You can print a 9.875% sales tax table here. The rates display in the files below represents total sales and use tax rates (state, local, county, and district where applicable).

Pin On Semiotics October 2018

2020 rates included for use while preparing your income tax deduction.

San francisco sales tax rate 2018. Rates include state, county, and city taxes. File your quarterly sugary drinks tax return. To avoid late penalties/fees, the return must be submitted and paid o n or before the last day of february.

↑ california department of tax and fee administration, detailed description of the sales & use tax rate, accessed december 20, 2018 ↑ note: Depending on the zipcode, the sales tax rate of san francisco may vary from 6.5% to 9.25% depending on the zipcode, the sales tax rate of san francisco may vary from 6.5% to 9.25% The median property value in san francisco, ca was $1.22m in 2019, which is 5.06 times larger than the national average of $240,500.

This is the total of state, county and city sales tax rates. , ca sales tax rate. For tax rates in other cities, see california sales taxes by city and county.

The 8.5% sales tax rate in san francisco consists of 6% california state sales tax, 0.25% san francisco county sales tax and 2.25% special tax. What is the sales tax rate in san francisco, california? Alpine 7.750% san diego alta :

The san francisco annual business tax return (return) includes the gross receipts tax, payroll expense tax, and administrative office tax.beginning in tax year 2019, the return will also include the early care and education commercial rents tax and homelessness gross receipts tax. For tax rates in other cities, see california sales taxes by city and county. The december 2020 total local sales tax rate was 9.750%.

San francisco has a number of mandates on the books aimed at improving workers’ lives, which make it more expensive to operate a business in the city. To view a history of the statewide sales and use tax rate, please go to the history of statewide sales & use tax rates page. The 9.625% sales tax rate in san mateo consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.25% san mateo tax and 3.125% special tax.

The 9.875% sales tax rate in south san francisco consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.5% south san francisco tax and 3.125% special tax. Alturas* 7.250% modoc alviso (san jose*) 9.250% : The san francisco, california, general sales tax rate is 6.5%.

The sales tax jurisdiction name is san jose hotel business improvement district (zone a), which may refer to a local government division. You can print a 9.375% sales tax table here. For tax rates in other cities, see california sales taxes by city and county.

While this tax was originally scheduled to phase out completely during 2018, it was retained at 0.38 percent because grt revenue was lower than expected. The california sales tax rate is currently %. More than $100 but less than/equal to $250,000 $2.50 for each $500 or portion thereof.

For example, a measure to increase the total rate from 8 percent to 8.5. Alta loma (rancho cucamonga*) 7.750% san bernardino altadena. Between 2018 and 2019 the median property value increased from $1.2m to $1.22m, a 1.82% increase.

There is no applicable city tax. The homeownership rate in san francisco, ca is 37.1%, which is lower than the national average of 64.1%. The 9.375% sales tax rate in san jose consists of 6% california state sales tax, 0.25% santa clara county sales tax, 0.25% san jose tax and 2.875% special tax.

Altaville 7.250% calaveras alton : If you have questions regarding any san francisco tax matters, please contact either of the following deloitte The county sales tax rate is %.

Avila beach 7.250% san luis obispo azusa* 9.500% los angeles badger 7.750% tulare bailey 9.500% los angeles baker 7.750% san bernardino bakersfield* 8.250% kern balboa (newport beach*) 7.750% orange balboa island (newport beach*) 7.750% orange balboa park (san diego*) 7.750% san diego baldwin park* 9.500% los angeles The latest sales tax rates for cities starting with 's' in california (ca) state. Percents listed in this column provide the amount of the tax rather than the amount of the tax relative to the prior rate.

Until 2018, all businesses with a taxable san francisco payroll expense greater than $150,000 must file a payroll expense tax statement for their business annually by the last day of february for the prior calendar year (jan. The minimum combined 2021 sales tax rate for san francisco, california is. South san francisco, ca sales tax rate.

The transfer tax rate for the city and county of san francisco, payable upon transfer of real property, is calculated as follows: The rate is adjusted periodically, and for the 2018 tax year, is 0.38 percent. You can print a 9.625% sales tax table here.

