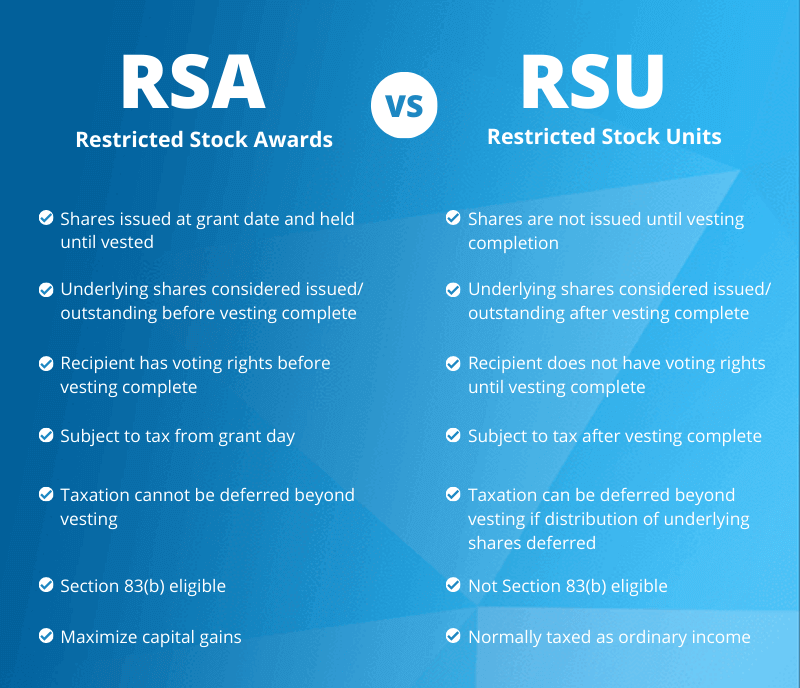

Rsus are taxed at the ordinary income tax rate when they are issued to an employee, after they vest and you own them. Most companies will withhold federal income taxes at a flat rate of 22%.

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Because there is no actual stock issued at grant, no section 83 (b) election is permitted.

Rsu tax rate canada. I am paid in cad and all my tax deductions are inline with the bc provincial rules. When you become vested in your stock, its fair market value gets taxed at the same rate as your ordinary income. In case a company is granting 200 rsus with a condition of 25% rsu vesting every year, then 25% (50 shares) can be claimed at the end of the first year.

Another 25% or 50 shares can then be claimed in the second year, and only at the end of the fourth year will an. The taxation of rsus is a bit simpler than for standard restricted stock plans. An rsu, or a proportion of an rsu, is liable to income tax under the paye system and is also a income tax in a state with which there is a double taxation agreement.

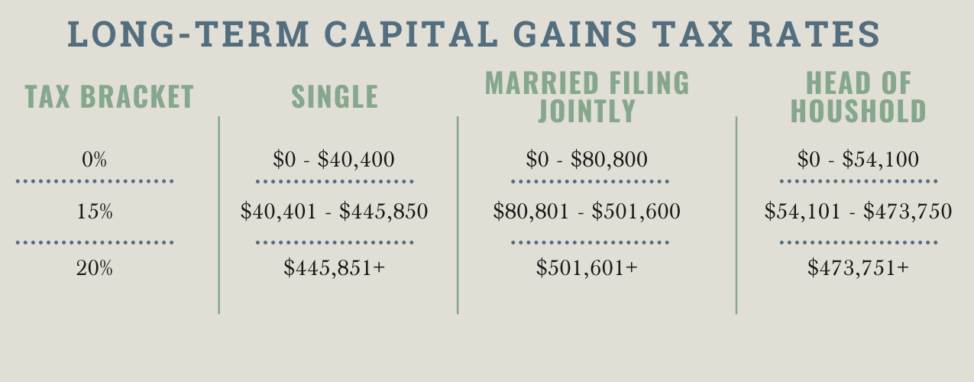

25% federal income tax + 6.8% fica & medicare, + 10% state would be 41.8%; So right around what you had. In other words, if the stock increase in value after you’ve paid ordinary income tax on it, and you.

Theapayroll operator is satisfied thattaxa foreign income tax applies and has established the effective tax rates on the doubly taxed amount. Tax on the capital gains. The ordinary earned income tax rate when the rsus vest, or;

Ad a tax agent will answer in minutes! At any rate, rsus are seen as supplemental income. This article will try to explain how one can lose 70% of rsu value to tax and nic.

