However, the applicant’s spouse, parents, children, or domestic partner may represent the applicant by signing Hi everyone, last fall, i spent about 6 hours preparing a written appeal of santa clara county (ca) property tax increases.

Tony Soprano Doesnt Have A Thing On Santa Claras Police Union – Opinion – The Silicon Valley Voice

Describe in detail the reason(s) for filing this claim and attach all supporting documentation.

Santa clara property tax appeal. Santa clara county includes the cities of santa clara, san jose, sunnyvale, cupertino, milpitas, monte sereno, palo alto, mountain view, los altos, los altos hills, saratoga, campbell, los gatos, morgan hill, and gilroy. Or assessment number (for unsecured property): Street san jose ca 95112.

Paradigm tax group is here to supply our clients in santa clara county and san mateo county with property tax assistance. Your only avenue of approach is to prove your house is valued less than the value the assessor thinks. County of santa clara department of tax and collections 852 n 1st.

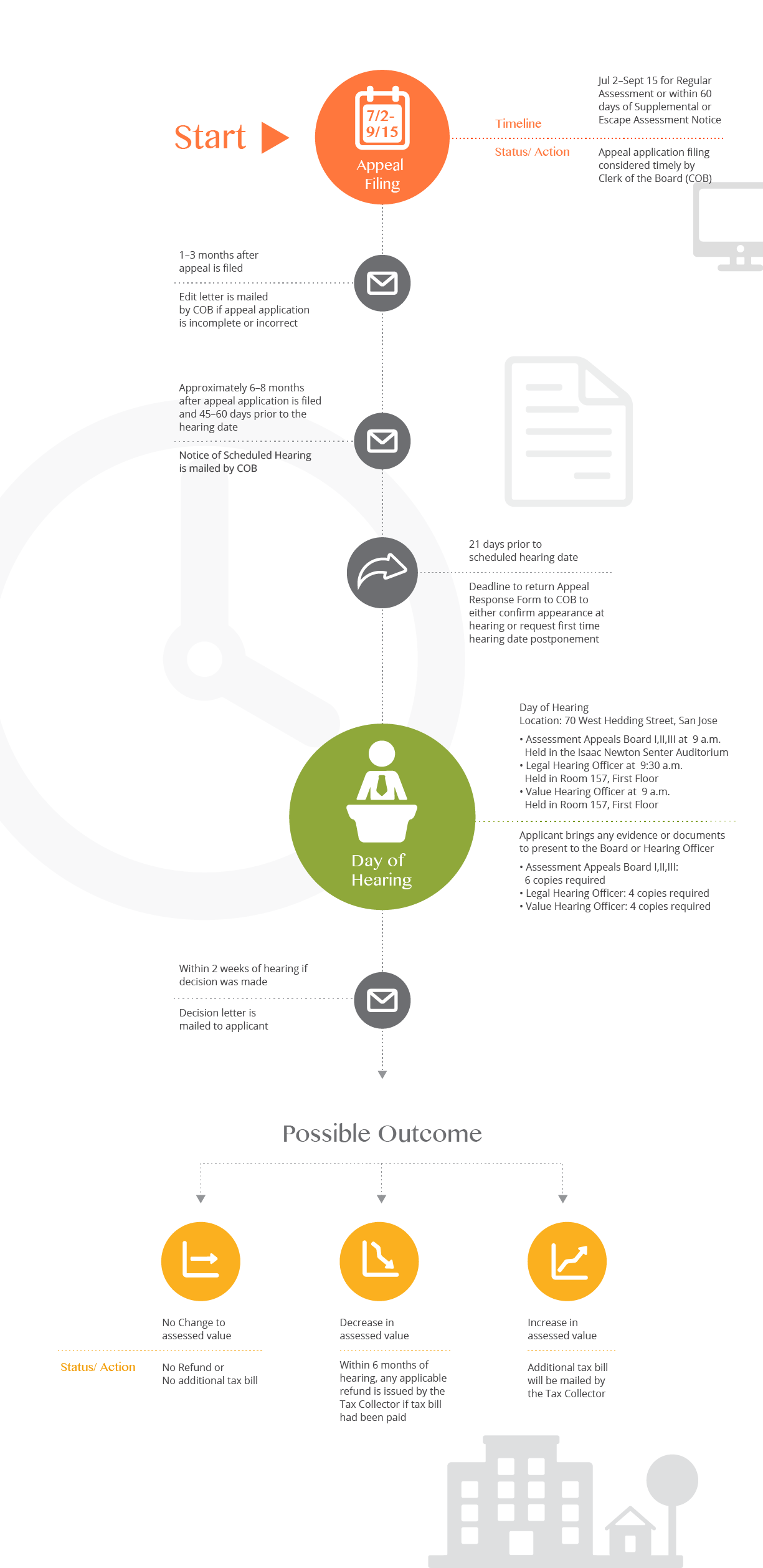

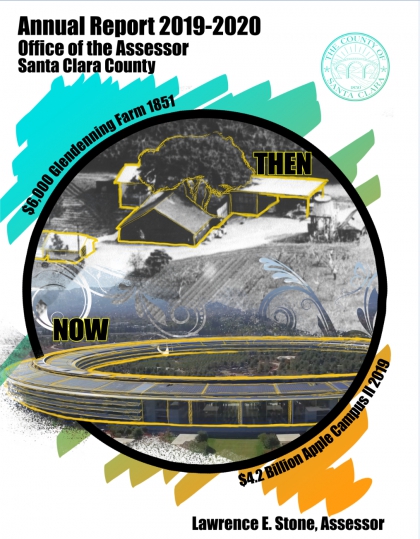

The assessor has developed an on line tool to look up basic information, such as assessed value and assessor's parcel number (apn), for real property in santa clara county. During the appeal process, you must pay the assessed property taxes. This step is very important!

