Find out how to lower your tax bill for 2020. This year, i’m reviewing all of my s corp clients to see if s corp is still the best tax structure for them.

The Top 9 Tax Planning Strategies For High Income Employees

The more money you make, the more taxes you pay.

Tax effective strategies for high income earners. Alright, now that you’ve got the basics. Clearly, the less income that is taxed, the lower your tax bill. The law allows you to give up to 60% of your adjusted gross income and deduct it on one tax return.

Donate cash to a charity. Charitable giving can be one of the most attractive tax shelters for high income earners who want to do good while getting a tax break. For the sake of this post, we'll consider anybody in the top three tax brackets as a high income earner.

How to reduce taxable income for high earners. Contribute to your superannuation fund. If you itemize your tax return, you can reduce your tax burden by giving a gift of cash to a charity (or charities) of your choice.

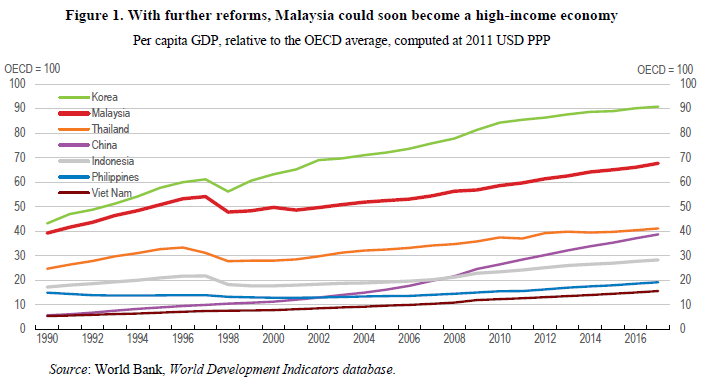

This report compares top effective marginal tax rates on labour income in 41 oecd and eu countries. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. That means that if you earn more than $163,301 in gross income as a single earner and $326,601 if you're married filing jointly, you are a high income earner.

Despite the increases of the standard deduction limits in recent years, it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions. These penalties can range from fines to imprisonment for more serious offences. When you make a concessional contribution into your super account, however, you only pay a.

The first way you can reduce your taxable income (and therefore your tax on that income) is through additional superannuation contributions. Take home rates for an annual income of $400,000: Discover the proper strategy for avoiding estate tax that is best suited to your family's needs, wants, and goals in our published book 7 secrets to high net worth investment.

