Taxing authority rate assessed exemptions taxable total tax; San mateo county collects, on average, 0.56% of a property's assessed fair market value as property tax.

Secured Property Taxes Tax Collector

San mateo county collects, on average, 0.56% of a property's assessed fair market value as property tax.

San mateo county tax collector property tax. Where can i make my tax payment in person? Payments at cashier window accepted until 5 p.m. Each echeck transaction is limited to $999,999.99.

Sandie arnott, san mateo county tax collector. You also may pay your taxes online by echeck or credit card. This type of title transfer applies only to mobile homes not on permanent foundations.

Your secured property tax bill contains your assessor’s identification number (ain) and personal identification number (pin), which you will need to complete the transaction. San mateo county has one of the highest median property taxes in the united states, and is ranked 45th of the 3143 counties in order of median property taxes. Monday through friday in room 140.

If there are any taxes owing, they must be paid before a tax clearance certificate can be issued. Tax payments may be paid in person to the: Summary of valuations of property in the assessment rolls of the county.

Sandie arnott, san mateo county tax collector. See detailed property tax report for 1321 bel aire rd, san mateo county, ca. Click here to start a live chat with tax collector staff.

San mateo county secured property tax bill is payable in two installments: Property tax business license property tax and business license. San mateo county treasurer and tax collector 555 county center, first floor

Tax payments are mailed to the: Secured tax roll the term secured simply means taxes that are assessed against real property, (e.g., land or structures). There is no cost to you for electronic check (echeck) payments.

The fee is imposed by the credit card companies and cannot legally be absorbed by the county, therefore the fee must be passed on to the customer. The tax is a lien that is secured by the land/structure even though no document was officially recorded. Of december 10th to make your payment before a 10% penalty is added to your bill.

The median property tax in san mateo county, california is $4,424 per year for a home worth the median value of $784,800. Arnott is able to push back the county’s property tax deadline because the board of supervisors passed a resolution saying that if the. Proposition 13, enacted in 1978, forms the basis for the current.

However, you have until 5:00 p.m. You also may pay your taxes online by echeck or credit card. The 1st installment is due and payable on november 1.

The office of treasurer & tax collector is open from 8:30 a.m. Tax collector sandie arnott announced the decision today. This means that if the taxes remain unpaid after a period of 5 years, the property may be sold to cover the taxes owed.

The tax rates and valuation of taxable property of san mateo county publication includes: The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. That department cannot transfer title of a used mobile home subject to local property taxes without a tax clearance from the county tax collector of the county in which the mobile home is situated.

The median property tax in san mateo county, california is $4,424 per year for a home worth the median value of $784,800. Make tax checks payable to: San mateo county tax collector.

Property taxes in san mateo county are now due on may 4 instead of on friday, but the county’s tax collector is urging for those who can, to pay now. San mateo county tax collector 555 county center redwood city, ca 94063 for more information, please visit the san mateo county tax collector’s web site. Center 1600 pacific hwy, room 162 san diego, ca 92101

Pacific time on the delinquency date. In san mateo county, the heads of these offices are elected officials. San mateo county tax collector.

Parcel #, account #, address. Each of them are responsible to the public for the assessment, collection and. The 2nd installment is due and payable on february 1.

2

2

San-mateo-county Property Tax Records – San-mateo-county Property Taxes Ca

San-mateo-county Property Tax Records – San-mateo-county Property Taxes Ca

Search – Taxsys – San Mateo Treasurer-tax Collector

San Mateo County Extends Property Tax Deadline To May 4 – Climate Online

San Mateo County Postpones Property Tax Due Date Until May 4 Palo Alto Daily Post

