San francisco voters approved the tax in nov. The city began making the transition to a gross receipts tax from a payroll tax (based on wages paid to employees) in 2014.

The Texas Margin Tax A Failed Experiment Tax Foundation

Residential landlords with no more than $2,000,000 in gross receipts in either 2020 or 2021 are exempt from estimated quarterly business tax payments in 2021, and if their gross receipts in 2020 were less than or equal to.

San francisco gross receipts tax 2021 due dates. The annual business tax return due date has been extended by the ordinance from march 1, 2021 1 to april 30, 2021. Businesses operating in san francisco pay business taxes primarily based on gross receipts. Deadline to pay business property and possessory interest tax bill to the tax collector's office sep 15 deadline to file a formal assessment appeal with the assessment appeals board

Over the next few years, the city will phase in the gross receipts tax and reduce the payroll. (such as those at the san francisco international airport and the. The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april, july, and october, respectively.

Business license renewal due for the sf office of the treasurer and tax collector , department of health , fire department , police department , and entertainment commission The tax, which imposes a 1% to 5% citywide tax on gross receipts from cannabis businesses, was approved by voters in november 2018 and was slated to go into effect on jan. Under the revised general rule, the registration fee is $52 for businesses with less than $100,000 in gross receipts.

Business with $25 million or less in san francisco gross receipts have the deadline deferred to november 1, 2021 while businesses with more than $25 million in gross receipts had their deadline deferred to june 30, 2021. Interest and penalty (if any) will be levied by the city of san francisco if the statement and payment aren’t submitted by. Taxpayers must register or renew their business.

And food services will see tax cuts in 2021 and. If you are a quarterly filer, then your gross receipts tax is due on or before the last day of the first month following the close of the quarter. Estimated business tax payments are due april 30th, july 31st and october 31st.

These quar terly estimated tax liabilities must instead be paid along with annual tax payments. 50% less time in the city may mean a 50% reduction in tax owed. A san francisco ballot measure that approves sweeping.

Important filing deadlines include the san francisco gross receipts filing deadline of february 28 and the april 1st business property tax filing. Gross receipts and payroll taxes. The ordinance, which passed tuesday, suspends the tax through dec.

In 2021, san francisco has many, unique corporate tax deadlines beyond the traditional april 15th tax return date. Feb 28:payroll expense tax and gross receipts tax returns due mar 31: No penalty will be assessed for taxpayers that pay san francisco's 2020 business registration tax by april 30, 2021.

Gross receipts tax (gr) proposition f was approved by san francisco voters on november 2, 2020 and became effective january 1, 2021. The new highest fee is $40,261 for businesses with more than $200 million in. Payroll tax and gradually raise gross receipts tax rates by 40% for all industries.

The san francisco annual business tax return (return) includes the gross receipts tax, payroll expense tax, administrative office tax, early care and education commercial rents tax and homelessness gross receipts tax. First enacted in 2014, the gross receipts tax (grt) is imposed on the amount of a taxpayer’s gross receipts that are sourced to san francisco. Tax, commercial rents tax, and homelessness gross receip ts tax that would other wise be due on april 30, 2020, are waived for taxpayers or combined groups that had combined san francisco gross receipts in calendar year 2019 of $10,000,000 or less.

If you are a monthly filer, the gross receipts tax is due on or before the 20th day of each month. Residential landlords with less than $1,120,000 in gross receipts are exempt from estimated quarterly business tax payments and will not receive an estimated business tax. Estimated business tax payments (quarterly) estimated business tax payments are due april 30th, july 31st and october 31st.

2018, which imposes a 1 percent to 5 percent citywide tax on gross receipts from cannabis businesses. In addition to the gross receipts tax, san francisco requires payment of a business registration fee. San francisco’s gross receipts tax (grt) is calculated based on individual employees’ time spent in sf.

San francisco's 2020 business registration tax return, originally due june 1, 2020, and extended to march 1, 2021, has been further extended to april 30, 2021. To avoid late penalties/fees, the return must be submitted and paid on or before april 30, 2021. Proposition f fully repeals the payroll expense tax and increases the gross receipts tax rates across most industries while providing relief to.

San francisco's 2019 gross receipts tax and payroll expense tax are due on or before march 2, 2020. Additionally, businesses may be subject to san francisco gross receipts, homelessness gross receipts, commercial rents, and payroll expense taxes. The grt is based on a taxpayer’s city receipts for each calendar year, regardless of the taxpayer’s fiscal year end.

