Estimated taxes are quarterly payments you send to the u.s. Corporate estimated tax payments safe harbor the safe harbors for corporate estimated tax are both 100%.

2

Estimated tax payment safe harbor details the safe harbor estimated tax has three components, which we’ll outline here.

Virginia estimated tax payments safe harbor. Careful consideration and analysis should be given to properly calculate state income tax projections and state estimated tax payments, including exploring the existence of safe harbor rules (e.g. The date on which any portion of the underpayment is paid. How to make estimated tax payments electronically the department provides two secure online options for submitting estimated payments:

Without the irs’ leniency clause, it’s easy to have your estimated payments fall short of the income you projected for the year which might cause you to owe more money. How to make estimated tax payments electronically the department provides two secure online options for submitting estimated payments: Individuals, including sole proprietors, partners, and s corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

The total timely estimated tax payments and credits are at least equal to an amount calculated using the current Which would mean using the total prior year state tax liability (from the state tax return) and dividing that by. This is also known as the “safe harbor rule”.

Taxpayers who are required to make estimated tax payments but wait until Virginia does not have this leniency clause, so the best bet is to make sure your automatic withholding or estimated tax payments cover the tax you owed last year. If you pay 100% of your tax liability for the previous year via estimated quarterly tax payments, you’re safe.

Thus, each installment should be at least 25% of the company’s current year income tax or 25% of the prior year’s income tax, whichever. As you had no tax liability in virginia for tax year 2018, you are not required to pay estimated taxes for tax year 2019. Eforms and business online services.

If you follow these methods, you won’t be subject to additional interest and penalties, even if you still owe tax when you file your return. A pte made no estimated payments in calendar year 2020 and makes the election on the 2020. If you pay 100% of your tax liability for the previous year via estimated quarterly tax payments, you’re safe.

Here is the main part of the safe harbor rule: Estimated payments in tax year 2020 does not need to amend. You owe less than $1,000 in tax for the year.

The total of your withholding and estimated tax payments was at least as much as your 2015 tax (or 110% of your 2015 tax if your agi was more than $150,000, $75,000 if your 2016 filing status is married filing separately) and you paid all. Filing is required only for individuals whose income and net tax due exceed the amounts specified in section i. The best way to avoid underpayment penalties is to understand the safe harbors and pay enough in estimated taxes.

The estimated safe harbor rule has three parts: How to make an estimated payment we offer multiple options to pay estimated taxes. If you are required to file a tax return and your virginia income tax liability, after subtracting income tax withheld and any allowable credits, is expected to be more than $150, then you must make estimated tax payments or have additional income tax withheld throughout the year from your.

The safe harbor is the minimum amount of payments and credits paid toward your tax liability that protects you from a penalty for underpayment of your estimated taxes. Who must make estimated tax payments? Payments are made by debit eft and you may schedule your payment for a future date.

If you expect to owe less than $1,000 after subtracting your withholding, you’re safe. You pay at least 90% of tax owed for the current year ( 2020 ), or 100% of the tax you paid for the prior year (2019), whichever is smaller. Payments are made by debit eft and you may schedule your payment for a future date.

The irs has safe harbor methods for calculating your estimated tax payments. If your adjusted gross income for the year is over $150,000 then it’s 110%. If your adjusted gross income (agi) was less than $150,000 last year, then you’ll need to make quarterly estimated payments that total the smaller of 100%.

If you are required to make estimated income tax payments, but Payment of 110% of prior year tax) to avoid underpayment penalties, where possible. Form 760es is used by individuals to make estimated income tax payments.

Is there a safe harbor amount for estimated payments? What are irs estimated taxes and when are they due? Generally, you will not be charged an estimated underpayment penalty if you made payments in equal

Tax account form, to adjust the estimated accounts. A payment of estimated tax on any installment date shall be considered a payment of previous underpayment only to the extent such payment exceeds the installment which would be required to be paid if the estimated tax were equal to 90% of the income tax. In fact, this is one of the exceptions to the penalty for underpayment of estimated taxes.

Hi @jfclague, i suggest that you base your estimated state income tax payments so that they will result in your having a safe estimate. If you make estimated tax payments for this year that are at least 100% of the tax owed on your prior year return, then you will not owe an estimated tax penalty. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You must make quarterly estimated tax payments if your estimated tax liability (your estimated tax reduced by any state tax withheld from your income) is at least $600, unless that liability is less than ten percent of your estimated tax. (b) an electing pte that filed the 510 published prior to june 29, 2021, and only made. If your adjusted gross income for the year is over $150,000 then you must pay at least 110% of last year’s taxes.

Generally, an underpayment penalty can be avoided if you use the safe harbor rule for payments described below. You avoid a penalty through one of two safe harbors : Visit our website at www.tax.virginia.gov for information on electronic payment options.

Safe harbor rules for individual taxpayers required to make estimated tax payments, the department will not impose the estimated underpayment penalty when: What is the safe harbor rule for 2020?

