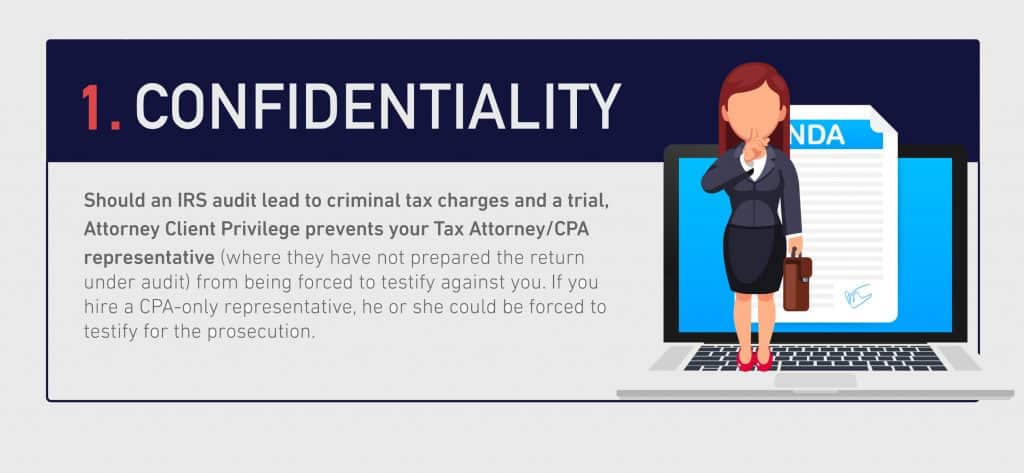

If you do end up in court, this legal protection of communications between you and your lawyer means you can seek help without the risk what you share privately coming out publicly in a trial. About us book a free consultation.

Tax Attorney And Cpa In California David W Klasing

Join a network of business leaders & highly qualified professionals with a cpa designation

Tax attorney or cpa. Ad the cpa designation is regarded as a mark of high professional competence by employers. Payroll, employment, and business tax lawyers in chicago. An expert in taxation and business law, cpa tax attorney carl a.

They have passed the state bar exam and specialize in the legal side of tax preparation. Cpas have more experience on the financials of tax prep, but attorneys can give legal advice if you are facing adversity or other issues. In the event of litigation or potential criminal proceedings, your call(s) and conversations with the irs can be used in a court of law against you.

Both tax attorneys and cpas can help you with financial decisions, lowering tax penalties, and tax planning. An attorney saves you considerable time in closing any open matters. Ad professional tax relief attorney & cpa helping to resolve complex tax issues.

If you believe that an auditor’s findings are erroneous, you’ll have a window to file an appeal with help from a tax attorney in chicago. Tax attorneys specialize in tax law, having spent three years in law school and years of practice understanding the intricacies of the case law and legal. In this realm, tax attorneys offer more specialization in the legal questions of tax planning, while cpas have more expertise on.

Give us a call today to discuss your specific situation in a free consultation. Ad professional tax relief attorney & cpa helping to resolve complex tax issues. Trust an attorney if you require counsel in a tax defense lawsuit.

