Dekalb county has one of the highest median property taxes in the united states, and is ranked 458th of the 3143 counties in order of median property taxes. Tax commissioners office provides payoff amount (interest + fees) petitioner is notified of the payoff amount and petitioner provides $75 cashier’s check for processing fee made payable to “dekalb county” dekalb board of commissioners (boc) votes to either approve, defer or deny the sale of tax interest;

Rent To Own Homes In Dekalb County Ga In 2020 Rent To Own Homes Own Home Home

In fact, the rate of return on property tax liens investments in dekalb county, ga, can be anywhere between 15 and 25% interest.

Tax liens in dekalb county georgia. Until your property taxes have been paid in full, the tax lien prevents you from selling or refinancing the property. Petitioner pays full payoff amount The median property tax in dekalb county, georgia is $1,977 per year for a home worth the median value of $190,000.

Interested in a tax lien in dekalb county, ga? Though the tax commissioner’s office does not report information to credit agencies, a tax lien may appear on your credit reports and. In fact, the rate of return on property tax liens investments in dekalb county, ga, can be anywhere between 15 and 25% interest.

It is also the first step in taking the property to tax sale. 252 atlanta, ga 30345 fax: The buyer of the tax lien has the right to collect.

A county in georgia is owed property taxes that go unpaid. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property. Dekalb county property records provided by homeinfomax:

This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent acceptance and filing by a clerk of superior court. Dekalb county dekalb county dekalb county dekalb county dekalb county dekalb county peachtree renaissance pr peachtree renaissance pr saad inc saad inc dekalb. Index of documents on file in the authority's central indexing system.

Delinquent tax cross reference listing penalty/interest date 11/30/21 owner name tax year bk/ pg tax sale #/ cycle principal amount due interest due 10% tax penalty fifa charge other. The county files a lien, and then auctions off a deed. Investing in tax liens in dekalb county, ga, is one of the least publicized — but safest — ways to make money in real estate.

Here is what i found for fulton county: How does a tax lien sale work? The certificate is then auctioned off in dekalb county, ga.

A tax lien is a claim or encumbrance placed on a property that authorizes the tax commissioner or the sheriff to take whatever action is necessary and allowed by law to obtain overdue taxes. Arwb youth council november 2009 county name/address organization/position cherokee sonia carruthers p o circle, rm. In order to redeem, the former owner must pay dekalb county none 20% penalty of the amount for the first year or fraction of a year and 10% penalty for each year or fraction of a year thereafter on the amount the winning bidder paid to purchase.

Field tax auditor arwb member) henry ulysses young 34 covington street mcdonough, ga 30253 fax: Dekalb county property records are real estate documents that contain information related to real property in dekalb county, georgia. In georgia, the clerk of superior court is also responsible for the recording of all land records.

6758 browns mill lake rd: Houses (4 days ago) investing in tax liens in dekalb county, ga, is one of the least publicized — but safest — ways to make money in real estate. Property tax liens are used on any type of property, whether it’s land, your house, or commercial property.