State Retirement Income Tax Retirement Income Military Retirement Benefits Income Tax

Estimated Tax Payments Made Easy – Glassman Wealth Services

2

Strategies For Minimizing Estimated Tax Payments

2

Safe Harbor For Underpaying Estimated Tax Hr Block

2

2

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Making Estimated Tax Payments Sc Associates

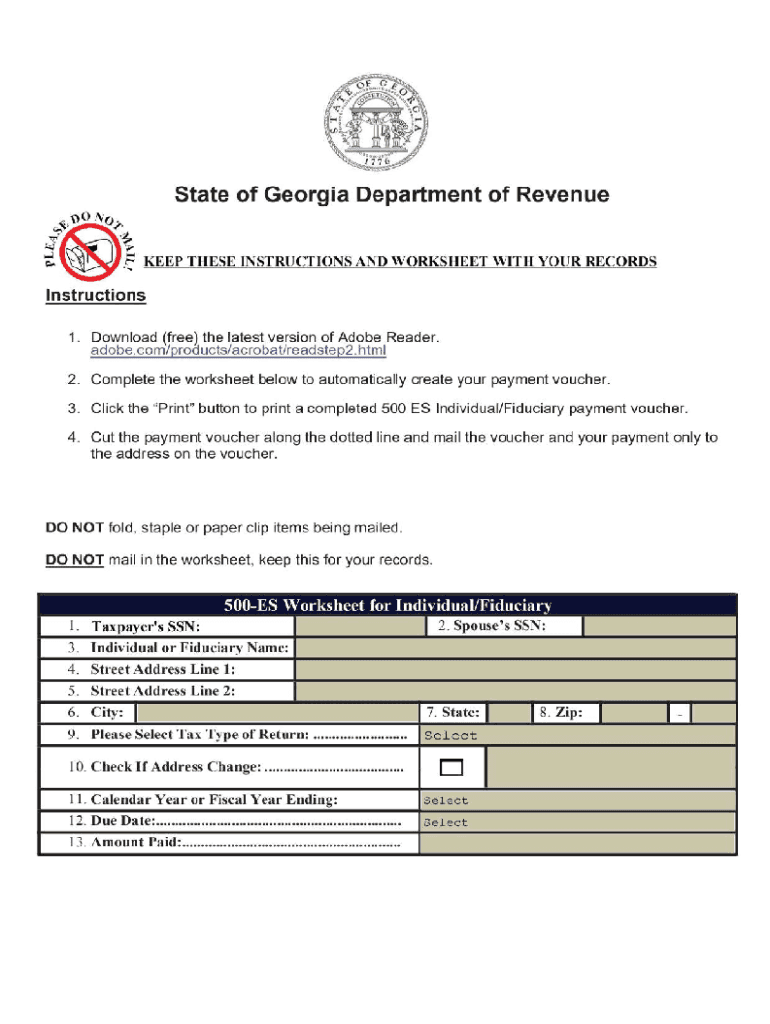

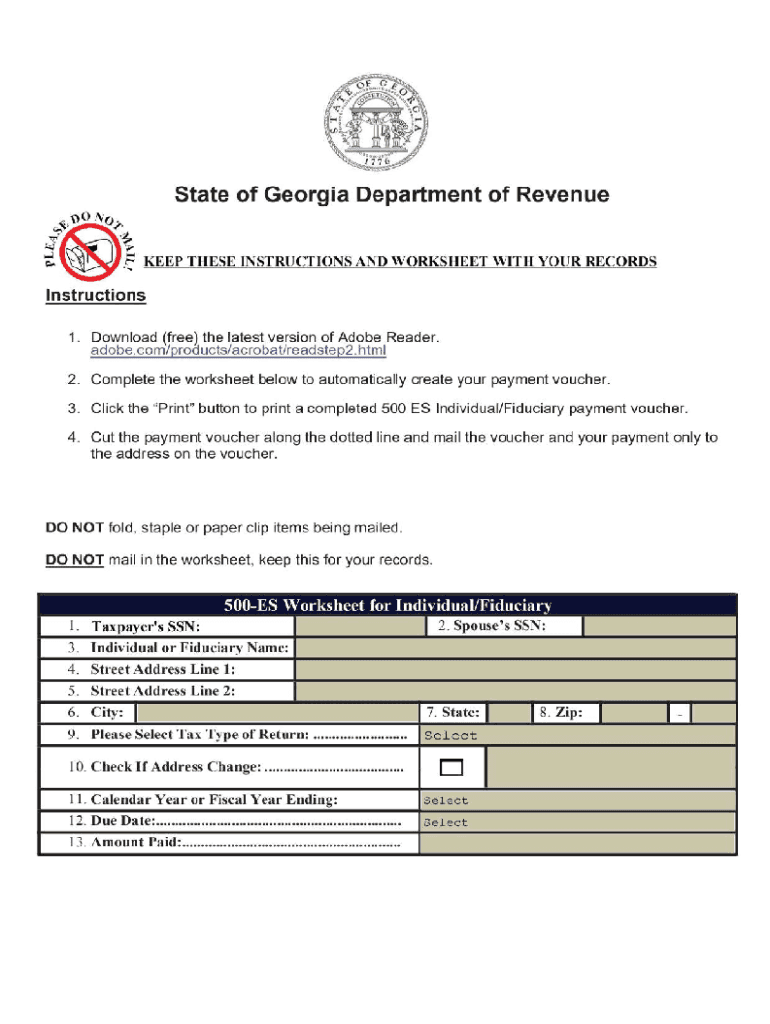

2021 Form Ga Dor 500 Es Fill Online Printable Fillable Blank – Pdffiller

Estimated Tax Payment Consideration Under Covid-19 – Thompson Greenspon Cpa

Making Estimated Tax Payments How To Avoid Penalties For Underpayment Keybank

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Safe Harbor Requirements For Estimated Tax Payments – Miller Consulting Group

What If You Havent Paid Quarterly Taxes Mybanktracker

Safe Harbor For Underpaying Estimated Tax Hr Block

Penalty-proofing Yourself From The Irs By Making Estimated Tax Payments

Quarterly Estimated Tax Payments – What You Need To Know