And we can prove it. South dakota state rate (s) for 2021.

South Dakota And Sd Income State Tax Return Information

South dakota sales tax rates.

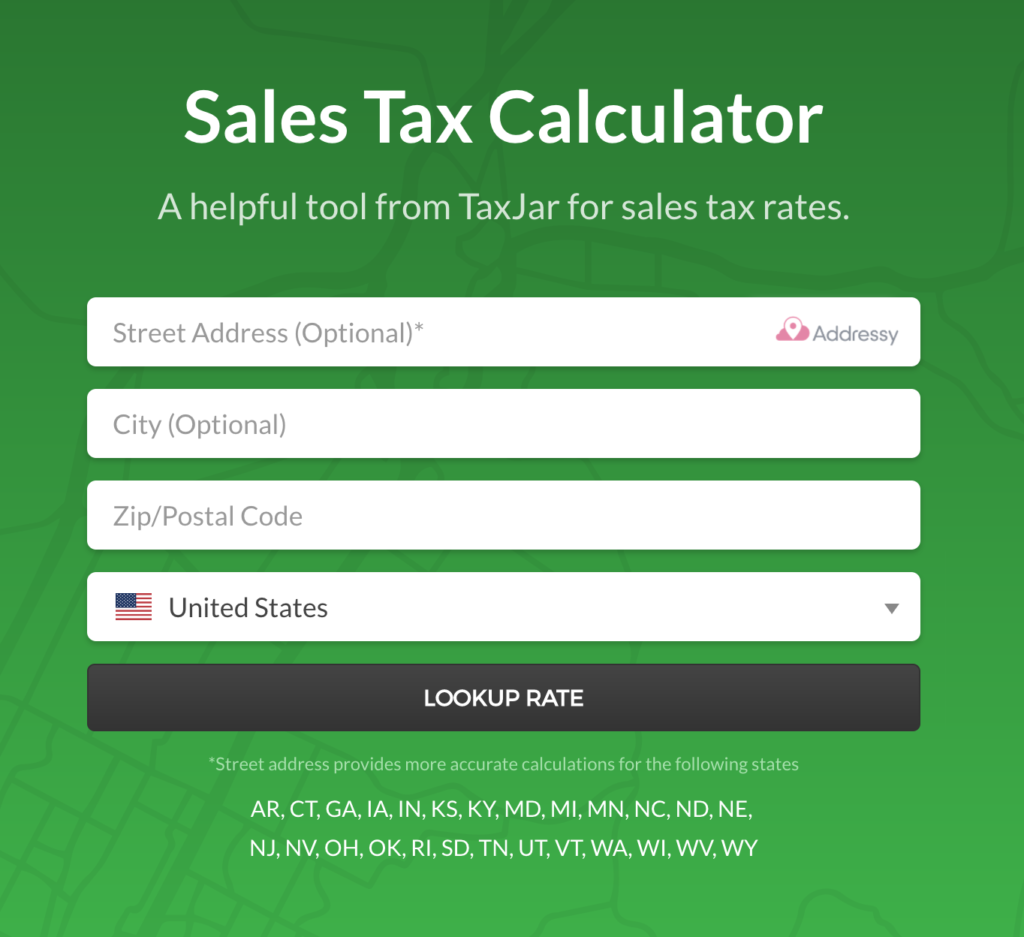

South dakota sales tax calculator. Citing the significant increase in new home building in a recent edition of south dakota taxation news, the south dakota department of revenue and regulation discussed the addition of a bid calculator for contractors. In addition, cities in south dakota have the option of collecting a local sales tax of up to. Municipalities may impose a general municipal sales tax rate of up to 2%.

South dakota’s state sales tax rate is 4.50%. The current total local sales tax rate in aberdeen, sd is 6.500%. Local tax rates in south dakota range from 0% to 2%, making the sales tax range in south dakota 4.5% to 6.5%.

The south dakota (sd) state sales tax rate is currently 4.5%. South dakota has a higher state sales tax. The tax rate on a home in south dakota is equal to the total of all the rates for tax districts in which that home lies, including school districts, municipalities and counties.

South dakota sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. South dakota law also requires any business without a physical presence in south dakota to obtain a south dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year: See how we can help improve your.

31 rows south dakota (sd) sales tax rates by city. One of a suite of free online calculators provided by the team at icalculator™. Get all of the tools that you need to manage your business efficiently with wix.

