The tax evasion case27 dealt with an (it must be said optimistic) argument that evasion of tax did not include failing to disclose to inland revenue Avoidance meant arranging your affairs so tax wasn’t due.

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

A tax evasion a discussion on the distinction between avoidance and evasion often starts by stating that.

Tax avoidance vs tax evasion nz. Nz tax law requires that your returns be filed on time, else, pay a late filing penalty which can keep increasing depending on your net income. Tax crime is when people deliberately avoid paying their fair share of tax or claim money they're not entitled to. Tax avoidance and criminal acts • company director jailed for tax evasion thursday, 01 july 2010 13:55 • evading tax of more than $700,000 has led to four years jail for a bay of plenty labour hire company director.

Contact us to learn more. We help people to get their tax right, and take action against those who deliberately do the wrong thing. Nz passes law to stop tax avoidance by multinationals.

6 oct, 2021 09:00 am. 1.5 tax avoidance in new zealand tax avoidance is a problem facing by all the tax system, especially for a higher tax rate , tax. Tax evaders do not come under anything like the same level of scrutiny.

Assets within the trust are subject to local tax laws (sometimes zero tax) and local secrecy laws (sometimes complete secrecy). Access financial crime compliance information to mitigate risk & prevent tax evasion. Obviously some tax avoidance will always occur, on the basis that it has occurred ever since the modern tax system came into existence.

Failure to meet your tax obligations may result in civil penalties, criminal penalties, or, worst case scenario, both. A taxpayer by all means wants to minimise its tax liability, whereas the tax collector maximise. Tax avoidance means legally reducing your taxable income.

Contact us to learn more. Successive administrations, including the current one, have been increasing the power of the ird to get at this. The difference used to matter.

Since the inception of the income tax the difference of opinion between a taxpayer and the tax collector has always been and will always remain. Tax evasion means concealing income or information from tax authorities — and it's illegal. For somewhere between us$2,000 and us$20,000 to set up the trust, the name of the real owner or beneficiary can be hidden.

Tax avoidance lies between the two, exploiting the form of tax law while denying its substance. I would be very surprised if tax avoidance reduces the overall tax take by anything like 25%. For example, evade tax is both a criminal and civil penalty.

It isn’t illegal for the celebrity or a politician to move their money (so long as it is theirs to begin with). Tax avoidance, largely because of the fact that the scheme would probably never have been profitable and because of the substantial mismatch in timing between the tax deduction and incurring the cost in an economic sense. Only something like 60 to 80 tax evasion cases are filed annually.

Since 1988, the new zealand income tax law allowed foreigners to use trusts established in new zealand (referred to as “foreign trusts”) to avoid or evade the tax they would otherwise have had to pay in their home country. The pandora papers are almost 12 million documents, revealing hidden wealth, tax avoidance and, in some cases, money laundering by some of the world. The commissioner contended that there were two discrete tax avoidance arrangements:

“the ird, as a matter of policy, allows all taxpayers of new zealand to. Revenue minister stuart nash says the new tax law aimed at multinational corporations will collect $200 million of currently unpaid tax each. Tina orem mar 18, 2020

Ad protect your organization from tax avoidance and tax evasion. The “management fee arrangement” (limited to the payments of $40,000 in 2003 and $180,000 in 2004 due to the disputant’s concession that the management fees were properly assessed under the personal services attribution rule); Up to 1000 welfare beneficiaries are prosecuted each year.

Major tax evasion and avoidance schemes have cost governments an estimated €150bn (£127bn) in lost revenues, research shows. Ad protect your organization from tax avoidance and tax evasion. Logan says it’s important to distinguish between tax avoidance and evasion.

What’s the difference between tax avoidance and tax evasion? Access financial crime compliance information to mitigate risk & prevent tax evasion. It meant not paying tax that was due.

In ordinary use “avoid” and “evade” are interchangeable. Instances the government may even encourage it. In the tax world, however, there is a very clear distinction between tax avoidance and tax evasion, a point highlighted by the minister of revenue’s remark about “legitimate tax avoidance” in the recent 60 minutes programme on new zealand’s foreign trusts industry.

Legislating Against Tax Avoidance Ibfd

Pdf Tax Avoidance Corporate Governance And Firm Value In The Digital Era

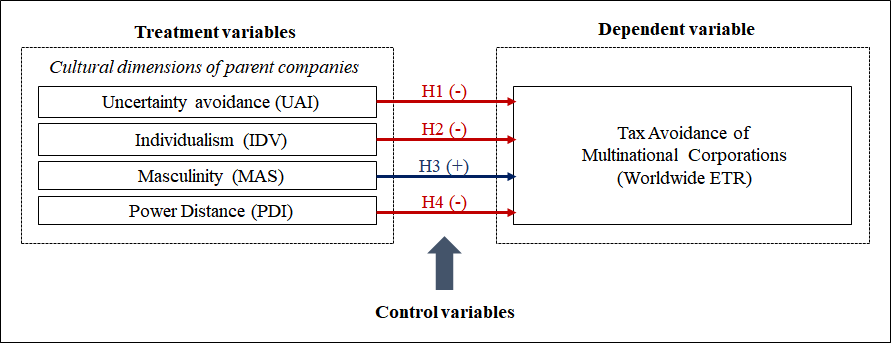

Sustainability Free Full-text National Culture And Tax Avoidance Of Multinational Corporations Html

Change Of Value Function In Prospect Theory Depending On The Amount Of Download Scientific Diagram

2

Pdf Detecting Tax Evasion When Tax And Accounting Earnings Match

2

Pdf Explaining The Us Income Tax Compliance Continuum

Fighting Tax Evasion – Oecd

Pdf The Impact Of Tax Rates On Tax Evasion A Macroeconomic Study

Pdf Cooperative Tax Avoidance Evidence Of Implementation Of Agency Theory

Apa Perbedaan Praktik Penghindaran Pajak Dan Penggelapan Pajak Pdf

Pdf Detecting Tax Evasion When Tax And Accounting Earnings Match

2

Tax Avoidance Tax Mitigation And Tax Evasion

Pdf Tax Evasion A Financial Crime Rationalized

Tax In The Future Responding To The New Global Economy – Ppt Download

Tax Evasion Vs Benefit Cheats

Tax Evasion And Tax Avoidance Explainedpdf – Tax Avoidance And Tax Evasion Explained And – Studocu