It limits the property tax rate to 1% of assessed value (ad valorem property tax), plus the rate necessary to fund local voter‐approved debt. Proposition 13, the property tax limitation initiative, was approved by california voters in 1978.

Property Tax Exemption For Live Aboards

Business and personal property taxpayers in santa clara county now have access to scc dtac, a new mobile app launched by the county of santa clara department of tax and collections to provide more than 500,000 property owners with convenient access to pay their secured property tax payments.

Santa clara property tax assessor. You can pay tax bills for your secured property (homes, buildings, lands) as well as unsecured property (businesses, boats, airplanes). The santa clara county assessor's office, located in san jose, california, determines the value of all taxable property in santa clara county, ca. Enter property address (this is not your billing address):

If the date falls on a saturday, sunday or a legal holiday, the property statement can be submitted on the next business day. It is also the most affluent county on the west coast of the u.s. Santa clara county property records are real estate documents that contain information related to real property in santa clara county, california.

Remember to have your property's tax id number or parcel number available when you call! A santa clara county property tax exemption can save you hundreds. Property taxes are levied on land, improvements, and business personal property.

The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Property taxes are levied on land, improvements, and business personal property. Currently you may research and print assessment information for individual parcels free of charge.

The assessor has developed an on line tool to look up basic information, such as assessed value and assessor's parcel number (apn), for real property in santa clara county. Special assessments are taxes levied for specific projects and services. The assessor has developed an on line tool to look up basic information, such as assessed value and assessor's parcel number (apn), for real property in santa clara county.

Enter property parcel number (apn): Currently you may research and print assessment information for individual parcels free of charge. Enter property address (this is not your billing address):

See detailed property tax report for 3121 oakgate way, santa clara county, ca. The state of california generally has low property tax rates, and santa clara follows this trend. Enter property parcel number (apn):

Learn more about scc dtac, property tax payment app. Santa clara county assessor's office services. Currently you may research and print assessment information for individual parcels free of charge.

The assessor has developed an on line tool to look up basic information, such as assessed value and assessor's parcel number (apn), for real property in santa clara county. To pay property taxes for secured property, you will need your assessor's parcel number (apn) or. When contacting santa clara county about your property taxes, make sure that you are contacting the correct office.

Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Select alley avenue blvd circle commons court drive expressway highway lane loop parkway place road square street terrace trail walkway way. View and pay for your property tax bills/statements in santa clara county online using this service.

It limits the property tax rate to 1% of assessed value (ad valorem property tax), plus the rate necessary to fund local voter‐approved debt. Proposition 13, the property tax limitation initiative, was approved by california voters in 1978. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property.

The assessor has developed an on line tool to look up basic information, such as assessed value and assessor's parcel number (apn), for real property in santa clara county. The santa clara county tax assessor is the local official who is responsible for assessing the taxable value of all properties within santa clara county, and may establish the amount of tax due on that property based on the fair market value appraisal. Currently you may research and print assessment information for.

Currently you may research and print assessment information for individual parcels free of charge. Santa clara county, ca, is the sixth most populated county in california and home to silicon valley. If you have documents to send, you can fax them to.

Parcel maps and search property records. The assessor's office allows residents to view, free of charge, basic information about properties in santa clara county such as assessed value, assessor's parcel number (apn), document number, property address, assessor parcel maps, and other information. The assessor has developed an on line tool to look up basic information, such as assessed value and assessor's parcel number (apn), for real property in santa clara county.

Annual Report 2020 – 2021

When Is A Building Permit Required – County Of Santa Clara

Property Tax Email Notification – Department Of Tax And Collections – County Of Santa Clara

2

Santa Clara County California Medicare Patient Health Risk Assessment Hra History Form – Sccipa Download Fillable Pdf Templateroller

Official Map Of The County Of Santa Clara California Compiled From Us Surveys County Records And Private Surveys And The Tax-list Of 1889 By Order Of The Hon Board Of Supervisors –

What Is Proposition 19 Santa Clara County Assessor Larry Stone Explains Prop 19 And More – Youtube

2

Some Santa Clara County Executives Decline Covid Hazard Pay

2

How Has Covid-19 Impacted The Housing Market

Property Taxes – Department Of Tax And Collections – County Of Santa Clara

Santa Clara County Property Tax Tax Assessor And Collector

Grant Deed Form Santa Clara County – Fill Out And Sign Printable Pdf Template Signnow

