With their latest tax proposal, democrats are going after an elusive target: Im curious if this could actually work.

Biden Tax Plan And 2020 Year-end Planning Opportunities

This is super foolish if it’s applied universally, it will require people to keep much higher amount sitting in cash to pay for those taxes.

Taxing unrealized gains 401k. Currently, the tax code stipulates that unrealized capital gains aren't taxable income. Evidence from a survey experiment on the realization rule, the researchers found: According to a survey experiment conducted in may of 2021, americans strongly oppose taxing unsold gains across all demographics.

Americans oppose taxing unrealized gains. No, i didn’t just make that up. Taxing unrealized gains means that you would be taxed on the gains that your investements make as if you sold them.

I can’t believe any reasonably logical person would even think of this. So if you invest $100,000 and that investment goes up 10% (lots of zeros for you because threes and sevens are hard) you would have $110,000. The democrats want to get their foot in the door to tax unrealized gains.

Billionaires, and their growing piles of untaxed investment gains. Most people scoff at that thought however, even janet yellen, former chair to the federal reserve and current secretary of the treasury is an advocate for taxing your unrealized capital gains on your retirement plan like a 401k. To pay for the $5 trillion love letter to progressives, the democrats have floated taxing “ unrealized capital gains.”.

Thank you for your support. Taxing unrealized capital gains will unlock a pandora’s box. Investors not happy with the proposals the proposal worries investors.

Non resident alien from the us retirement withdrawal 401k u.s. Some are concerned that average investors would eventually have to pay the new tax. The basis will still be taxed at the ordinary income tax rate in the year of distribution and could be subjected to the 10 percent early withdrawal 72 (t) penalty tax if the withdrawal occurs.

The proposal to tax unrealized gains is deeply unpopular with the american public. The government would love to get 25 percent of your 401 (k)’s annual rise, and our nation’s massive annual deficits and cumulative debt means it will need that money sooner rather than later. “exactly,” musk, who is at the moment the wealthiest person in the world, wrote.

Although principle residences and holdings in 401k plans apparently will be excluded, the wyden proposal takes new tax hikes a step closer to imposing unrealized capital gains tax on the average investor. In their paper, the psychology of taxing capital income: Then, they're coming for your 401k plan.

Essentially it’s a way to tax. If i only keep 6 months of my needs in cash and invest everything, then if one of my stocks go parabolic i. If you are under 59 ½ a 10% penalty could also apply.

“it’s not a wealth tax, but a tax on unrealized capital gains of exceptionally wealthy individuals,” the treasury secretary concluded. Ad you can withdraw your entire us 401(k) ira tax free using tax treaty. 401k and ira is next.

Would you agree to a tax on unrealized gains such as taxing your house, stocks you hold and your 401k? You would then be taxed on the the gains ($10,000) at the capital gains tax rate (15/20%). This tax on unrealized gains would be not only difficult to implement but also could devastate markets, especially liquid markets, where stocks, bonds and commodities trade.

A proposed alternative is taxing gains to the extent of debt exceeding the decedent’s basis in transferred property and sheppard asserts that this approach would cover the problem of a decedent enjoying gains without tax during lifetime. Ad you can withdraw your entire us 401(k) ira tax free using tax treaty. Currently, you pay taxes on your retirement plan like a 401k, when you dip into your account.

If you tax unrealized gains, meaning you didn't sell. More than $5 trillion is. Taxing all gains at death is terrible policy.

What this means is that someone who owns stock or property that increases in value does not pay tax on that. And if you don't pony up for janet yellen's salary, the government is coming for you. Non resident alien from the us retirement withdrawal 401k u.s.