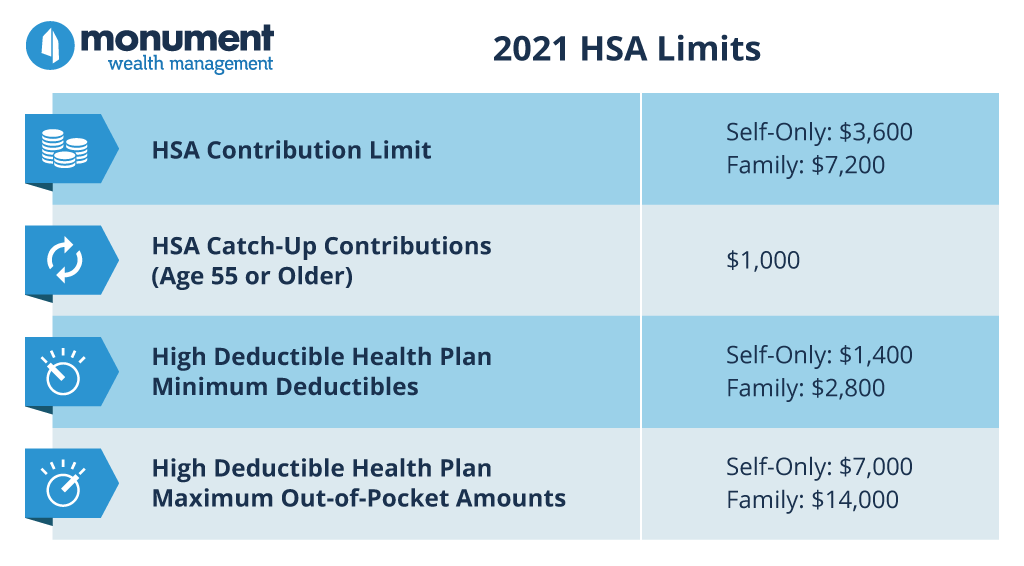

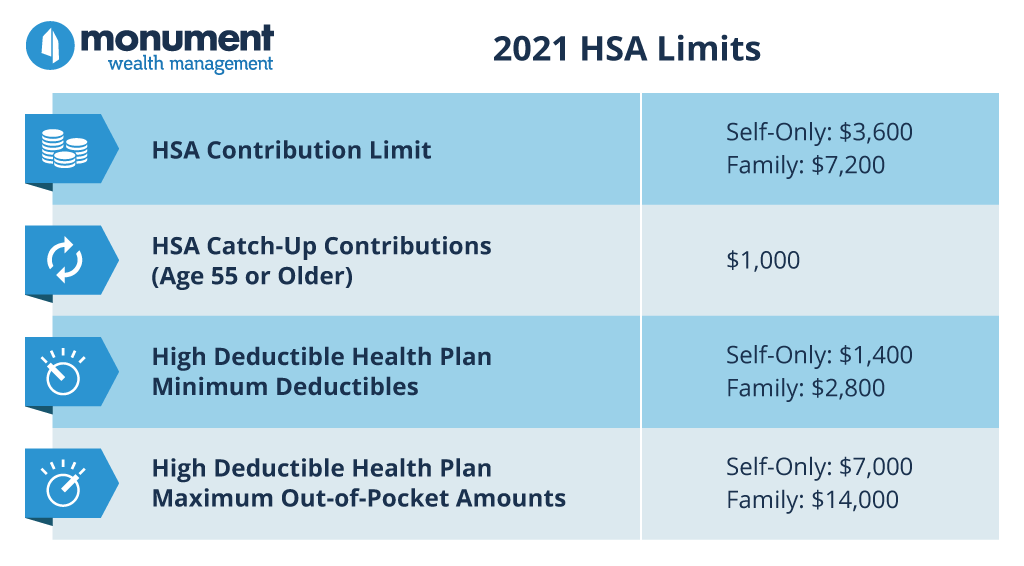

Next, if eligible, high income earners should fully fund a health savings account each year, to further shelter income. So, what are the top tax planning strategies for high income employees? In australia, the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

Effective tax planning with a qualified accountant/tax specialist can help you to do that. You get less of a benefit from paying these taxes in a year that. December 27, 2013 at 9:46 am.

Be careful to not exceed your ‘contribution cap’ for deductible superannuation contributions. The secure act, which became law at the end of 2019, includes several provisions that apply to high income earners. You’re not avoiding taxes using this strategy;

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the australian tax office (ato). High earners should invest the maximum in a 401 (k) or 403 (b). The great thing about ea training is that we know about these taxes and can plan for them.

Under the tcja, the irs allows you to deduct cash contributions to eligible charities, with the deduction maxing out at 60% of adjusted gross income (agi).

How Do Taxes Affect Income Inequality Tax Policy Center

The Theory Of International Tax Competition And Coordination – Sciencedirect

Search Results For Productivity – Ecoscope

The Top 9 Tax Planning Strategies For High Income Employees

The Most Effective Investment Strategies And Options For High Income Earners – Infinitas

Pin On Entrepreneurship

High-income Earners Need Specialized Advice Investment Executive

Bidens Tax Plan Explained For High-income Earners Making Over 400000

Tax Planning Strategies For High Income Earners The Private Office

Hierarchy Of Tax-preferenced Savings Vehicles For High-income Earners Fairpoint Wealth

Affordable Rental Housing Making It Part Of Europes Recovery In Departmental Papers Volume 2021 Issue 013 2021

The 4 Tax Strategies For High Income Earners You Should Bookmark – Monument Wealth Management

Tax Minimisation Strategies For High Income Earners

Tax Strategies For High-income Earners Lalea Black

How To Pay Less Taxes For High Income Earners Wealth Safe

The 4 Tax Strategies For High Income Earners You Should Bookmark – Monument Wealth Management

The Best 3 Long-term Tax Strategies For High Income Earners – Sd Mayer

5 Outstanding Tax Strategies For High Income Earners

4 Ways To Reduce Taxes For High-income Earners In 2022