The current total local sales tax rate in sumner county, tn is 9.250%. • total vehicle sales price = $25,300 • $25,300 x 7% (state general rate) = $1,771 • $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 • clerk negotiates check for $1,771 tn sales tax paid by dealer if.

Two Challenge Anthony Holt For Sumner County Executive Seat

2.3 drive insured tn faq:

Tn vehicle sales tax calculator sumner county. Typically, automobile and boat sales in tennessee are subject to sales or use tax. The 9.25% sales tax rate in gallatin consists of 7% tennessee state sales tax and 2.25% sumner county sales tax. $ 4.00 regist & title + sales tax + plate postage + lien if one = total fees ($92 or $15.50)+ sales tax + $4.00 + $11 if lien = total fees checks should be made payable to:

Sumner county clerk 355 n belvedere dr rm 111 gallatin tn, 37066 (low selling price affidavit.) you can check the value of your vehicle at www.kbb.com or www.nada.com; The minimum combined 2021 sales tax rate for sumner county, tennessee is.

$0.70 per residential square foot; Commercial vehicle (buses, taxis) registration is. Between spouses, siblings, lineal relatives (parents and children, grandparents and grandchildren, great grandparents and great grandchildren) or spouses of.

Tennessee sales and use tax county and city local tax rates county city local tax rate effective date situs fips code ^ county city local tax rate effective date situs fips code ^ jackson 2.75%; Occasional and isolated sales of motor There is no applicable city tax or special tax.

Tennessee collects a 7% state sales tax rate. <<strong>calculate tax</strong>> if you obtained your vehicle from a lineal relative or the selling price is less than 75 percent of the retail pricing guide value, both the seller and the purchaser are required to complete an additional form. Taxation of car and boat sales.

3.2 view available license plates: Other counties in tn may have a. You can find these fees further down on the page.

3.1 vehicle sales tax calculator. 2.2 proof of identy/ residence: The sumner county sales tax rate is %.

In addition to taxes, car purchases in tennessee may be subject to other fees like registration, title, and plate fees. Tennessee sales and use tax county and city local tax rates Personal vehicle registration is $21.50;

The few exceptions to this rule are when vehicles or boats are sold: $0.40 per commercial square foot; $50,000 / 100 = 500 x $2.262 = $1,131.00 (rounded) or ($25,000 x.02262 = $1,131.00)

For tax rates in other cities, see tennessee sales taxes by city and county. , tn sales tax rate. If sales tax value is greater than $1600 but less than $3200 your single article tax is 2.75% after $1600 if sales tax value is more than $3200 your single article tax is $44.00 disclaimer:

Tn auto sales tax calculator the following information is for williamson county, tn, usa with a county sales tax rate of 2.75%. $ click here license plate postage: You can print a 9.25% sales tax table here.

Replacement titles for current sumner county registered vehicles can be applied for. The tennessee state sales tax rate is currently %. How is sales tax calculated in sumner county, tennessee sales tax in sumner county, tennessee is calculated using the following formula:

There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. The 2018 united states supreme court decision in south dakota v. This is the total of state and county sales tax rates.

Sumner county’s tax burden is lower than most in the nashville market. The assessed value is $50,000 (25% of $200,000), and the tax rate has been set by your county commission at $2.262 per hundred of assessed value. The sales tax calculator is for informational purposes only, please see your motor vehicle clerk to confirm exact sales tax amount.

To figure the tax simply multiply the assessed value ($50,000) by the tax rate (2.262 per hundred dollars assessed). 1.5 duplicate title 2.1 tag renewal information. Vehicle tag renewal click here.

Sales tax rate = s + c + l + sr

Tn Vehicle Sales Tax Calculator Sumner County – 122021

Tennessee County Clerk – Registration Renewals

Midterm Elections Tennessee Election Day 2018 Sumner County Results

Tn Vehicle Sales Tax Calculator Sumner County – 122021

Information

Tn Vehicle Sales Tax Calculator Sumner County – 122021

Tennessee County Tax Statistics Ctas

Tn Vehicle Sales Tax Calculator Sumner County – 122021

Vehicle Taxes What You Need To Know Miracle Cdjr Blog

Tennessee County Clerk – Registration Renewals

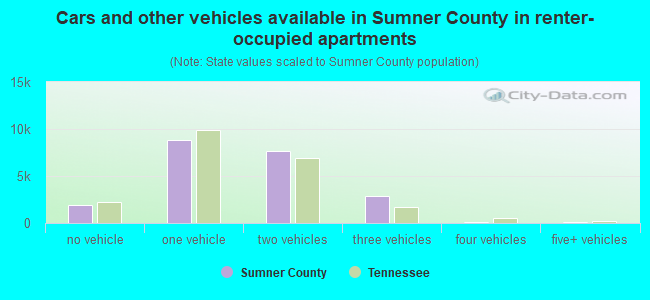

Sumner County Tennessee Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Car Tax By State Usa Manual Car Sales Tax Calculator

Tn Vehicle Sales Tax Calculator Sumner County – 122021

Tn Vehicle Sales Tax Calculator Sumner County – 122021

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Tn Vehicle Sales Tax Calculator Sumner County – 122021

Sumner County To Increase Property Taxes By At Least 20 Percent For The Second Time In Five Years – Tennessee Star

Sumner County Tn Businesses For Sale – Bizbuysell

Tn Vehicle Sales Tax Calculator Sumner County – 122021