Mayor london breed and the board of supervisors sponsored the measure, which will. The rate of the payroll expense tax shall be 1½.

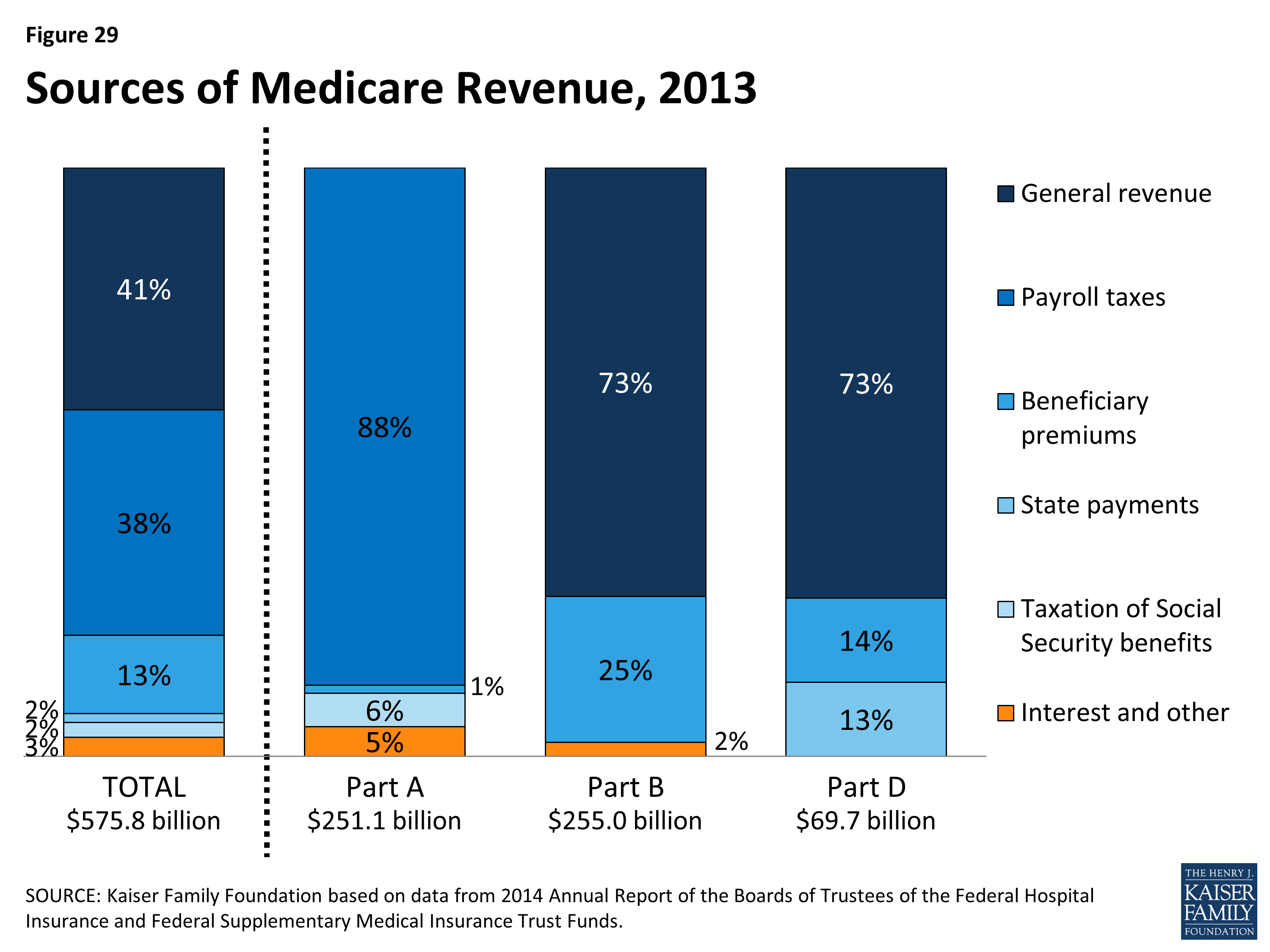

A Primer On Medicare How Is Medicare Financed And What Are Medicares Future Financing Challenges Sec 14 7615-04 Kff

The california sales tax rate is currently %.

San francisco payroll tax rate. Proposition f passed 68% to 32%, with all precincts reporting. Therefore, fica can range between 15.3% and 16.2%. The tax is calculated as a percentage of total payroll expense, based on the tax rate for the year.

Local minimum wages as of jan, 2021 The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april, july, and october, respectively. San francisco payroll tax rate 2020.

