Every san mateo county voter receives a vote by mail ballot. All rentals must be approved prior to renting in mariposa county.

2020 Property Tax Highlights Publication Press Release Controllers Office

Center 1600 pacific hwy, room 162 san diego, ca 92101

San mateo county tax collector change of address. The 2nd installment is due and payable on february 1. With more than 100 volunteers and dedicated staff, pvi ensures that seniors will be able to age in place in san mateo county. Make tax checks payable to:

3501 civic center drive, room 202, san rafael, ca 94903. The tot tax is imposed on people who stay less than 30 days. If your mailing address has changed, please.

The san mateo county treasurer and tax collector's office is part of the san mateo county finance department that encompasses all financial functions of the local government. Change of mailing addresspermanent change of mailing address request. The 1st installment is due and payable on november 1.

San mateo county tax collector. Our research shows that the majority of people that appeal successfully reduce their property tax bill. For pdf, please return the completed form to the assessor via mail, fax or online.

1st floor 555 county center redwood city, ca 94063. Our success rate is 37% better than the san mateo county, california average. You can submit the change of mailing address request form by using docusign or pdf form.

Looking up property owners by name and address You may contact the san bruno city treasurer for questions about: However, you have until 5:00 p.m.

Ab 8, enacted in 1979, provides a methodology, whereby, the increase or decrease in a local governments share of the property tax is based on increase/decrease in property values in that jurisdiction and the county. Property records requests for san mateo county, ca; The grace period on the 2nd installment expires at 5:00 p.m., on april 10.

Sandie arnott, san mateo county tax collector. Property owners are responsible for notifying the assessor if their mailing address has changed. Sandie arnott is the san mateo county treasurer/tax collector and is a member of the retirement board by virtue of her office.

Her current term as treasurer/tax collector will. Please provide your full name, revenue services account number, and a telephone number where you can be reached. In mariposa county tax will be 12% of the room rate and the tbid is 1.5% starting january 1, 2021.

These declarations acknowledge the severity of the crisis and outline the actions each district would take to address climate change. These occur when requests are made to the controller to make a change to the tax rolls. Of december 10th to make your payment before a 10% penalty is added to your bill.

A 2.35% processing fee, or a minimum fee of. Popular annual financial report (pafr) , which summarizes the cafr and presents the county's financials in the context of the larger economic picture. Bids start as low as $3,900.00.

A successful appeal results in an average savings of $650. Sandie arnott, san mateo county tax collector. The san mateo county board of supervisors established the veterans commission in june 2015 with a mission to promote programs and policies that address the unmet needs of veterans in the county.

These are all no reserve auctions! San mateo county secured property tax bill is payable in two installments: She first began serving in this office in january 2011, but served as assistant county treasurer for many years during which she was also active on the retirement board.

If you have changed where you receive your mail, but have not changed your. It is important to keep your information up to date so we can ensure your ballot reaches you. To avoid unnecessary delays in mail delivery, it is important to update your mailing address promptly.

San mateo county tax collector. 555 county center, 3rd floor redwood city, ca 94063. Appointments can also be made online at tax.smcgov.org

Make tax checks payable to: San mateo county budget comprehensive annual financial report (cafr) , which provides both an overview as well as details of the county's financial transactions for the prior two years. You can provide a new address, telephone number, or employment information by mail, fax, telephone, or in person.

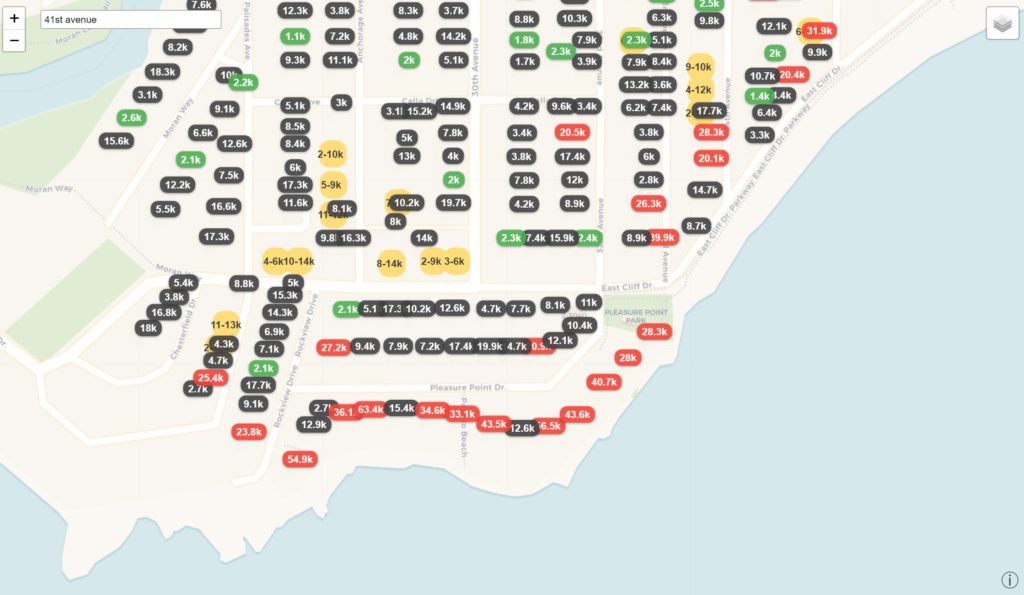

Maps Show Disparity In Santa Cruz County Property Taxes Santa Cruz Local

San-mateo-county Property Tax Records – San-mateo-county Property Taxes Ca

Secured Property Taxes Tax Collector

Instructions On Acres Self-service Appointment Scheduling Tool – San Mateo County Assessor-county Clerk-recorder Elections

Rywhyue0v6m52m

Contact The Tax Collectors Office Tax Collector

Recology San Mateo County Recology San Mateo County

Board Of Supervisors Approve 63 Billion Two-year Spending Plan All Of California In One County

Instructions On Acres Self-service Appointment Scheduling Tool – San Mateo County Assessor-county Clerk-recorder Elections

3981 Casanova Dr San Mateo Ca 94403 – Realtorcom

2020 Property Tax Highlights Publication Press Release Controllers Office

25 Mountain View Pl San Mateo Ca 94402 – Realtorcom

A Brief Illustrated History Of The Palace Hotel Of San Francisco Palace Hotel Palace Hotel San Francisco Grand Hotel

1101 Norton St San Mateo Ca 94401 Zillow

Covid-19 Newsletters County Managers Office

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Tax Collector

Connect The Coastside Planning And Building