The tax is calculated as a percentage of total payroll expense, based on the tax rate for the year. The sales tax jurisdiction name is san francisco tourism improvement district (zone 2), which may refer to a local government $1,000,000 or more but less than $5,000,000 $3.75.

Amador city* 7.750% amador amargosa (death valley) 7.750%. More than $250,000 but less than $1,000,000 $3.40 for each $500 or portion thereof. The current total local sales tax rate in south san francisco, ca is 9.875%.

California city and county sales and use tax rates rates effective 10/01/2018 through 03/31/2019 city rate county camino 7.250% el dorado camp beale 7.250% yuba camp connell 7.250% calaveras camp curry 7.750% mariposa camp kaweah 7.750% tulare camp meeker 8.125% sonoma camp nelson 7.750% tulare camp pendleton 7.750% san diego 2018 (and potentially future years) at a rate of 0.38%.20 contacts:

Annual Business Tax Return Treasurer Tax Collector

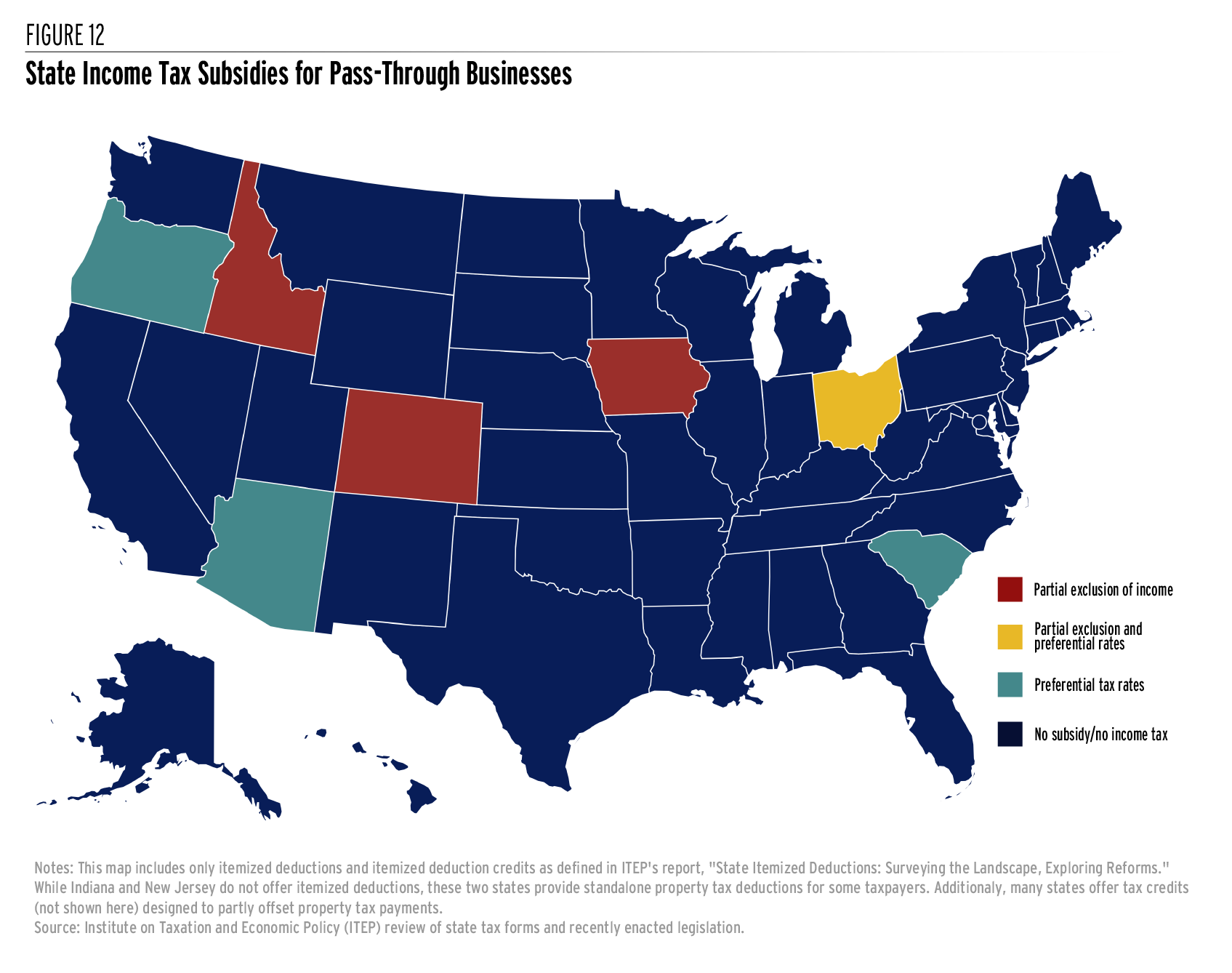

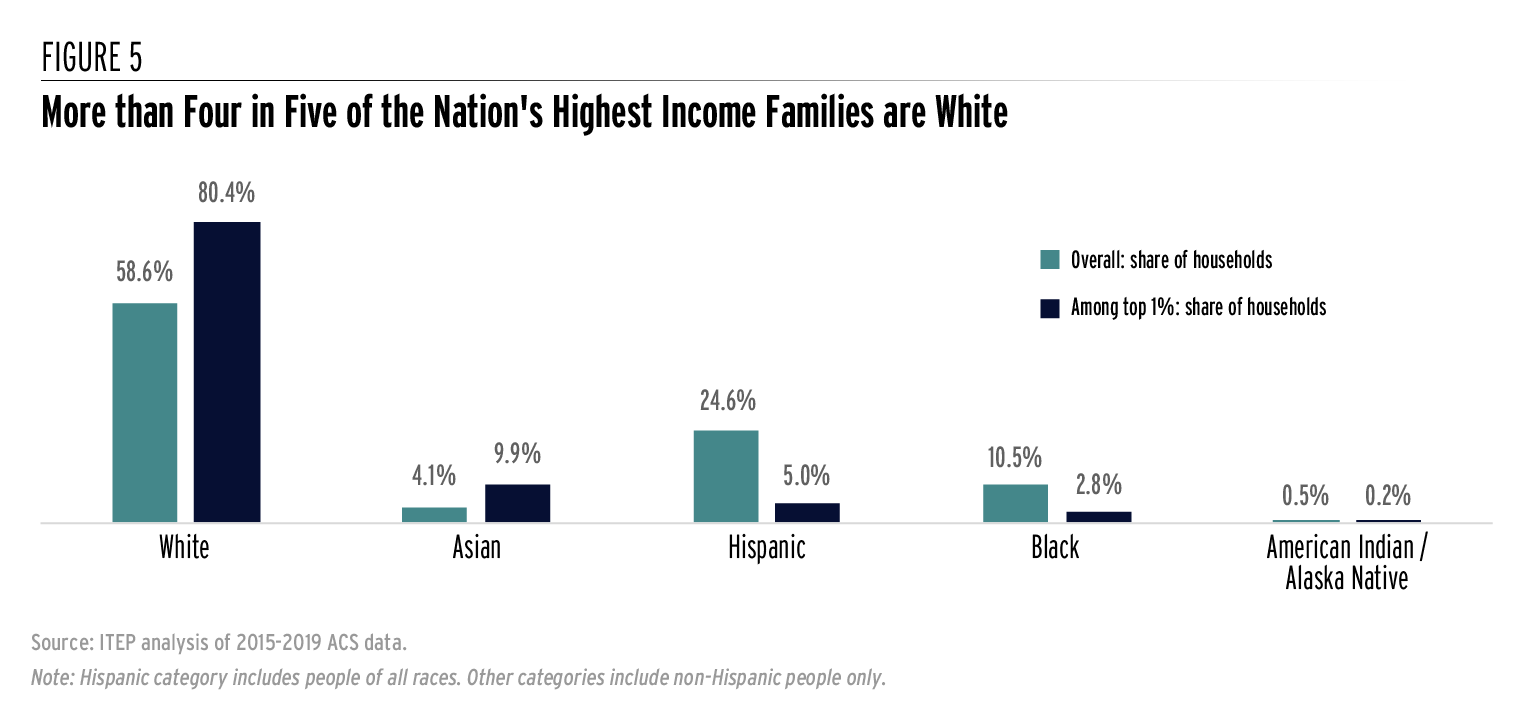

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

At What Income Level Does The Marriage Penalty Tax Kick In

Condo Rents Rise 1 In Feb Hdb Rents Up 05 Srx Property Property News Top Stories – The Straits Times Condo Rent Property

2

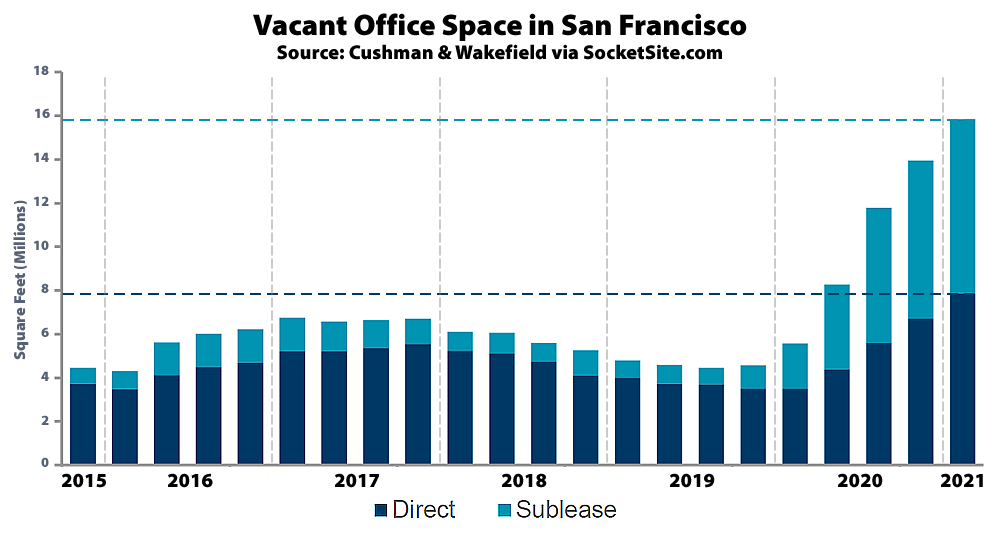

Office Vacancy Rate Continues To Climb In San Francisco

