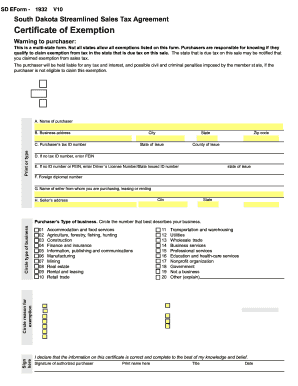

Fill out, securely sign, print or email your streamlined sales and use tax agreementcertificate of exemption. Cannot accept a prime contractor’s exemption certificate for a qualified utility project.

Dorsdgov

Streamlined sales tax exemption certificate.

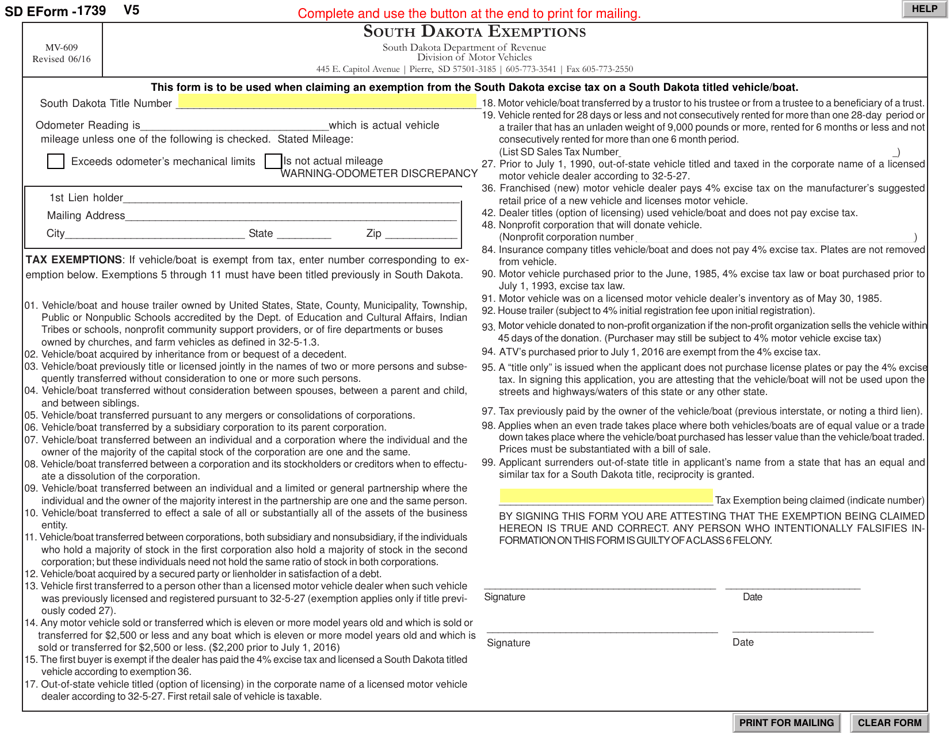

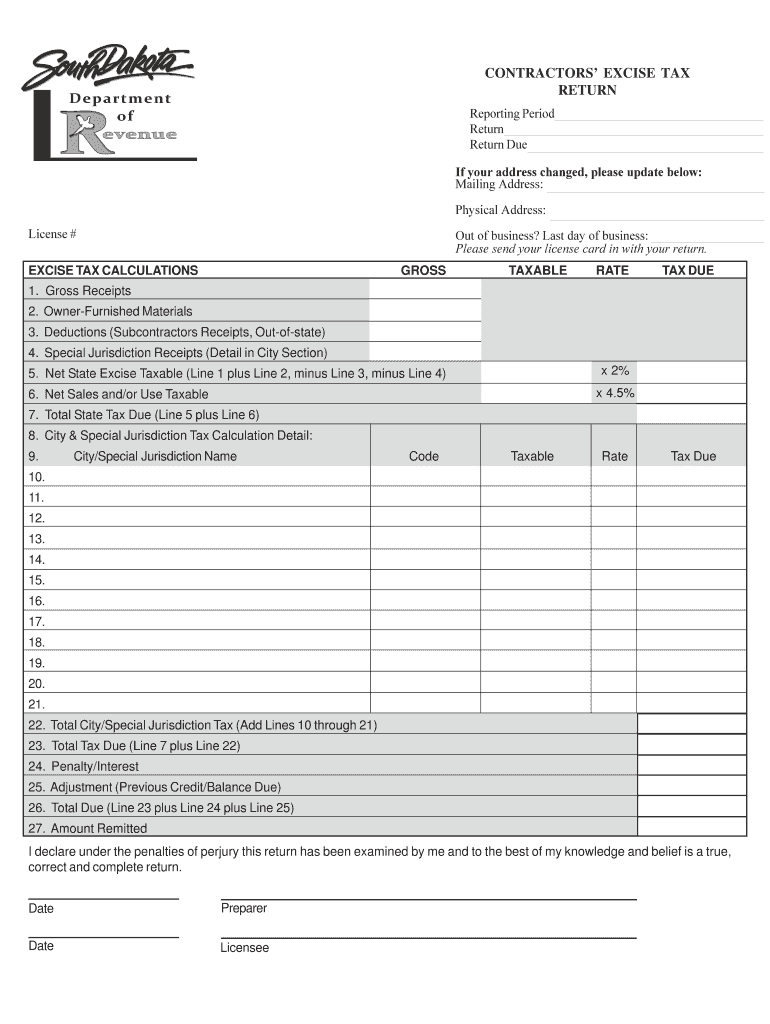

South dakota excise tax exemption certificate. ’ excise tax or use tax license numbers (numbers containing an et or ut). On a qu project, the prime contractor and all subcontractors owe the 2% contractors’ excise tax on their gross receipts. Visit us on the web at www.state.sd.us/drr, email us at bustax@state.sd.us or write us:

South dakota businesses with permit numbers containing ut (use tax) or et (contractor’s excise tax) cannot buy The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. If the secretary of revenue has granted a contractor the authority to report and