California has a 6% sales tax and san bernardino county collects an additional 0.25%, so the minimum sales tax rate in san bernardino county is 6.25% (not including any city or special district taxes). This table shows the total sales tax rates for all cities and towns in san.

Food And Sales Tax 2020 In California Heather

What is the sales tax rate?

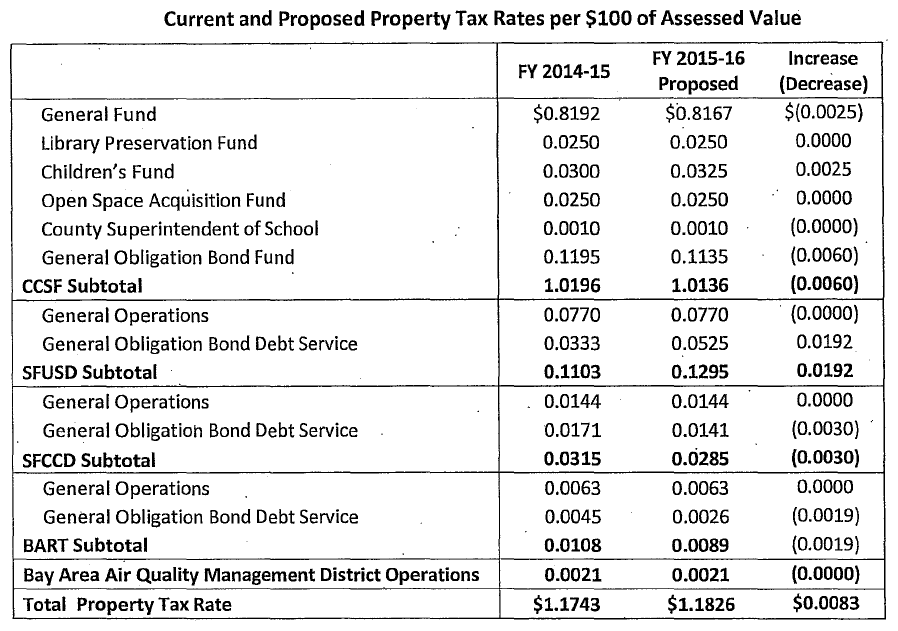

San francisco sales tax rate breakdown. Limited to 1.5% per year on the minimum base tax, 3.0% per year on. Go to our website at. The city experienced a 43 percent drop in sales taxes from april to june compared to the same period in 2019, chief economist ted egan told the planning commission thursday.

The county sales tax rate is %. Where can my clients smoke? Click here for a larger sales tax map, or here for a sales tax table.

The minimum combined 2021 sales tax rate for san francisco, california is. Car ownership in san francisco, ca is lower than the national average, with an average of 1 car per household. The california sales tax rate is currently %.

There is no applicable city tax. If you need access to a database of all california local sales tax rates, visit the sales tax data page. Sales & use tax rates.

