Proof of vt motorcycle insurance. Verification of vin or hin.

2

To request a vin/hin be assigned when the vehicle has never had or no longer has a proper vin/hin number.

Vermont department of taxes sales verification form. If you must pay sales and use tax for multiple locations, or if your total sales and use tax remitted for the year will exceed $100,000, the commissioner of taxes has mandated that you use myvtax. To verify the vehicle identification number (vin) or hull identification number (hin). This information has been conveyed to the purchaser, both ora lly and in writing in accordance with 23 v.s.a.

You can file and pay sales and use tax electronically using the department's free and secure file and pay webpage, or you may purchase software from a vendor. 2020 income tax return booklet; The necessary motorcycle registration fees and taxes.

How to use sales tax exemption certificates in vermont. The buyer must sign the salvage section if the vehicle is salvaged or has been totalled. If this section is completed at least one new owner must sign:

The motorcycle's current title signed by the buyer and seller. Sections 2093 (b) (c), salvaged, totaled and rebuilt vehicles. Odometer disclosure statement required if vehicle is 9 years old or newer.

Check return or refund status / tax homestead declaration filing If you buy fertilizer for the flower beds surrounding your home, you will pay the sales tax. The certificate is signed, dated and complete (all applicable sections and fields completed).

Public records request statewide public records database government transparency Bill of sale and odometer disclosure statement. To be completed by the applicant.

• vehicles being titled under bond. To verify the vehicle identification number (vin) or hull identification number (hin). • and have not been vehicles with registrations from any foreign country, including canada.

The sale of fertilizer is subject to sales tax. November and december 2020 returns have been extended to be due on february 22nd for qualified businesses. The certification is on an exemption form issued by the vermont department of taxes or a form with substantially identical language.

Penalty and interest waived for 33 days for certain sales, use, and withholding taxpayers with returns due january 20, 2021. Public records request statewide public records database government transparency If you have a single location, and cannot file and pay through myvtax, you may still use the paper forms.

Reports of a new hire must be filed within 10 days of the first day work is performed, or was previously employed by the employer, but has been separated from such prior employment for at least 60 consecutive days. • vehicles over 1 5 years old, for which a vermont resident is When to file file as early as possible.

If, however, the fertilizer is to be used directly and exclusively for farming purposes, it is exempt from tax. The property purchased is of a type ordinarily used for the stated purpose, or the exempt use is explained. The 2020 property tax credit is based on 2019 household income and 2019/2020 property taxes.

Including taxes, license fees and similar governmental charges. Current owner's last name first middle mailing address city state zip code Complete and submit this form to the vermont dmv after the private sale of a vehicle.

This form, effective 7/1/2009, reflects the sales and use tax rate changes that occurred for all counties in the 2009 legislative session pursuant to sb 429. Tangible personal property that becomes a component of a manufactured product is also exempt.

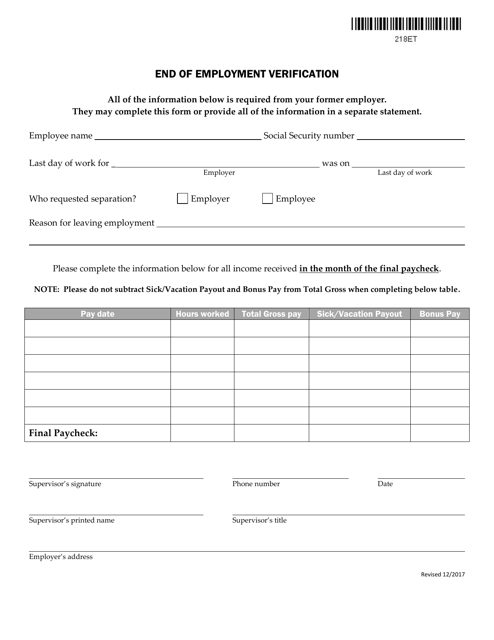

Form 218et Download Fillable Pdf Or Fill Online End Of Employment Verification Vermont Templateroller

