A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. Qualified small business property or farm property deduction.

How To Avoid Massachusetts Estate Taxes Massachusetts Estate Planners Toolkit – Mcnamara Yates Pc

If a person dies in 2019, she can leave a $11.4.

Unified estate tax credit 2019. The unified credit is a credit for the portion of estate tax due on taxable estates mandated by the internal service revenue (irs) to combine both the federal gift tax and estate tax into one. Making large gifts now won't harm estates after 2025. Doing the math, the 2019 unified credit is $4,505,800, up $88,000 from 2018's levels.

That means an individual can leave $11.4 million to heirs and pay no federal estate or gift tax, while a married couple can shield $22.8 million. The amount of the unified credit is currently higher than it has ever been while an estate tax is. In short, the unified tax credit sets a dollar amount that each person is able to gift during their lifetime before any estate or gift taxes kick in.

Value of all property subject to estate tax regime The extent of the benefit provided by the unified tax credit depends on the tax year in which you intend to use the credit. But all of this is more complicated than it has to be from a taxpayer's standpoint.

They also announced the official estate and gift tax limits for 2019 as follows: The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at one’s death. The estate and gift tax exemption is $11.4 million per individual, up from $11.18 million in 2018.

For 2020, the basic exclusion amount will go up $180,000 from 2019 levels to a new total of $11.58 million. The lifetime estate exclusion amount (also sometimes called the estate tax exemption amount, the applicable exclusion amount, or the unified credit amount) has been increased for inflation beginning january 1, 2019. The gift tax is imposed on transfers of property by gift.

Estate taxes 2019 2018 estate tax exemption $ 11,400,000 $ 11,180,000 unified estate tax credit $ 4,505,800 $ 4,417,800 top estate tax rate 40% 40% gift taxes 2019 2018 lifetime gift tax exemption $ 11,400,000 $ 11,180,000 annual gift tax exclusion gifts per person $. Doing the math, the 2019 unified credit is $4,505,800, up $88,000 from 2018's levels. The unified credit is per person, but.

If you need more information about the unified tax credit, use our free. The estate tax on estates of decedents is imposed on the decedent's taxable estate (gross estate less deductions). The applicable credit amount is commonly referred to as the “unified credit” because it is both “unified” (i.e., it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax) and a tax “credit” (i.e., it reduces the amount of tax owed).

For an estate of any decedent dying in calendar year 2020, the basic exclusion amount will be $11.58 million for determining the amount of the unified credit against estate tax under irc section 2010. The internal revenue service (irs) recently announced that the estate and gift tax exemption is increasing next year: When an estate is below the unified gift and estate tax credit limit, there will be no estate tax due at the time of death.

While congress can vote to make the $11.7 million exception permanent, the biden administration has pledged to drastically decrease the unified credit for estate taxes from $11.7 million to $3.5 million, and the credit for gift taxes to $1 million. Up from $11.18 million per individual in 2018 to $11.4 million in 2019. The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them.

See tables here from davenport evans lawyers. The estate tax is a tax on your right to transfer property at your death. It mainly serves the purpose of preventing taxpayers from giving away too much during their lifetimes in order to avoid estate taxes.

That number is used to calculate the size of the credit against estate tax. The gift tax is based on the cumulative value of current and prior taxable gifts. But all of this is more complicated than it has to be from a taxpayer's standpoint.

A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases. It consists of an accounting of everything you own or have certain interests in at the date of death (refer to form 706 pdf (pdf)). You’d have just $6.7 million left of that $11.7 million credit with which to shield your estate from taxation at the time of your death.

Instead, all of those funds pass directly to the specified recipients. A credit (based on the applicable exclusion amount) against estate tax is allowed, as well as other credits. Gifts and estate transfers that exceed $11.7 million are subject to tax.

All people are qualified to take advantage of this tax perk from the internal revenue service (irs).

