Sales taxes are applied to a variety of goods including tangible personal property,. The milk and bread are grocery food, but the clothing is not.

Utah Use Tax

Under the task force plan, grocery food would be taxed at the full 4.85% state rate, plus applicable local.

Utah non food tax rate. In the state of utah, the foods are subject to local taxes. California (1%), utah (1.25%), and virginia (1%). Utah county, utah sales tax rate 2021 up to 7.25%.

Use the following formula to calculate the taxable sales: Utah house votes to eliminate state sales tax on food — bill now goes to the senate. Grocery food is currently subject to reduced rate of state sales tax in utah:

It is only in case of food stuff packed in containers with brand name that other gst rates are applicable. At the time of this writing, that sales tax rate is a combined 3% across utah. Since local option and county sales tax also apply to the sale of grocery food, the combined sales tax rate is 3% throughout the state.

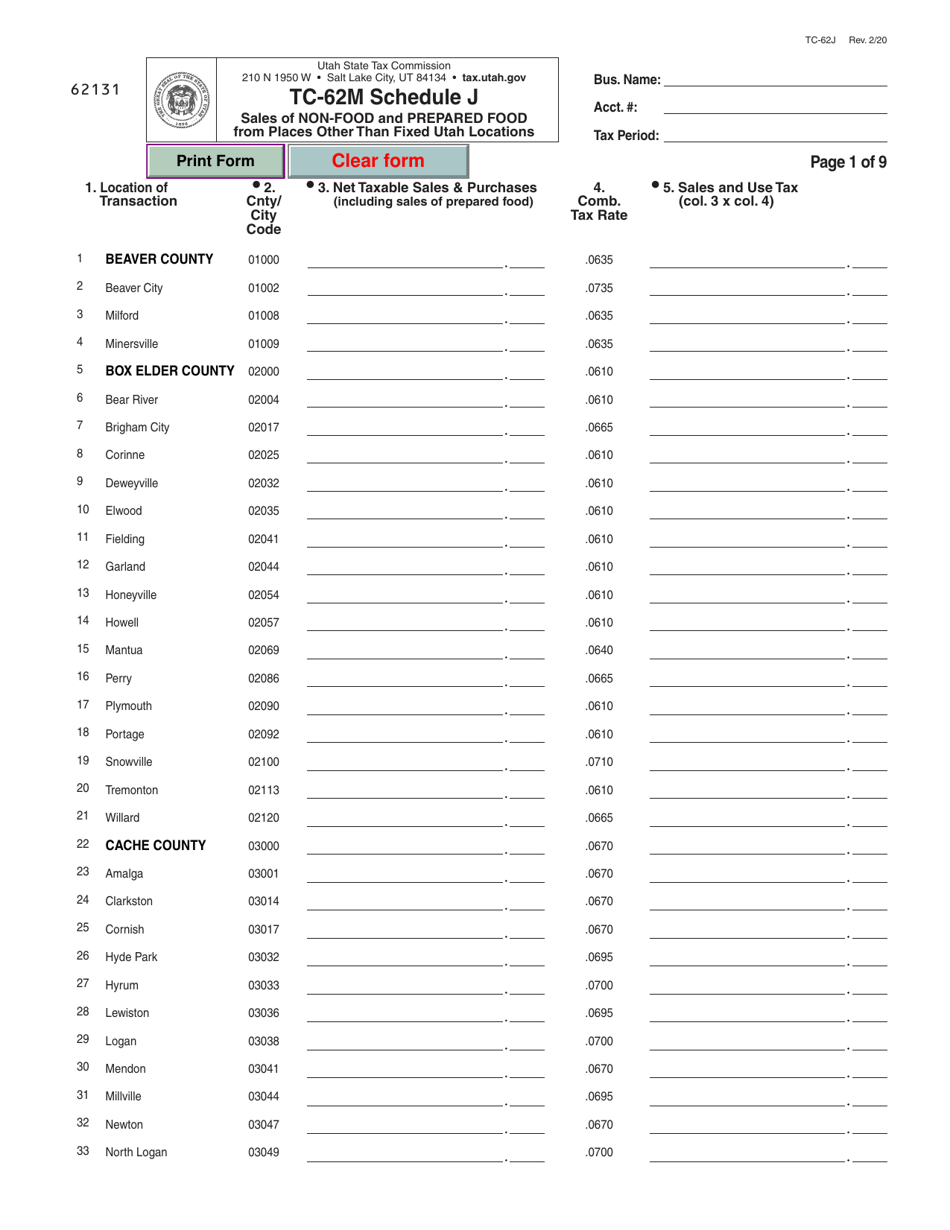

See tax.utah.gov/sales/rates for current rates. In the state of utah, any voluntary gratuities which are distributed to employees are not considered to be taxable. Average sales tax (with local):

Other, targeted income tax cuts include making up for the loss of personal exemptions in federal income taxes. Rate variation the 84129's tax rate may change depending of the type of purchase. Sales tax treatment of groceries, candy & soda, as of july january 1, 2019 (a) alaska, delaware, montana, new hampshire, and oregon do not levy taxes on groceries, candy, or soda.

Both food and food ingredients will be taxed at a reduced rate of 1.75%. Verify your location’s tax rate before the start of each quarter. The utah (ut) state sales tax rate is 4.7%.

Some cities and local governments in utah county collect additional local. We include these in their state sales tax. You sell milk, bread and clothing in one transaction.

Utah has state sales tax of 4.85% , and. The combined rate used in this calculator (7.25%) is the result of the utah state rate (4.85%), the 84129's county rate (1.35%), and in some case, special rate (1.05%). 89 rows the entire combined rate is due on all taxable transactions in that tax jurisdiction.

