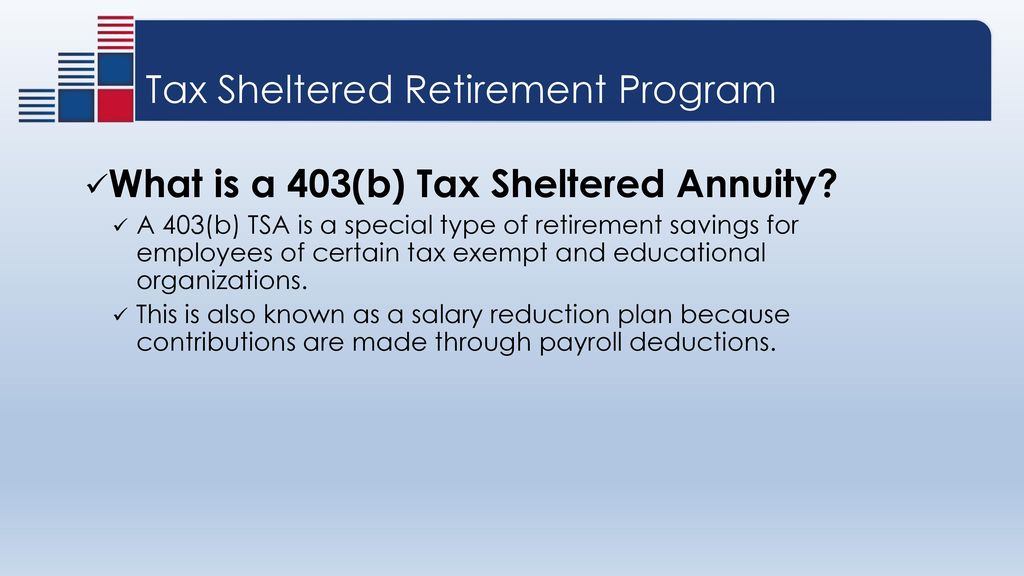

Through such an arrangement, you make a series of payments into an insurance company’s account and, at some designated point in the future, receive disbursements from that account. While individual retirement account, or ira, as it is generally known, is available for all to save for future, 403b, which gets its name from being listed in section 403(b) of us tax code is for specific categories of people mentioned 403(b).

The Tax Sheltered Annuity Tsa 403b Plan

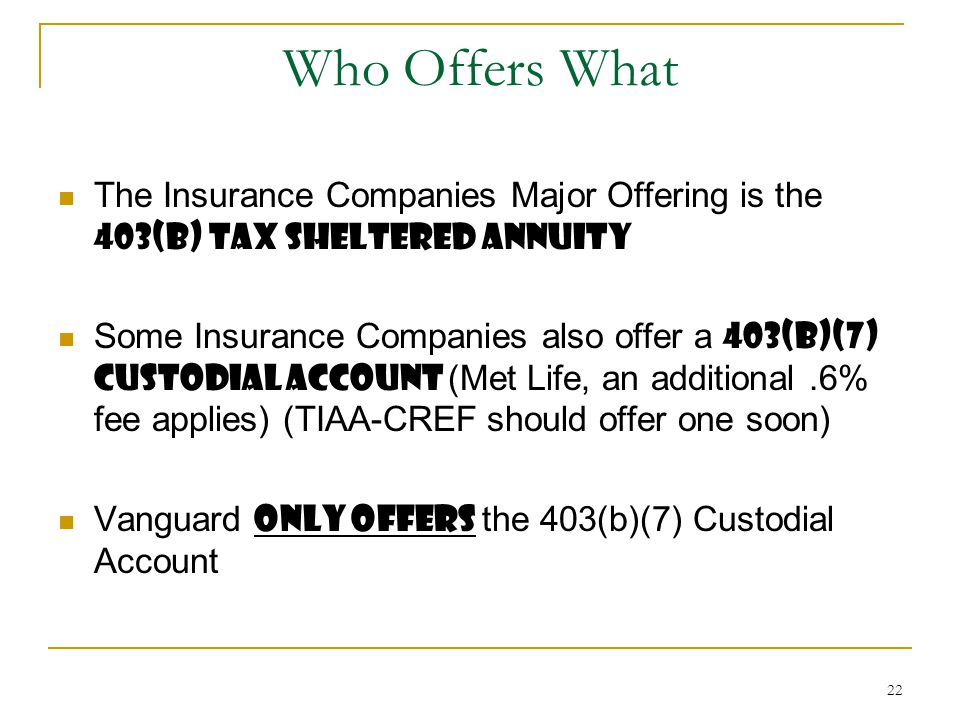

Either way, participants can contribute to annuities, variable annuities or mutual funds.

Tax sheltered annuity vs 403b. Is a 403b an ira or annuity? The deferred salary is generally not subject to. When can 403(b) money be accessed without penalty?

However, a 403(b) plan may also offer designated roth accounts. The main difference between a 401(k) and a 403(b) plan is based on where you work. These plans tend to be offered by public schools and some nonprofits.

A 403 (b) plan allows employees to. While times have changed, and 403(b) plans can now offer a full suite of mutual funds similar to those available in 401(k) plans, many still offer annuities. Here’s what you should know about a 403 (b) plan and how it differs from other retirement savings vehicles.

Just as with a 401 (k) plan, a 403 (b) plan lets employees defer some of their salary into individual accounts. The deferred salary is generally not subject to federal or state income tax until it's distributed. 403b is also referred to as tsa, or tax sheltered annuity.

What is a 403 (b) plan? Both 403b and ira are targeted towards retirement planning. As far as the irs is concerned, a 403(b) is a tsa, and a tsa is a 403(b).

For reference, the private company equivalent of a 403(b) is a 401(k) plan. But there are other differences as well.

2

Massmutual Whats In A Name A Retirement Plan Comparison

Withdrawing Money From An Annuity How To Avoid Penalties

The 403b The 403b What Is It Whats Wrong With It – Ppt Video Online Download

What You Should Know About Tax-sheltered Annuities The Motley Fool

Taxsheltered Annuity Plans Also Known As 403b Plans

Taxsheltered Annuity Plans Also Known As 403b Plans

Taxsheltered Annuity Plans Also Known As 403b Plans

403b Tax-sheltered Annuity Plans Tsas Longmeadow Ma

Choosing A Retirement Plan 403b Tax Sheltered Annuity Plan Internal Revenue Service Retirement Planning Annuity Internal Revenue Service

Ira Rollover Indicates To Move Loan From A Retirement Plan Such As A 401 K 403b Tax Sheltered Annuity Or 457 Personal Budget Household Budget Budgeting

2

Business And Finance 403b Tax Sheltered Annuity Documents

The Tax Sheltered Annuity Tsa 403b Plan

![]()

403b Tsa Tax Sheltered Annuity Eecu Member Investment Services

The Importance Of Saving For Your Retirement – Ppt Download

403b Tax-sheltered Annuity Plan Overview – Vermillion Financial Advisors Inc

403b Tsa Annuity For Public Employees – National Educational Services

Taxsheltered Annuity Plans Also Known As 403b Plans