You must then submit an attestation that. In 2019, democrats in olympia passed a hefty new payroll tax that will hit paychecks starting in january.

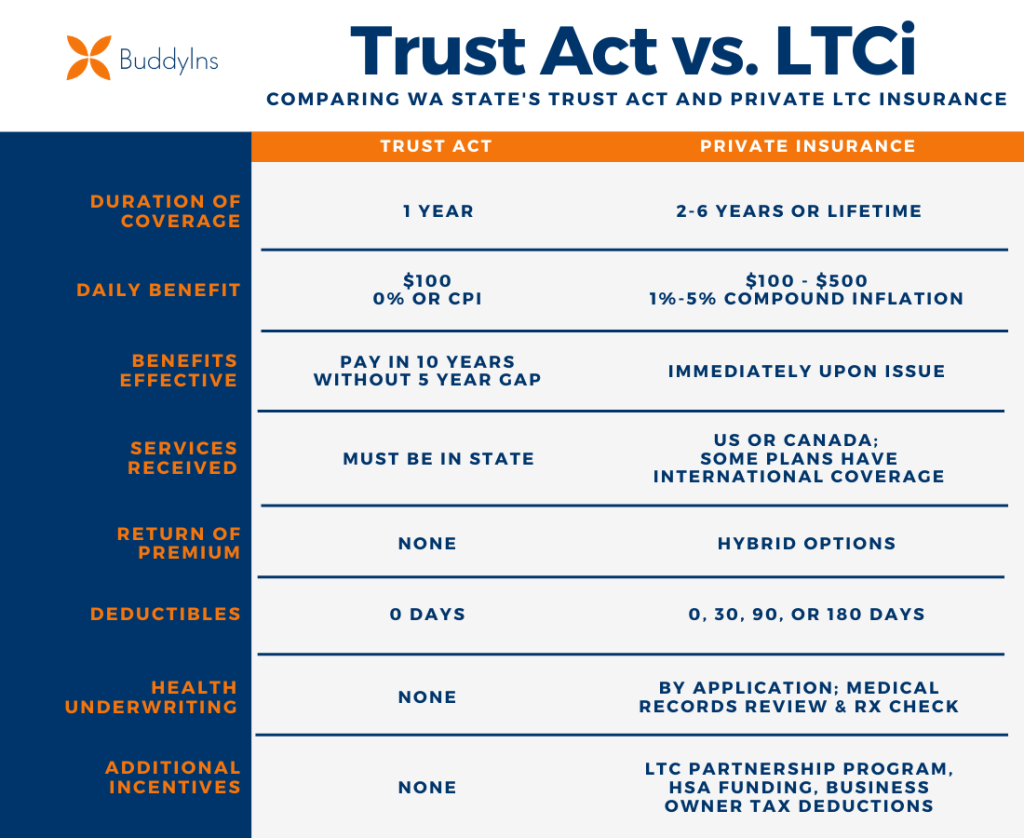

Washington State Trust Act Should You Opt Out – Buddyins

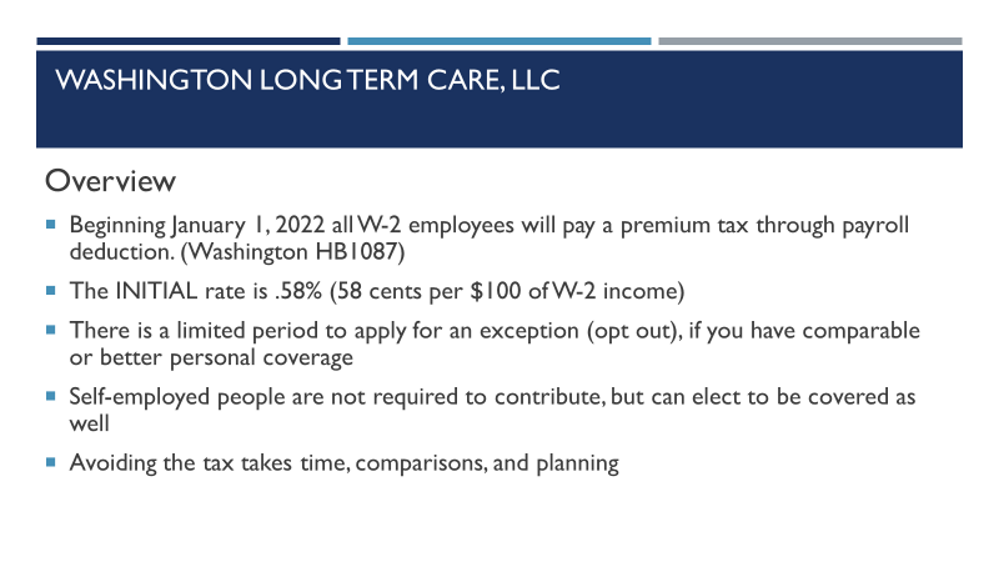

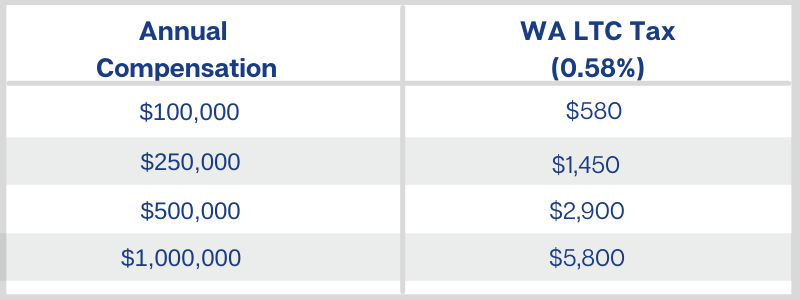

The current rate for wa cares premiums is only 0.58 percent of your earnings.

