This is the total of state and county sales tax rates. Moorpark city 86 10 1.047300 1.078300.

Why Buy Now Lennar Mansions New Homes

Camarillo city 373 07 1.090900 1.154338.

Ventura property tax rate. Also, how do i find property tax records? City or school district areas areas tax rate range. Ventura county has one of the higher property tax rates in the state, at around 1.095%.

The ventura county sales tax rate is 0.25%. Note that 1.095% is an effective tax rate estimate. 30 out of 58 counties have lower property tax rates.

30 out of 58 counties have lower property tax rates. The average yearly property tax paid by ventura county residents amounts to about 3.61% of their yearly income. Thousand oaks (includes newbury park and ventura area of westlake village) 1.0400%:

The median property tax (also known as real estate tax) in ventura county is $3,372.00 per year, based on a median home value of $568,700.00 and a median effective property tax rate of 0.59% of property value. Information contained in this database is derived from the current fiscal year tax rates & general information publication. The tax cannot exceed 1% of a property’s assessed value (plus bonds and direct assessment taxes) and increases in assessed value are limited to 2% annually.

The median property tax on a $568,700.00 house is $5,971.35 in the united states. The minimum combined 2020 sales tax rate for ventura county, california is 7.25%. This is the total of state and county sales tax rates.

Ventura county has one of the higher property tax rates in the state, at around 1.095%. Ventura county is ranked 342nd of the 3143 counties for property taxes as a percentage of median income. Search for the words property listings, property database or property information at the tax assessor's website.

Note that 1.095% is an effective tax rate estimate. Special assessment and exemption data are not available. Does ventura county have income tax?

Property tax in ventura county ventura county has one of the higher property tax rates in the state, at around 1.095%. This calculator can only provide you with a rough estimate of your tax liabilities based on the. City level tax rates in this county apply to assessed value, which is equal to the sales price of recently purchased homes.

Property tax in ventura county ventura county has one of the higher property tax rates in the state, at around 1.095%. The ventura county sales tax rate is 0.25%. Property tax in ventura county.

The california state sales tax rate is currently 6%. How much is property tax in ventura county california? The california state sales tax rate is currently 6%.

30 out of 58 counties have lower property tax rates. 26 counties have higher tax rates. 26 counties have higher tax rates.

The property tax rate in the county is 0.78%. Go to that county's home page and navigate to the link to the tax assessor's office. You can use the california property tax map to the left to compare ventura county's property tax to other counties in california.

The ventura county sales tax rate is 0.25%. The property tax rate is 1% of the assessed value, plus any voter approved bonds, fees, or special assessments. The median property tax on a $568,700.00 house is $4,208.38 in california.

Fillmore city 20 01 1.143700 1.151538. 30 out of 58 counties have lower property tax rates. The us average is 4.6%.

Sacramento county is located in northern california and has a population of just over 1.5 million people. The median property tax on a $568,700.00 house is $3,355.33 in ventura county. Property tax in ventura county.

It's also home to the state capital of california.

Property Tax Calculator

Ventura And Los Angeles County Property And Sales Tax Rates

What It Feels Like Real Estate Articles Tax Lawyer Home Buying

Ventura-county Property Tax Records – Ventura-county Property Taxes Ca

Pin On Florida

How To Calculate California Sales Tax 11 Steps With Pictures

California March Sales Report Housing Market Real Estate Information California

Property Tax By County Property Tax Calculator Rethority

Ventura County Assessor – Supplemental Assessments

How To Calculate Cannabis Taxes At Your Dispensary

Property Tax By County Property Tax Calculator Rethority

States With The Highest And Lowest Property Taxes Property Tax High Low States

2

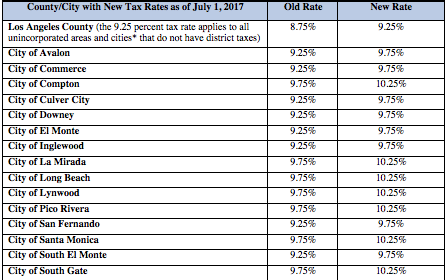

Los Angeles Countys Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizens Voice

How To Calculate An Irr In Excel Excel Financial Management Calculator

Understanding Californias Sales Tax

Understanding Californias Property Taxes

State-by-state Guide To Taxes On Retirees Retirement Income State Tax Retirement Locations

Pin On United States