State tax commission, 437 s.w.2d 665, 668 (mo. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property.

2

If you opt to visit in person, please schedule an appointment.

St louis county personal property tax on car. Louis) collector's office sent you receipts when you paid your personal property taxes. Louis county assessor's office is responsible for accurately classifying and valuing all property in a uniform manner. The median property tax in st.

You can also obtain a receipt for $1.00 at one of our offices. Louis county has one of the highest median property taxes in the united states, and is ranked 348th of the 3143 counties in order of median property taxes. We reserve the right to refuse service to anyone not wearing a face mask.

Every person owning or holding real property or tangible personal property on the first day of january, including all such property purchased on that day, shall be liable for taxes thereon during the. Personal property tax covers purchases like new cars, boats and recreational vehicles, while property tax is assessed. These tax bills are mailed to citizens in november and taxes are due by december 31st of each year.

The leasing company will be billed for personal property tax directly. An online tax receipt will be accepted at the missouri department of revenue license offices when licensing your vehicle. Louis county residents pay two types of property tax:

Louis county collects, on average, 1.25% of a property's assessed fair market value as property tax. Louis county residents and the county is encouraging people to avoid the line and pay online. We are committed to treating every property owner fairly, and to providing clear, accurate and timely information.

The value of your personal property is assessed by the assessor's office. Louis county, mo are responsible for the financial management of government funds, processing and issuing st. Residents can pay their personal property and real estates taxes through our online tax payment portal.

Louis county personal and real property taxes. You must present the receipts (an original, photocopy, fax copy, or copy of an internet confirmation screen is acceptable) when you obtain license plates. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, and motorcycles.

To declare your personal property, declare online by april 1st or download the printable forms. Places near ballwin, mo with st louis county personal property tax office. The missouri department of revenue requires proof of paid personal property taxes or a waiver for the last two years at the time you register or renew the license plates on your vehicle.

Louis county, missouri is $2,238 per year for a home worth the median value of $179,300. Paid personal property tax receipts. Your county (or the city of st.

If you purchased a vehicle after january 1 you will not pay personal property tax on that vehicle until the following year. Louis county tax bills, and the collection of st. Treasurers & tax collectors are key departments in the broader st.

You will pay taxes for the full year. Subtract these values, if any, from the sale price of the unit and. Clarkson valley (5 miles) valley park (7 miles) chesterfield (8 miles) grover (8 miles) glencoe (9 miles) glendale (11 miles) eureka (12 miles) fenton (13 miles) rock hill (15 miles) crestwood (15 miles)

Treasurer & tax collector offices in st. You are required to file a personal property form each year. About the personal property tax.

Personal property tax receipts are available online or in person at the collector of revenue's office. In order to do so, the leasing company must have the correct garaging address of the vehicle.

Listings Search County Park St Louis County Virtual Tour

Port Authority – St Louis Economic Development Partnership

Collector Of Revenue – St Louis County Website

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

Collector Of Revenue Faqs – St Louis County Website

Convention Center Design Moves Ahead But Major Construction On Hold Amid St Louis County Council Impasse Local Business Stltodaycom

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

11 Million Dollar Project Approved St Louis Mo Stlrealestatenews Project Approved Much Has Been Done To The Grove Ar Green Street Real Estate Chouteau

St Louis Moseptember 20 2017 Stlrealestatenews Missouri Development Company Scannell Properties This Week Submitted A Plan To Fedex Express Route Stl

