since The Suta Rates Changes Are Made At The End Of Cheggcom

Chapter 5 Unemployment Compensation Taxes Futa And Suta

Ppt – Chapter 5 Powerpoint Presentation Free Download – Id6793830

Solved White Lemon Cameras Has The Following Employees Cheggcom

Suta Tax Requirements For Employers State-by-state Guide

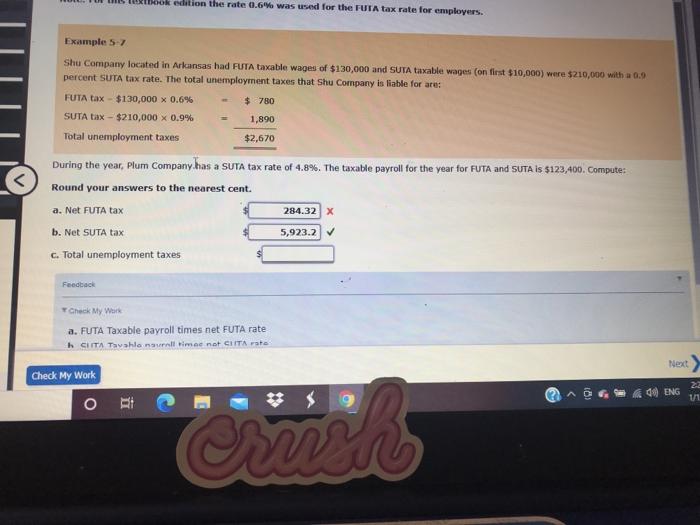

Solved Ook Edition The Rate 06 Was Used For The Futa Tax Cheggcom

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

What You Need To Know About Taxable Wages 3 Things

Solved Peroni Company Paid Wages Of 170900 This Year Of This Amount 114000 Was Taxable For Net