“it’s not a wealth tax, but a tax on unrealized capital gains of exceptionally wealthy individuals,” the treasury secretary concluded. President biden’s proposal to require roughly 700 u.s.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Call Option Definition

Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government.

Taxing unrealized gains explained. Democrats are gearing up to impose a tax on unrealized capital gains. Treasury secretary janet yellen proposed taxing billionaires’ unrealized capital gains to fund president joe biden’s $2 trillion spending bill — a bill which the president has claimed costs $0. As the wsj explains, this new unrealized capital gains tax would look at the value of the asset on january 1 and then again on december 31 of the same year.

Of course, like the controversial $600 irs monitoring proposal, yellen stressed that the proposal was aimed at “extremely wealthy individuals, billionaires.”. Posted on november 4, 2021. Currently, the tax code stipulates that unrealized capital gains are not taxable income.

Taxing unrealized gains grants the government the ability to monitor your each and every move. The madness of taxing unrealized capital gains. Then, going forward, payers would be on the hook for annual capital gains taxes on new unrealized income — although unrealized losses could be carried forward as offsets.

The tax targets “unrealized capital gains,” which are oxymorons that exist only in the minds of tax law enthusiasts. House of representatives speaker nancy pelosi. If a billionaire’s real estate.

Janet yellen, the treasury secretary in the joe biden administration, has proposed a tax on unrealised capital gains. Tax on unrealized capital gains, explained. Across all demographic groups, americans strongly oppose.

The new proposal would tax unrealized capital gains, meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Us treasury secretary, janet yellen, explained the plan to tax unrealized gains on cnn's state of the union this sunday, october 24th, “what’s under consideration is a proposal. An unrealized gain is a type of profit that an investor, company or individual is yet to receive but is expected to make in the future.

Yellen emphasized, however, that the tax was not a wealth tax. Democrats want to impose a new tax on america’s wealthiest by taxing unrealized capital gains similar to other types of income. If the proposal were to pass, billionaires.

This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset. A profit that is recorded on paper is an unrealized gain, such profit can be made through an investment or sales by a company. During an interview with cnn on sunday, yellen touted the idea of taxing the unrealized capital gains of the wealthiest 1 percent, though she claimed.

President biden’s proposal to require roughly 700 u.s. The madness of taxing unrealized capital gains. President biden’s proposal to require roughly 700 u.s.

The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. The madness of taxing unrealized capital gains. Payments could be spread out over five years.

House of representatives speaker nancy pelosi. These incomes escape taxation until the investors realize them, or sell the assets, yellen explained. The tax would apply to people who make more than us$ 100 million a year for three years in a row or if one makes us$ 1 billion in annual income.

There are plenty of other objections to taxing unrealized capital gains and, writing back in 2019, david. We need to stick it to the taxpayer. That would impose a tax on unrealized capital gains on liquid assets held by extremely wealthy individuals — billionaires.

The impacted assets include stocks, bonds, real estate, and art. A capital gain is the profit you make when you sell an investment asset for. Capital gains tax is a tax on the profit that investors realise on the sale of.

Once lawmakers have the power to tax unrealized gains, it will be just a matter of time before lawmakers running out of tax revenue will set their aim at one of the largest sources of wealth hiding from the irs, unrealized gains in real estate and mutual funds that the public holds. Nearly every post on social media and forums concerning this. Nearly every post on social media and forums concerning this subject is littered with commentary that indicates americans think taxing unrealized gains is a horrible idea.

Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government. Yellen explained the concept, which aims to tax americans on unrealized capital gains stemming from liquid assets. I wouldn’t call that a wealth tax.”.

Taxing unrealized gains grants the government the ability to monitor your each and every move. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government. Democrats unveil billionaire’s tax on unrealized capital gains.