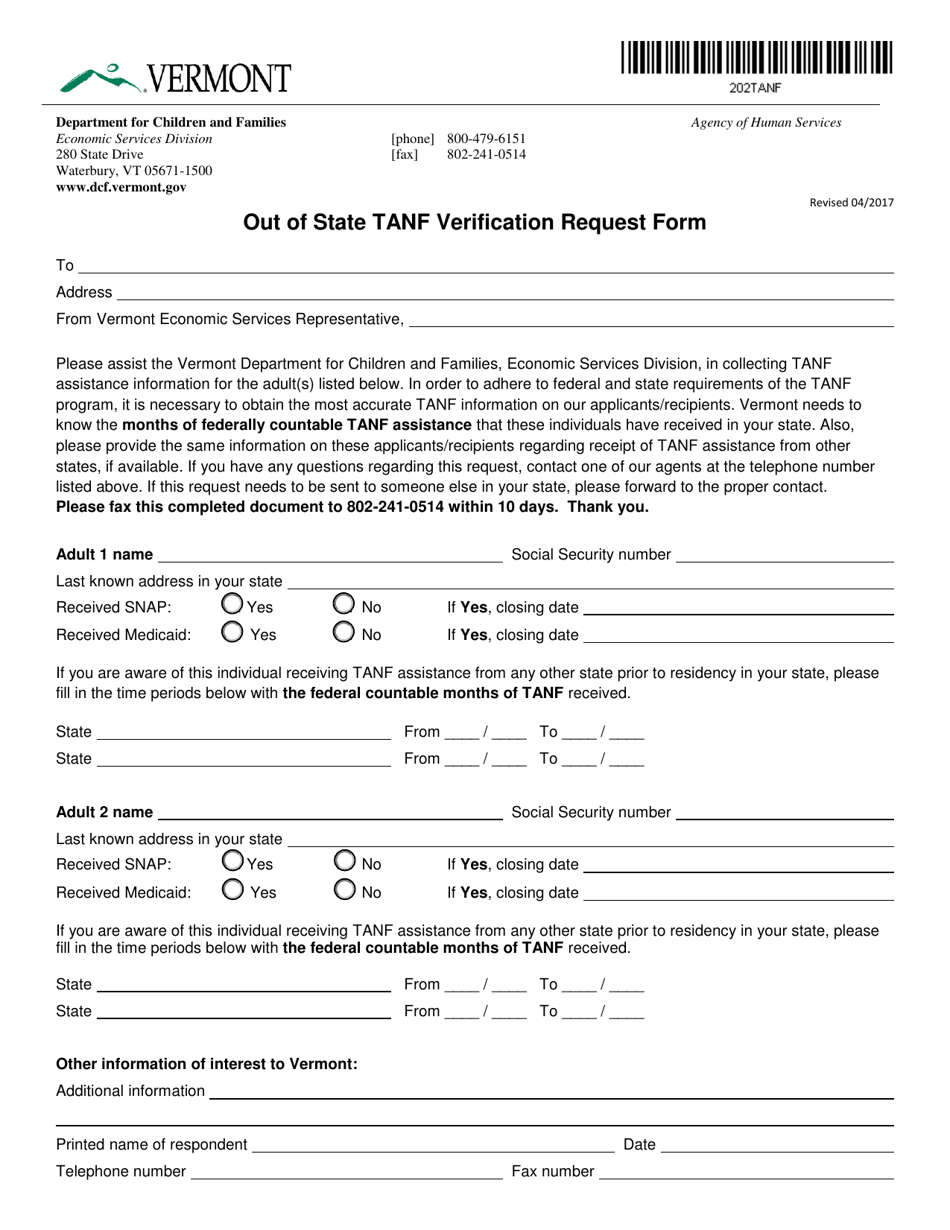

Form 202tanf Download Fillable Pdf Or Fill Online Out Of State Tanf Verification Request Form Vermont Templateroller

