Enhanced star is a school property tax benefit that saves most senior homeowners in new york state hundreds of dollars each year. Basic and enhanced star exemption new star applicants will receive a check from new york state instead of a reduction on the school property tax bill.

Tax Exemptions Town Of Oyster Bay

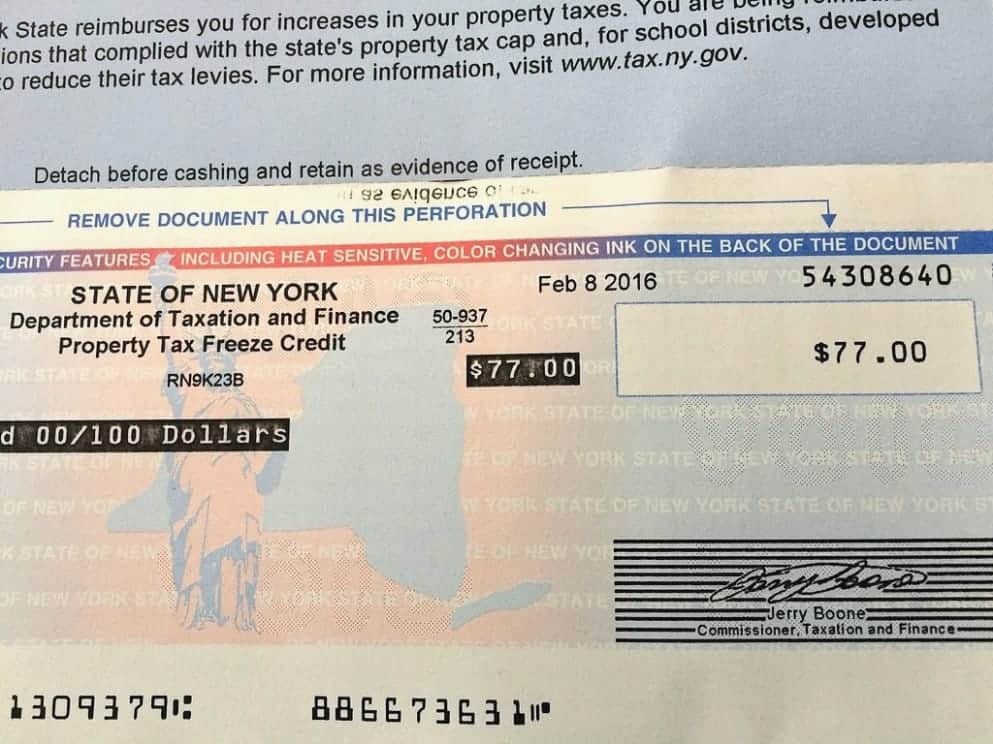

If you are registered for the star credit, the tax department will send you a star check in the mail each year.

Tax ny gov enhanced star. 2 pages (9/99) application for school tax relief (star) exemption. The benefit is estimated to be a $293 tax reduction. Persons with disability & limited income exemption

Basic star is for homeowners whose total household income is $500,000 or less. As long as you remain eligible for. New star recipients will receive a check directly from new york state instead of receiving a school property tax exemption.

Who can apply homeowners not currently receiving the star exemption who meet the program's eligibility requirements may apply for the star tax credit with the new york state department of taxation and finance. Apply and are eligible for the enhanced star exemption. The amount of the benefit will be the same.

The enhanced star exemption is available for owner occupied, primary residences of senior citizens who are turning 65 during the next calendar year with household incomes not exceeding the statewide standard ($86,300 for 2017). The basic new york state school tax relief (star) and the enhanced school tax relief (estar) exemptions, reduces the school tax liability for qualifying homeowners by exempting a portion of the value of their home from the school tax. If you are eligible and enrolled in the star program, you’ll receive your benefit each year in one of two ways:

Will i need to reapply for the enhanced star exemption or the ivp in future years? If you do not furnish your social security numbers, you will be unable to receive an enhanced star exemption. Application for school tax relief (star) exemption.

Enhanced star is for homeowners 65 and older whose total household income for all owners and spouses who live with them is $92,000 or less. Enter the security code displayed below and then select continue. Please do not contact our office regarding this program, as it is filed directly with new york state.

As a result of recent law changes, the star program is being restructured. If you are using a screen reading program, select listen to have the number announced. Because new york state is mailing out star credit checks on a rolling basis;

The following are links to the new york state office of real property web site; Star exemption information basic star exemption and star enhanced exemption beginning in 2016 any homeowner who is applying for the first time on a property, meaning you have never had any star exemptions on your property before or you are a new homeowner of a property, is required to register with new york state department of taxation and finance. New changes to star program:

It lowers the tax burden on new york residents who live in school districts. (proof of age and income of owners of property also required.) application for enhanced school tax relief (star) exemption. The following security code is necessary to prevent unauthorized use of this web site.