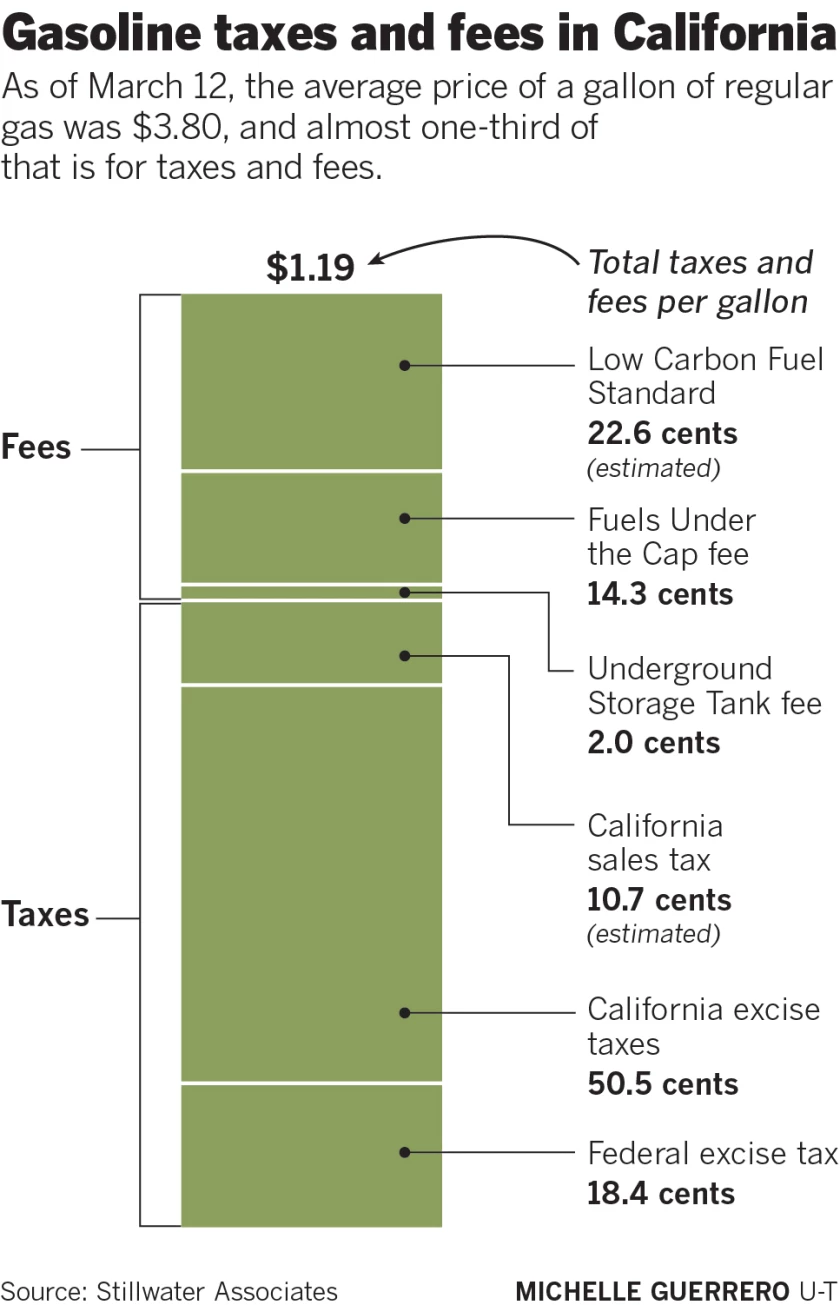

This tax is paid by the guest, so the guest will be charged 14% in addition to your listed rental fee. Www.cdtfa.ca.gov and select tax and fee rates, then choose sales and use tax rates (scroll down to download for the. California has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%.

The homeownership rate in san francisco, ca is 37.1%, which is lower than the national average of 64.1%. The december 2020 total local sales tax rate was 8.500%. Sales tax is 8.5 percent;

The san francisco sales tax rate is %. The new tax rates, tax codes, acronyms, and expiration dates will be available to view and download as a spreadsheet prior to july 1, 2021, on our webpage california city & county. People in san francisco, ca have an average commute time of 32.1 minutes, and they used public transit to get to work.

The 8.5% sales tax rate in san francisco consists of 6% california state sales tax, 0.25% san francisco county sales tax and 2.25% special tax. ·€cities with an asterisk may fall within multiple taxing areas. Smoking is permitted only in designated smoking areas.

Click any locality for a full breakdown of local property taxes, or visit our california sales tax calculatorto lookup local rates by zip code. This table does not include special local taxes (admissions, entertainment, food and beverage, lodging, liquor, restaurant). There are a total of 513 local tax jurisdictions across the state, collecting an average local tax of 2.492%.

The sales tax jurisdiction name is san francisco tourism improvement district (zone 2), which may refer to a local government division. San francisco, ca sales tax rate. The current total local sales tax rate in san francisco, ca is 8.625%.

San francisco residents who rent out any portion of their residence must collect the 14% transient occupancy tax (tot), in addition to the rental amount they charge their guests. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. This is the total of state, county and city sales tax rates.

San juan plaza (san juan capistrano) 7.750%:

Sales Tax Collections City Performance Scorecards

Taxes Contra Costa Herald

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Understanding Californias Sales Tax

Setting Up Tax Rates And Adjusting Tax Options

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

Frequently Asked Questions City Of Redwood City

Understanding Californias Sales Tax

Understanding Californias Sales Tax

Understanding Californias Sales Tax

Understanding Californias Sales Tax

California Wealth And Exit Tax Would Be An Unconstitutional Disaster – Foundation – National Taxpayers Union

California Sales Use Tax Guide – Avalara

California Sales Tax Rates By City County 2021

Understanding Californias Sales Tax

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How To Calculate Cannabis Taxes At Your Dispensary

Understanding Californias Sales Tax