Ira Vs 401 K Top 8 Best Differences With Infographics

Unrealized Capital Gains Tax Explained

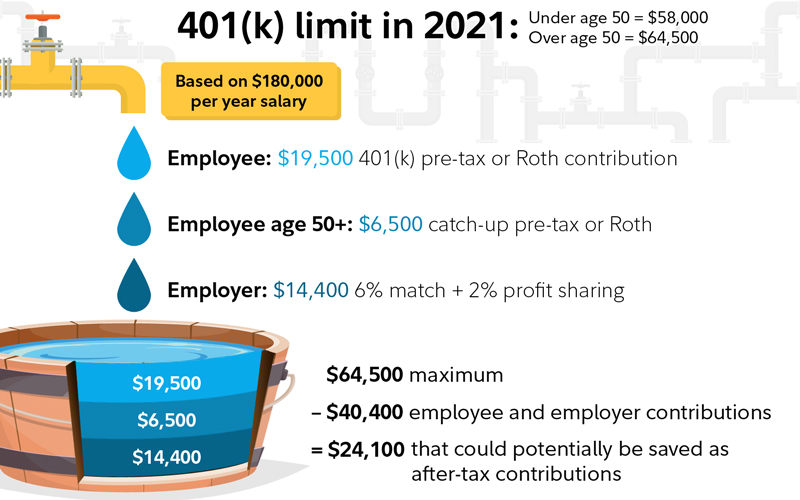

After-tax 401k Contributions Retirement Benefits Fidelity

Net Unrealized Appreciation The Undiscovered Pearl In Your 401k

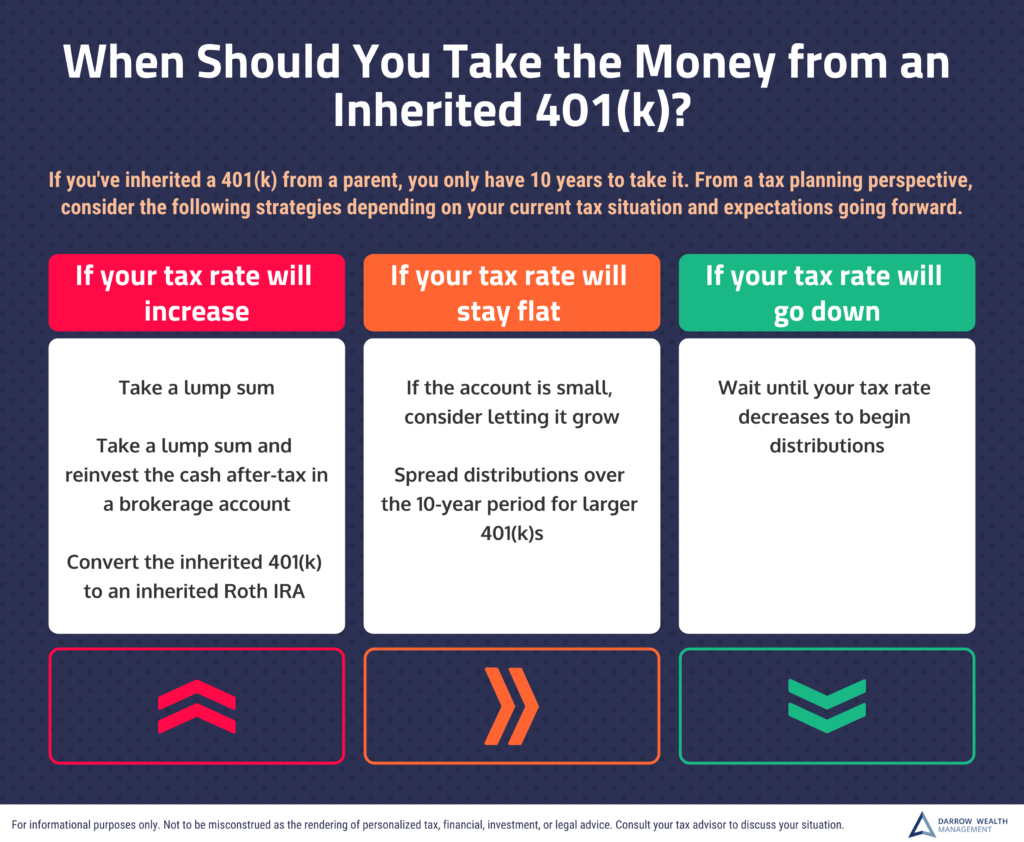

Inherited A 401k From A Parent Tax Planning For Distributions

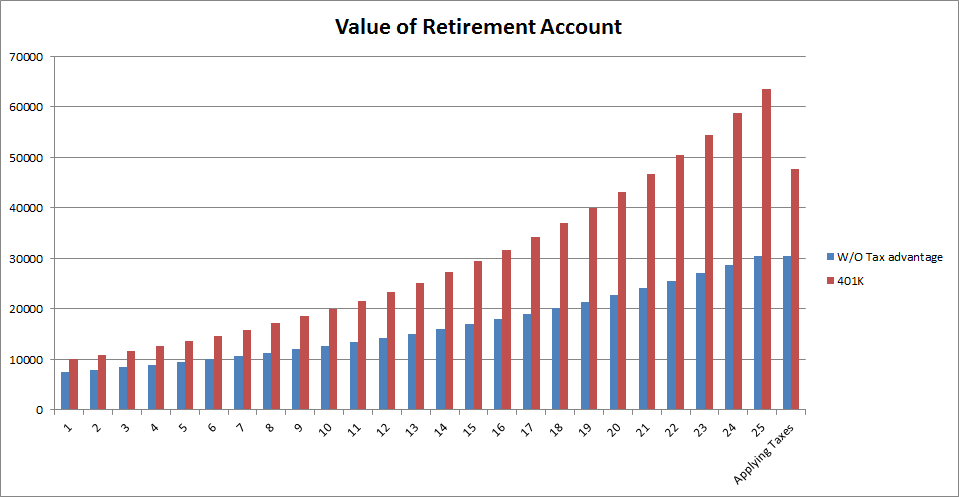

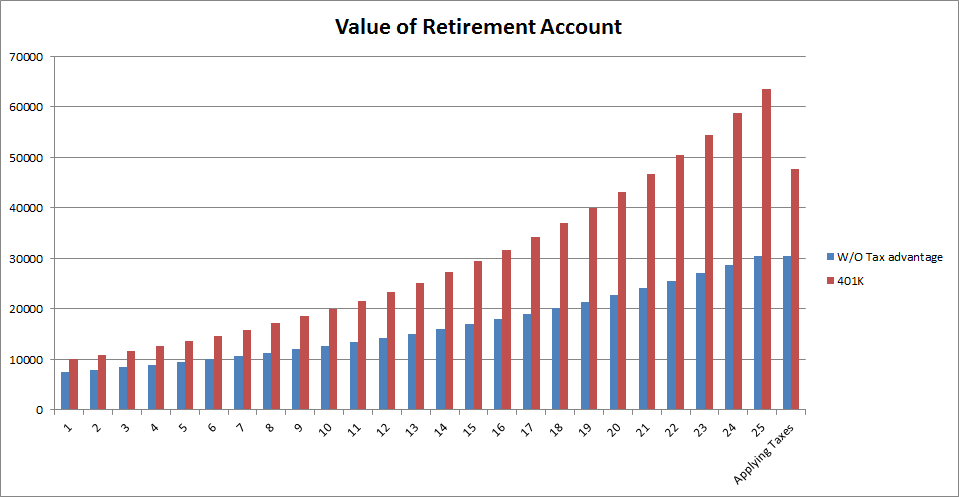

Rebuttal Ditching The 401k Is A Favor To The Taxman But It Ruins Your Returns Seeking Alpha

Net Unrealized Appreciation – Nua – 401k Company Stock – Rollover

Skip 401k Taxes By Transferring Stock With Nua

What Is Unrealized Gain Or Loss And Is It Taxed Gobankingrates

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Improve Your Retirement With A Better Nua Decision When You Dont Need The Money Immediately

401k Secrets Capitalize On Net Unrealized Appreciation Nua

Understanding The Nuances Of Net Unrealized Appreciation

After-tax 401k Contributions Retirement Benefits Fidelity

How Does Taxing Unrealised Capital Gains Work Do You Force Them To Sell The Stock And Take Profit How Can You Tax Money That Has Not Materialised No Hate Just Curious

Opposed To The Unrealized Capital Gains Tax Relonmusk

Would Bidens Capital Gains Tax Hike Affect You Probably Not Investment Tulsaworldcom

How To Use Company Stock A 401k Net Unrealized Appreciation For Tax Savings

When Should 401k Capital Gains Taxes Be Paid