The state sales tax rate in new york is 4.000%. Groceries are exempt from the erie county and new york.

Psl2ijkx5swvvm

With local taxes, the total sales tax rate is between 4.000% and 8.875%.

Sales tax on clothing in buffalo ny. But each individual local government gets to decide. This is the new ebay. When it comes to clothing and footwear purchases, new york waives its 4 percent charge for qualifying items under $110 each.

Simply press one rate and then press and maintain alt + select the other rate(s). With local taxes, the total sales tax rate is between 4.000% and 8.875%. The erie county, new york sales tax is 8.75% , consisting of 4.00% new york state sales tax and 4.75% erie county local sales taxes.the local sales tax consists of a 4.75% county sales tax.

But did you check ebay? 22 sales tax jobs available in buffalo, ny on indeed.com. State sales tax also doesn’t apply to the following:

Ad over 80% new & buy it now; The local sales tax rate in erie county is 4.75%, and the maximum rate (including new york and city sales taxes) is 8.75% as of november 2021. Calculation of the general sales taxes of 14217, buffalo, new york for 2021.

Check out new york sales tax on ebay. The december 2020 total local sales tax. The minimum combined 2021 sales tax rate for williamsville, new york is.

And sales of services are treated differently. The buffalo, new york sales tax rate of 8.75% applies to the following 29 zip codes: At issue for local governments is a new.

How 2021 sales taxes are calculated in buffalo. The sales tax growth this year isn’t limited to erie county. State sales tax doesn’t apply to most clothing and footwear sold (for human use) for less than $110 per item or pair, while clothing priced $110 or higher is taxable.

The push comes as lawmakers this week in albany are expected to approve a state budget, setting spending and revenue policy for the next 12 months. The current total local sales tax rate in buffalo, ny is 8.750%. For information on the oneida nation settlement agreement, see oneida nation settlement agreement.

You can simply select one rate or multiple rate for a maximum total equivalent to the combined. The new york sales tax rate is currently %. Buffalo, ny sales tax rate.

Check out new york sales tax on ebay. Download our new york sales tax database! Sales tax applies to retail sales of certain tangible personal property and services.

The sales tax applies broadly to the sale of tangible personal property. When you buy a hammer, you generally pay sales tax. You file an annual or quarterly sales tax return and:

Sales tax refund review (reverse audits) a sales tax refund study is the process of reviewing the business operations to determine when and how the nys sales tax laws (exemptions) apply to the business’ operations and recover sales tax paid in error on supplies and materials that are used. The buffalo, new york, general sales tax rate is 4%.depending on the zipcode, the sales tax rate of buffalo may vary from 4% to 8.75% every 2021 combined rates mentioned above are the results of new york state rate (4%), the county rate (4.75%). New york has recent rate changes (sun sep 01 2019).

What is the sales tax for products in buffalo? The exemption extends to items used to make or repair exempt clothing and footwear. Use tax applies if you buy tangible personal property and services outside the state and use it within new york state.

But did you check ebay? The department issues the appropriate annual tax bill predicated on the final assessed value. New york’s comptroller says local sales tax collections statewide were up about 13 percent in october, compared to 2020.

Under new york’s rules, sales of goods. This is the total of state, county and city sales tax rates. , ny sales tax rate.

The county sales tax rate is %. This is the new ebay. On children's clothing, adult clothing, food etc.

What is the sales tax rate in williamsville, new york? The erie county sales tax is collected by the merchant on all qualifying sales made within erie county. Pursuant to the new york state real property tax law, the department of assessment and taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the city of buffalo.

14201, 14202, 14203, 14204, 14205, 14206, 14207, 14208, 14209, 14210, 14211, 14212, 14213, 14214, 14215, 14216, 14220, 14222, 14233, 14240, 14263, 14265, 14267, 14269, 14270, 14272, 14273, 14276 and 14280. Apply to customer care specialist, accounts payable clerk, senior accounting clerk and more! The williamsville sales tax rate is %.

There is no city sale tax for buffalo. Sales tax calculator of 14217, buffalo for 2021. Ad over 80% new & buy it now;

Local government leaders from around new york are urging state lawmakers to reverse a sales tax law that diverts more than $59 million from municipalities.

