So if the annuity buyer paid $10,000 and the death benefit. However, there are differences that govern if and when taxes are due on the annuity principal, the money used to purchase or fund the annuity.

Annuity Taxation How Various Annuities Are Taxed

If a person is employed by a school or other qualifying organization covered under irc section 501(c) (3), they’re allowed to accumulate funding for their retirement in a specialized.

Tax sheltered annuity taxation. Because the contributions are pretax, irs does not tax the contributions and related benefits until the employee withdraws them from the plan. If you’re the spouse of the original annuitant, then you can choose to continue receive payments according to the annuity schedule. Of an annuity should do detailed.

Once the money is in the annuity, though, it gets the same tax deferral that ira and 401 (k) money gets. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. Moreover, are tax sheltered annuities taxed?

Similarly, what is a tax sheltered annuity account? With the right guidance you can set up one too. The deferred salary is generally not subject to.

However, these taxes will be determined by how you set up the annuity contract. Tax deferral for annuity money. A tax sheltered annuity (tsa) is a pension plan for employees of nonprofit organizations as specified by the irs, under sections 501(c)(3) and 403(b) of the internal revenue code.

An annuity can provide you with income that is guaranteed for as long as you live. Tax shelters are often created by the. Under such a plan a portion of an employee's annual salary is not taxed at the time the salary is earned.

Just as with a 401 (k) plan, a 403 (b) plan lets employees defer some of their salary into individual accounts. If you have a 403(b)/tsa contract, there is a mandatory withholding of 20% for federal taxes from any withdrawal or rollover if you take receipt of funds. Intent of 403 (b) plans.

Tax shelters are financial instruments that everyone can use. Through this plan, employees save for retirement by. The plan may offer fixed or.

A 403 (b) plan allows employees to contribute some of their salary to the plan. You don't have to worry about paying tax on the income the. The employer may also contribute to the plan for.

Employees save for retirement by contributing to individual accounts. Annuities are taxed at the time of withdrawal regardless of the type of annuity purchased. In that instance, any taxes owed on distributions would be deferred until you receive them.

Employers can also contribute to employees’ accounts. A tax shelter, not to be confused with a tax haven, is a financial instrument used by individuals and organizations to lower their taxable income and thus their overall tax liability either permanently or temporarily. Tsa, as defined by irs.

However, at least part of your annuity payments may be subject to federal income taxes.throughout this guide, we highlight the different ways the irs taxes annuities. This means any earnings on the investment are not taxed until they are paid out to the annuity holder.

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Shelter Free Vector Eps Cdr Ai Svg Vector Illustration Graphic Art

Annuity – Lifetime Income Later – Safety – Guarantees – Magi

The Tax Sheltered Annuity Tsa 403b Plan

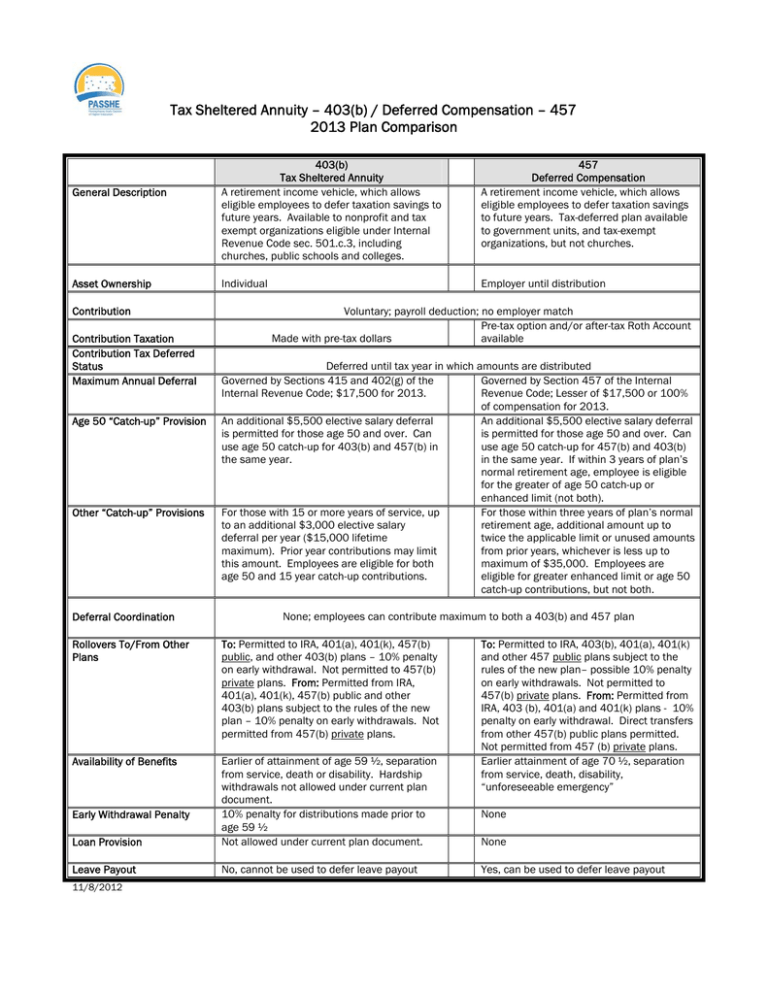

Tax Sheltered Annuity 403b Deferred Compensation 457

Taxsheltered Annuity Plans Also Known As 403b Plans

Series 6 Exam Prep Ryan Kussman Volleyball

Tax-sheltered Annuity Definition How Tsa 403b Plan Works

What Is A Tax-deferred Annuity – Due

Taxes Inflation And Investment Strategy Bodie Kane And

Tax Sheltered Annuity

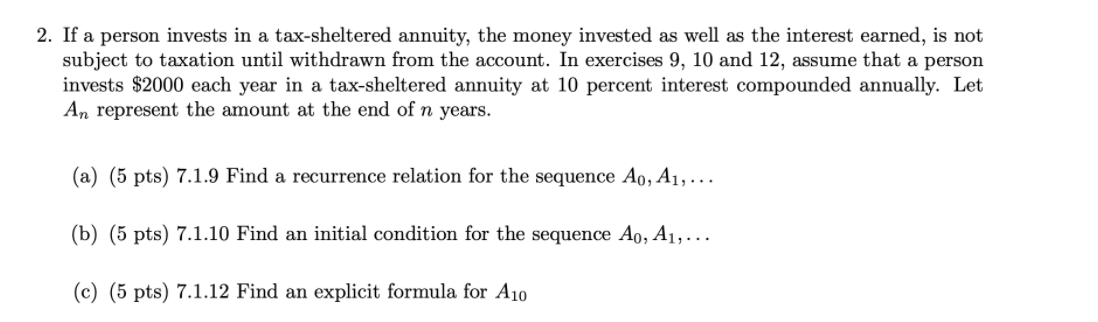

Solved 2 If A Person Invests In A Tax-sheltered Annuity Cheggcom

Taxation Of Annuities Ameriprise Financial

Tax-sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits

403b Tsa Annuity For Public Employees – National Educational Services

Btuorg

Btuorg

Annuity Basics Ppt Video Online Download

Solved 1 If A Person Invests In A Tax-sheltered Annuity Cheggcom