The report provides an overview of the property tax lending industry in texas and discusses the findings and The history of property tax loans in texas dates back to 1933.

So How Do Tax Liens And Tax Levy Differ Independent Reading Activities Word Wall Independent Reading

The goal of the tptla is to raise awareness of property tax loans and promote high standards of behavior among its members and the industry at large.

Texas property tax lien loans. The bad part about the fee — you’re only paying for the possibility of getting a loan. Excessive tax delinquency can even lead to foreclosure, often for fractions of the value of the property. Tax loan myth number one:

This all depends on the requirements of the property tax lien financing company that you decide to work with. We look forward to helping by offering affordable payment options for your property tax balance. The type of foreclosure for a property tax lien changes depending on the date that the loan was originated.

Property tax lenders in conjunction with the transfer of property tax liens and the payoff of loans secured by property tax liens. The texas tax code allows the tax transferee to charge the mortgage lender/servicer a 25% premium for redemption of the property. North texas tax lien loans is a licensed tax lien lender who lends real property owners money to pay off property taxes, interest and penalties instantly with the convenience of low monthly payments.

Our property tax loans are suited for almost all situations and budgets. A lien transfer is a far better alternative. Click here click here for an instant quote.

To visit our arlington location click here. A coalition of partners that have agreed to be held to the highest bar. Property taxes are rising in texas, and this makes property tax lien transfers an economic necessity for many in the lone star state.

An association of lenders committed to the highest standards with a consumer driven focus. In texas, even though you may hear of a sale referred to as a “texas tax lien sale”, a buyer is not buying a lien, but is actually buying the deed to a property at a sheriff sale. Being behind on your texas property taxes can open a floodgate of penalty fees and payments.

Lien transfers are a form of tax lending, but often provide better options and lower interest rates for property owners in texas. Property tax liens differ from federal and state tax liens in several respects. This is not a complete list of laws that property tax lenders are required to comply with.

As a statewide alliance of 10 companies, we maintain the highest lending standards. Some of the most common that we get asked about here at the library are listed below. The texas property tax lienholders association (tptla) is a statewide alliance of companies.

Property tax funding will pay your delinquent property taxes, penalties, and interest and provide you with a customized repayment plan that fits your budget. We’ve helped thousands of texans avoid penalties, collection fees and foreclosure by offering a fast and simple solution. However, policies around property tax lien transfers continue to change today.

There are several different kinds of property liens in which foreclosure can be used to collect the debt that is owed. Sb 1520 would allow a first lien holder to pay off a tax lien loan within six months of. You have to pay for property loans in texas.

The tax lien debt and protect their interest in the property. Taxes leading to foreclosure can include property taxes, city taxes, hospital taxes and school taxes as well as city liens placed against the property by the city. Property liens are notices that are attached to a piece of real property by a creditor when money is owed to them by the homeowner.

The landmark of property tax lending in texas. Property tax lending lets owners avoid this scenario, and gives them more payment options and ways to renegotiate payments if they fall behind. Welcome to the official texas property tax loans® website.

