Sacramento tax sales house foreclosure.homes.com. California’s overall property taxes are below the national average.

Apply For Top Up On Your Existing Loan If You Need Funds For Personal Or Business Use Myloancare Baataapkeinterestki Topuploan Loan Personal Loans Person

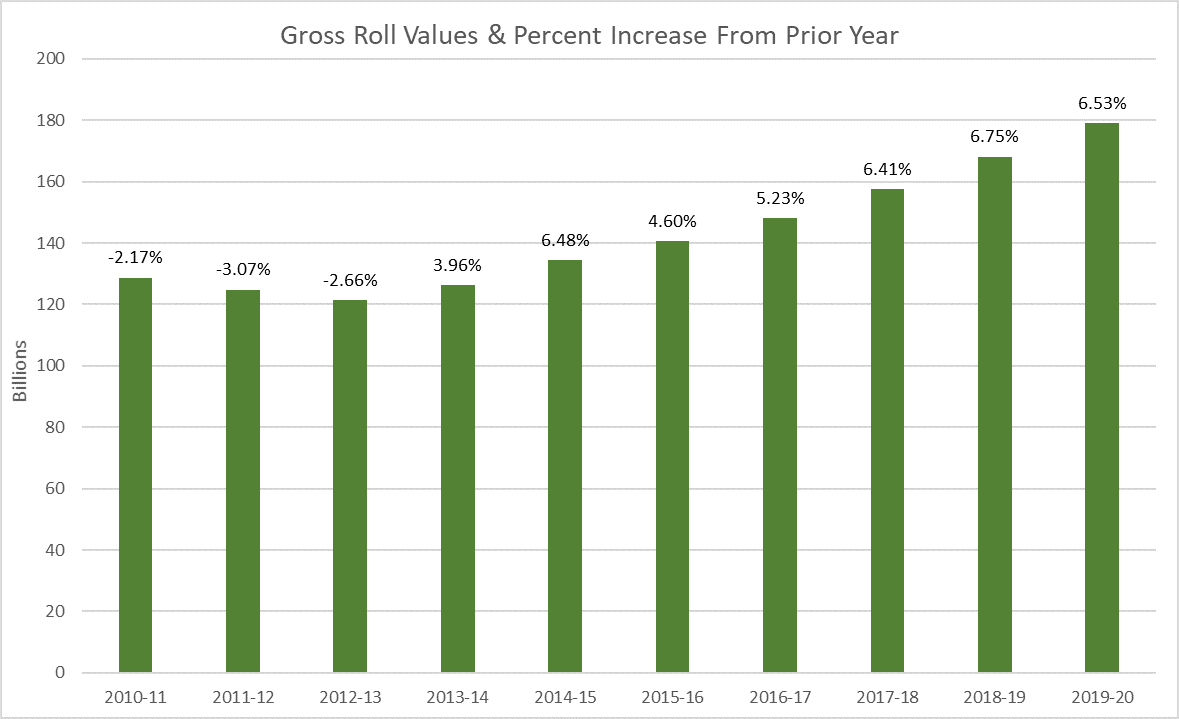

It also limits increases in assessed value to 2% every year, except if the home has changed ownership or undergone construction.

Sacramento property tax rate 2020. The median property tax in sacramento county, california is $2,204 per year for a home worth the median value of $324,200. The california sales tax rate is currently %. Capitalization rate used in the valuation of enforceably restricted historical property for the 2020 assessment year is 4.25 percent.

The sacramento sales tax rate is %. The county sales tax rate is %. Percentage of home value median property tax in dollars.

This is the total of state, county and city sales tax rates. Placer county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. Property tax is calculated by multiplying the property's assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting of any exemptions would pay.

California property tax proposition 13, passed by california’s voters in 1978, sets the maximum allowable property tax rate at 1% of a home’s assessed value. Emerald hills (redwood city) 9.875%: The minimum combined 2021 sales tax rate for sacramento, california is.

For property taxes due in 2020, elk grove village accounted for approximately 10% of the overall property bill. Updated july 23, 2020 12:38 pm. The annual tax bill covers the fiscal year, which begins july 1st of that year, and ends june 30th of the next year.

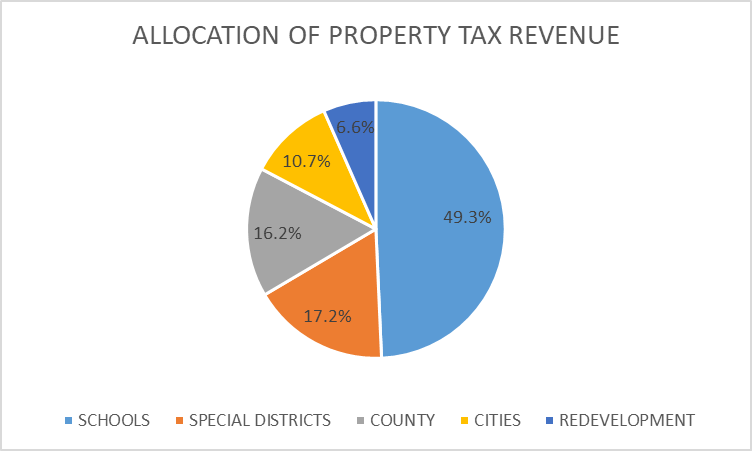

For your reference, a table is enclosed listing the interest components announced for current and prior assessment years. These funds were allocated as follows: Sincerely, /s/ david yeung david yeung deputy director property tax department.

