4) 01057 amended return business tax 02051 county/state business tax return 1) 01054 estimated payment (qtr.

Free Form Fae 170 Franchise And Excise Tax Return Kit – Free Legal Forms – Lawscom

The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the secretary of state to do business in tennessee, regardless.

Tn franchise and excise tax guide. These taxes are the excise tax and the franchise tax and they are imposed on corporations and most limited liability companies. Pay all taxes from the time the articles of incorporation were filed with the state to the tn dept of revenue. The minimum tax is $100.

Select the form you need in our library of legal forms. 3) 01056 estimated payment (qtr. This franchise, excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of tennessee franchise, excise tax requirements.

The excise tax is 6.5% of the net taxable income. The franchise tax is based on the greater of the entity’s net worth or the book value of certain fixed assets, plus an imputed value of rented property. The franchise tax has a minimum payment of $100.

Franchise tax is figured at.25% of the net worth of corporation or the tangible property. When calculating franchise tax, if the holding entity owns an interest in several other entities, its equity can potentially be taxed more. Once all of the above is complete, the secretary of state requires a letter of clearance from the dept of revenue.

However, they would still be on the hook for the excise tax (6.50%) since that's based on the net earnings of the llc during the year. The information provided in the department’s tax manuals is general in nature. Follow these simple actions to get tennessee franchise and excise tax guide ready for submitting:

See previously issued multistate tax alert for Penalty on estimated franchise and excise tax payments is calculated at a rate of 2% per month, or portion thereof, that an estimated payment is deficient or delinquent, up to a maximum of 24% of the deficient or delinquent amount. The state of tennessee imposes two taxes for the privilege of doing business within its boundaries.

2 dear tennessee taxpayer, this franchise and excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of tennessee franchise and excise tax requirements. It is not an allinclusive document or a substitute for tennessee franchise and excise tax statutes or rules and regulations. The excerpts from the tennessee code are through the 2020 legislative session.

The tennessee department of revenue has updated its state corporate franchise and excise tax guidance to reflect legislation enacted in 2015 [h.b. Create an account using your email or sign in via google or facebook. The tax guide is not intended as a substitute for tennessee franchise, excise statutes or rules

Pay all penalties and interest to the dept of revenue. Do that by pulling it from your internal storage or the cloud. Franchise tax will be based on $0.25 per every $100 of net worth with a minimum $100 tax.

The excise tax is based on the net income of Click on the fillable fields and put the requested details. It is calculated from the due date of the estimated

Look through the recommendations to find out which info you will need to provide. Tn state tax, you will file a tn annual franchise and excise tax return. Open the form in the online editor.

$0.25 per $100 based on either the fixed asset or equity of the entity, whichever is greater. General partnerships and sole proprietorships are not subject to these taxes. Yourself with how these taxes apply to you.

To sign a franchise ampampamp excise tax forms tennessee right from your iphone or ipad, just follow these brief guidelines: Install the signnow application on your ios device. Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for tennessee purposes.

Two years ago, bridgestone received approval from the commissioner of economic development to offset 100% of its state franchise and excise taxes using the. The tennessee department of revenue recently published a redacted letter ruling, no. Tennessee's 2015 franchise and excise tax guide provides additional information that companies operating inside and outside tennessee should review and plan accordingly in advance of 2016.

Tennessee’s “industrial machinery credit” gives companies who meet investment thresholds a tax break of between 3% and 10% of the purchase price of certain business equipment. From my understanding, the only upside here is that they don't have to pay the franchise tax (0.25%), which is tied to the value of the assets held in the llc. The excise tax is based on net earnings or income for the tax year.

Upload the pdf you need to esign. The information in this guide is. 2) 01055 estimated payment (qtr.

Tennessee franchise and excise tax guide, tenn. Excise tax is based on 6.5% of net earnings from tn business profits. 6.5% excise tax on the net earnings of the entity, and;

The tennessee franchise and excise tax has two levels: Amended streamlined sales tax ser (annual) franchise & excise 01050 annual return 01051 extension 01053 estimated payment (qtr.