St Louis County Revenue Dept 4546 Lemay Ferry Rd Saint Louis Mo 63129 – Ypcom

Print Tax Receipts – St Louis County Website

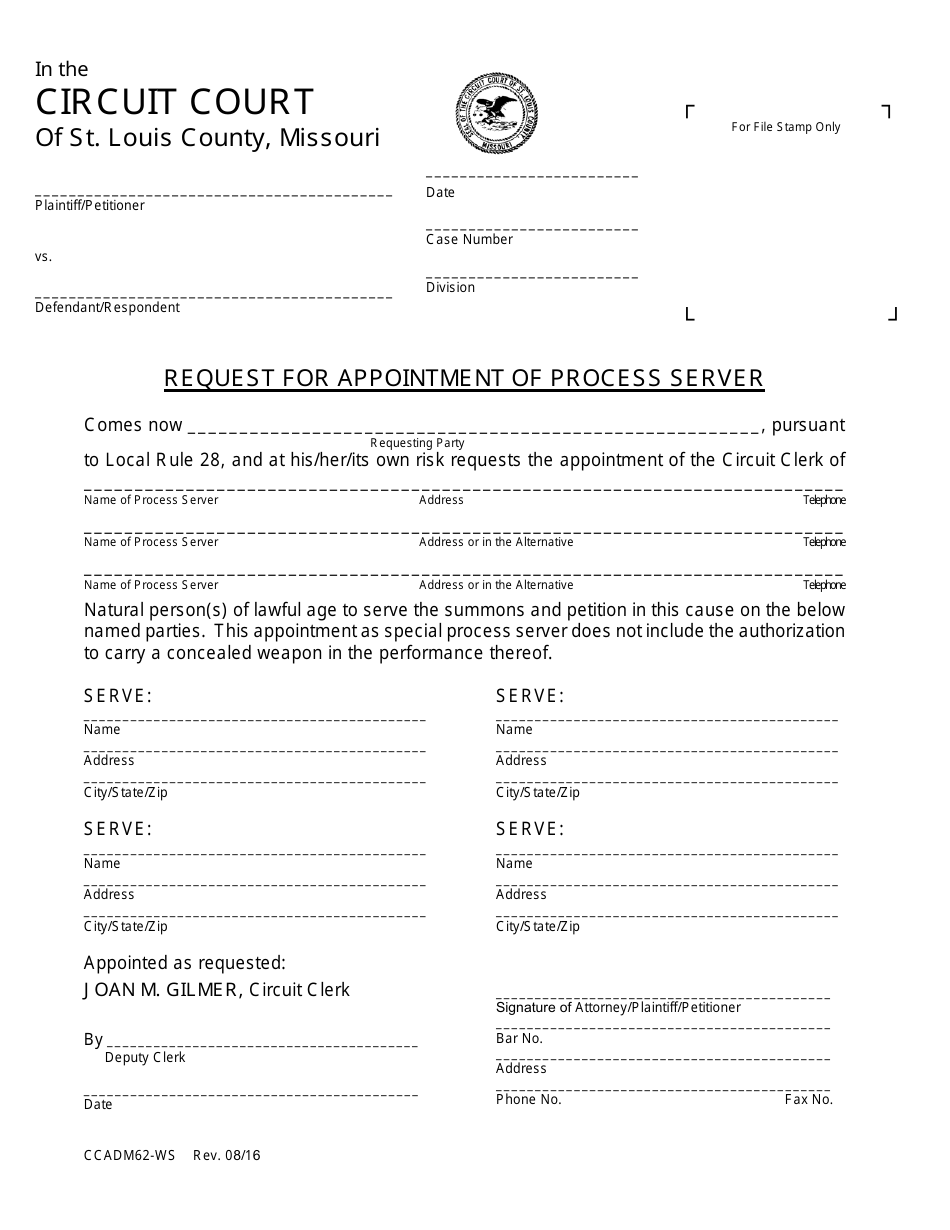

Form Ccadm62-ws Download Fillable Pdf Or Fill Online Request For Appointment Of Process Server St Louis County Missouri Templateroller

Revenue – St Louis County Website

Form Ccadm62-ws Download Fillable Pdf Or Fill Online Request For Appointment Of Process Server St Louis County Missouri Templateroller

Pay For

You Can Pay St Louis County Real Estate And Personal Property Taxes Online Fox 2

2020 Unclaimed Property – St Louis County By Stltodaycom – Issuu

2

2