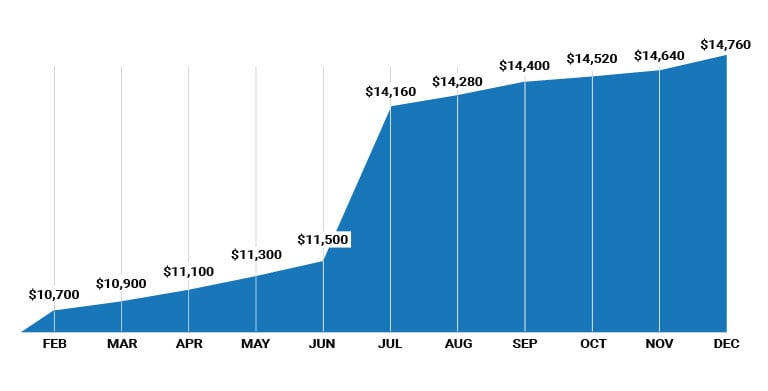

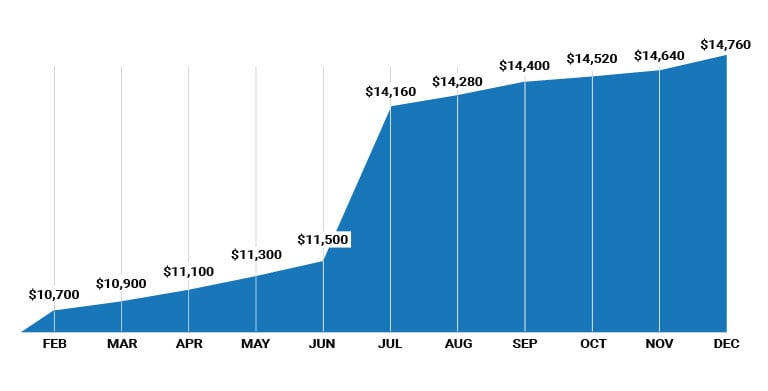

These are the primary statutes and rules that apply to property tax lenders. The finance commission has collected and analyzed current and historical data in an effort to provide a clear picture of the costs of property tax loans. The bill would require judicial oversight of foreclosures and would institute a foreclosure process with more safeguards.

Our online application process is simple; Serving a need for their clients in a way no other lenders can. Some texas property tax lenders charge for the application process.

A loan to pay property taxes can provide fast funding & help you avoid penalties. They’ve changed a lot in the last 80 years. We provide easy approval and fast funding in texas.

Tax liens and personal liability chapter 351, texas finance code: Not necessarily true, but it’s not completely false either. (a) on january 1 of each year, a tax lien attaches to property to secure the payment of all taxes, penalties, and interest ultimately imposed for the year on the property, whether or not the taxes are imposed in the year the lien attaches.

It’s easy to pay off your property taxes when you call tax ease. The lien exists in favor of each taxing unit having power to tax the property. We offer flexible terms and attractive rates to all property owners to pay your property taxes and penalties.

The holder or mortgage servicer of a recorded preexisting lien on property encumbered by a tax lien transferred as provided by subsection (b) is entitled, within six months after the date on which the notice is sent, to obtain a release of the transferred tax lien by paying the transferee of the tax lien the amount owed under the contract between the property owner and the transferee. Your first legal collection penalties, typically in july, amount to 20%, then you will receive collection letters that. Primary state statute chapter 32, texas tax code:

No filing of the lien is required. There are no upfront costs and no sales gimmicks. Government’s legal claim against your property when you don’t pay a tax debt.

Free Second Offer To First Lien Holder Lender Form Real Estate Forms Letter Form Word Template

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Dallas County Release Of Lien Form Texas Deedscom County Faulkner Baltimore County

How Property Tax Lien Transfers Protect Homeowners

I Chose This Image Because It Is An Example Of A Ucc-1 Which Means It Is A Formal Notice That A Li Bill Of Sale Template Financial Independence Card Templates

Tarrant County Property Tax Loans Ovation Lending

What You Need To Know About State Tax Liens In Texas

Texas Property Tax Loans Funding Loans For Property Taxes

Texas Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537471334 Amazoncom Books

How To Become A Landlord With No Money Being A Landlord How To Become Investing

Pin By Waretsu Hiirga On Social Share Mortgage Loans Reverse Mortgage Real Estate Investing

Tptla Property Tax Loans

Property Tax Loans Vs Lien Transfers Is There A Difference

Get Rid Of Your Tax Liens In Texas Tax Ease Blog

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Property Tax Loans – Rev Tax Group

Monetary Vs Non Monetary Rewards In An Employee Referral Program Care Jobs Financial Advisors Payday Loans

Offer To First Lien Holder Lender Real Estate Forms Letter Form Word Template