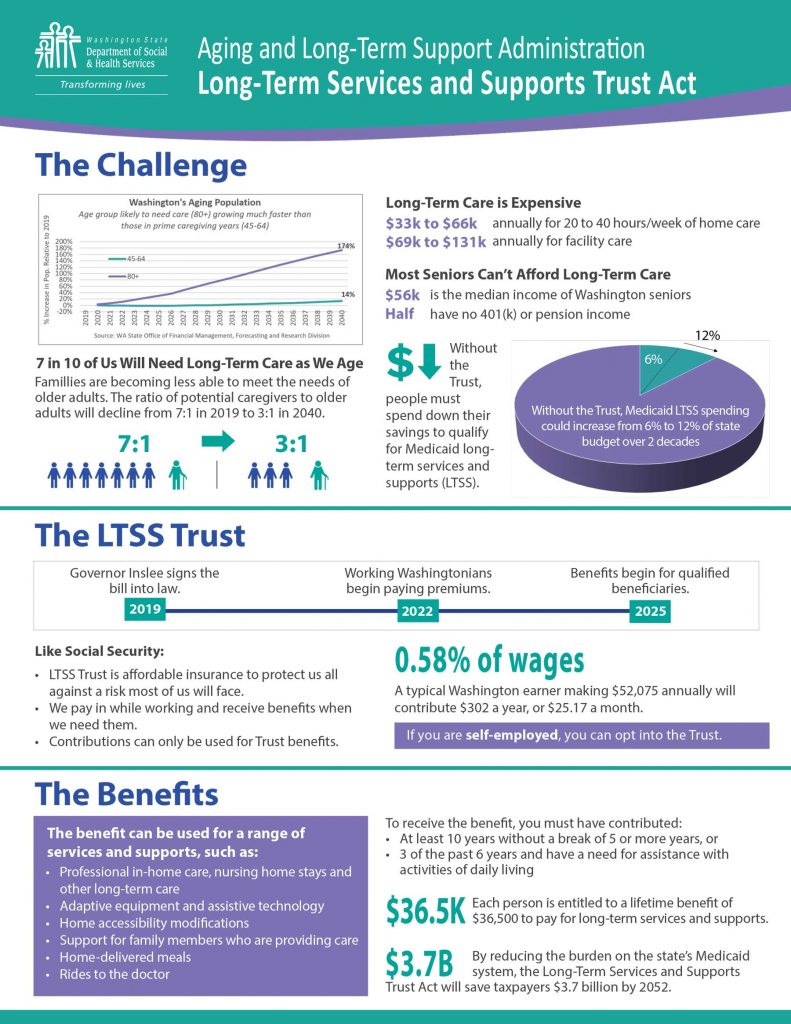

Wa state long term care payroll tax opt out. The deadline for this law (jan. The fund was established by the legislature in 2019, and levies a 58 cents per $100 payroll tax, which will start coming out of worker’s paychecks across the state in january 2022. You will not need to submit proof of coverage when applying.