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

2

California Wealth And Exit Tax Would Be An Unconstitutional Disaster – Foundation – National Taxpayers Union

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How High Are Capital Gains Taxes In Your State Tax Foundation

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Prop W – Transfer Tax Spur

How To Calculate Cannabis Taxes At Your Dispensary

Pin By Ava Cat On Urban Planning Data Viz Budgeting City Urban Planning

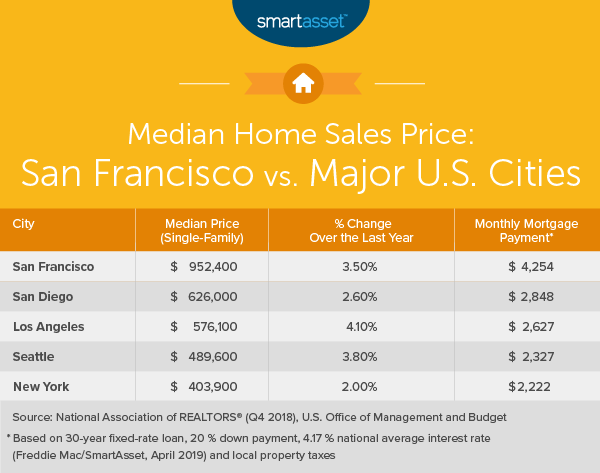

What Is The True Cost Of Living In San Francisco – Smartasset

Sales Tax Collections City Performance Scorecards