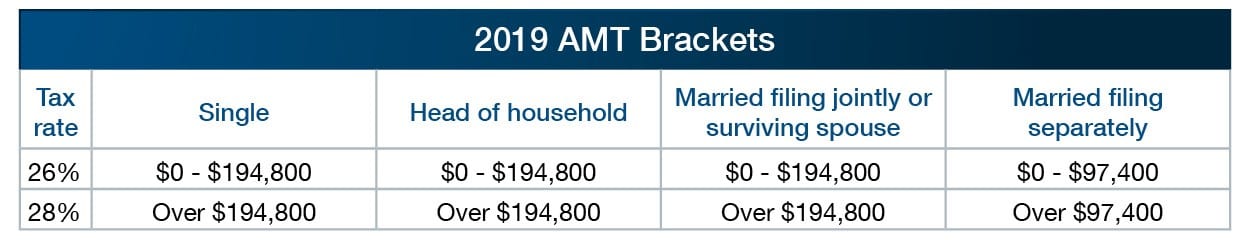

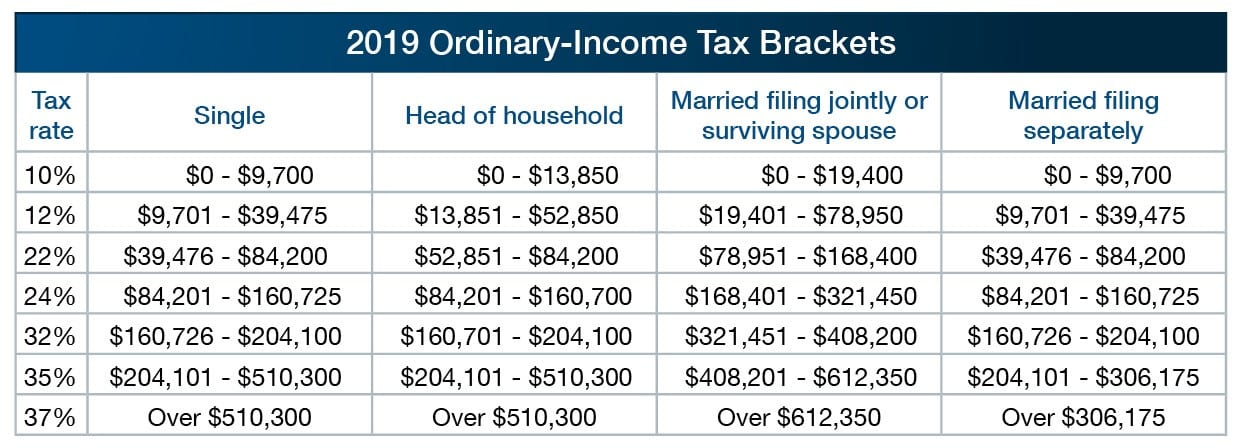

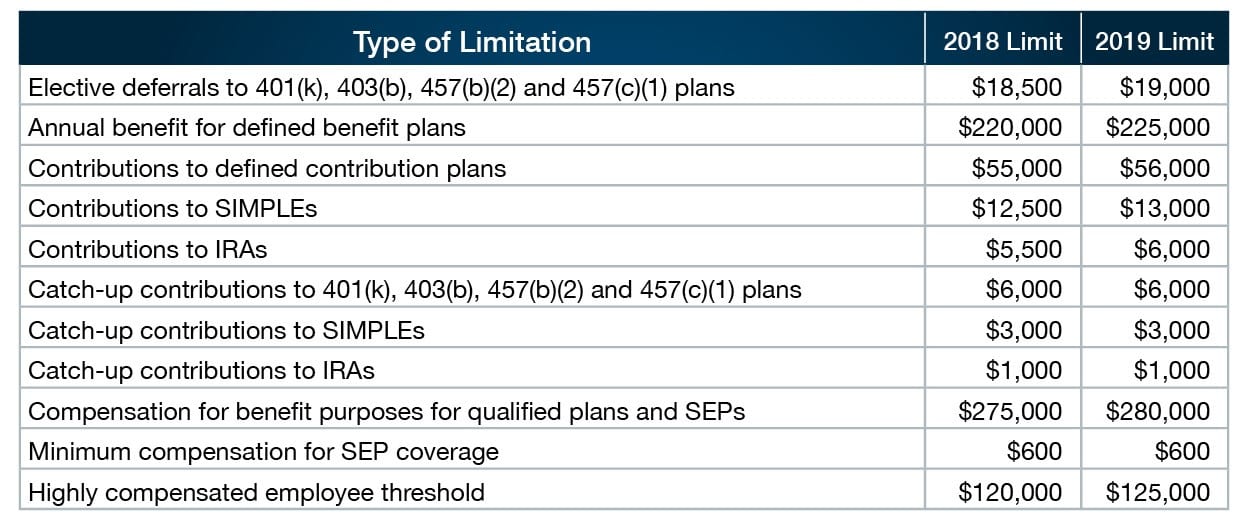

What Do 2019 Cost-of-living Adjustments Mean For You – Pya

312263 Estate And Gift Tax Returns Internal Revenue Service

312263 Estate And Gift Tax Returns Internal Revenue Service

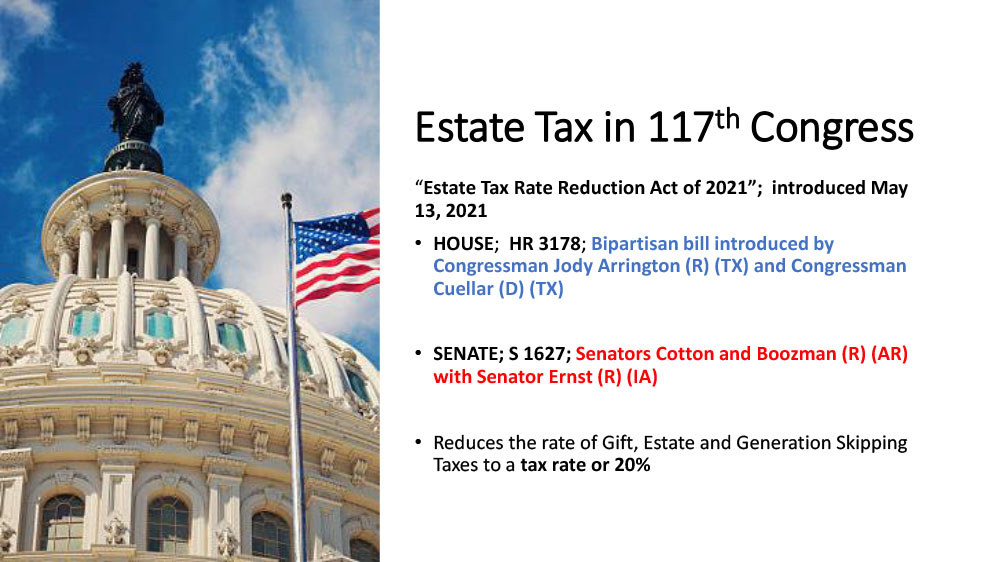

Legislation – Policy And Taxation Group

/vault-1144249_1920-dd5f13b69371488bb2f354e6eca08b28.jpg)

Unified Tax Credit Definition

312263 Estate And Gift Tax Returns Internal Revenue Service

312263 Estate And Gift Tax Returns Internal Revenue Service

Thoughtful Gifting Part 1 Use It Or Lose It Now Could Be The Time To Use Your Gift And Estate Tax Exemption

2

Irs Guidance On Clawback Of Gift Estate Tax Exemption – Bosinvest

The Federal Estate Tax Is Back – Ppt Video Online Download

The Federal Estate Tax Is Back – Ppt Video Online Download

312263 Estate And Gift Tax Returns Internal Revenue Service

Build Back Better Estate Tax Planning Impacts

What Do 2019 Cost-of-living Adjustments Mean For You – Pya

Tax Rate – An Overview Sciencedirect Topics

How Do Millionaires And Billionaires Avoid Estate Taxes

What Do 2019 Cost-of-living Adjustments Mean For You – Pya

What Is The Lifetime Gift Tax Exemption For 2021 – Smartasset