Property Taxes – Department Of Tax And Collections – County Of Santa Clara

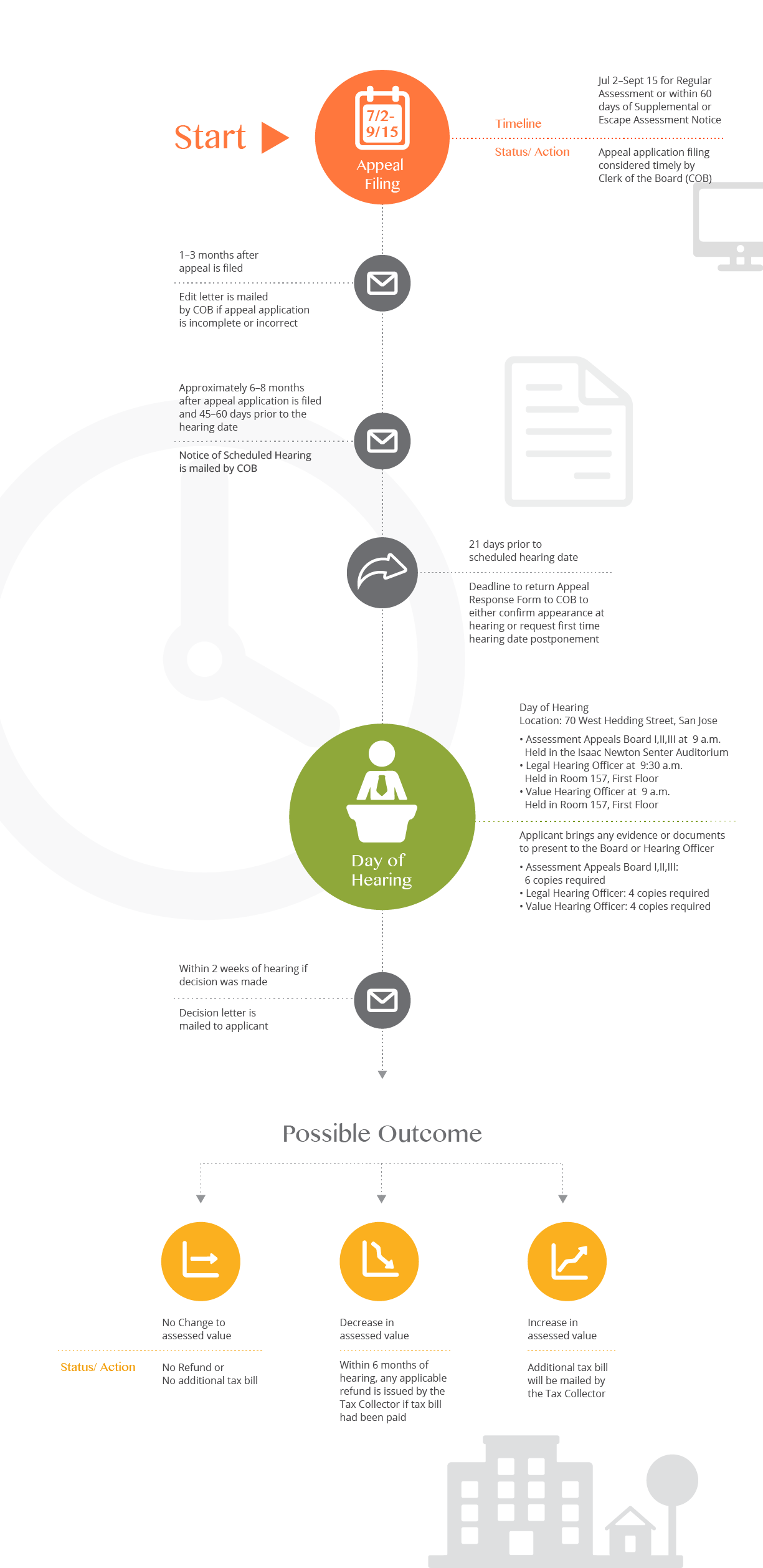

Assessment Appeal Process – Office Of The Clerk Of The Board Of Supervisors – County Of Santa Clara

Property Taxes – Department Of Tax And Collections – County Of Santa Clara

Family Court – Jane And John Q Public

Understanding Californias Property Taxes