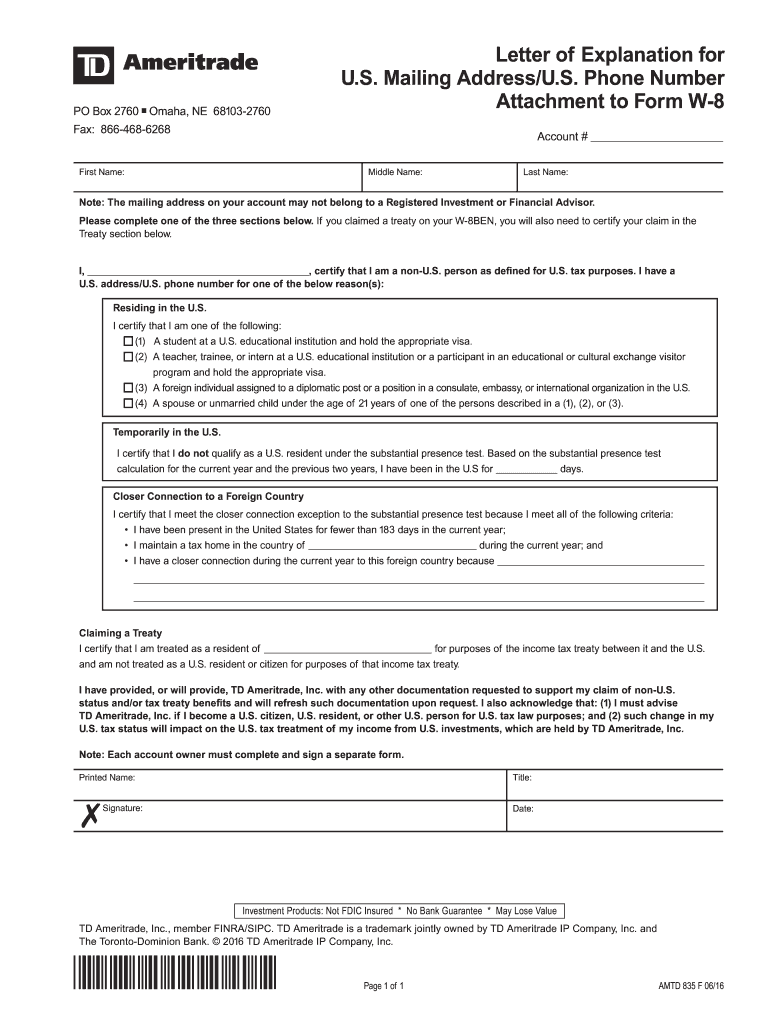

For united states tax withholding give this form to thewithholding agent or payer. If you do not make an election, we will automatically apply withholding (if required) at the minimum rate based on your state of

Logo – Td Ameritrade Institutional

I recently opened an account with td ameritrade.

