$3,600 per year ($300 per month) for children under the age of six. The amount of the child tax credit is based on the age of your dependent children:

Business Administration – Operations Management – Niagara College Canada Co-op Program Overview Operations Management Business Administration Online Jobs

The aotc is a tax credit worth up to $2,500 per year for an eligible college student.

Tax credit college student. On this case, only b can claim the bills for functions of the american opportunity and lifetime studying credits regardless of whether he or his parents paid them. Our tax professionals have intensive experience in supplying tax debt in the form of irs fee plans to assist companies and other. This content has been created with the help of gsa content generator demo!

The maximum credit is 2,500 per student, and 40% of that credit is now refundable for college students and mother and father with little or no taxable income. The lifetime learning credit in the same tax yr. Claiming the american opportunity credit score described above means that you may not declare a lifetime learning credit score for any of that student’s.

It is refundable up to $1,000, which means you can get money back even if you do not owe any taxes. Funding for college students can come from scholarship money and grants, for starters. How much is the child tax credit for college students?

It allows a maximum student tax credit of up to $2,500 per student of these costs: The undeniable truth about tax credit for college students that nobody is telling you by batman posted on october 6, 2021 october 8, 2021 992 views they’ll get you through the means of an audit with restricted negative recourse from the irs. It is refundable up to $1,000, which means you can get money back even if you do not owe any taxes.

The american opportunity credit and the lifetime learning credit. This has been created with the help of gsa content generator demo! You’ll be able to file a form 1040x to amend your tax return.

The aotc is a tax credit worth up to $2,500 per year for an eligible college student. Only for the first four years at an eligible college or vocational school. The american opportunity tax credit is:

However, the student’s income does embody gifts or expenses paid on the student’s behalf. This laws assures that faculty emergency grants to students authorized by the cares act will not. Worth a maximum benefit up to $2,500 per eligible student.

Later years to help working canadians with the price of eligible coaching charges. You could save up to a few thousand dollars on your taxes each year if you qualify for tax breaks. The american opportunity tax credit (aotc) provides a maximum annual credit of $2,500 for eligible students and their families.

It’s sometimes referred to as the college tuition tax credit, because it’s often taken to offset the costs of college tuition. These credits are uncle sam’s way of helping you invest in your education. But when you're looking for.

Here are some important things taxpayers should know about these credits. There are two major education tax credits available to students to help offset the costs of higher education: Tax credit for college students.

You may claim this credit a maximum of four times per eligible college student. The canada training credit (ctc) is a new refundable tax credit score out there for 2020. Claiming college tax credits and deductions can help defray the costs of certain expenses, such as tuition, fees, books and supplies.

For students pursuing a degree or other recognized education credential. The child tax credit amount is determined by the age of your dependent children: The principle credit for faculty college students are the american opportunity tax credit (aotc) and the lifetime learning credit (llc).

While college students did not qualify for stimulus checks, households that are eligible for the tax credits could get $500 for kids aged 18 to 24. With the rising price of college tuition and textbooks, students need all the money saving tips they can get. But when you're looking for an opportunity.

Qualified expenses and fees incurred for college include tuition, textbooks, and other course materials needed for the first four years of. It discovered that the share of present college students who expertise a relative value impact from the credit would be 56.5%.23 it additionally concluded that college students who spend large quantities on education simply reap a “windfall gain” of about 42% for the reason that credit would trigger no price change for additional spending.24 thus, they’d obtain the tax. Learning tips on how to file taxes as a college pupil could be difficult and confusing.

You may claim this credit a maximum of four times per eligible college student. Worth a maximum benefit of up to $2,500 per eligible student. Learn more about the specifics of the american opportunity tax credit.

Textbooks required for a course are. What is the amount of the college student child tax credit? Taxpayers use form 8863, education credits, to claim the credits.

The first tax credit available to college students is the american opportunity tax credit, or aotc. There are a million things a student needs to prepare for college. The lifetime learning credit is another fashionable tax credit for college students as well as lifetime learners.

Tax Tips For College Students In 2021 Tax Deductions Saving Money Deduction

Us And International College Student Tax Guide Forms Filing And Deductions Tax Guide Student Student Guide

Extra Curricular Activities For Resume Elegant Resume Co Curricular Activities Resume Skills Resume Examples Student Resume Template

Student Tax Credits To Take Advantage Positive Discipline Parenting Techniques Positive Parenting

Pin On Co-op Education

Renovation Technician – Niagara College Canada Co-op Program Overview Online Jobs Education Technician

How Do Education Tax Credits Work – Tax Relief Center Tax Credits Online Education Post Secondary Education

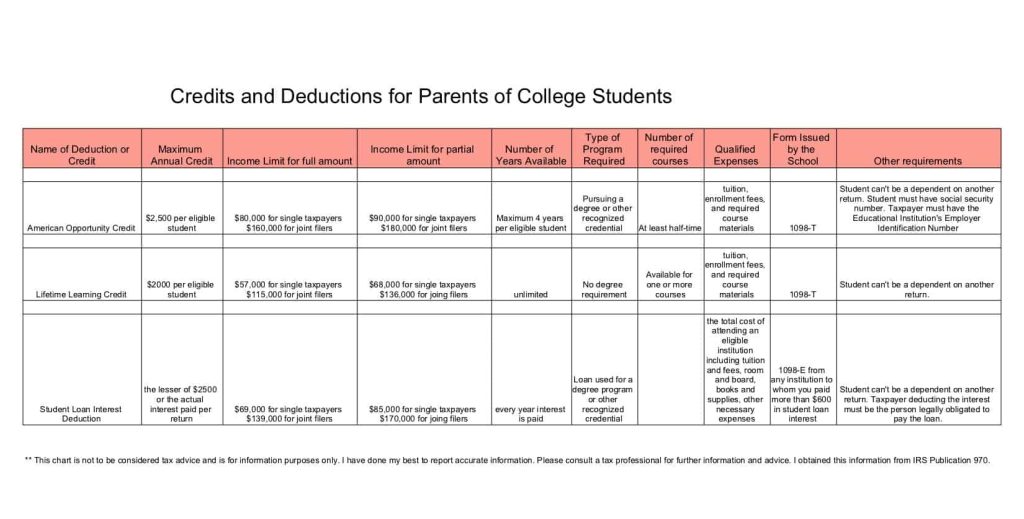

Tax Credits And Deductions For Parents Of College Students Grants For College College Parents Scholarships For College

Tax Credits And Deductions For Parents Of College Students – Almost Empty Nest Tax Credits Deduction College Finance

Account Suspended Tax Guide Money Saving Tips Tax Preparation

Taxcredit On Education For 2019 American Opportunity Credits Studentdebt 2500 Of Tax Credit Can Be Claimed By An A Student Studying Student Debt Student

College Kid Tax Guide Tuition Deduction Versus Education Credit College Studentfinance Taxes Deductions Credits Tax Guide Tuition Student Finance

Tuition Deduction V Education Credit Tax Guide For Students New Grads Everything You Need To Know Sc Tax Guide Student Loans Funny College Budgeting

Education Tax Credits And Deductions Can You Claim It Tax Credits Education Educational Infographic

The Tax Benefits Of College Savings Plans Hr Block Financial Literacy Lessons Saving For College College Savings Plans

College Tax Credit Understanding The Aotc Centsai Tax Credits Finance Education Personal Finance Lessons

American Opportunity Tax Credit Tax Credits Tax Time Tax

Asian College Student Studying In The Library By Take A Pix Media – College Student Student Student Studying College Marketing College Students

Education Tax Credits The Lifetime Learning Tax Credit Explained Tax Credits Education Tax Refund