Ch15

Sec Filing Patria Investments Limited

Sec Filing Patria Investments Limited

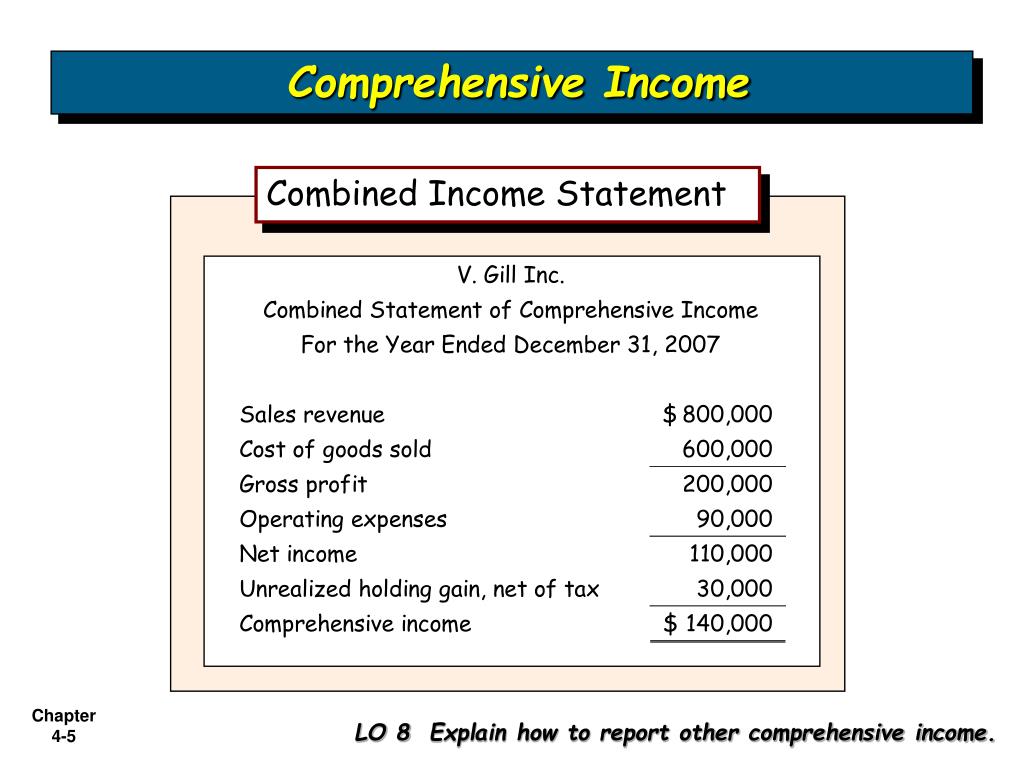

Slide 4 1 Chapter 4 Income Statement And

Accounting Conservatism And Income Smoothing Practices In Eu Food And Drink Industry Emerald Insight