2021 tax deadlines for san francisco startups. The office of treasurer and tax collector will publish gross receipts tax rate and payroll expense tax rate by 9/1 of each year. Proposition f revises the registration fee structure for registration years beginning on or after july 1, 2021.

Due Dates For San Francisco Gross Receipts Tax

Overpaid Executive Gross Receipts Tax Approved Jones Day

What Is Gross Receipts Tax Overview States With Grt More

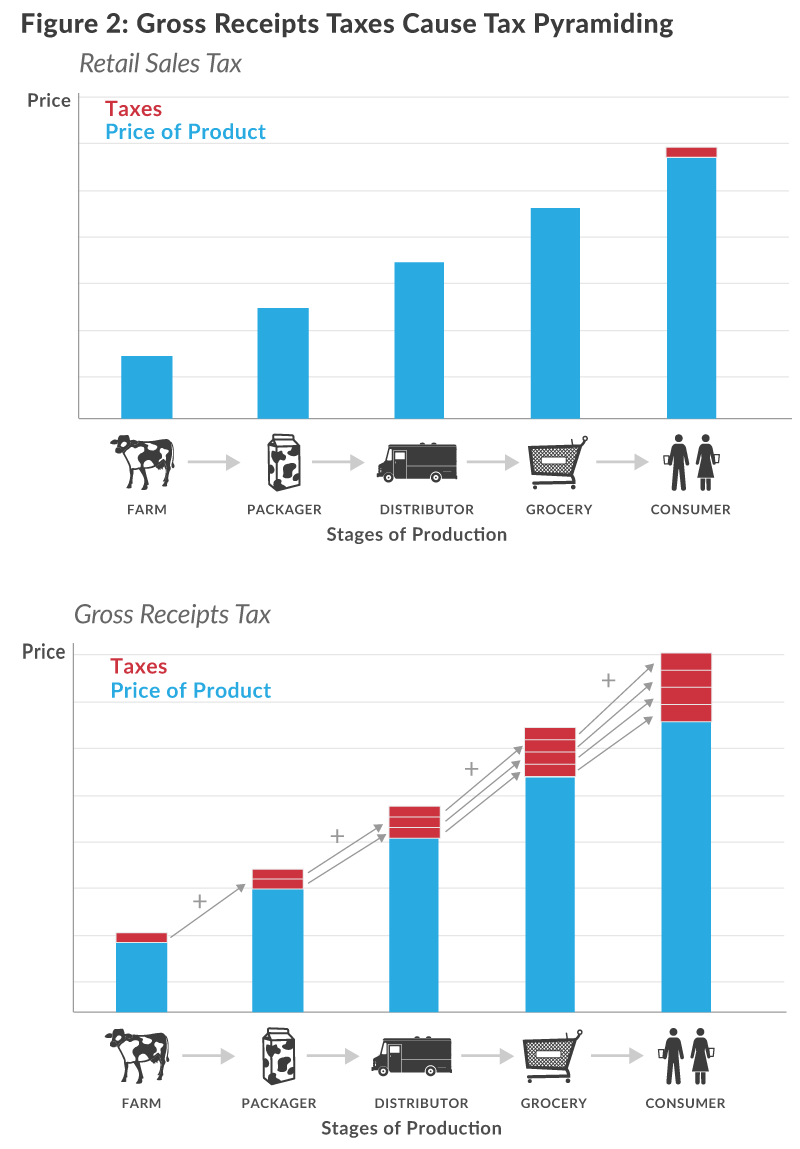

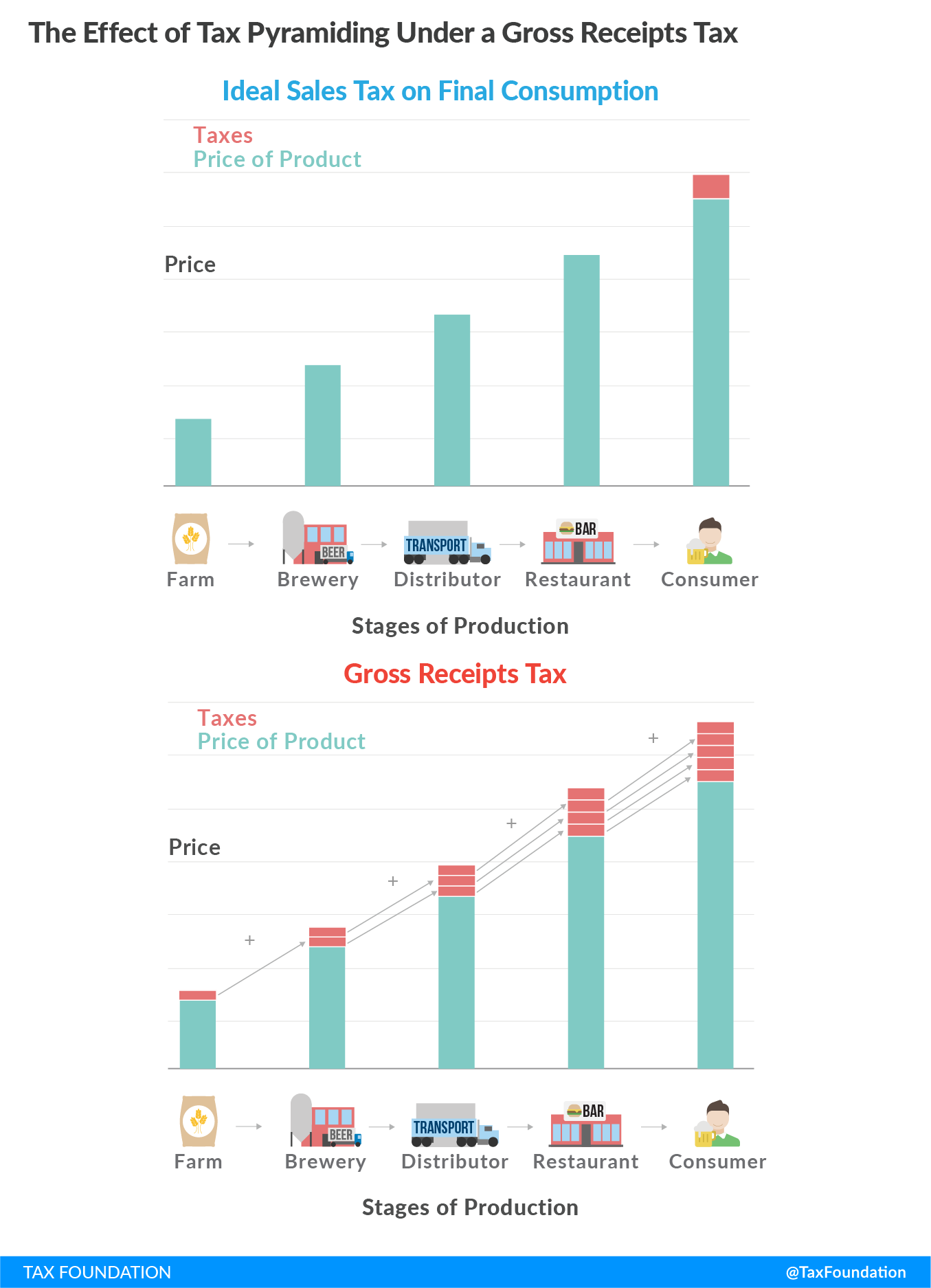

Tax Pyramiding What Is Tax Pyramiding Taxedu

San Francisco Gross Receipts Tax

Annual Business Tax Return Treasurer Tax Collector

7 Easy Payroll Remittance Form Sample In 2021 Payroll Payroll Taxes Form

San Francisco Business Taxes In 2021 What You Need To Know

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Working From Home Can Save On Gross Receipts Taxes Grt – Topia

Annual Business Tax Return Treasurer Tax Collector

Annual Business Tax Returns 2020 Treasurer Tax Collector

Quickbooks Online Vs Quickbooks Self Employed Quickbooks Online Quickbooks Self

Forensic Report Template – Horizonconsultingco With Regard To Forensic Accounting Report Template Forensic Accounting Report Template Forensics

Gross Receipts Tax And Other Indirect – Pmba

The Texas Margin Tax A Failed Experiment Tax Foundation

Tax Pyramiding What Is Tax Pyramiding Taxedu

What Is Gross Receipts Tax Overview States With Grt More

Usa California Pge Pacific Gas And Electric Company In 2021 Bill Template Templates Document Templates