If you plan to protest property taxes of your home or investment properties in santa clara ca or in any other city in california, on housecashin platform you can find trusted property tax reduction advisors that would love to help you with your property tax appeal! I am not an expert on property tax law and i would contact the assessor's office again either in writing, email or phone. It limits the property tax rate to 1% of assessed value (ad valorem property tax), plus the rate necessary to fund local voter‐approved debt.

We had an office building in santa clara county that was reduced from $3.1 million to $2.4 million by the county appraiser. We are a national consulting firm that has the necessary experience to serve clients all over the country by providing them with property tax help that is both effective and efficient. 8 appeal), then you must file your application between july 2nd and september 15th (for alameda, inyo, kings, orange, placer, san francisco, san luis obispo, santa clara, sierra, sutter counties) or november 30th for all other counties.

Then, if you get the value reduced, you must actually call and ask for your refund check. Each three member assessment appeals board, which is independent of the assessor and trained by the state board of equalization, consists of private sector property tax professionals, cpa's, attorneys, and appraisers appointed by the santa clara county board of supervisors. The regular appeals filing period will begin on july 2, 2021 in each county and will end either on september 15 or november 30, depending on whether the c ounty assessor has elected to mail assessment notices by august 1, 2021, to all taxpayers with property on the secured roll.

Learn what our cleints say in: We can help you through the appeals process by filing the appropriate forms, discussing your case with the tax assessor, and representing you at your appeal hearing. Currently you may research and print assessment information for individual parcels free of charge.

Describe in detail the reason for requesting a cancellation of penalty. The applicant of an assessment appeal is the property owner or any person having a direct economic interest in the payment of the property taxes, usually any person directly responsible for the payment of the property taxes. The first step in the appeals process is an administrative hearing in front of the county board of superiors.

If you are appealing the current year's taxes because your property has declined in value (a prop. The following table shows the filing deadline for each county. Proposition 13, the property tax limitation initiative, was approved by california voters in 1978.

Penalty amount $ apn (for secured property): As your santa clara county home taxes are calculated basically by multiplying the assessed value of your home by its areas set tax rate, you do not have any premises to appeal the tax rate just the house assessment value. Alameda, contra costa, placer, sacramento, san joaquin, san.

Appeal applications must be filed between july 2 to september 15, with the clerk of the board (clerk of the county board of. Applications may include but are not necessarily limited to decline in value, base year value, personal property, and. Find property tax appeal consultants in santa clara and surrounding areas.

The santa clara county assessment appeals board has issued a decision that drastically slashes the assessed value of levi’s stadium, a decision that county assessor larry stone described. Appeal of administrative of architectural committee or planning commission decisions form (pdf) citizen service request form (pdf) procedure for filing a claim against the city & claim form (pdf) written petition to city council form (pdf) last updated: My analysis showed that i'm paying ~5% higher than comparable homes in the area, and 61% higher than identical units in my condo complex (even.

Property owners can appeal property taxes by filing an application with the clerk of the board of supervisors at the county by the appeal deadline listed in the table below. Complete the informational section at the top of the property tax penalty cancellation form, include your contact information, mailing address, tax bill information, apn/assessment number, etc. So they hired us and we were able to get a larger reduction.

I’ve had experience with clients that have filed their own property tax appeal and they have come to me and said that they didn’t think the reduction was large enough. Your initial consultation is free.

Santa Clara County Property Tax Tax Assessor And Collector

Search Results Archives Santa Clara County Board Of Supervisors

Office Of The County Executive – Office Of The County Executive – County Of Santa Clara

Assessment Appeals – Office Of The Clerk Of The Board Of Supervisors – County Of Santa Clara

2

Unofficial Election Results 2020 Santa Clara City Council Sunnyvale Mayor Sunnyvale City Council School Board More – The Silicon Valley Voice

Search Results Archives Santa Clara County Board Of Supervisors

Santa-clara-county Property Tax Records – Santa-clara-county Property Taxes Ca

2020 Assessment Roll Captures Another Economic Peak Tops 5515 Billion

Santa-clara-county Property Tax Records – Santa-clara-county Property Taxes Ca

Office Of The County Executive – Office Of The County Executive – County Of Santa Clara

Suicide Prevention And Crisis Services – Behavioral Health Services – County Of Santa Clara

Santa Clara Assessor Sheriff And Da Get Raises

2845193 Reasons We Made This Client Smile Shannon Snyder Cpas

Santa-clara-county Property Tax Records – Santa-clara-county Property Taxes Ca

Assessment Appeal Process – Office Of The Clerk Of The Board Of Supervisors – County Of Santa Clara

Santa-clara-county Property Tax Records – Santa-clara-county Property Taxes Ca

2

Choose To Be A Resource Family – Social Services Agency – County Of Santa Clara