This will exempt the first $66,800 of assessed value. Who is eligible for enhanced star? For a list of who else should use this form, see the instructions on page 2.

The amount of the benefit is generally the same, but you will receive your benefit in the form of a check from new york state. The following security code is necessary to prevent unauthorized use of this web site. Senior citizen third party mailing:

With basic star exemptions who wish to apply and are eligible for the enhanced star exemption. If you are using a screen reading program, select listen to have the number announced. Register with the nys tax department at www.tax.ny.gov/star.

Additional income and ira disclosure Enter the security code displayed below and then select continue. For information on the star program, visit the nys star property tax relief web page.

If you want to see when you can expect to get one, go to the star check delivery schedule page on the web site of the new york state department of taxation and finance here: Register for the star credit. The school tax relief (star) program offers property tax relief to eligible new york state homeowners.

New homeowners are eligible for the star credit rather than the star exemption. The new york state department of taxation and finance will annually determine income eligibility for qualifying enhanced star applicants. Will be forwarded to the new york state department of taxation and finance, which will use them to verify, or attempt to verify, whether your income is greater than the applicable income standard for purposes of the enhanced star exemption.

Enhanced star is available to senior citizens (age 65 and older) who own and live in their primary residence, and who meet certain income requirements (see below). This requirement applies to property owners who received basic star benefits and are applying for enhanced star and those already receiving enhanced star benefits but who did not register for the income.

2

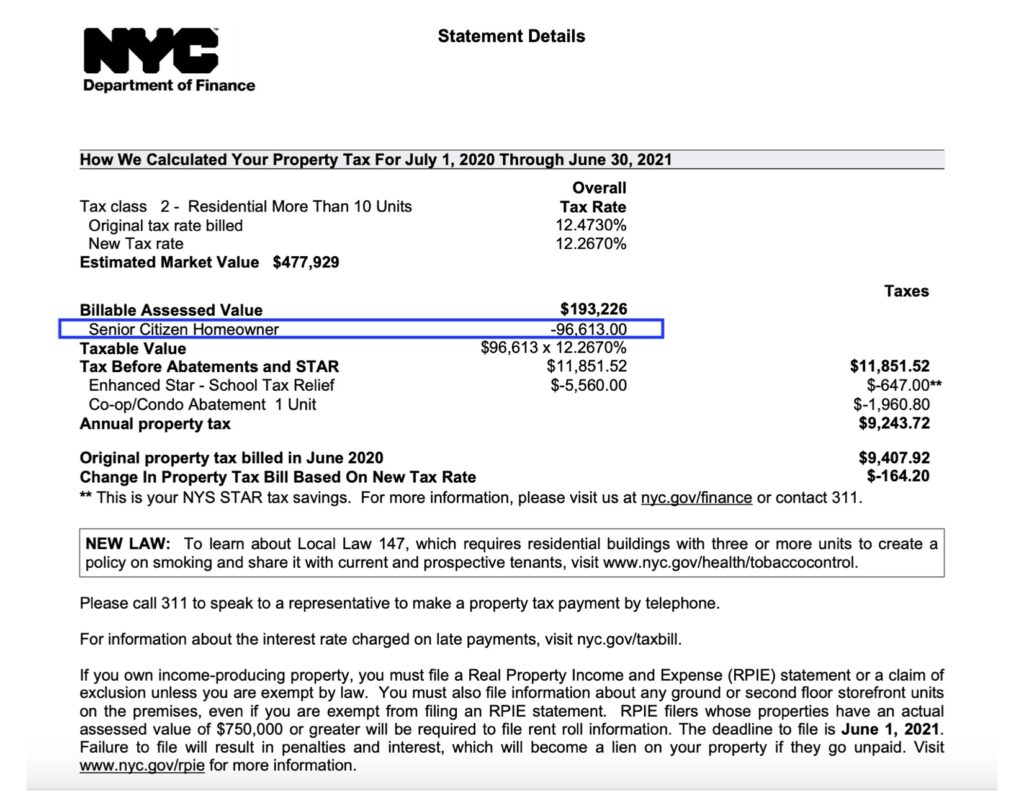

What Is The Basic Star Property Tax Credit In Nyc Hauseit

2

2

2

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Tax Collectortax Assessor – Town Of Lewis Ny