On the “create an account” page, select the “create an account” button to the right of “wa cares exemption”. Right now, the wa cares fund website says of opting out, exemptions are for life. Once you’ve logged in and selected paid family and medical leave from your list of services in saw, you’ll click “continue” to proceed to creating your wa cares exemption account.

1, 2022) is rapidly approaching and the deadline for opting out is already here (nov. One man i spoke with recently called it,. New initiative will allow workers to avoid new state payroll tax.

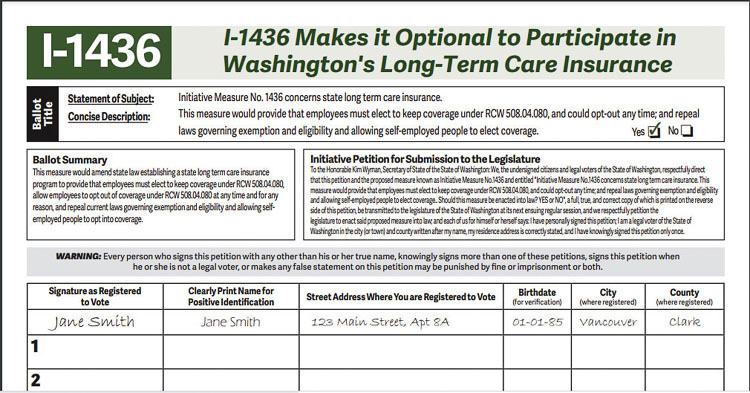

Cary condotta has introduced a citizens initiative to give people a choice regarding washington state’s long term care (ltc) program and the payroll tax that goes with it. 1 to escape new payroll tax Once a plan is purchased, an individual must apply for an exemption from the program to the employment security department (esd) between oct.

The employee must provide proof of their esd exemption to their employer before the employer can waive. Go to an apply for an exemption button near the bottom of the “exemptions” page of the wa cares fund website. 1, 2021 can apply for an exemption to the new program and payroll tax.

Private insurers may deny coverage based on age or health status. First, to opt out, you need private qualifying long term care coverage in force before november 1, 2021. For now, those who have private ltci can apply to opt out of the state program and payroll tax by following the steps below.

The regressive tax is 58 cents per $100 earned, with no income limit. Can you opt out of the fund? For someone with annual wages of $50,000, that’s $290 a year in premiums.

The legislature passed the law in 2019 and it will go into effect in january 2022. Washington workers have until nov. How do i file an exemption to opt out?

Its Coming-more Employee Tax News Goldendalesentinelcom

Alert Time Is Running Out To Opt-out Of The New Wa State Ltc Payroll Tax

Website To Opt Out Of Washingtons New Long-term Care Tax Crashes On First Day

What You Need To Know About The New Washington State Long-term Care Act – Coldstream Wealth Management

Washington Long-term Care Tax How To Opt-out To Avoid Taxes

The Private Ltc Insurance Option For Washington State Workers

Did You Receive A Long-term Care Email From Your Employer Heres What It Means To Opt-in Or Opt-out – Geekwire

Did You Receive A Long-term Care Email From Your Employer Heres What It Means To Opt-in Or Opt-out – Geekwire

Payroll – Washington Long Term Care Llc

:quality(70)/d1hfln2sfez66z.cloudfront.net/11-01-2021/t_c29a232019094739ab860abd9d770ce6_name_file_960x540_1200_v3_1_.jpg)

Monday Deadline To Opt-out Was Long-term Care Tax Kiro 7 News Seattle

Washington State Long Term Care Trust Act – 058 Payroll Tax – 36500 Lifetime Maximum Benefit – Page 11 – Bogleheadsorg

Washingtons Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

Washington State Long Term Care Tax What You Need To Know – North Town Insurance

I-1436 Will Give Workers Choices On States Long Term Care Insurance Program Clarkcountytodaycom

Can You Opt Out Of States New Long Term Care Act And Tax Should You

Mandatory Payroll Tax For Washington Long-term Care Program Employee News

Washington State Long-term Care Tax Avier Wealth Advisors

Long-term Care Payroll Tax Webinar – Youtube

Some Plan To Opt Out Of New Washington Long-term Care Insurance – The Columbian