2

2

2

2

2

How To Get A Certificate Of Exemption In Vermont – Startingyourbusinesscom

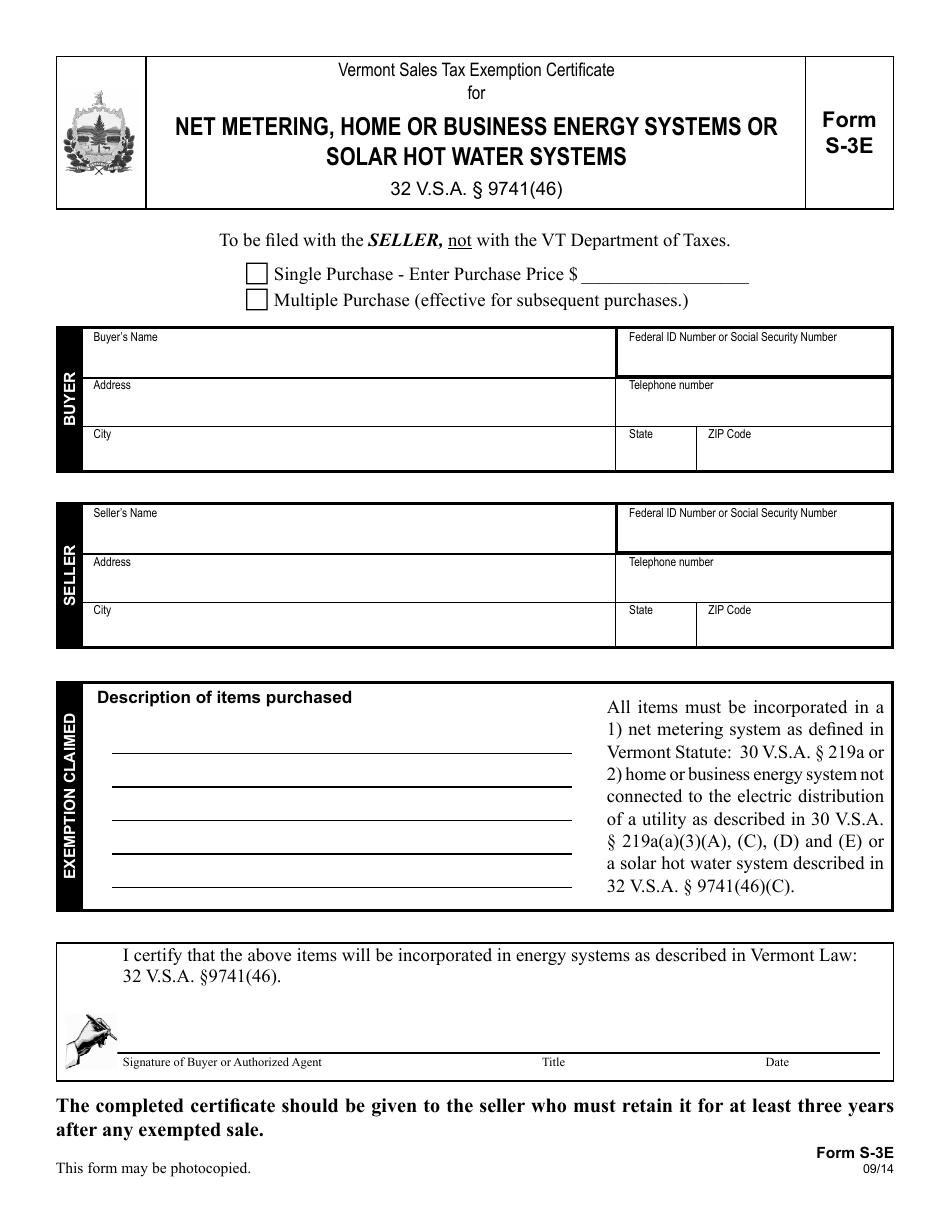

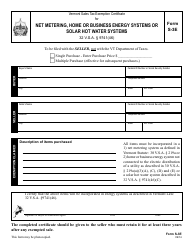

Vt Form S-3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

2

2

2

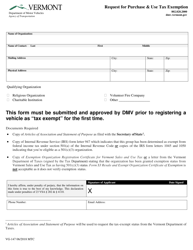

