Seattle, washington employer payroll tax takes effect january 1, 2019. Effective january 1, 2021, through december 31, 2040, employers engaging in business in seattle will be subject to a payroll expense tax.

Seattles Payroll Expense Tax On Salaries Of Top Earners Bader Martin

The initial ordinance was recommended by the council ‘progressive revenue task force’ that “recommended that the city seek to collect $75 million from a new employee hours tax, a new payroll tax, or both to.

Seattle payroll tax ordinance. And amending sections 5.30.010, 5.30.060, 5.55.010, 5.55.040, 5.55.060, 5.55.150, 5.55.165, 5.55.220, 5.55.230, and 6.208.020 of the seattle municipal code. Jumpstart seattle (city ordinance 126108), on wages being paid to seattle employees.you may have already heard about this new tax. Businesses rebelled and the tax was ultimately repealed before it took effect.

The payroll tax is represented as needed to provide additional money to the city as it anticipates an estimated. The seattle city council passed a bill creating a new payroll tax on persons engaged in business in seattle. The passed ordinance would come into effect in january 2021 and establishes “a payroll expense tax on persons engaging in business in seattle”.

The ordinance takes effect at the start of 2021 and sunsets at the end of 2040. On july 6, 2020, the seattle city council passed city ordinance number 126108, imposing a payroll expense tax on persons engaging in business in seattle. The tax was imposed on companies doing business in seattle with payrolls over $7 million a year.

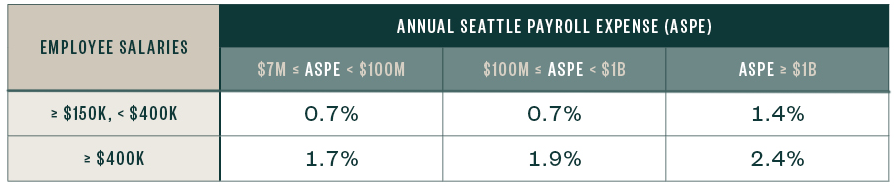

The tax applies to businesses with more than $7 million of annual payroll expense, but only for highly compensated employees earning $150,000 or more annually as. Applied to the seattle payroll tax, it doesn’t seem apt at all. Applied to cary, the phrase was clearly apt.

In may of 2018, the seattle city council passed an employee earnings tax, or head tax. An ordinance related to creating a fund for payroll expense tax revenues; For employees who perform work partly within and partly outside seattle, the compensation paid in seattle to those employees shall be, for each individual employee, the portion of the employee’s annual compensation which the total number of the employee’s hours worked within seattle bears to the total number of the employee’s hours worked within and.

10 rows whereas, on july 6, 2020, the city council enacted ordinance 126108, which added. The tax is progressive and imposes tiered rates based on the company’s total payroll and the amount of compensation paid to employees earning above $150,000 per year. Effective january of 2021, the city of seattle will impose a payroll expense tax on businesses operating in seattle.

Body whereas, on july 6, 2020 the city council passed ordinance 126108, imposing a progressive tax on businesses with payrolls of $7 million and higher annually (payroll expense. Seattle, washington mayor jenny a. Seattle has proposed rules for its new payroll expense tax that took effect january 1, 2021.

A business must have at least $7 million in seattle payroll in the prior calendar year to be subject to the tax. The seattle commuter benefits ordinance became effective on january 1, 2020. The ordinance says explicitly that a company may not take the tax out of an employee’s wages.

The payroll expense tax, also known as jumpstart seattle ( city ordinance 126108 , council bill119810). 24 whereas, the new tax on corporate payroll is anticipated to generate an average of $500 25 million in proceeds on an annual basis, as shown in the spending plan included as 26 attachment 1 to this ordinance; Ordinance 126108 and the seattle municipal code (smc) 5.38.070 specify annual adjustments to the payroll expense dollar thresholds and exemption thresholds for the payroll expense tax.

We previously issued a blast on this ordinance, with details on how this tax applies to businesses. The seattle department of finance and administrative services will administer the tax. The rules clarify several areas of uncertainty in how the ordinance will be implemented.

Adding a new section 5.38.055 to the seattle municipal code; We wanted to share some of the key points. Durkan signed into law a new city ordinance that effective january 1, 2019, will impose a new employer payroll tax on seattle businesses with $20 million or more in taxable gross income.

The ordinance was recently signed into law by mayor jenny durkan. Imposing a payroll expense tax on persons engaging in business in seattle; The payroll tax, referred to as jumpstart seattle, was passed in july 2020.

Move forward to july 2020 and the seattle city council passes another form of payroll tax: And providing additional guidelines for expending proceeds. The city of seattle has recently enacted a new payroll expense tax:

An ordinance relating to taxation; The draft rules address areas of ambiguity in the ordinance adopted by the seattle city council in july (see pwc’s insight for more on the new payroll expense tax law). The seattle payroll tax is measured by “the payroll expense of the business” times a rate that varies based on the business’s total seattle payroll expenses and the compensation paid in.

Adding a new chapter 5.38 to the seattle municipal code; The city of seattle has finalized their rule on the new payroll expense tax which became effective january 1, 2021. The city’s payroll tax will fall on the payers, not the recipients, of income.

Effective january 1, 2021, through december 31, 2040, seattle will impose a payroll expense tax, aka the jumpstart tax, as specified in the newly enacted chapter 5.38 of the seattle municipal code. A lawsuit has been filed challenging the seattle tax, and there is a draft.

How Seattles New Payroll Tax Complicates Efforts To Enact One Statewide Crosscut

Seattle City Passed New Jumpstart Payroll Tax Paylocity

Seattle Metropolitan Chamber Of Commerce Sues The City Over Payroll Tax King5com

Seattle Payroll Expense Excise Tax Details

Council Discusses Details Of Proposed Payroll Tax

Seattle Payroll Tax Debacle Could Have National Repercussions

The Seattle Payroll Expense Tax What You Need To Know – Clark Nuber Ps

New Seattle Employer-paid Tax Effective January 1

Council Connection Councilmember Mosqueda Moves Forward With Transparency And Accountability Measures For Jumpstart Seattle

Seattle City Council Approves Payroll Tax On Largest Best-paying Companies Fox Business

Seattle City Council Approves New Payroll Tax – The Lens

Seattle City Council Unveils New Payroll Tax Targeting Amazon And Other Large Companies – Geekwire

Seattle Metropolitan Chamber Of Commerce Takes City To Court Over Payroll Tax – Puget Sound Business Journal

Seattle Passes Big Business Tax On Salaries Of Top Earners After Years Of False Starts – Geekwire

Employment Tax Compliance Across The States In 2018

Seattlegov

Understanding The Mayors Proposed 2022 Budget Part Ii The Payroll Tax

How Seattles New Payroll Tax On Amazon And Other Big Businesses Will Work – Geekwire

Seattle City Council Adopts Transit Benefit Ordinance Smarter Transportation