Tax rate for your single fixed place of business provided on this line. If this rate is missing or not readable, you can find the appropriate tax rate for your business location online at tax.utah.gov/sales/rates. The utah county sales tax is 0.8%.

Just a year after legislators seriously considered raising the sales tax on food, the utah house. You collect tax at the grocery food rate (3 percent) on the grocery food and the combined sales tax rate at your location for the clothing. The bill will also drop the state income tax rate from 4.95 percent to 4.75 percent.

Depending on local jurisdictions, the total tax rate can be as high as 8.7%. As of yet, gst on food items or food services do not exceed 18% and no food items are as of yet featured in the highest tax bracket of 28%. 4.7% is the smallest possible tax rate (bridgeland, utah) 6.1%, 6.2%, 6.35%, 6.4%, 6.45%, 6.5%, 6.6%, 6.65%, 6.7%, 6.75%, 6.85%, 6.9%, 6.95%, 7%, 7.1%, 7.15%, 7.25%, 7.35%, 7.45%, 7.5%, 7.6%, 7.75%, 7.95%, 8.05%, 8.1%, 8.2%, 8.25%, 8.3%, 8.75% are all the other possible sales tax rates of utah cities.

The rate may also vary for the same zip code depending of the city and street address.

Holladay Utah Home Sales Sale House Real Estate New Homes

Pin Di Gaya Hidup

Grocery Food

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19367952/merlin_19023.jpg)

Latest Tax Reform Plan Subjects Fewer Services To Utah Sales Taxes – Deseret News

Utah Income Tax Calculator – Smartasset

Solar Incentives In Utah – Utah Energy Hub

Form Tc-62m Schedule J Download Fillable Pdf Or Fill Online Sales Of Non- Food And Prepared Food From Places Other Than Fixed Utah Locations Utah Templateroller

Sales Tax On Grocery Items – Taxjar

Is Shipping Taxable In Utah Taxjar Blog

2

Utah Sales Tax Information Sales Tax Rates And Deadlines

Pin On Politics Advocacy

Income Tax Withholding

Utah Sales Tax – Small Business Guide Truic

Utah Sales Tax – Taxjar

2

Utah Income Tax Calculator – Smartasset

Utah Sales Tax Rates By City County 2021

Utah Intent On Taxing More Services Increasing Sales Tax On Food