Car and recreational vehicle rentals are taxed at 11.5%. Charging full 6% sales tax up front on leased cars, not based on the monthly payment 2.

Sales Tax On Cars And Vehicles In Maryland

On the other hand, the sales and use tax does apply to car and boat rentals, under different tax rates.

Sales tax on leased cars in maryland. (this protects people who lease from having a spike in how much they owe if state sales taxes are increased.) the sales tax varies by state. The failure to do so could result in a devastating assessment down the line. Boat sales are subject to a boat titling tax which is administered by the maryland department of natural resources.

Back to maryland sales tax handbook top. Is the 6% sales tax due upfront on the sale price of the lease car or the lesee pays 6% tax on each payment. Sales of motor vehicles are subject to the maryland motor vehicle titling tax which is administered by the maryland motor vehicle administration.

Yes, unfortunately md levies sales tax on the entire selling price of the car, rather than just the leased portion. Generally, when a car is rented or leased in florida, the payment is subject to florida’s six percent (6%) state sales tax rate and any county sales tax on each lease payment. However, leases for at least one year are considered to be exempt.

The full amount of tax due with the sales tax return filed for the period in which the leased motor vehicle was delivered to the lessee in this state. A law that became effective july 1 eliminated the 5 percent use tax maryland motorists were charged on their monthly lease payments. Sales of motor vehicles are subject to the maryland motor vehicle titling tax which is administered by the maryland motor vehicle administration.

On the other hand, the sales and use tax does apply to car and boat rentals, under different tax rates. I did substantial research into this when i leased my last car. This means you only pay tax on the part of the car you lease, not the entire value of the car.

A 6% tax rate applies to most goods and services. Maryland collects a 6% state excise tax on the purchase of all vehicles. The dealer does not have to be the one that you purchased your car from, and can even be from out of state, although you need to be sure that either they or you file the paperwork with the state of md correctly (i know this for a fact, since.

In many cases, the vehicle is exempt from any excise tax provided that the lessee(s) identified on the lease agreement is/are the same as the new owner(s). Must a dealership separately state the sales tax on the monthly invoice issued to the lessee? The sales tax break is only available if you trade your car in with a dealer.

The most common method is to tax monthly lease payments at the local sales tax rate. It’s the same in va. But using the above example, say the sales tax was 8 percent.

For vehicles that are being rented or leased, see see taxation of leases and rentals. Boat sales are subject to a boat titling tax which is administered by the maryland department of natural resources. When you’re leasing a car, the rules on when and how much sales tax to pay vary by state.

It is important for dealers to understand the florida sales tax treatment of leased vehicles. In the state of maryland, any leases for a maximum of 180 days will be taxed at a special rate. However, vehicle rentals and the sale of alcoholic beverages are taxed at different rates.

Arkansas, illinois, maryland, oklahoma, texas and virginia calculate sales tax on the full price of the vehicle with the payment due at signing. According to the maryland department of transportation, the state of maryland collects a six percent state excise tax on vehicle purchases. For example, if the monthly lease payment is $300 and the sales tax is 8 percent, the total payment is $324.

Sales of tangible media property are subject to sales tax in maryland. They don't remit any portion of that to maryland to cover sales taxes, as those taxes have already been paid. Previously, the motor vehicle administration did not apply tax credit when the trade was a lease and the new car was a purchase, or when both cars were a lease, but the new car was with a different leasing company.

(11) a vehicle transferred to a lessee who exercises an option under a vehicle leasing What is the sales tax in maryland for car purchases? In states that charge sales tax on cars, you’ll have to pay that tax if you lease a car.

For a car costing $400 a month, the change will lower the. But using the above example, say the sales tax was 8 percent. Act 1164 of 2013 repealed th second option, leaving only the e first option that lessors must collect tax on the long.

This page covers the most important aspects of maryland's sales tax with respects to vehicle purchases. Charging 6% tax again on the same car if you decide to buy it at lease end. For example, if your local sales tax rate is 5%, simply multiply your monthly lease payment by 5% and add it to the payment amount to get your total payment figure.

So, if you assume that lease, none of that payment represents sales tax. (this protects people who lease from having a spike in how much they owe if state sales taxes are increased.) the sales tax varies by state. (1)purchase the motor vehicle tax free as a sale for resale and collect sales tax on the subsequent lease payments, (2) or pay sales tax on the purchase of the motor vehicle and lease to consumers tax free.

However, some states calculate the sales tax differently.

