South carolina does not tax inheritance gains and eliminated its estate tax in 2005. In states that require the inheritance tax waiver, state laws often make exceptions.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Close relatives and charities are exempt from the tax;

South carolina inheritance tax waiver. Most relatives who inherit are exempt from maryland's inheritance tax.maryland collects an inheritance tax when certain recipients inherit property from someone who lived in maryland or owned property there. In connecticut, for example, the inheritance tax waiver is not required if the successor is a. I further understand that i may not waive my rights in favor of any particular person.

Alabama, alaska, arkansas, california, colorado, connecticut, delaware, district of columbia, florida, georgia, idaho, iowa, kansas, kentucky, louisiana, maine maryland, massachusetts, michigan, minnesota, mississippi, nebraska, nevada new hampshire, new mexico, north carolina, oregon, south carolina,. However, the federal government still collects these taxes, and you must pay them if you are liable. South carolina last will and testament.

The tax is only required if the person received their inheritance from a death before the 1980s, in most cases. Subscribe today and save up to 80% on this form. South carolina has no estate tax for decedents dying on or after january 1, 2005.

Waive any stockholder’s rights or privilege to subscribe for or otherwise acquire additional stock; The following states do not require an inheritance tax waiver: Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

Estate taxes generally apply only to wealthy estates, while inheritance taxes. Nebraska, nevada, new hampshire, new mexico, north carolina, oregon, south carolina, texas, utah, vermont, virginia, washington, wisconsin, wyoming. Established by congress in 2010 as part of a broader tax compromise, portability allows a surviving spouse to use a prior deceased spouse’s unused estate tax exemption.

South carolina inheritance tax and gift tax. For example, let's say a family member passes away in an area with a 5% estate tax and a 10% inheritance tax. There are no inheritance or estate taxes in south carolina.

South carolina does not levy an inheritance or estate tax, but like all states, it has its own unique set of laws regarding inheritance of estates. Agrees to waive bond for the person(s) nominated above. Also, what states require an inheritance tax waiver form?

Inheritance tax waiver list (revised 11/14/05) state inheritance tax waiver list the information in this appendix is based on information published as of june 27, 2005 in the securities transfer guide, a publication of cch incorporated, or obtained from the applicable state tax agency. Since florida is on the above list, the state does not require an inheritance tax waiver. (f) it is the intent of the legislature of the state of south carolina by this provision to clarify the laws of this state with respect to the subject matter hereof in order to ensure the ability of persons to disclaim interests in property without the imposition of federal and state estate, inheritance, gift, and transfer taxes.

Receipt and release with waiver {403es} this is a south carolina form that can be used for probate court within statewide. Inheritance tax waiver is not an issue in most states. It is one of the 38 states that does not have either inheritance or estate tax.

Executed this day of , 20. Other inheritors pay the tax at a 10% rate. _____ waive all my rights of inheritance _____ waive my right to _____ of shares (number) this waiver of rights is made with my knowledge that stock in oc may have potential future value even though at present it has no ascertainable market value.

For example, in 2014, if a husband dies having an estate of $1,000,000, assuming there are no deductions or credits, since his estate tax exemption is $5,340,000, he would have $4,340,000 of unused. South carolina also has no gift tax. In this detailed guide of south carolina.

There is no inheritance tax in south carolina. Estate and inheritance taxes payable by reason of my death in respect of all items included in the computation of such taxes, whether passing under this will or otherwise. Sworn to before me this day ofsignature:, 20print name:address:notary public for south carolinamy commission expires:

Maryland imposes the lowest top rate at. Make sure to check local laws if you’re inheriting something from someone who lives out of state. Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million.

Does south carolina have an inheritance tax or estate tax? Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (s.c. A copy of an inheritance tax waiver or consent to transfer from the applicable state or territory tax authority may be required if the deceased owner legally resided in iowa, indiana, montana, north carolina, oklahoma, puerto rico, rhode island, south dakota, or.

Of the six states with inheritance taxes, nebraska has the highest top rate at 18 percent. South carolina disclaimer of interest under the south carolina statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (s.c. I understand this is effective only to the extent the law allows for nomination and waiver of bond.