2017-2021 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank – Pdffiller

Tennessee Franchise And Excise Tax Guide – Pdf Free Download

Franchise Excise Tax – Obligated Member Entities – Youtube

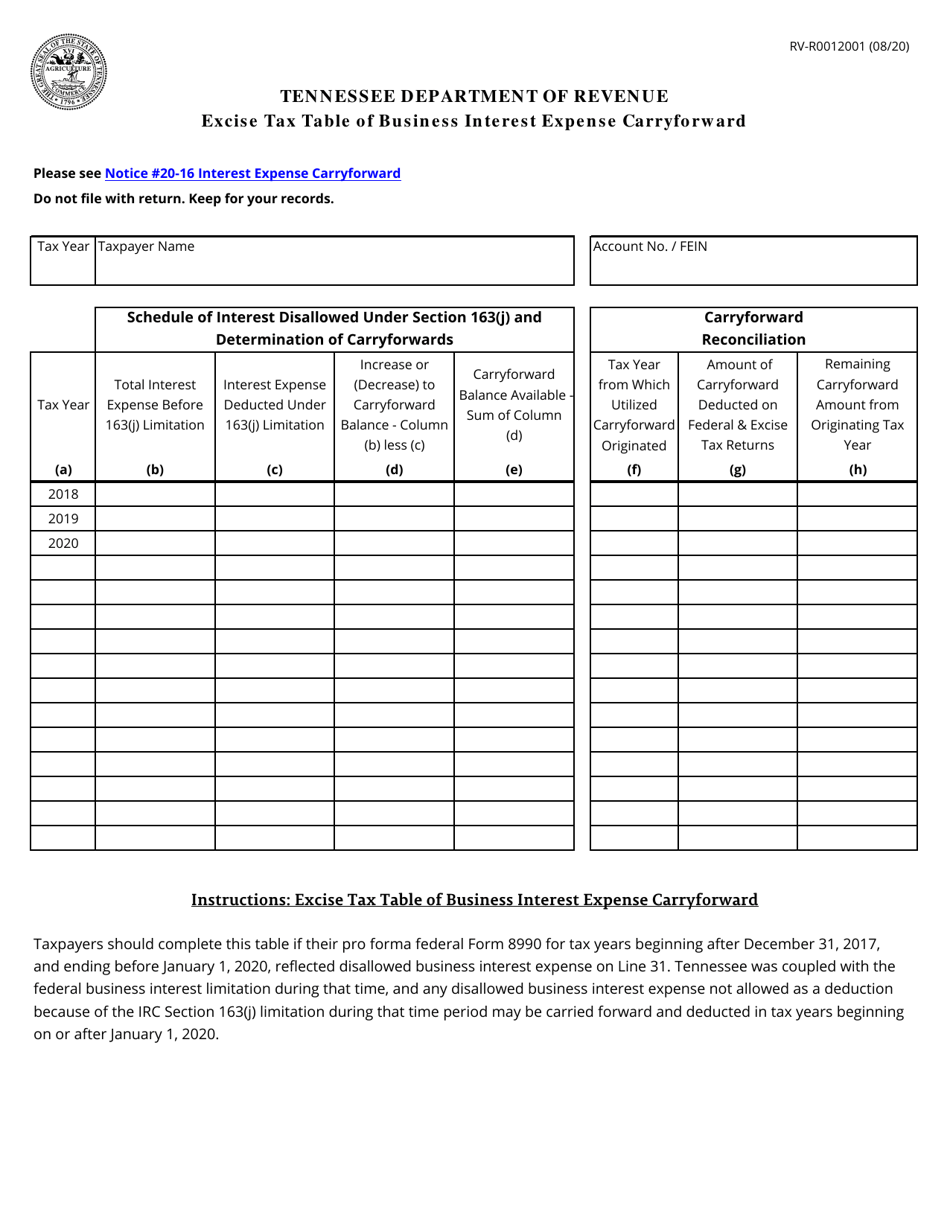

Form Rv-r0012001 Download Printable Pdf Or Fill Online Excise Tax Table Of Business Interest Expense Carryforward Tennessee Templateroller

Franchise Excise Tax Workshop – Filing And Paying Requirements – Youtube

Tennessee Franchise And Excise Tax Guide – Tngov Franchise And Excise Tax Guide Is Intended As An Franchise And Excise Tax Statutes Or Rules Also Offers A Toll-free Franchise –

Franchise Excise Tax Workshop – Youtube

Tngov

Tennessee Franchise And Excise Tax Guide August Pdf Free Download

Tennessee Franchise And Excise Tax Guide – Fill And Sign Printable Template Online Us Legal Forms

Tennessee Franchise And Excise Tax Guide – Pdf Free Download

Tngov

Tennessee Franchise And Excise Tax Guide – Pdf Free Download

Tngov

Fae 170 – Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print – Pdffiller

Tngov

Tennessee Franchise And Excise Tax Guide – Tngov Franchise And Excise Tax Guide Is Intended As An Franchise And Excise Tax Statutes Or Rules Also Offers A Toll-free Franchise –

Tennessee Franchise Excise Tax – Price Cpas