Canggu Beachside Villas Managed By The Luxe Nomad

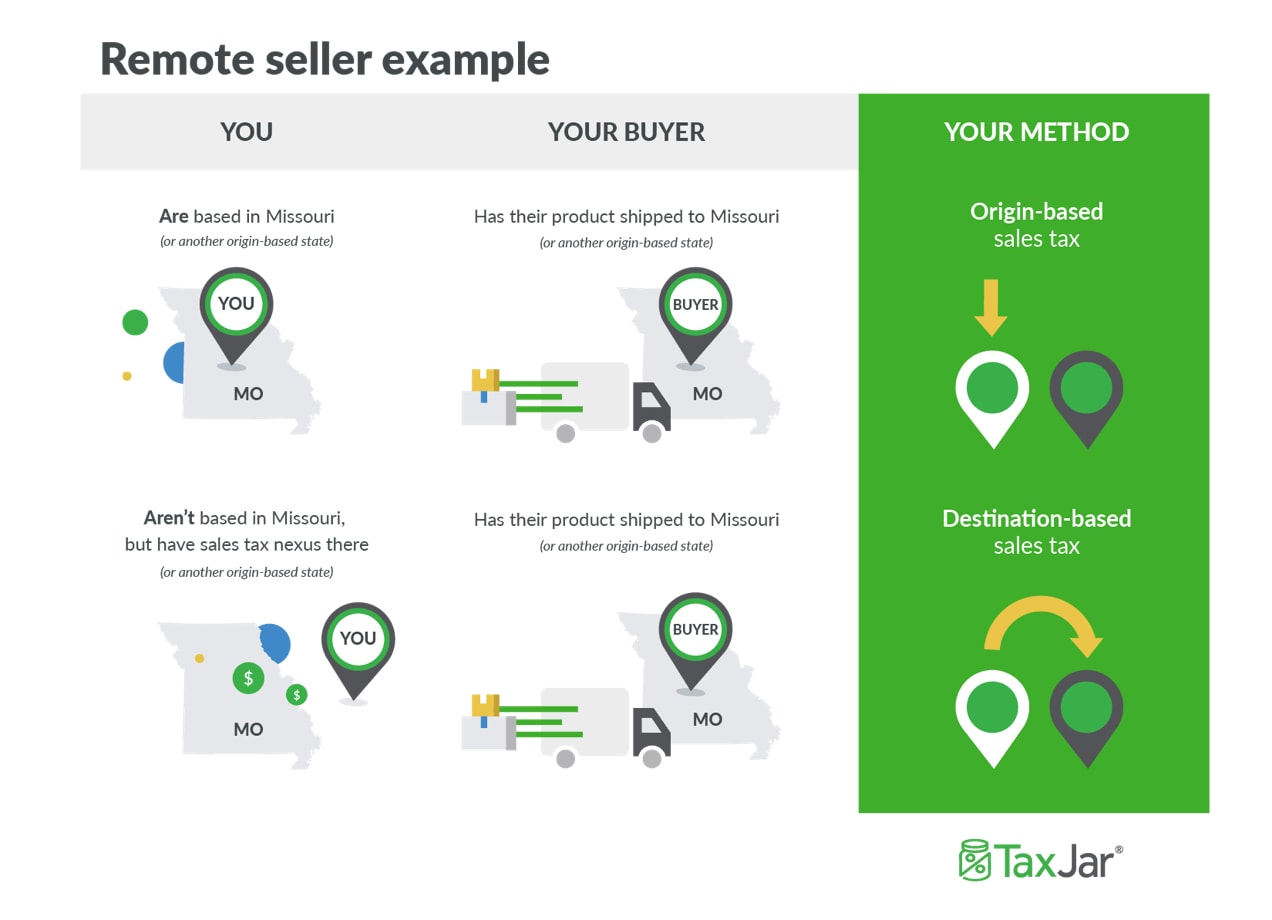

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

The New York Clothing Sales Tax Exemption Demystified – Taxjar

Facts Figures Schott

How To Charge Your Customers The Correct Sales Tax Rates

The New York Clothing Sales Tax Exemption Demystified – Taxjar

Psl2ijkx5swvvm

Humidors Luggage Suitcase

Premiere Suite – Bali Nusa Dua Hotel

How To Calculate Sales Tax – Video Lesson Transcript Studycom

Fkm Universitas Jember Agrocoastal Community

2

Kabid Kb-ks Lotim Buka Pertemuan Penguatan Ketahanan Keluarga Berbasis Kelompok Bkb Bkkbn Ntb

How To Charge Your Customers The Correct Sales Tax Rates

Online Sales Tax Compliance Ecommerce Guide For 2021

Fkm Universitas Jember Agrocoastal Community

Online Sales Tax Compliance Ecommerce Guide For 2021

The New York Clothing Sales Tax Exemption Demystified – Taxjar