Engaging in business in san francisco. Nonresidents who work in san francisco also pay a local income tax of 1.50%, the same as. Until 2018, all businesses with a taxable san francisco payroll expense greater than $150,000 must file a payroll expense tax statement for their business annually by the last day of february for the prior calendar year (jan.

The san francisco annual business tax returns include the gross receipts tax, payroll expense tax, administrative office tax , commercial rents tax and homelessness gross receipts tax. San francisco was the only city in california to base its business tax on payroll expense. Tax rate & allocation the tax rate is 1.5 percent of total payroll expenses.

Due dates for quarterly installment payments. (city and county of san francisco, treasury and tax collector website)2018 was to be the last year of the payroll expense tax when starting in 2019, businesses were to pay only the. The san francisco sales tax rate is %.

Determine total san francisco payroll expenses. The minimum combined 2021 sales tax rate for san francisco, california is. The measure required a simple majority to pass.

Payroll expense tax (py) proposition f was approved by san francisco voters on november 2, 2020 and became effective january 1, 2021. For example, if the minimum wage rate in san francisco is $16.07 per hour, then the employers in san francisco will need to pay their employees as per the local base wage rate as it is greater than the state and federal minimums. Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018.

Payroll tax of 3.28% on payroll expense attributable to the city.5 commercial rents tax effective january 1, 2019, san francisco joins the new york city borough of. The city of san francisco (city) has issued the payroll expense tax rate for 2019, which is unchanged from the prior year at 0.380%. Determine total san francisco payroll expenses.

The city of san francisco levies a 1.50% gross receipts tax on the payroll expenses of large businesses. San francisco voters passed proposition f, a business tax overhaul package that phases out the city’s payroll tax and increases the city’s gross receipts tax. Compute the tax by subtracting (b) from (a) and multiply the difference by 1.5%.

The administrative office tax (aot) is a 1.4 percent tax on the san francisco payroll expense of a person or combined group engaging in business within san francisco as. Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income tax. What is the sales tax rate in san francisco, california?

So the california taxpayer has a $5,580.23 state income tax liability and a $190 local tax liability. For employees earning more than $200,000, the medicare tax rate goes up by an additional 0.9%; Others (like alaska, florida, nevada, south dakota, texas, washington, and wyoming) don’t.

Although this is sometimes conflated as a personal income tax rate, the city only levies this tax on businesses. The county sales tax rate is %. The city of san francisco levies a 1.50% gross receipts tax on the payroll expenses of large businesses.

The san francisco office of the controller, city and county of san francisco announced that for tax year 2018 the payroll expense tax rate is 0.38%, down from 0.711% for 2017. Although this is sometimes conflated as a personal income tax rate, the city only levies this tax on businesses. Businesses that operate only an administrative office in san francisco currently pay a 1.4% payroll tax instead of a gross receipts tax.

This is the total of state, county and city sales tax rates. Until the passage of proposition e, san francisco levied a 1.5% tax on the payroll expense of larger businesses in the city. San francisco imposes a payroll expense tax on the compensation earned for work and services performed within the city.

The 2018 payroll expense tax rate is 0.380 percent. Some states have an income tax;

What Are Employee And Employer Payroll Taxes Ask Gusto

2021 Federal State Payroll Tax Rates For Employers

I Robot U Tax Considering The Tax Policy Implications Of Automation – Mcgill Law Journal

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pnbp Limited Stay Permit Indonesia

Payroll Tax Vs Income Tax Whats The Difference The Blueprint

Real Estate Bookkeeping Services Nomersbiz Bookkeeping Services Bookkeeping Online Bookkeeping

What Is Casdi Employer Guide To California State Disability Insurance Gusto

2021 Federal State Payroll Tax Rates For Employers

San Francisco Voters Approve Ballot Measures Overhauling Citys Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Annual Business Tax Returns 2020 Treasurer Tax Collector

4 Important Things To Look For Quiet Payroll Tax Penalties Payroll Taxes Payroll Business Notes

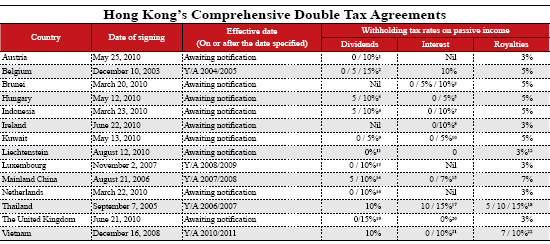

Using Hong Kong As A Base For China The Tax Advantages – China Briefing News

Annual Business Tax Return Treasurer Tax Collector

2

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Income Types Not Subject To Social Security Tax Earn More Efficiently

2

San Franciscos New Local Tax Effective In 2022