For current information, please consult your legal counsel or,

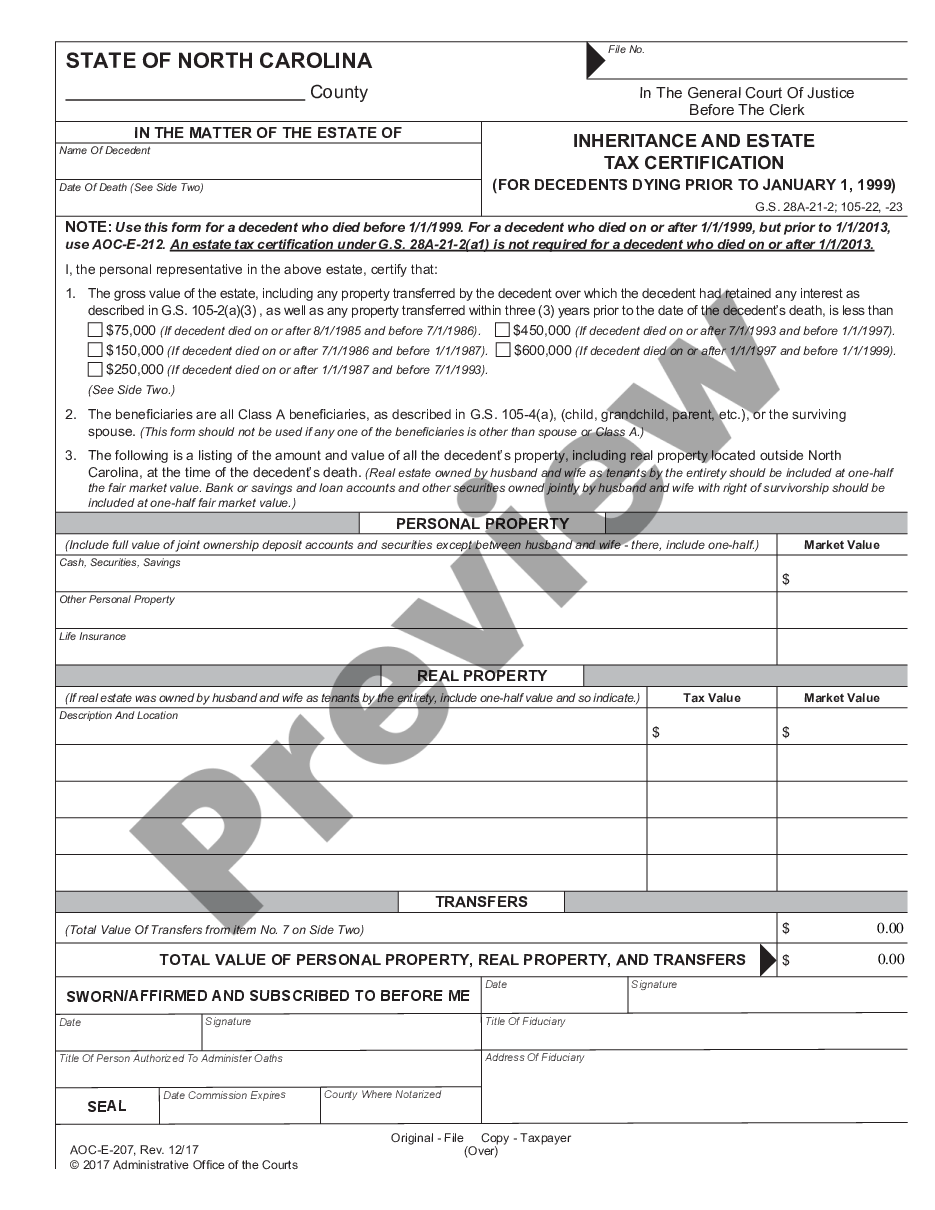

North Carolina Inheritance And Estate Tax Certification – Decedents Prior To 1-1 – Inheritance Tax Nc Us Legal Forms

Does Your State Have An Estate Or Inheritance Tax

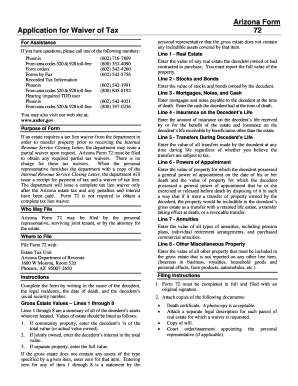

Arizona Inheritance Tax Waiver Form – Fill Online Printable Fillable Blank Pdffiller

States With An Inheritance Tax Recently Updated For 2020

Free Form Application For Inheritance Tax Waiver – Free Legal Forms – Lawscom

States With An Inheritance Tax Recently Updated For 2020

Flynnwrightcom

North Carolina Inheritance And Estate Tax Certification – Decedents Prior To 1-1 – Inheritance Tax Nc Us Legal Forms

Worldwidestocktransfercom

L9 Form – Fill Online Printable Fillable Blank Pdffiller

Pa Inheritance Tax Waiver – Fill Online Printable Fillable Blank Pdffiller

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Does South Carolina Require Inheritance Tax – King Law

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Tax Or Inheritance Tax – Tax Foundation

17 States With Estate Taxes Or Inheritance Taxes

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die