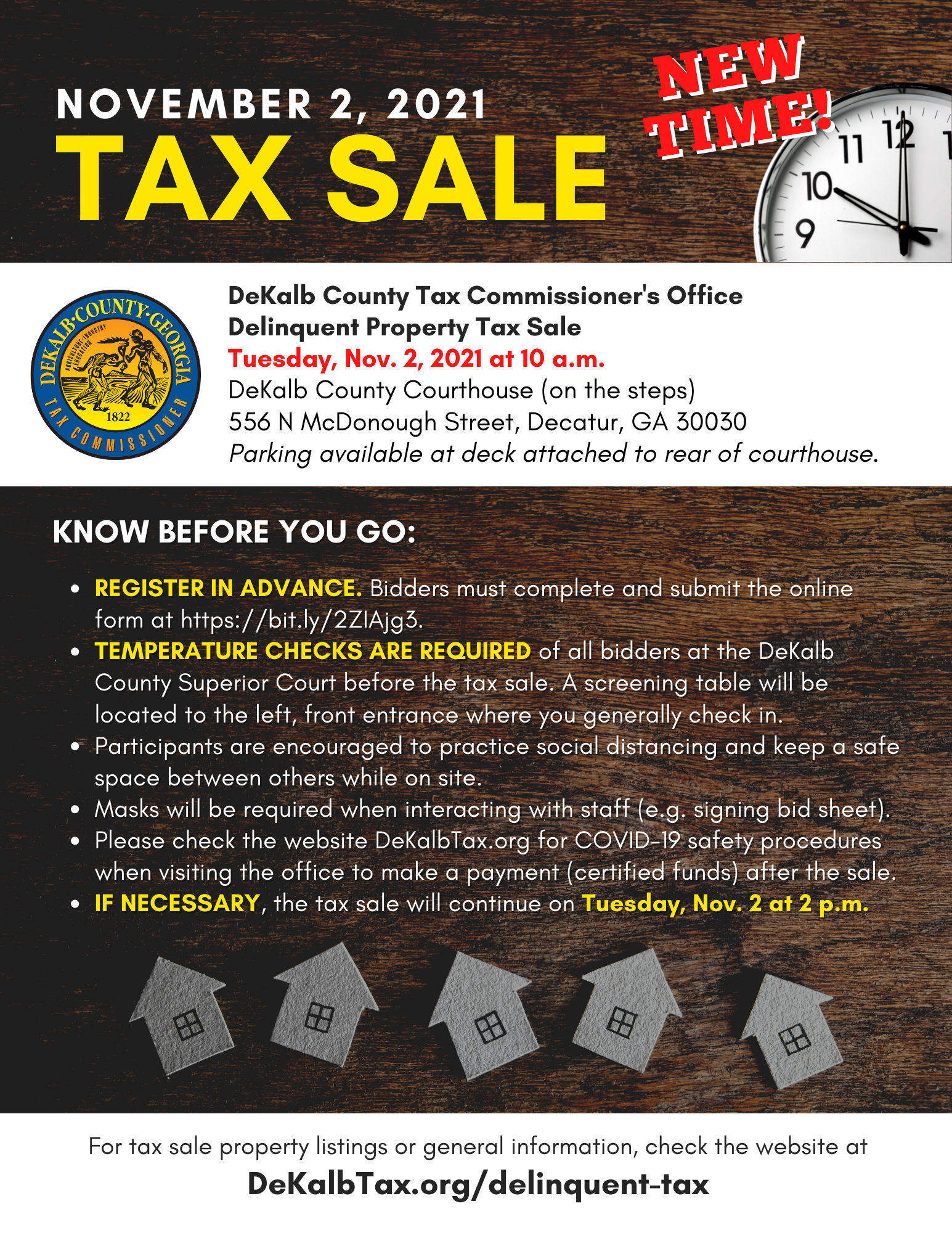

Dekalb county collects, on average, 1.04% of a property's assessed fair market value as property tax. Learn to buy tax liens in dekalb county, ga, today with valuable information from foreclosure.com. Tax sales are held on the first tuesday of each month, between the hours of 10 am and 4 pm on the steps of the fulton county courthouse, 136 pryor street, sw (except when the first tuesday of the month falls on a legal holiday in which case the sale is held the next business day).

Robin gordon didn’t know about the tax lien fulton county placed against her apartment until the county sold the lien to a private company, foreclosed and sold the. In georgia, the courts have a legal claim against your property, called a tax lien, when you have unpaid property taxes. Now, you wait a year.

What are georgia tax liens? You win at the auction, and purchase it (a portion of your purchase price goes to pay the taxes that were in arrears). Lien searches | search by name | gsccca.