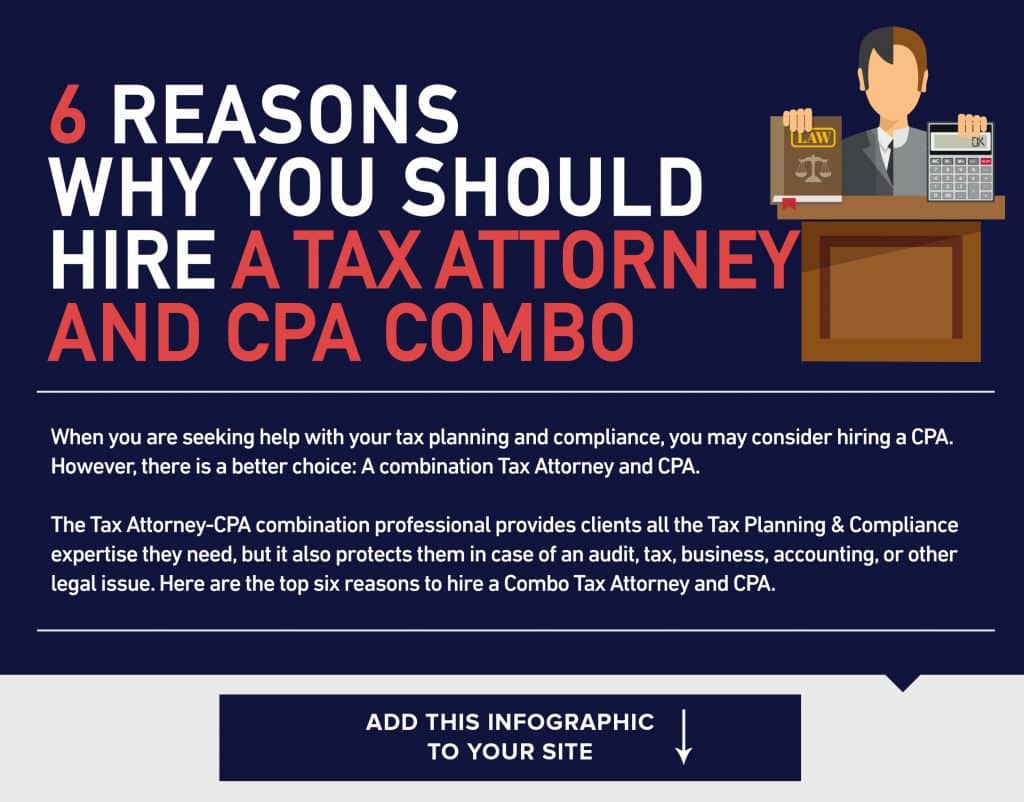

For instance, one may advertise themselves as a criminal tax attorney, while another may advertise themselves as an estate tax attorney. The primary difference between the two is that, while a cpa holds expertise in dealing with the financial implications of tax matters, a tax attorney specializes in handling the legal aspects of taxation. Miller, jd, ll.m, cpa, offers services in.

A cpa cannot defend a taxpayer in tax court since their license is limited to the issuing state in most situations, whereas a tax attorney can. Get a free consultation today & gain peace of mind. Cpas undergo rigorous business and monetary training so they can act as financial.

Every tax problem has a solution. A tax attorney can give you attorney client privilege and a cpa could be forced to testify against you by the irs. The answer depends on your business's specific tax needs and goals.

Carl miller law areas of service. A tax attorney is completely different than a cpa, although both help taxpayers. A tax attorney may be involved in a specific niche of tax law;

All conversations with the irs are recorded. Both cpas and tax attorneys provide tax planning support, helping individuals and organizations make financial decisions with an eye on the possible tax benefits or penalties that those moves would create in the future. Certified public accountants (cpa) and tax attorneys are both professionals who can attend to your tax needs.

Cpas may be more knowledgeable about the money perspective of tax preparation, but an attorney can give additional counsel in the event of difficulty or potential complications. Cpas have some similarities to tax attorneys in that they both provide tax services to their clients, but there are many key differences that set. As tax issues arise, you may wonder whether a tax attorney or certified public accountant (cpa) is better suited to help you.

Your tax attorney or cpa should be the one reaching out on your behalf. A tax attorney is also expedient, understanding the complexities of your issue and the processes necessary for resolution. Join a network of business leaders & highly qualified professionals with a cpa designation

At frost law, our experienced tax attorneys know how to resolve tax disputes of all types effectively. Tax group center is here to help you navigate everything from complex audits to tax preparation. The purpose of this blog is to explain what tax attorneys and cpas do while also detailing the distinctions between the two.

Cpa tax attorney carl miller law is denver's most trusted team for estate, business and tax law. Get a free consultation today & gain peace of mind. Cpas are accounting professionals who can prepare taxes to maximize assets and lower the tax liabilities of a client.

Based in the washington, d.c. A tax attorney can act as a liaison between a client and the internal revenue service, often minimizing penalties or negotiating payment terms. Ad the cpa designation is regarded as a mark of high professional competence by employers.

A tax attorney or cpa can help you handle your tax difficulty, depending on your situation. Tax attorneys are legal professionals with law degrees. Nonetheless, they do not always carry out the exact same solutions.

Area, we serve clients across the country and around the world. Both professionals help with tax planning and advising clients through complicated tax situations, but there are some key differences in qualifications. Tax attorneys and cpas often occupy the same space, but there are several key differences between the two professions.

Cpas and tax lawyers can both assist with taxation, credit card service, and reducing tax consequences. Every tax problem has a solution. Discover the crucial differences between a tax attorney as well as a cpa, as well as examine that offers the services you require.

Both tax attorneys and also accredited public accountants are there for you during tax obligation period. Protect your self by using a tax attorney who can provide client privilege protection.

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Florida Tax Attorney Cpa Daniel Rosefelt Associates Llc Attorney Cpa

Should You Hire A Tax Attorney Or Cpa – Upcounsel

Do I Need A Tax Attorney Or Cpa – Laws101com

Differences Between Cpas And Tax Attorneys Infographic

The Difference Between A Cpa And A Tax Lawyer In California

Tax Attorney Vs Cpa Why Not Hire A Two-in-one – Aaa-cpa

Do I Need A Tax Attorney Or Cpa – Laws101com

Bootstrap Business What Is The Difference Between A Tax Attorney And A Cpa

Tax Attorney And Cpa In California David W Klasing

Whats The Difference Between A Cpa And A Tax Attorney –

Irs Criminal Tax Audit Infinite Partnerships Tax Attorney

Do I Need A Tax Attorney Or Cpa – The Law Offices Of Lawrence Israeloff Pllc

High Qualified Chicagos Tax Attorney- Chicago Tax Lawyer Firm By Tax Attorney – Issuu

Tax Attorney And Cpa In California David W Klasing

Cpa Vs Tax Attorney Whats The Difference

Why You Want A Tax Attorney To Help You With A Tax Problem Instead Of Or In Addition To A Cpa Or Tax Service

Whats The Difference Between A Tax Attorney A Cpa And An Enrolled