Charities To Donate Car To – Best Car All Time Best Donate Car Donate Charity

Nj Car Sales Tax Everything You Need To Know

Used Kia Forte For Sale Near Baltimore Md With Photos – Cargurus

Used Cars For Sale In Baltimore Md Edmunds

Real Estate Classes In Baltimore Md Heres What You Can Choose From Real Estate Classes Real Estate School Maryland Real Estate

Maryland Car Tax Everything You Need To Know

Check Out This Used 2011 Toyota Camry Le For Only Here Httpswwwusacarshoppercomvehicles4t1bf3ek2 Toyota Camry 2011 Toyota Camry Toyota Camry For Sale

Five Reasons To Get Rid Of Your Old Car Car Auctions Insurance Auto Auction Car Rental Company

Used Acura For Sale In Baltimore Md Edmunds

Untagged And Unregistered Vehicles Anne Arundel County Md

Car Leasing Service Auto Leasing Lease Transfer Lease Termination Lexus Lease Deals Car Lease Deals Niss Drivers Education Car Lease Car Buying Tips

Proposed Riverfront Stadium Gets A Name National Car Rental Field National Car Riverfront Car Rental

2015 Toyota Camry Review New Car Review Toyota Camry Camry 2015 Toyota Camry

Only 1 Space Left – 1000sf – Call Me Loopnet – 4601 W Sahara Ave Las Vegas Nv Las Vegas Commercial Property Sahara

Register Your Car In Maryland Step-by-step Guide Bumbleauto

Nj Car Sales Tax Everything You Need To Know

2012 Ford F 550 Tiffany Coach Bus 28 Pax Limousine Party Bus For Sale Party Bus For Sale Party Bus Buses For Sale

Maryland Firearm Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsof Document Templates Bill Of Sale Template Templates

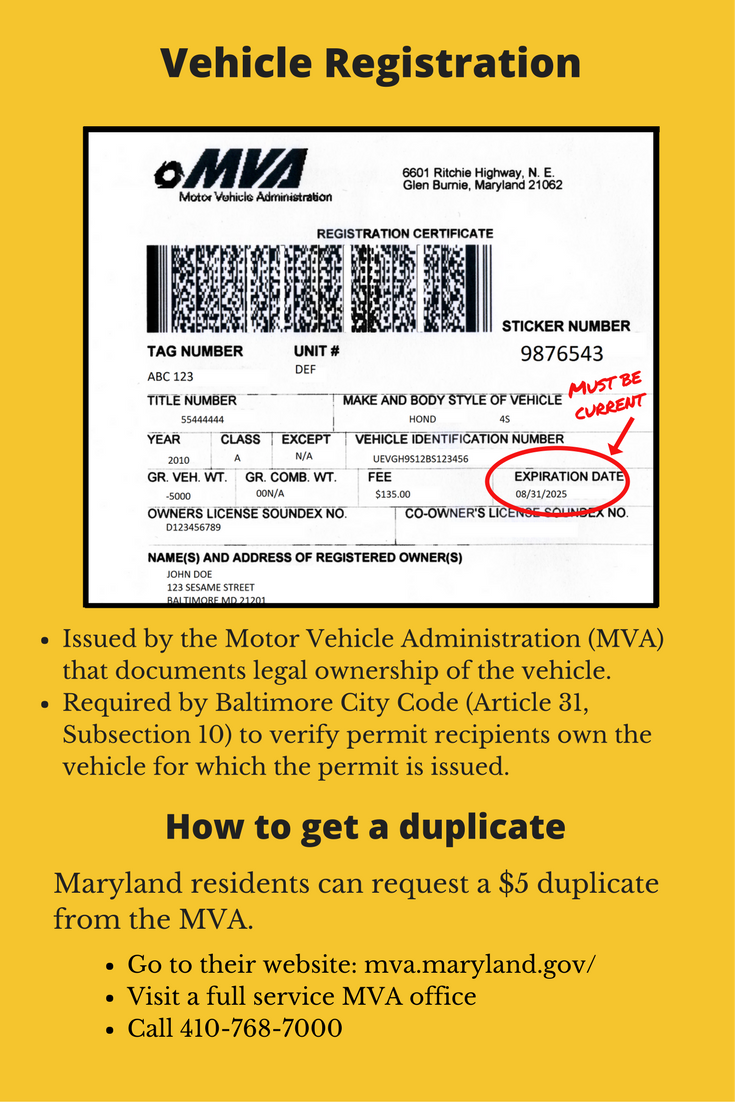

Required Customer Documents Parking Authority