Average property taxes paid rose 4% in 2020, according to data from real estate information firm attom data solutions. Hence, the median property taxes paid for such homes are about $2,412.in the table below, we will go over each state and see how it. [voc] $155,237 x.00275 = $426.90 [tax due] )

Housing experts expect them to jump even higher in 2021 as many communities. Transfer rate the transfer tax is charged at $2.75 per thousand on the full value of consideration (voc) / purchase price. Voting to repeal proposition 13 will shrink racial equity gaps on property tax rates.

It's also home to the state capital of california. The property tax rate in the county is 0.78%. Property taxes are utilized by multiple units of local government for revenue.

Today, it is california’s counties, cities, schools, and special districts that depend on the property tax as a primary source of revenue. Annual secured property tax bills are mailed only once each year by november 1st. 3 hours ago this is a tax lien listing.

Annual secured tax bills all real property is assessed annually, based on each property's status as of the lien date, january 1, of that year. Effective property tax rates by state. It is not a property for sale.

Counties 15 percent, cities 12 percent, schools (school districts and community As separate, independent units of government, the village has no control over the other. Calculating property taxes in california.

Powell special to the sacramento bee. Please remember annual property taxes are due and delinquent the same dates. Sacramento county is located in northern california and has a population of just over 1.5 million people.

The village of elk grove is one of approximately 11 units of local government that comprise the typical resident’s overall property tax bill. Total statewide base sales and use tax rate : The average effective (after exemptions) property tax rate in california is 0.79%, compared with a national average of 1.19%.

The median property tax (also known as real estate tax) in placer county is $3,441.00 per year, based on a median home value of $427,600.00 and a median effective property tax rate of 0.80% of property value. California property tax rates typically fall between 1.1 percent to 1.6 percent of its assessed value. Sacramento county collects, on average, 0.68% of a property's assessed fair market value as property tax.

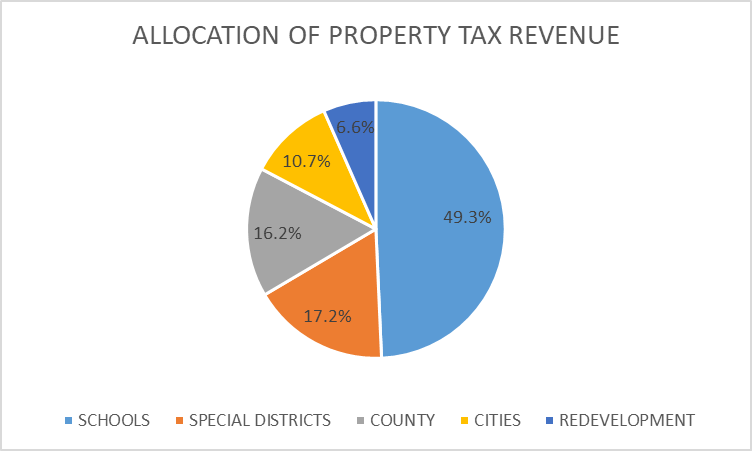

The assessment roll reflects the total gross assessed value of locally assessed real, business and personal property in sacramento county as of january 1, 2020. City level tax rates in this county apply to assessed value, which is equal to the sales price of recently purchased homes. The tax rates are expressed as dollars per 100 of assessed value, therefore the tax amount is already divided by 100 in order to obtain the correct value.

The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.

How To Get Your First Credit Card In 2021 Credit Card Infographic Credit Card Application Credit Card

Sacramento-county Property Tax Records – Sacramento-county Property Taxes Ca

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Best Buy Cities Where To Invest In Housing In 2017 Where To Invest Investing Cool Things To Buy

Property Taxes – Department Of Tax And Collections – County Of Santa Clara

Best Upgrades For Rental Property To Increase Rent Rental Property Stylish Flooring Rental

Shape Create And Design Modern Employee And Customer Experience In 2021 Fintech Design Working From Home

Real Estate Advisory Commercial Construction Development Expansion Commercial Real Estate Broker Real Estate Development Consulting Business

Vicuna – Wikipedia Wikipedia Bertha Weather Screenshot

Tong Hop Cac Bai Tap Thue Gia Tri Gia Tang Co Loi Giai Bai Tap

Florida Satisfaction Of Mortgage Mortgage Satisfaction Word Program

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

Sacramento-county Property Tax Records – Sacramento-county Property Taxes Ca

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

Building And Managers Association Boma Energy Challenge Estate Management Real Estate Management

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

California Ab-5 And How It Affects The Owner-operator California Ferry Building San Francisco Water

Californians Adapting To New Property Tax Rules

Facts For Second Home Mortgage Secondhomemortgage Mortgage Rates Mortgage Second Mortgage