Secured Property Taxes Tax Collector

438 Cavanaugh St San Mateo Ca 94401 Realtorcom

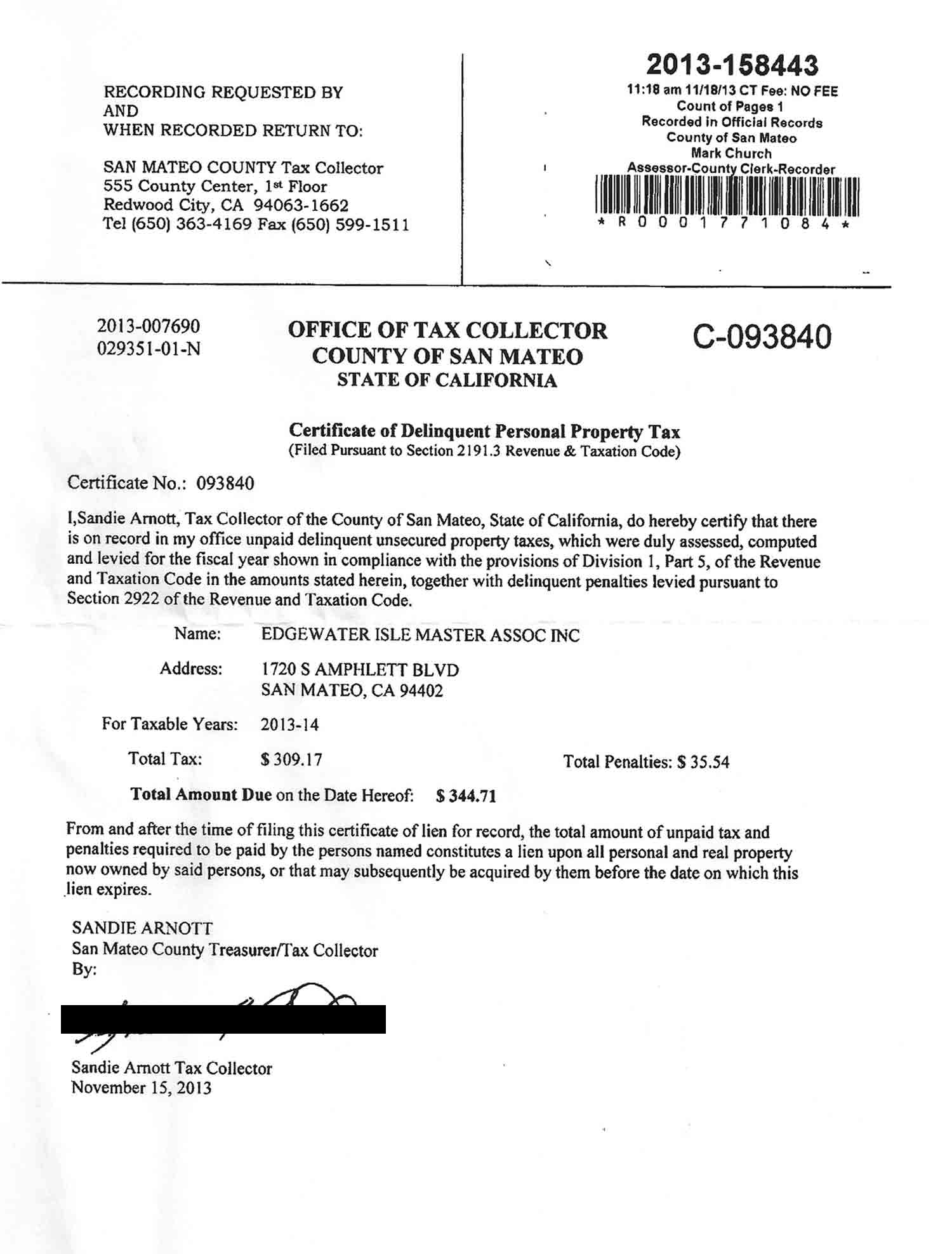

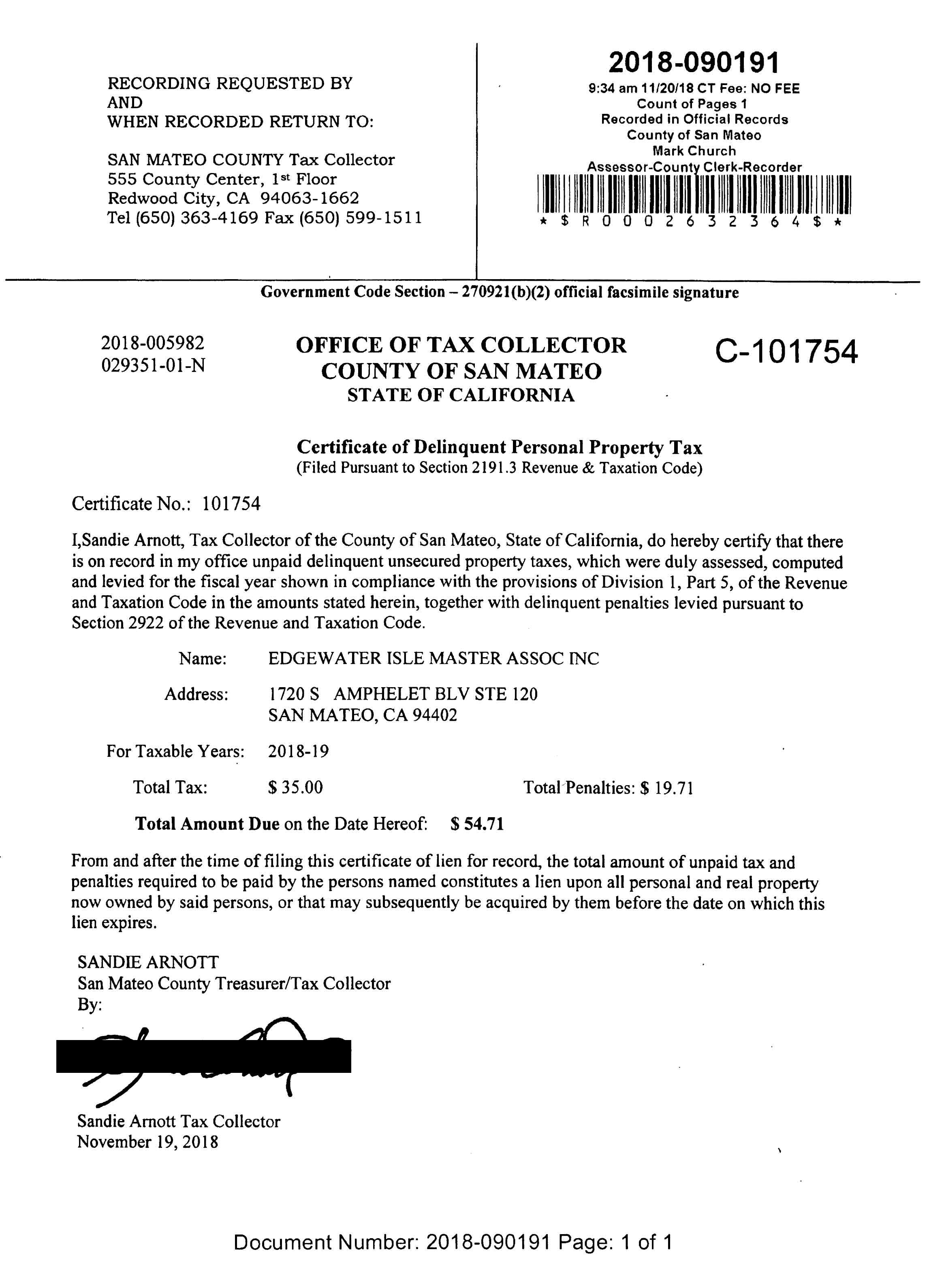

San Mateo County Issues Liens Against Master Association

