Specializing current and pass owner, title and lien searches in colorado. The amount sold at the tax lien sale includes the unpaid taxes, the county interest of 1% per month and the advertising fee.

Tax Lien Sale Jefferson County Co

Property tax lien sale information.

Tax lien search colorado. To search by document #, enter a document # and select search. If you do not see a tax lien in colorado (co) or property that suits you at this time, subscribe to our email alerts and we will update you as. Our public lien records search has listing for property liens, irs liens, tax liens, mechanic liens, bank liens, hoa liens, personal liens and more.

They are maintained by various government offices in rio grande county, colorado state, and at the federal level. Delinquent taxes for a specific lien certificate must be paid in full in certified funds. August 1 of each year, tax sale buyers are offered the option of paying the current years’ unpaid taxes on properties for which they hold a tax lien.

The grand county tax lien sale is held online at the grand county official tax certificate auction site. The certificate is then auctioned off in boulder county, co. A ucc lien search, a federal tax lien search, a state tax lien search, and a judgment lien search.

The tax lien sale certificate of purchase is only a lien on the property and does not change ownership of the property. The alamosa county treasurer holds a tax lien auction. And state revenue agencies can place tax liens on parcels, but the county treasurer’s office (the county entity responsible for collecting property taxes can also place tax liens on parcels.

Bennett ave., cripple creek, co 80813 mailing address: Buyers pay the total advertised price consisting of tax, interest to the date of public auction and an advertising fee. You query the secretary of state (sos) where the property is located, or the borrower incorporated.

Perform a free colorado public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes. For this reason, elected officials cannot guarantee. (this will include records that lapsed within the past 2 years.

This is the final step in the efforts to collect real estate taxes. Do not enter any additional search criteria. Records that lapsed more than 2 years ago are no longer available.)

Title search for all real estate records, deed copy’s, title records, data and lien information for all. List of county held tax liens. They are a valuable tool for the real estate industry, offering both.

Search eagle county recorded documents including property records, marriage records and tax liens by name, document type, reception number or date range. Include lapsed records in the search results. The buyer of the tax lien has the right to collect the lien, plus interest based on.

Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. The tax lien public auction is usually held around the first part of november; A tax lien is a claim against a property imposed by law to secure the payment of taxes.

This website allows public access to ( u.s. The dove creek press and the dolores county government/dolores county treasurer official website. However, may be subject to public disclosure under public records requirements including the colorado open records act (cora), with limited exceptions.

Parcel numbers beginning with 99000 or 99001 are for severed mineral interests. At the auction, tax liens are offered for the amount of taxes due plus interest and fees. It is a negotiable document that is valid for 15 years.

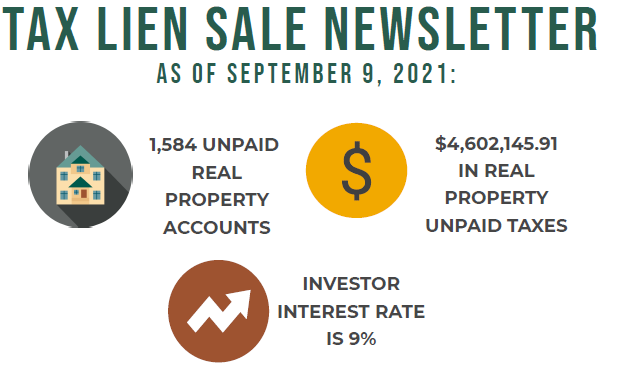

View tax sale information for detailed instructions on how the online tax lien sale works. If property taxes on real estate are not paid they will be sold at a tax lien sale, which is a public auction held each year, usually in november. They also pay a $4.00 certificate fee and an $8.00 auction fee plus any premium bid.

A tax lien is a lien (or a legal interest) on a given tax parcel issued by a taxing entity. Type in search terms and click the (search). Po box 367 cripple creek, co 80813 phone:

Public record property information and parcel maps are available on the assessor’s real property search page. As required by this statute, each taxpayer meeting these criteria was notified by mail that failure to cure their tax delinquency could result in their. Check your colorado tax liens rules.

Please just provide me the first and last name of the person you think has a lien record and their state of residence. Delinquent real property taxes will be advertised once a week for 3 consecutive weeks prior to the annual tax lien sale for the amount of taxes, accrued interest, advertising, and other applicable charges. I would be happy to search a property lien record for you.

The property owner is allowed to redeem the tax lien at any time. County property records and deed images for state recorders offices. However, 2021 auction is scheduled in october earlier than usual.

Please check back for more information. The amount to redeem is the amount sold at the tax lien sale plus the investor’s interest based on a per month basis.

Tax Lien Code – Home Facebook

Pin On Real Estate Is My Passion

Facebook Likes That Are Real Real Estate Infographic Real Estate Tips Real Estate

Tax Lien Code – Home Facebook

As You Can See Releasing A Tax Lien Has A Multitude Of Nuances And Variables To Consider The Actions And Strategies Are Dependent Tax Debt Debt Debt Reduction

Treasurerpublic Trustee Custercountycolorado

Matt Lockwood Colorado A Success Story Of Marketing In All Seasons Digital Marketing Marketing Consultant Marketing Director

Coloradohousingsearchcom Colorado Apartments Colorado Rental Homes Colorado Rental House Rental Colorado

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Spell To Sell A House Fast Rituals Of Magic Selling House Sell My House We Buy Houses

Fake Tax Warrarnts Warning Fake Tax Lien Warrants Received In Larimer County

Tax Lien Sale San Juan County

Triple Bottom Line Returns Triple Bottom Line Csr Ghg Emissions

Irs Puts 14 Billion Liens On Brockmans Aspen Properties Aspentimescom

Short Sale Process Chart Shorts Sale Process Chart Money Blogging

Tax Lien Sale Information – Logan County Colorado

Tax Lien Foreclosures On Properties Due To Nonpayment Of Property Tax Are Common Nowadays Foreclosures Avoid Foreclosure Buying A Foreclosure

Wheres My State Refund Track Your Refund In Every State

Tax Lien Information Larimer County