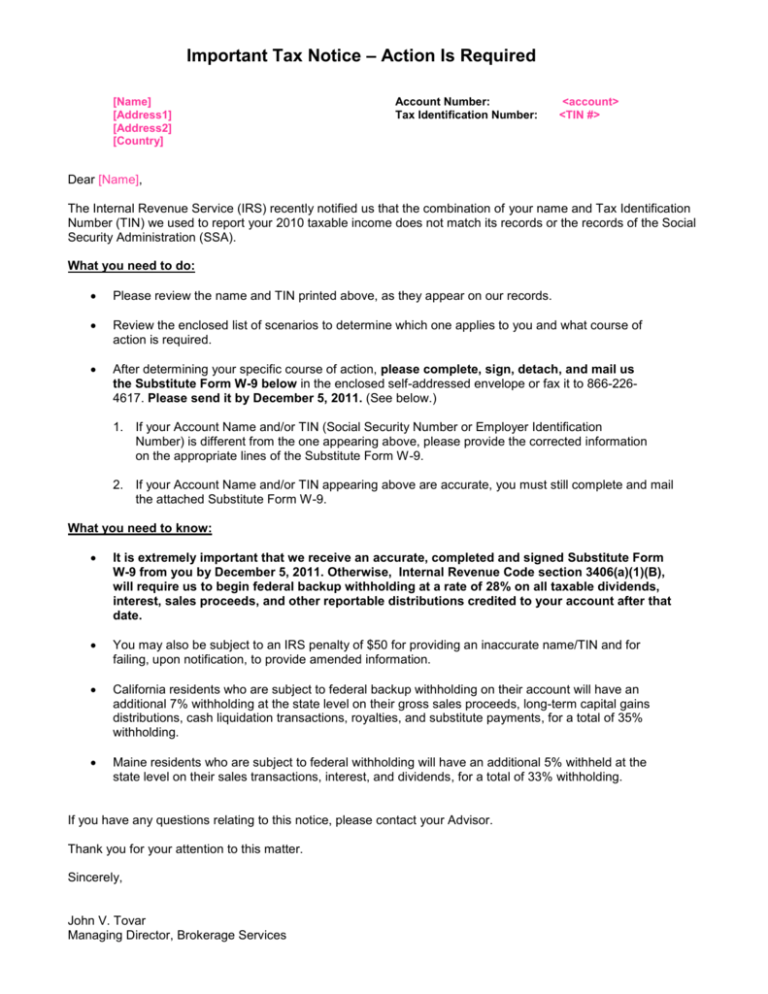

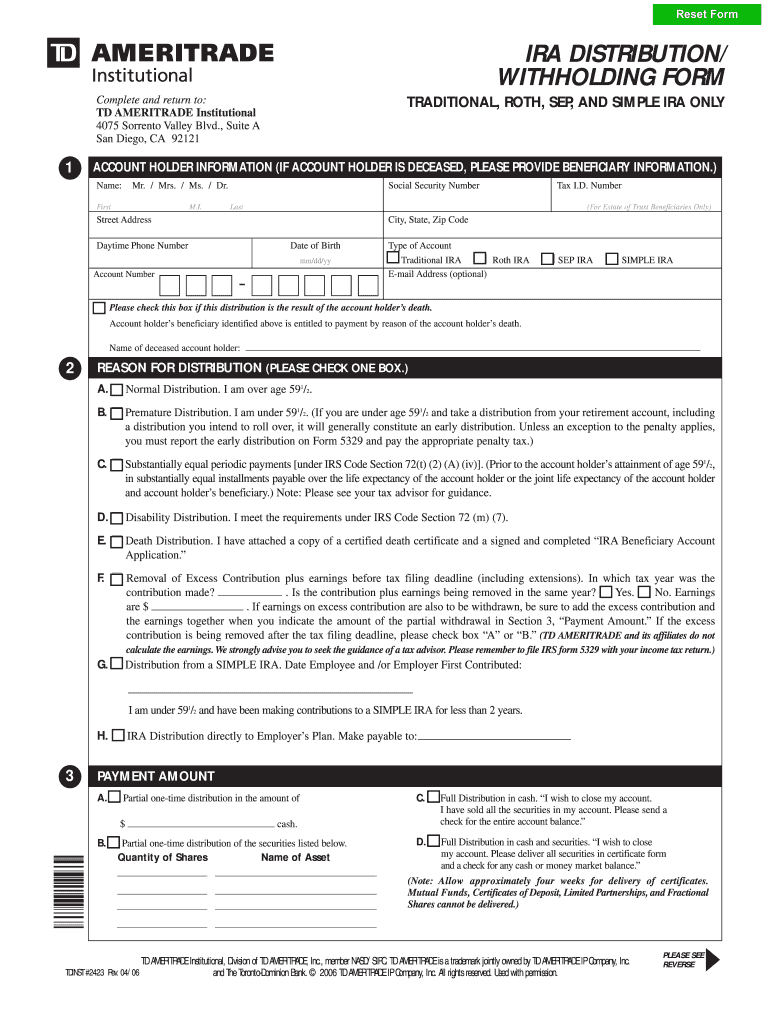

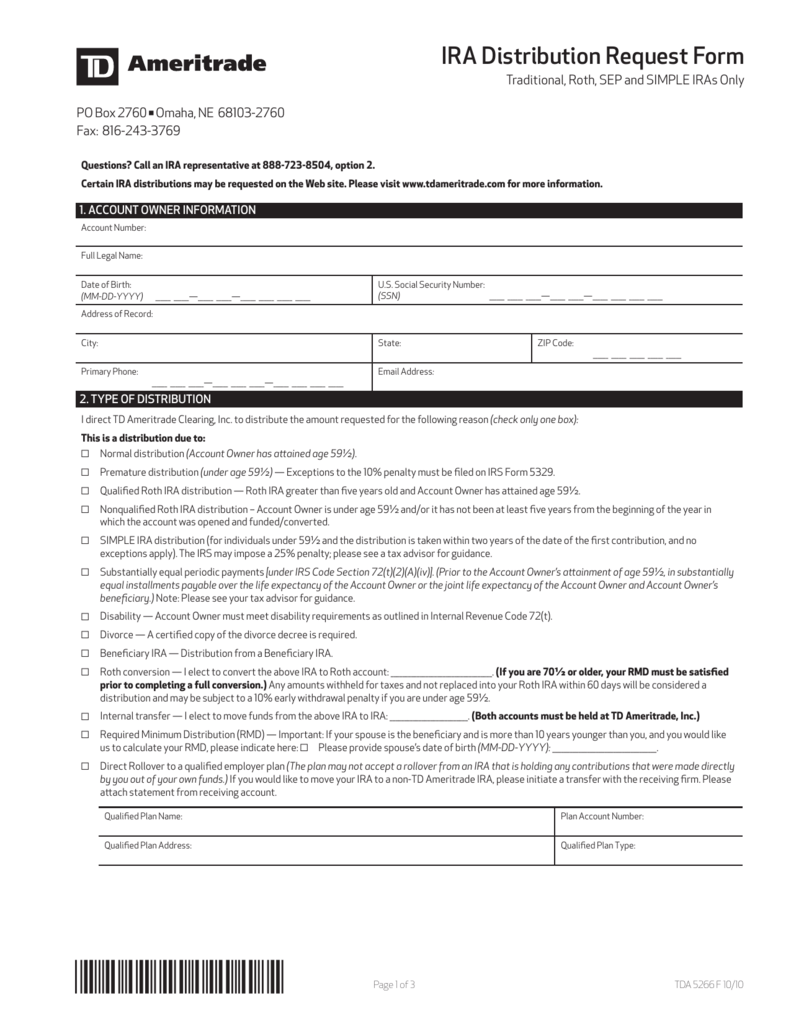

Td ameritrade tax withholding. Is not responsible for changes in Cases, td ameritrade clearing, inc. Is required by federal and/or state statutes to withhold a percentage of your ira distribution for income tax purposes.