3600 San Mateo Cir Corona Ca 92882 Realtorcom

320 Peninsula Ave Apt 318 San Mateo Ca 94401 Realtorcom

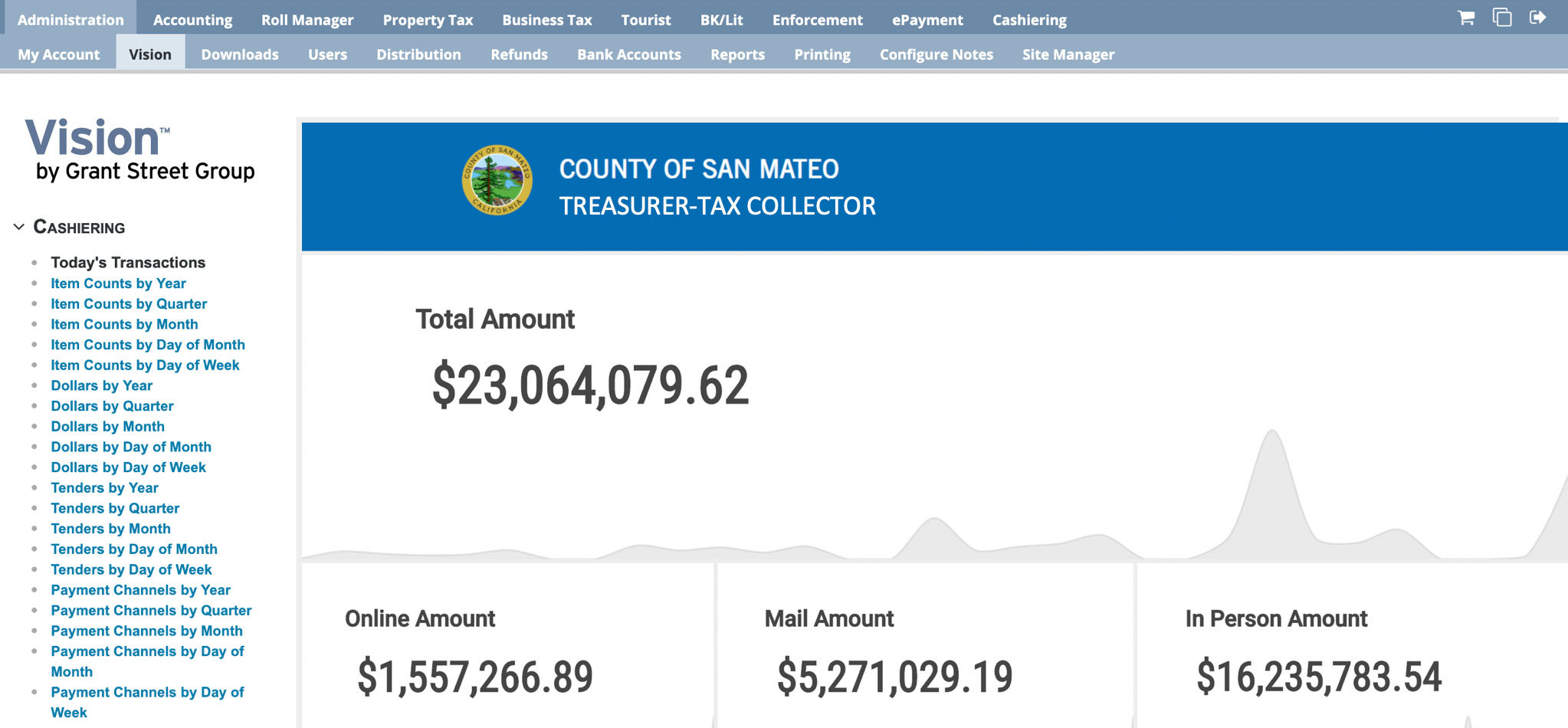

San Mateo County Ca Goes Live With Taxsys Business Wire

Secured Property Taxes Tax Collector

San Mateo County Issues Liens Against Master Association

2

San-mateo-county Property Tax Records – San-mateo-county Property Taxes Ca

2018 Property Tax Highlights Publication Press Release Controllers Office

2