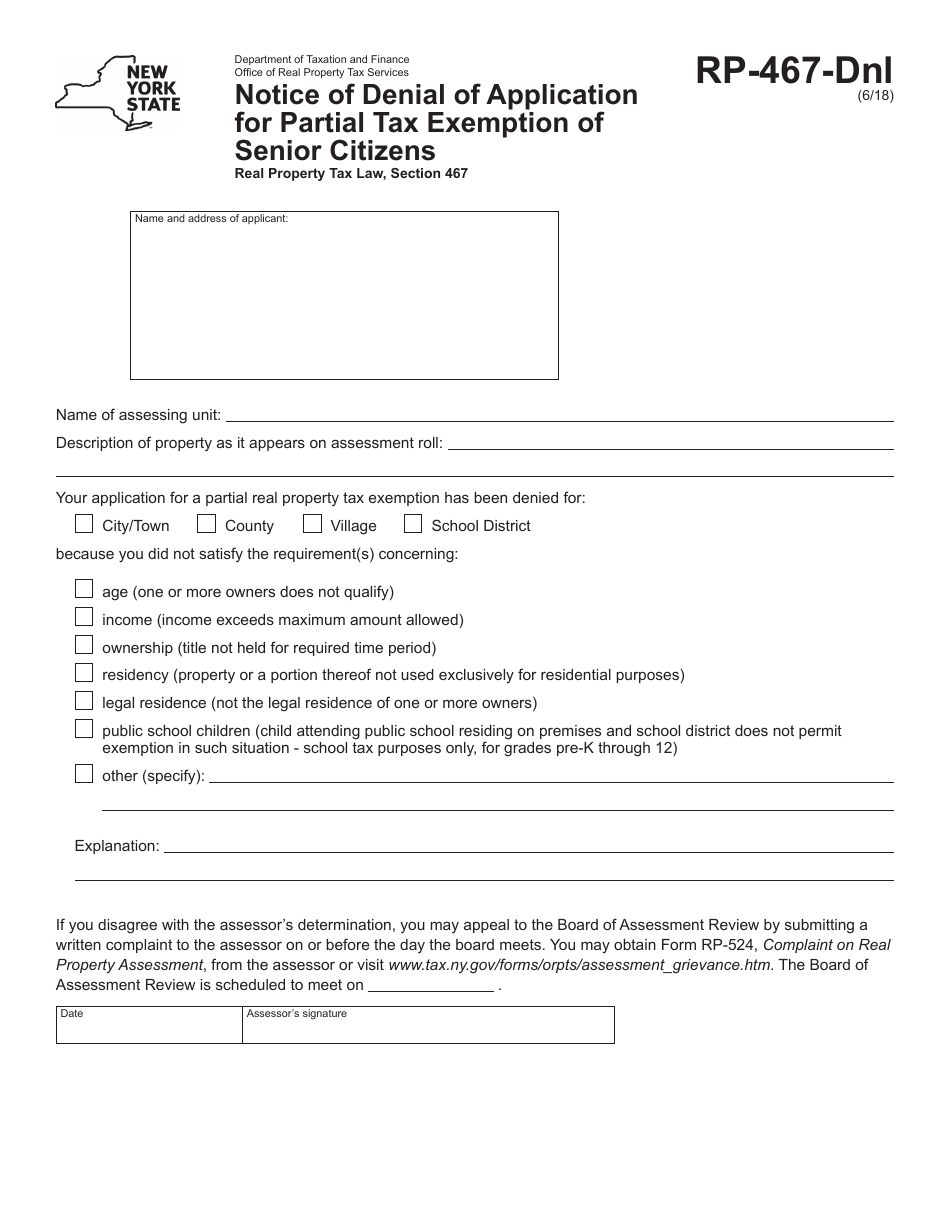

Form Rp-467-dnl Download Fillable Pdf Or Fill Online Notice Of Denial Of Application For Partial Tax Exemption Of Senior Citizens New York Templateroller

Form Rp-467-dnl Download Fillable Pdf Or Fill Online Notice Of Denial Of Application For Partial Tax Exemption Of Senior Citizens New York Templateroller

Register For The School Tax Relief Star Credit By July 1st – Greene Government

2

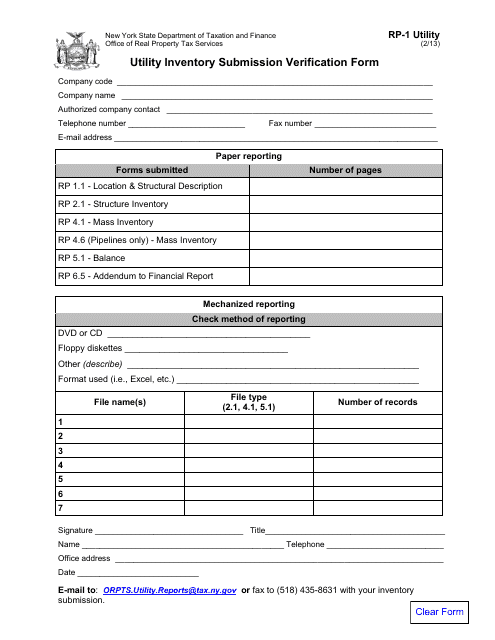

Form Rp-1 Utility Download Fillable Pdf Or Fill Online Utility Inventory Submission Verification Form New York Templateroller

The School Tax Relief Star Program Faq Ny State Senate

2

2

Assessor

2

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times