We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. Contribution limits for 401(k) and other retirement plans for the 2022 tax year are $20,500 or $27,000 if you’re 50 or older (2021:

Map Of European Countries By Birth Rate Birth Rate Best Countries In Europe Europe Map

Financial professionals do not provide specific tax/legal advice and the information presented at this webinar should not be considered as such.

Taxes in retirement 567 reviews. On the other hand, taxes in a state like nebraska, which taxes all retirement income and has high property tax rates, the overall state and local tax bill for a senior could be thousands of dollars higher. • common misconceptions about taxes in retirement. As such, it is worth worrying about your tax bill in retirement.

Wealth management services are offered through patriot financial group, an sec registered investment adviser, dba unified legacy advisors. I had a webinar with the retirement567 this morning and it was very informative. 34,665 पसंद · 1,823 इस बारे में बात कर रहे हैं · 527 यहाँ थे.

The goal is to have a comfortable and rewarding retirement lifestyle. While taxes aren’t as exciting to consider as warm weather activities, they’re still an essential part of retirement planning. Only $1,432 for people over 75

First, i wondered what 567 meant in the title? Consider making additional salary deferrals if you are eligible to participate in an employer supplemental employee retirement plan (serp). Social security 567 and taxes in retirement 567.

• a basic overview of the tax rules as they apply today. However, taxes are lower for people who are older. • possible tools and strategies available to help develop a retirement tax strategy.

At a taxes in retirement 567 seminar, you will learn: About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. The new tax and financial rules have changed.

Social security 567 and taxes in retirement 567. September 15 at 1:40 pm ·. 280 n old woodward ave ste 300.

For some retirees, they can make or break a retirement location. In a state like wyoming, which has no income tax along with low sales and property taxes, retirees can expect to have a very small tax bill. They say two things are inevitable in life — death and taxes.

Taxes in retirement 567 is an educational resource for those nearing retirement. Taxes in retirement 567, birmingham, michigan. Maxing out a 401 (k) is something that often can't be done on an average salary, since 401 (k)s let you put in up to $19,500 this year if you're under 50 or $26,000.

Contact estate planning 567 on messenger. It's how much you pay for it. This post was contributed by a community member.

Some good things to know about taxes on your retirment income. A little dour for a retirement planning article? Mark wiley recommends retirement income planning 567.

Naperville, il | featured event. I am an author, speaker and journalist specializing in investor and consumer protection. Dec 16 | taxes in retirement webinar | glen ellyn, il patch.

You can contribute up to $19,500 to a. Facebook is showing information to help you better understand the purpose of a page. To achieve this goal, we need to understand the impact of taxes on our retirement income.

Many universities offer it to their employees, as does the federal government. The most prevalent swindle in retirement isn't necessarily a bad product. The views expressed here are the author's own.

Taxes in retirement 567 is not associated with the social security administration or any government agency Taxes in retirement 567 seminar review. How much you're able to contribute to retirement each year depends in part on which accounts you have access to.

I liked the seminar, the information provided was very believable. That is why we've developed a special seminar that has already helped nearly 70,000 people nationwide navigate the retirement tax maze. According to the bureau of labor statistics, the average tax bill by age is:

A phased retirement is an arrangement where you keep working for the same employer but work less. Sharon neal recommends retirement income planning 567. Does it sound appealing to you?

According to the 2017 retirement confidence survey, only 35% of workers aged 55 or older had retirement savings of $250,000 or more, meaning that many millions have less. Neither taxes in retirement 567 nor the financial professional presenting this webinar are affiliated with the social security administration or any other governmental organization. If you haven’t contributed the maximum amount to a qualified retirement plan at work, consider adding money while you can.

• how lost deductions may affect your taxes in retirement. Contribution limits for 401(k) and other retirement plans for the 2022 tax year are $20,500 or $27,000 if you’re 50 or older (2021:

Taxes In Retirement 567 – Home Facebook

Taxes In Retirement 567 Workshop – Youtube

Taxes In Retirement 567 – Home Facebook

Retirement 567 – Home

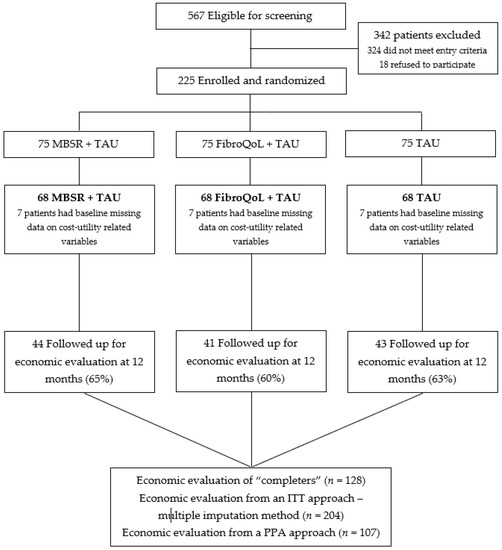

Jcm Free Full-text Costutility Of Mindfulness-based Stress Reduction For Fibromyalgia Versus A Multicomponent Intervention And Usual Care A 12-month Randomized Controlled Trial Eudaimon Study Html

Taxes In Retirement

Taxes In Retirement 567 Workshop – Youtube

Dec 16 Taxes In Retirement Webinar Lemont Il Patch

Taxes In Retirement 567 – Home Facebook

Retirement 567 Workshop – Youtube

Taxes In Retirement 567 – Home Facebook

Retirement 567 Workshop – Youtube

Taxes In Retirement 567 – Home Facebook

The Constitution Of India Poem Constitution Day Indian Constitution Indian Constitution Day

Taxes In Retirement 567 – Home Facebook

Uniinfo Telecom Services Ipo Subscribed 18 On Day 1 Should You Invest Best Investment Apps Investment Portfolio Investing In Stocks

Estate Plan Revocable Living Trust Estate Planning How To Plan

Free Mortgage Offset Calculator – How Much Interests I Can Possibly Save If I Use An Mortgage Loan Calculator Mortgage Calculator Mortgage Repayment Calculator

Does Your Credit Score Matter – The Finance Twins Credit Score Finance Managing Your Money