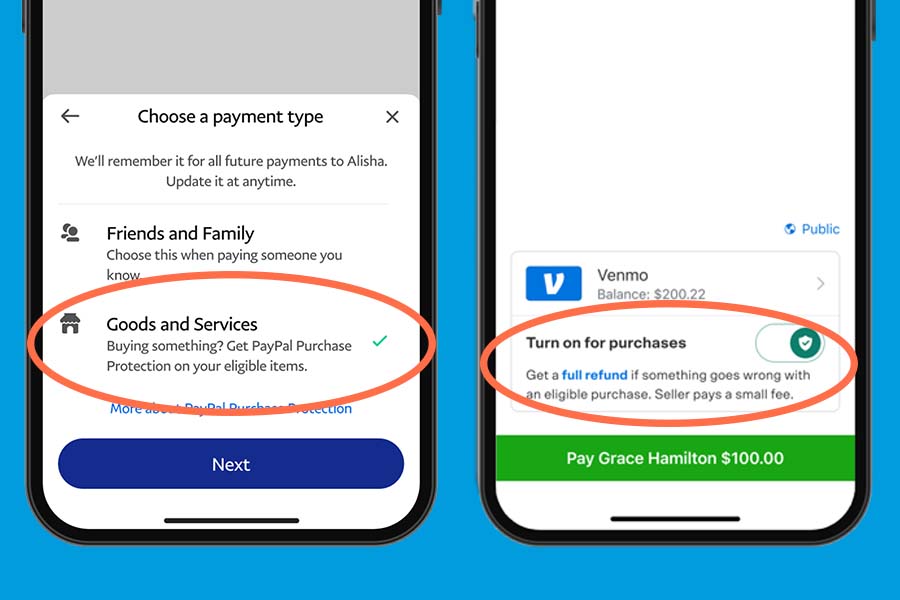

The change broadens the scope of reporting such that all tpsos, like paypal and venmo, need to collect tax information once you near or reach $600 in goods and services transactions (instead of the prior threshold of $20,000 and 200 transactions), so that we can remain compliant with our regulatory requirements and share those details with the irs. Venmo is a mobile app that allows users to transfer money on its peer to peer network in a matter of seconds.

If You Use Venmo Paypal Or Other Payment Apps This Tax Rule Change May Affect You

For more information about acceptable use of your business profile on venmo, please review the venmo user agreement.

Venmo tax reporting for personal use. For example, when you go out to a restaurant with friends and family and wish to split the bill between yourselves. The american rescue plan act has a provision that will require cash apps like venmo, paypal and zelle to file information reports with both the merchants who use their platforms and the irs. As of january 1, the irs will change the way it taxes income made by businesses that use venmo, zelle, cash app and other payment apps to receive money in.

Does venmo do any tax reporting? (getting all of my venmo questions out of the way in one thread, apparently.) 5 comments. These kinds of personal transactions don't need to be reported on your tax return and are perfect for venmo.

It allows you to easily split rent with your roommate, send cash to a family member, or transfer money to someone for any number of other reasons. This is because this income is considered taxable and must be reported to the irs. These forms are used to report different types of income you’ve received in a given year, outside of their regular salary.

Create or control more than one personal account for yourself without our express authorization, through, among other methods, using a. If you’re not sure what that means for your business or side hustle earnings, then let us spell it out for you: With such efficiency and convenience there should be no surprise that 10 million active users utilize the peer to peer network for both personal and business purposes.

Also, on a similar note, when someone uses venmo to send me their share of a bill after i pay the full bill on a card, would that be considered income? David super, a tax law professor at georgetown university, told verify in an email: This new tax reporting requirement is part of the american rescue plan act.

Businesses are still required to report any payments received through venmo and paypal as taxable income when filing taxes. Venmo is a payment processor made by paypal, for personal financial transactions. However, the moment you begin accepting business payments on a p2p platform, you’re responsible for.

If you use venmo, for example, to receive payment from a friend for their share of a meal tab, you don’t have to worry about reporting such payments on your tax return. “this proposal does not change what is taxable or what is deductible. If you're among the millions of people who use payment apps like paypal, venmo, square, and other payment apps, you could be affected by a tax reporting change that goes into effect in january.

Earlier in september, social media users discussed the possibility of the irs employing a tax on venmo transactions exceeding a. Report this information in box 1: For the users sending payments back and forth for their share of dinner.

27 2021, published 3:06 p.m. If you have questions about taxes and reporting, read on for more information. The tax reporting change will only apply to payments for goods and.

For venmo, cash app and other users, this may sound like a new tax—but it’s merely a tax reporting change to the existing tax law. If you have a personal account, use your venmo account to conduct transactions for goods or services with other personal accounts, except as expressly authorized by venmo;

Venmo Cash App And Other Payment Apps To Report Payments Of 600 Or More Smart Change Personal Finance Madisoncom

How To Make A Fake Walmart Receipt – Expressexpense – How To Make Receiptsexpressexpense How To Make Receipt Walmart Receipt Money Management Advice Receipt

How Safe Is Venmo And Is It Free Venmo Mobile Banking App

This Financial App Will Make You Hyper Aware Of Your Spending And Saving Habits Mint App Finance Apps Finance App

News For April 2016 Financial Apps App Make Easy Money

Individual Tax Preparation Checklist Tax Preparation Tax Preparation Services Tax Checklist

Mt5pn6szcntdsm

Custom Tumbler Order Form Etsy In 2021 Custom Tumblers Tumbler Custom

Httpssharecshcratesconicole2407 Pandora Screenshot Pandora

Venmo 1099 Taxes For Freelancers And Small Business Owners

Can I Use Venmo For Business – Amy Northard Cpa – The Accountant For Creatives Venmo Small Business Tax Business

We Are Actually Begging You To Make Your Venmo Transactions Private Venmo Perfect Emoji Make It Yourself

Getting Paid By Venmo Or Paypal The Irs Will Know Cpa Practice Advisor

Press Release New Us Tax Reporting Requirements Your Questions Answered

Beware Of New Tax Rule Affecting People Who Use Venmo Paypal Or Other Payment Apps – Tax Attorney Orange County Ca Kahn Tax Law

The Real Story Behind The Pnc-venmo Clash

Venmo Link In 2021 Money Apps Venmo Make Easy Money

/how-safe-venmo-and-why-it-free_FINAL-5c7d732a46e0fb00018bd86c.png)

What Is Venmo Are There Any Fees And Is It Safe

Venmo Taxation What Do I Need To Know – Wilkinguttenplan