The dollar amount of tax revenues being reduced as a consequence of tax abatement agreements during the accounting period; Complete removal of an amount due, (usually referring to a tax abatement a penalty abatement or an interest abatement within a governing agency).

Accounting Taxation How To Know Un-utilized Vatcst Waybills Andhrapradesh – Wwwapctgovin How To Know Accounting Mission Statement

The calculation of any associated abatement amounts are solely the responsibility of entity management.

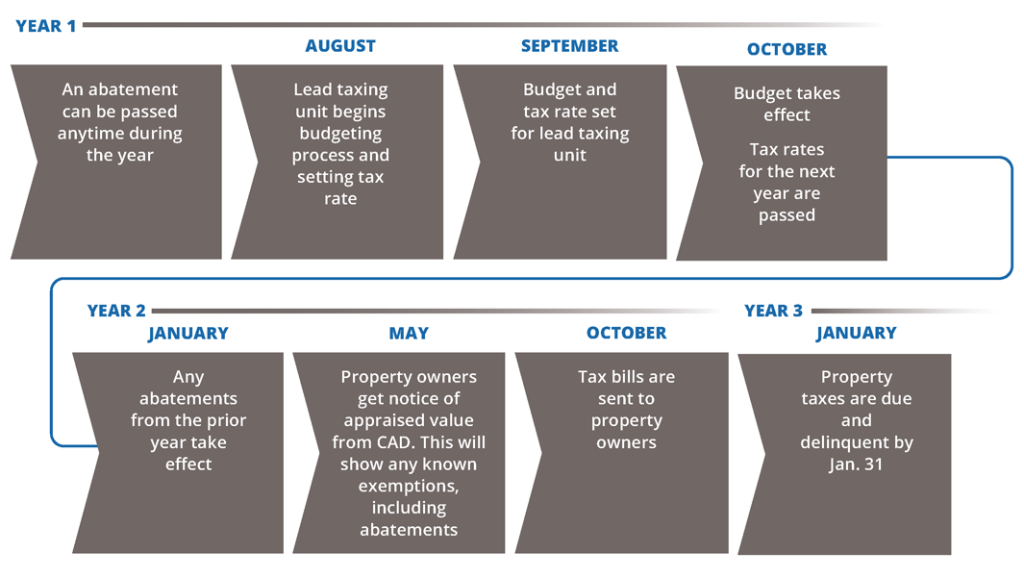

Tax abatement definition accounting. Baseline for sales tax revenues for the geographic area, including the proposed development, is established prior to the start of the project. The primary purpose for this new requirement is to provide more. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

In broad terms, an abatement is any reduction of an individual or corporation’s tax liability. These tax abatement agreements also include a prescribed start and end period lasting usually for 5, 10, 15, and 25 years. A reduction in the amount of tax that a business would normally have to pay in a particular….

Additional sales tax revenues above the baseline are specifically set aside for the payment of the bonds. Brief descriptive information that includes the names of the governments and dollar amount received or receivable from other governments, if a governmental unit has amounts received or receivable from other governmental units in. An abatement is a reduction in the normal amount of a levied tax or special assessment.

77 defines tax abatement for financial reporting purposes as the result of an agreement between a government and a taxpayer where the government promises to forgo tax revenues that the government is entitled and the taxpayer promises to take a specific action that contributes to economic development or provides some. There is abatement upto 75% so the service tax will be calculated on 25% portion only. This will assure the correct received date on the return so the correct amount of penalty and interest is assessed.

Property tax abatements generally have a finite life, offering the owner the benefit for only a specific period of time after which the owner is responsible to pay the full property tax amount. Such arrangements are known as tax abatements. Abatement a reduction or decrease.local governments sometimes offer tax abatements to new businesses in order to attract them to the area.commercial leases usually have clauses denying rent abatement if the leased property is partially destroyed and.

Here in the above case service tax can be taken as cenvat hence it is treated as current asset. This burden might take the form of a debt, an import tariff, a tax, a fine, a penalty or a reduction of the percentage being charged, like an interest rate or a tax bracket reduction. Everyone should remember that service tax receivable cannot be adjusted against the service tax payable, it is only adjusted against excise duty payable.

A sales tax holiday is another instance of tax abatement. Tax abatement n steuernachlass m. It can apply for an abatement t

Each governmental entity is responsible to determine which programs, from the tax distribution report, qualify as abatement programs for their respective entity. Tax breaks for research and development, depreciation, and more. For example, if one receives a tax credit for purchasing a house, one receives tax abatement because one pays less in taxes than he/she otherwise would.

A reduction of taxes for a certain period or in exchange for conducting a certain task. The concept also applies when an entity overpays a tax; Request an abatement of all assessments under the incorrect entity or tax period and request that ccp reprocess the return to the correct entity or tax period.

These motivations are common to in the business world; The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. The agreement details how the local government will reduce property taxes for an improvement an individual performs to a home or development a company contributes to the local economy.

77, tax abatement disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. The term abatement refers to a situation where an economic burden is reduced. Tax abatement synonyms, tax abatement pronunciation, tax abatement translation, english dictionary definition of tax abatement.

Tax abatement means a tax incentive given to business‘ for the purpose of spending it in another way. These perks allow a business to focus on the future rather than trying to survive in the present. “a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which (a) one or more governments promise to forgo tax revenues to which they are otherwise entitled and (b) the individual or entity promises to take a specific action after the agreement has been.

Recently, the gasb published gasb statement no. A) one or more governments promise to forgo tax revenues to which they are otherwise entitled, and This arrangement does not meet the definition of a tax abatement under statement 77

A property tax abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. Tax abatement is a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which: Abatements can last anywhere from just a few months to multiple years at a time.

An abatement is most commonly used to encourage businesses to move to or expand within a community.

Income Tax Presentation Slab Rates Income Tax Return Form 16 Types Of Taxes Etc Bymrparesh Jain Types Of Taxes Income Tax Tax Return

Pin On Service Tax

Understanding Business Accounting For Dummies Cheat Sheet In 2021 Accounting Basics Accounting Process Learn Accounting

Cap 55 Income And Business Tax Act – Income Tax Department Belize

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Ministry Of Corporate Affairs Mca – All About E-filing Accounting Taxation Accounting Mca Corporate

Non-profit Accounting Service And Advice El Paso Tx

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Deferred Tax Liabilities Meaning Example Causes And More In 2021 Deferred Tax Financial Accounting Accounting And Finance

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Why Your Real Estate Analysis Should Include An Apod Rental Property Investment Real Estate Investor Real Estate

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Costing Cost Sheet Cost Accounting Cost

Books Accounts And Records Under Gst Simple Tax India

Definition Of Ebitda Cash Flow Statement Financial Analysis Financial Analyst

Sports Exercise And Health Science Extended Essay In 2021 Health Science Summary Writing Essay

Pin On Templates

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Accountant Bookkeeping Services Accounting Services Accounting Notes

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China