Advises you to contact your tax professional before making any election regarding state withholding elections. Therefore, if you are a u.s. 90% of the tax you owe for the current year, or 100% of the tax you owed for the previous tax year.”

Regular tax bracket and 15% for most other taxpayers. Except in the unlikely case a specific tax treaty applies to you, everyone. In some cases, you may elect not to have state tax withheld, or you may tell us how much you would like us to withhold.

If you trade with td ameritrade, the withholding agent is td ameritrade. The statutory withholding rate is 30% unless you have claimed an active treaty for your account, in which case it may be lower. Will require td ameritrade singapore to begin federal backup withholding at a rate of 28% on all taxable dividends, interest, sales proceeds (including those from options transactions),

Status and avoid section 1446 withholding on your share of. Td ameritrade has a dedicated tax reporting section on their platform called. To withhold a percentage of your ira distribution for income tax.

Td ameritrade handles all taxable reporting for your clients’ accounts and the distribution of Is required by federal and/or state statutes to withhold a percentage of your ira distribution for income tax purposes. Mailing date for forms 480.6a and 480.6b.

Once completed you can sign your fillable form or send for signing. Withholding is done at the time when the payment was made, whether or not there is an actual transfer of cash or other property (p.3) Do i need to report anything on my tax return if i haven't withdrawn any funds from the account?

Td ameritrade institutional, division of td ameritrade, inc., member finra/sipc/nfa. Tda will provide you with a form known as a. This means td ameritrade should automatically withhold taxes from your dividends.

In other cases, federal and/or state statutes require td ameritrade, inc. For net gains that would otherwise be taxed in the two lowest regular brackets, the rate is 0% — in other words, State withholding if you change the state of residence listed on your account, you will be responsible for any state withholding tax implications.

Td ameritrade institutional td ameritrade institutional does not provide tax advice. We expect 1099s to be available online by february 15, 2021 by the irs deadline. Td ameritrade is a trademark jointly owned by td

Is required by federal and/or state statutes to withhold a percentage of your ira distribution for income tax purposes. Use fill to complete blank online td ameritrade pdf forms for free. Backup withholding is a form of tax withholding that all brokerage firms including td ameritrade, are required to make on income from stock sales, along with interest income, dividends, or other kinds of payments that are reported on the various types of form 1099.

Be sure to use the address for new accounts: You must enter the gain or loss on sales of securities, dividends and interest earned, etc. Meanwhile, proceeds from the sale of us stocks will not trigger a taxable event.

I think it is fine for newbies, the only issue so far with td ameritrade is the long wait for the account opening. If you do not make an. All forms are printable and downloadable.

With this option, you can download some pdf forms, fill them out, and snail mail them back in. Generally, td ameritrade will withhold an applicable percentage of dividend and interest income from u.s. Again, taxes collected from dividends payments will be withheld by the brokerage.

Foreign person, and pay the section 1446 withholding tax. Regardless of whether you withdrew money from your account or not. You may receive your form earlier.

If you have any other questions regarding your application or account, please contact td. Withholding agents are personally liable for any tax required to be withheld. This section is very useful for information about reportable transactions, tax documents availability, tax reporting questions, and rmd calculations just to name a few.

The document should arrive by february 16, 2021, depending on your trading activity and the dividend issuer’s. State law is subject to change, and td ameritrade clearing, inc.

What Are Qualified Dividends And Ordinary Dividends – Ticker Tape

Td Ameritrade Letter Of Explanation – Fill Online Printable Fillable Blank Pdffiller

Ameritrade Ira Distribution Withholding Form – Fill Online Printable Fillable Blank Pdffiller

How To Read Your Brokerage 1099 Tax Form – Youtube

1040s 1099s Other Federal Tax Forms What You Mig – Ticker Tape

Its Harvest Time Potentially Grow Your Savings Usin – Ticker Tape

Fill – Free Fillable Td Ameritrade Pdf Forms

W 8ben Tda Pdf Tax Treaty Withholding Tax

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien – Katie Scarlett Needs Money

W 8ben Tda Pdf Tax Treaty Withholding Tax

Fill – Free Fillable Td Ameritrade Pdf Forms

2

Ira Distribution Request Form

2

Excited About Your Tax Refund It May Not Be Worth Th – Ticker Tape

1099 Information Guide – Pdf Free Download

2

2

1040s 1099s Other Federal Tax Forms What You Mig – Ticker Tape