pay contractor's excise tax on the accrual basis and the contractor requests in writing for the authority to report and pay the tax on the cash basis, the secretary may grant such authority if assessment and collection of taxes are not jeopardized.

Reimbursed by the exempt entity. How to use sales tax exemption certificates in south dakota. No sales or municipal tax applies to receipts subject to contractors excise tax.

Tax paid on cash basis. You can download a pdf of the south dakota streamlined sales tax certificate of exemption (form sst) on this page. If the purchaser is from a state that does not issue sales tax permits, the

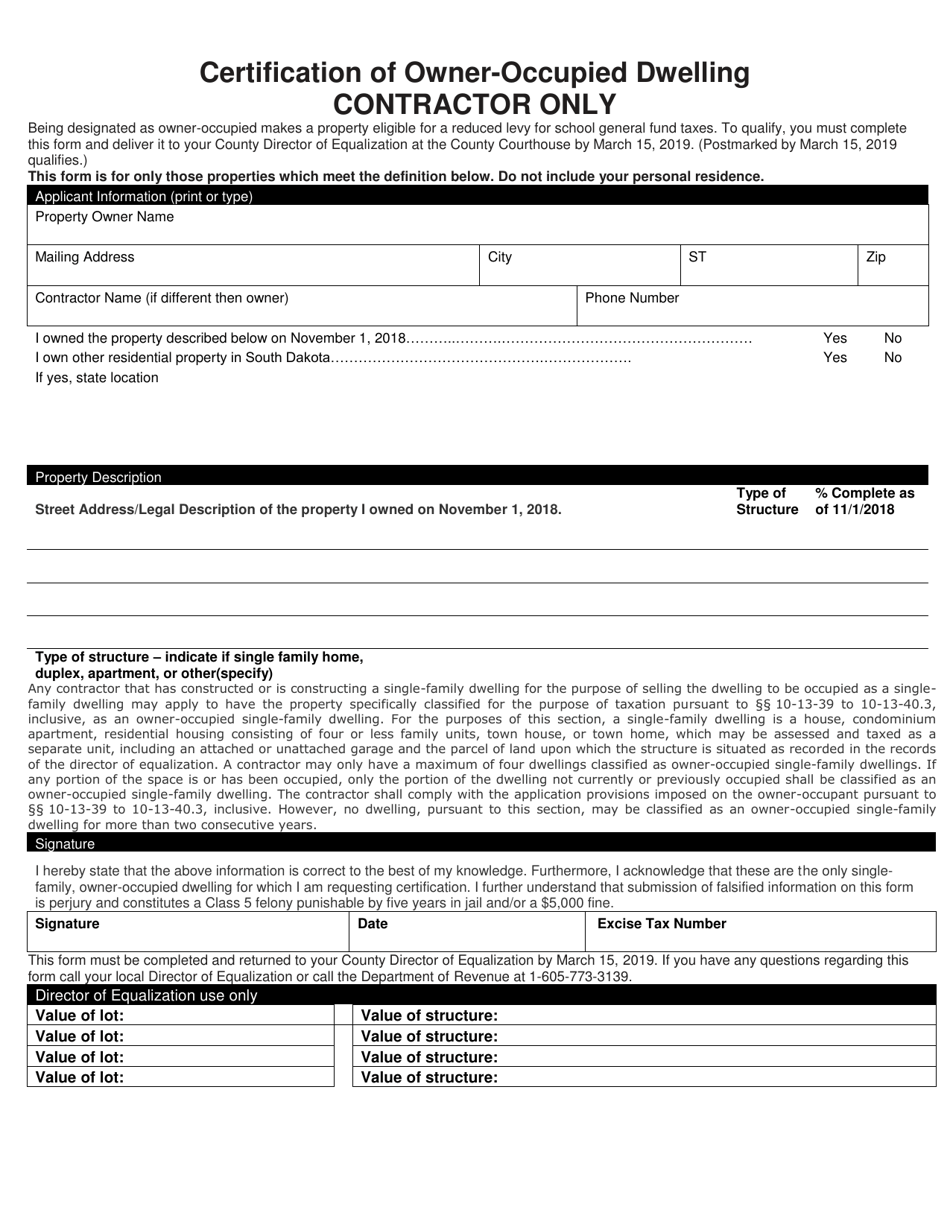

Available for pc, ios and android. • a prime contractor may not issue a prime contractors’ exemption certificate for a qualified utility (qu) project. The exemption certificate must show the prime contractor’s excise tax license number, the project location, and description.