After taxes, how much of your income do you take home? Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates. Click here for a larger sales tax map, or here for a sales tax table.

South dakota has state sales tax of 4.5%, and allows local governments to collect a local option sales tax of up to 6%.there are a total of 193 local tax jurisdictions across the state, collecting an average local tax of 1.125%. The south dakota department of revenue administers these taxes. Employers in south dakota pay unemployment tax on the first $15,000 in wages paid to each employee during a calendar year.

If this rate has been updated locally, please contact us and we will update the sales tax rate for parker. Get all of the tools that you need to manage your business efficiently with wix. South dakota has a 4.5% statewide sales tax rate , but also has 193 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.125% on.

This is supplemented in most parts of the state by local taxes that bring the total effective rate up to between 5.5% and 6.5%. Furthermore, taxpayers in south dakota do not need to file a state tax return. Federal income taxes are calculated using.

South dakota real wage calculator. The december 2020 total local sales tax rate was also 6.500%. Sales tax in parker, south dakota, is currently 4.5%.

Combined with the state sales tax, the highest sales tax rate in south dakota is 6.5% in the. They may also impose a 1% municipal gross receipts tax (mgrt) that is in addition to the municipal sales tax. South dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax;

Depending on local municipalities, the total tax rate can be as high as 6.5%. In 2020, the average unemployment tax rate paid by experienced employers was 1.13 percent. Like most states, south dakota has a blanket state sales tax rate of 4.5% that applies everywhere.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. The deadwood, south dakota sales tax comparison calculator allows you to compare sales tax between all locations in deadwood, south dakota in the usa using average sales tax rates and/or specific tax rates by locality within deadwood, south dakota. Searching for a sales tax rates based on zip codes alone will not work.

Enter a street address and zip code or street address and city name into the provided spaces. The state sales tax rate in. The bottom line is location matters.

The sales tax rate for parker was updated for the 2020 tax year, this is the current sales tax rate we are using in the parker, south dakota sales tax comparison calculator for 2022/23. South dakota salary tax calculator for the tax year 2021/22 you are able to use our south dakota state tax calculator to calculate your total tax costs in the tax year 2021/22. 4% is the smallest possible tax rate ( meckling, south dakota) 4.5%, 5.5% are all the other possible sales tax rates of south dakota cities.

Counties and cities can charge an additional local sales tax of up to 2%, for a maximum possible combined sales tax of 6%; For cities that have multiple zip codes, you must enter or select the correct zip code for the address you are supplying. South dakota municipalities may impose a municipal sales tax, use tax, and gross receipts tax.

, sd sales tax rate. Click search for tax rate. Your business’s gross revenue from sales into south dakota exceeded $100,000;

101 rows how 2021 sales taxes are calculated for zip code 57301. 6.5% is the highest possible tax rate ( alcester, south dakota) the average combined rate of every zip code in south dakota is 5.076%. Find your south dakota combined state and local tax rate.

How much can you buy with your hard earned wages? South dakota creates bid calculator for contractors and discusses tax responsibilities of specialty builders. The south dakota state sales tax rate is 4%, and the average sd sales tax after local surtaxes is 5.83%.

Iowa State Sales Tax Guide Tax Guide Sales Tax Tax Holiday

Free Business Sales Tax Calculator – Calculate Your Tax Now With Clickfunnels

Sales Use Tax South Dakota Department Of Revenue

Our Free Online Sales Tax Calculator Calculates Exact Sales Tax By State County City Or Zip Code County Sales Tax South Dakota

Sales Use Tax South Dakota Department Of Revenue

Avalara Salestax Free Sales Tax Calculator Rate Lookups Sales Tax Tax Map

Ebay Sales Tax Everything You Need To Know Guide – A2x For Amazon And Shopify – Accounting Automated And Reconciled

Calculate The Sales Taxes In The Usa For 2021 – Credit Finance

Sioux Falls South Dakotas Sales Tax Rate Is 65

Sd Sales Tax Rates

Ecommerce Businesses Can Integrate Shopping Carts Automatically From Walmart Amazon Shopify And Ebay Sales Tax Filing Taxes Revenue

Sales Use Tax South Dakota Department Of Revenue

South Dakota Sales Tax – Small Business Guide Truic

Sales Tax Calculator

Sales Use Tax South Dakota Department Of Revenue

South Dakota Sales Tax – Taxjar

South Dakota Paycheck Calculator – Smartasset

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

What Is Sales Tax Nexus – Learn All About Nexus