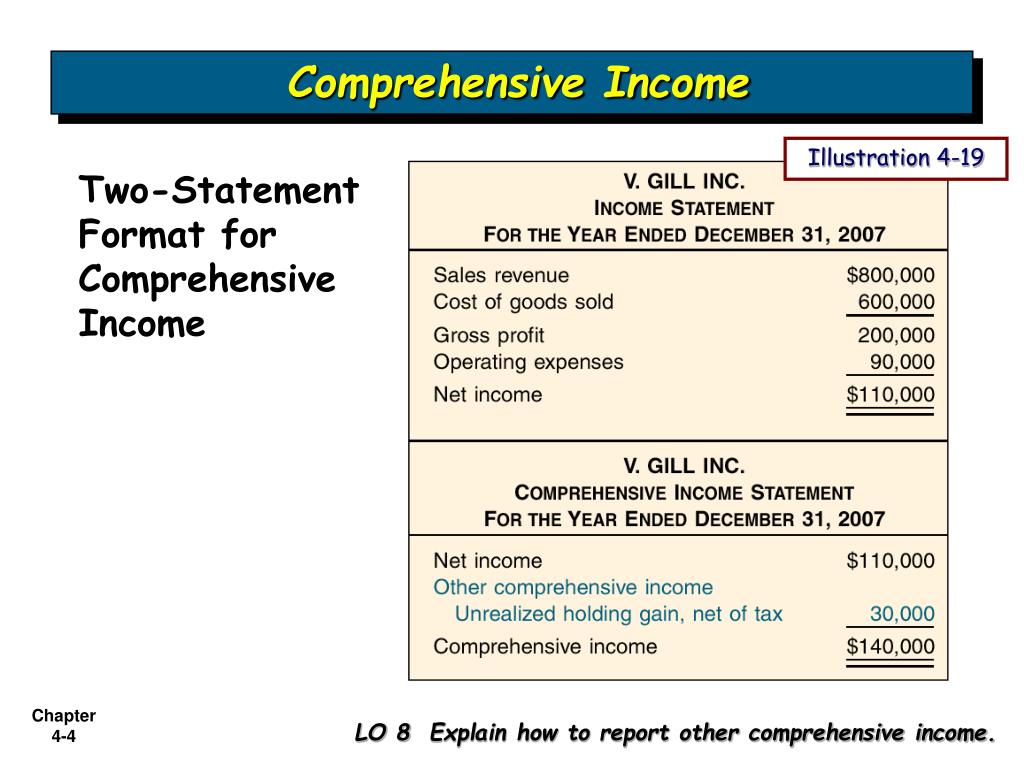

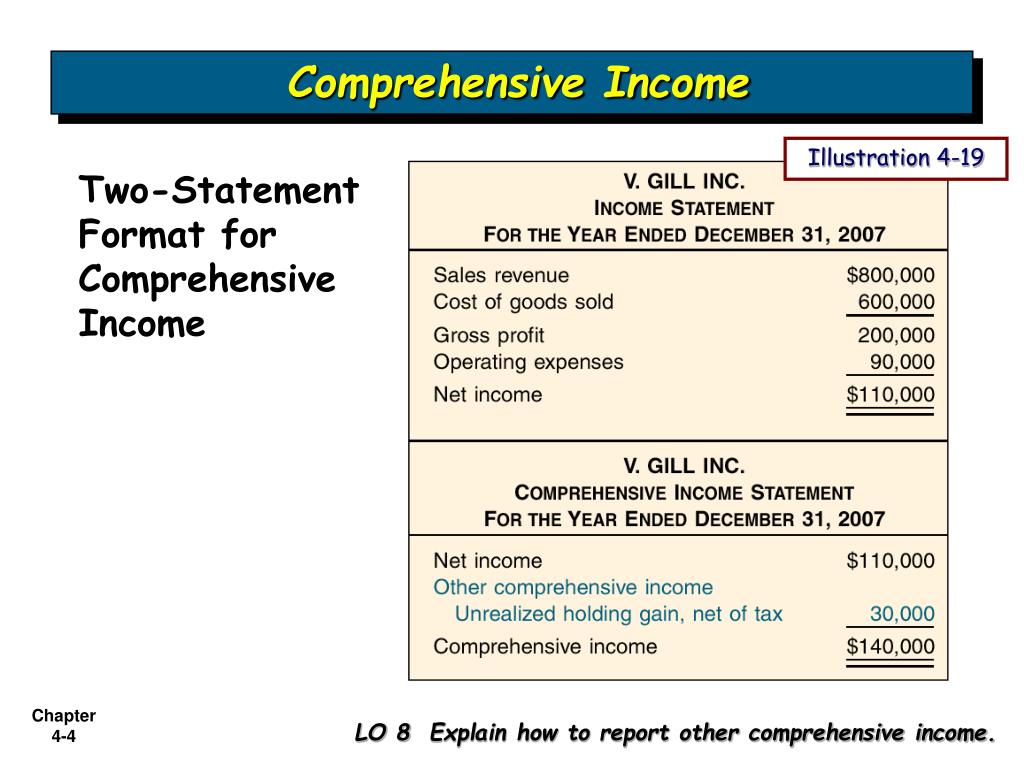

Ppt – Comprehensive Income Powerpoint Presentation Free Download – Id5575621

:max_bytes(150000):strip_icc()/dotdash_Final_Excess_Returns_Dec_2020-01-2a81d7a448684458b0ed30db04fd145c.jpg)

Excess Returns Definition

Is The Proposed Wealth Tax Constitutional Answer Depends On Direct Tax Definition

Slide 4 1 Chapter 4 Income Statement And

Basics Of Accounting Chart Of Accounts General Journal General Led Chart Of Accounts Accounting Accounting Basics

Ppt – Comprehensive Income Powerpoint Presentation Free Download – Id5575621

Accounting Conservatism And Income Smoothing Practices In Eu Food And Drink Industry Emerald Insight

Chapter 5 Monetary Accounts And Analysis In Macroeconomic Accounting And Analysis In Transition Economies

Passive Foreign Investment Company Expat Tax Online

Chapter 5 Monetary Accounts And Analysis In Macroeconomic Accounting And Analysis In Transition Economies

Income Tax Impact Of Switching In Mutual Funds Explained In 5 Points

Gold Price 50000 An Ounce Is Possible Jim Rickards Prediction Explained Predictions Gold Price Dollar Collapse

Corporate Tax 2021 Laws And Regulations Indonesia Iclg

Chapter 5 Monetary Accounts And Analysis In Macroeconomic Accounting And Analysis In Transition Economies