Tax Sale Listing Dekalb Tax Commissioner

The Official Legal Organ Of Dekalb County Georgia – Atlanta Goodlife

Home Dekalb County Clerk Of Superior Court

Apply For Georgia Homestead Exemption – Urban Nest Atlanta

How To Redeem A Tax Deed In Georgia – Gomez Golomb Law Office Gomez Golomb Llc

Dekalb County Tax Commissioners Office – Posts Facebook

Tax Sale Listing Dekalb Tax Commissioner

Tax Sale New Time Dekalb Tax Commissioner

Z6o56gsdkza45m

Dekalb County Ga Property Data Reports And Statistics

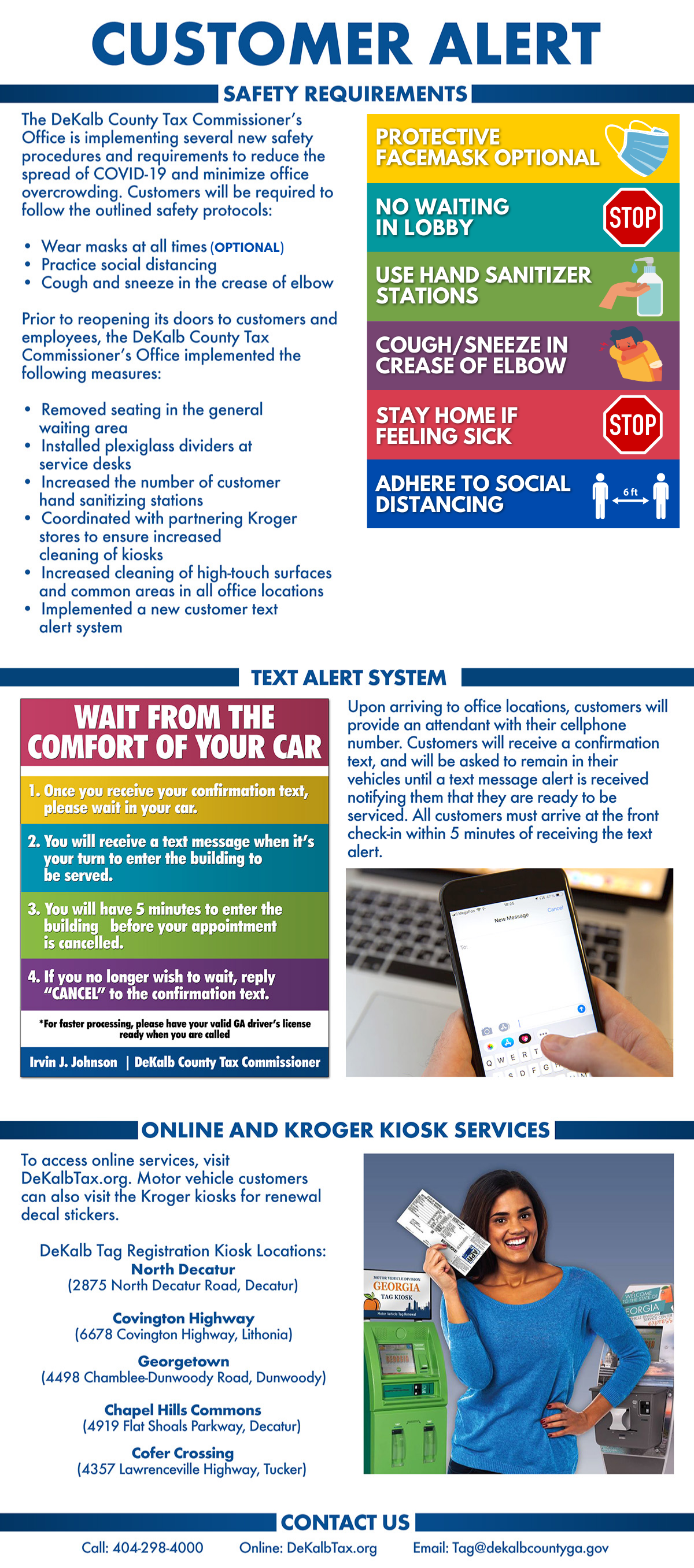

Covid-19 Customer Alert Dekalb Tax Commissioner

Dekalb County Tax Commissioners Office – Posts Facebook

Home Dekalb County Clerk Of Superior Court

2

Have A New Home Heres How To Apply For Homestead Exemption In Georgia This Will Reduce Your Property Taxes An How To Apply Real Estate Tips Homesteading

2

Tax Sale Listing Dekalb Tax Commissioner

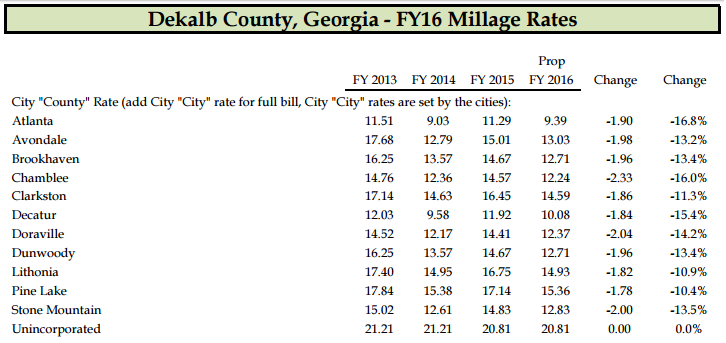

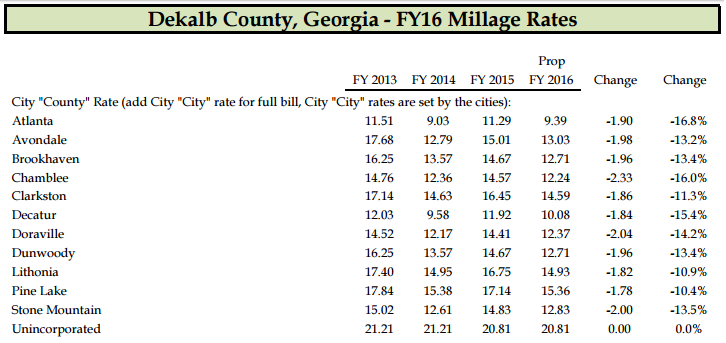

Dekalb County Residents May See Lower Property Taxes Next Year Wabe 901 Fm

Bank Owned Property Selling In Hart County 53 Sylvester Drive Hartwell 2 Bedrooms Hudson And Marshal Bank Owned Properties Macon Georgia Rockdale