Form Vg-147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

2

2

Vt Form S-3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

2

2

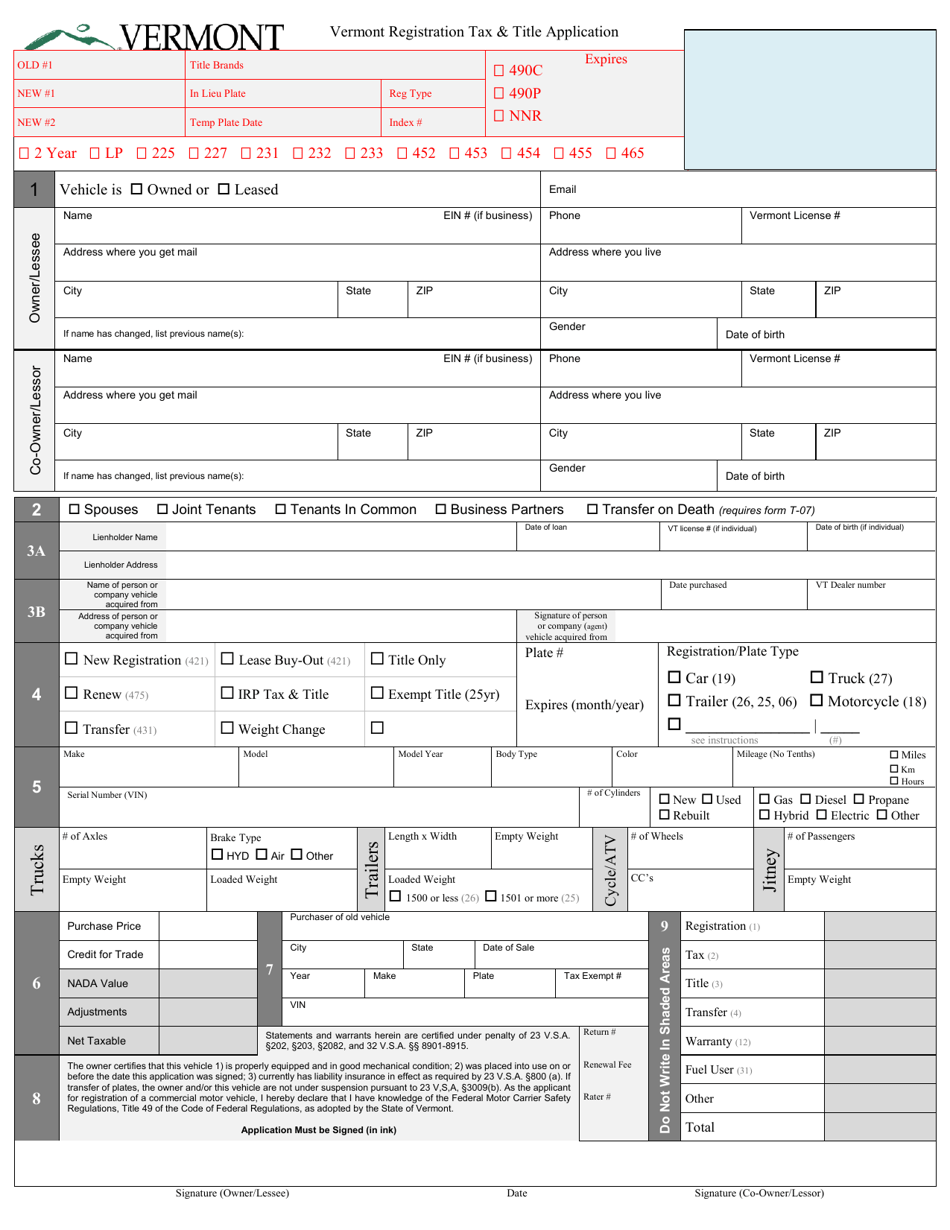

Form Vd-119 Download Fillable Pdf Or Fill Online Vermont Registration Tax Title Application Vermont Templateroller