Fuel tax fees are due on the 23rd of each month for the previous month and petroleum inspection fee payments are due electronically by the second to last day of the month. Etention of this certificate relieves the subcontractor from liability for contractors ’ excise tax for the project listed. South dakota department of revenue resale certificate please print legibly name of seller address of seller name of purchaser purchaser’s state tax license number sales tax license, wholesaler license, and manufacturer license numbers onldo not accept contractorsy.

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the south dakota sales tax. Payment of south dakota fuel excise taxes payments of fuel excise taxes are made by fuel vendors, not by end consumers, though the taxes will be passed on in the fuel's retail price. The state of south dakota became a full member of streamlined sales tax on october 1, 2005.

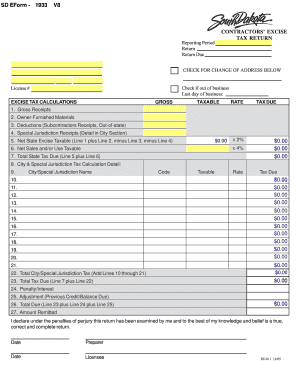

Do not include receipts if the project is for a qualified utility project. Indiana, iowa, north dakota, south dakota, tennessee, and wyoming. Excise tax calculation gross receipts (do not deduct out any tax before.

Prime contractors’ exemption certificate for. Purchases are taxable when payment is made by cash or by an employee who is. For other south dakota sales tax exemption certificates, go here.

O purchases must be paid for directly from the exempt entity by check, credit card or purchase order. The gross receipts would include the tax collected from the consumer. Streamlined sales and use tax agreementcertificate of exemption instantly with signnow.

South dakota businesses with permit numbers containing ut (use tax) or et (contractors’ excise tax) cannot buy products or services for resale. Contractors excise tax is a 2% state tax imposed on the gross receipts of all prime contractors engaged in construction services or realty improvement projects in south dakota. A blanket certificate cannot be issued to a subcontractor, it must list the specific project.

South dakota department of revenue.

How To Get A Certificate Of Exemption In South Dakota – Startingyourbusinesscom

Sd Form 1739 Mv-609 Download Fillable Pdf Or Fill Online South Dakota Exemptions South Dakota Templateroller

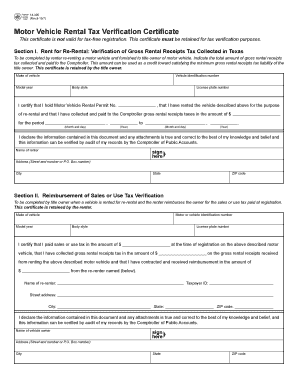

Fillable Online 14-305 Motor Vehicle Verification Exemption Certificate For Rental Tax 14-305 Motor Vehicle Verification Exemption Certificate For Rental Tax Fax Email Print – Pdffiller

D2l2jhoszs7d12cloudfrontnet

Printable South Dakota Sales Tax Exemption Certificates

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd – Fill Out And Sign Printable Pdf Template Signnow

Dorsdgov

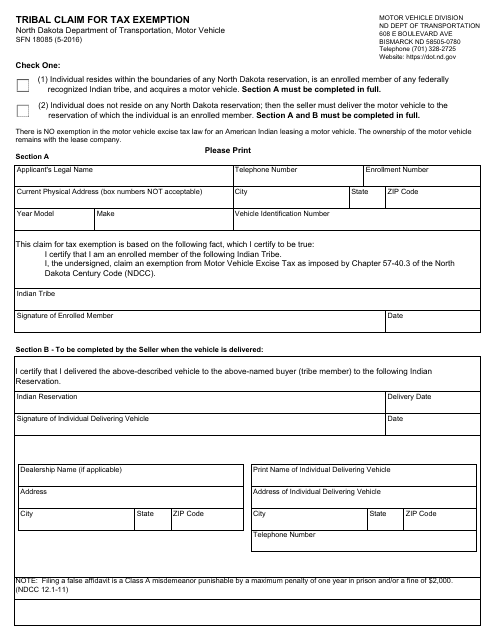

Form Sfn18085 Download Fillable Pdf Or Fill Online Tribal Claim For Tax Exemption North Dakota Templateroller

Dorsdgov

South Dakota Certification Of Owner Occupied Dwelling – Contractor Only Download Printable Pdf Templateroller

Sdsmtedu

Contractors Excise Tax South Dakota Department Of Revenue

Sales Taxes In The United States – Wikipedia

Handsdcountiesorg

Dorsdgov

Dorsdgov

Exemption Dakota South – Fill Out And Sign Printable Pdf Template Signnow

Cloudspokcom

Sd Contractors Excise Tax Return Formerly Rv-011 – Fill Out Tax Template Online Us Legal Forms