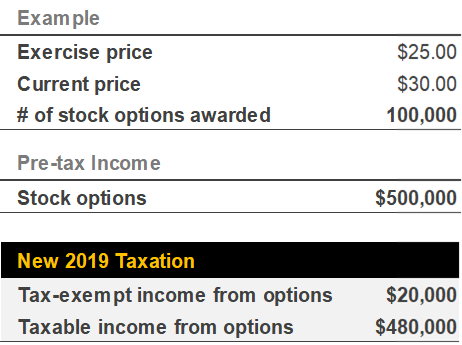

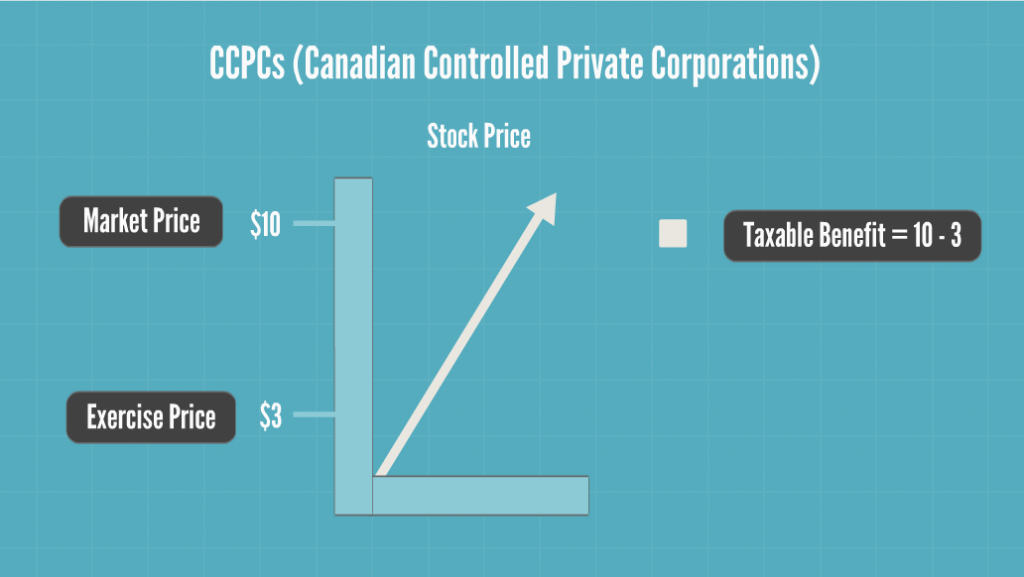

For nonresident corporations, the general corporation rates in the table apply to business income attributable to a permanent establishment in canada. 2021 and 2022, current as of september 30, 2021 [pdf 127 kb] 2021 and 2022, current as of june 30, 2021 [pdf 127 kb] income tax rates for ccpcs Suppose you had 100 rsus vested on october 31.

General corporation, current as of september 30, 2021 [pdf 133 kb] ccpc, current as of september 30, 2021 [pdf 138 kb] income tax rates for general corporations. So it’s up to you to enter a percentage. Some rsu receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

For 2018 and previous tax years, you can find the federal tax rates on schedule 1.for 2019, 2020 and later tax years, you can find the federal tax rates on the income tax and benefit return.you will find the provincial or territorial tax rates on form 428. For your state tax rate, it’d be a little much for us to pull each state’s income tax and include it. The closing price of the stock on that day is $50, and the tax withholding rate is 40%.

Canadian tax & legal alert cra issues new views on rsu taxation in canada april 21, 2021 contacts: The capital gains tax rate when you sell the shares you own; Employee total salary before rsu is £130,000 salary £130,000, rsu value £20,000

It’s important to remember that the rsu tax rate will be the same as your income tax rates. Ad a tax agent will answer in minutes! On the date that your rsus vest you will get shares net of the tax your employer withholds.

The withholding rate is what might be different, which is a common source of confusion. Rsus can trigger capital gains tax, but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future. This is because rsus, stock grants, and.

Tax rates for previous years (1985 to 2020) to find income tax rates from previous years, see the income tax package for that year. The value of over $1 million will be taxed at 37%. On the sale of rsus, esops and espps, the gains/profit made are subject to capital gains tax.

You didn't mention your state but since the number was so high i'm assuming a high income tax state. For rsus, the profit/gain is the difference between the sale price and the vesting price. This is true whether we’re talking about:

The exact tax rate will depend on your specific tax bracket as determined by your income. Add the federal and provincial/territorial tax rates for a combined federal and provincial rate. Last month, i had some rsu's that are vested and i see that i was taxed at 54% effective tax rate to cover the taxes on the vested rsu's.

A big note here, you must enter a value even if the value is 0%. What is the tax rate for an rsu?

Blog Upstart Wealth

Taxtipsca – Understanding Tax Rate Tables

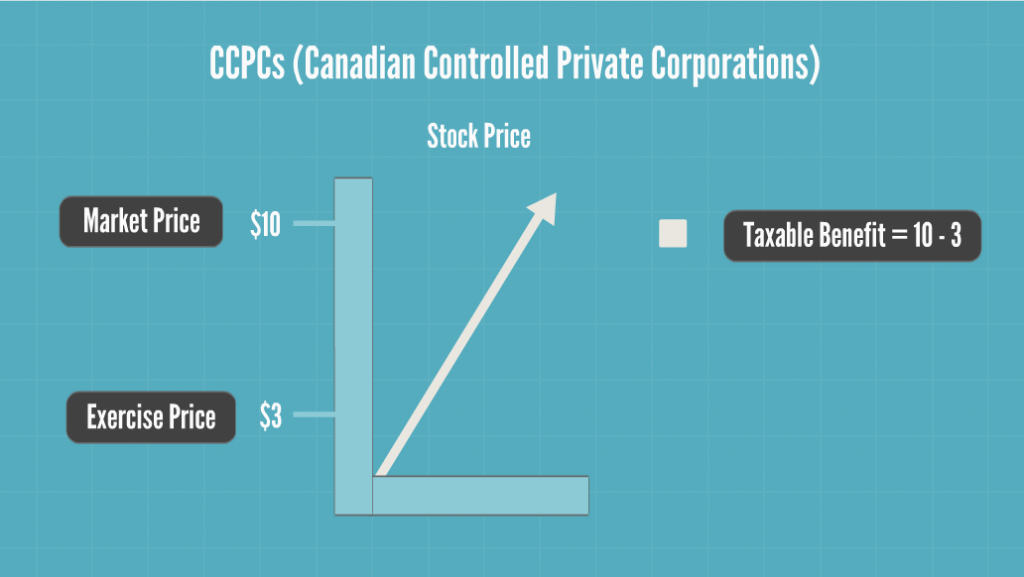

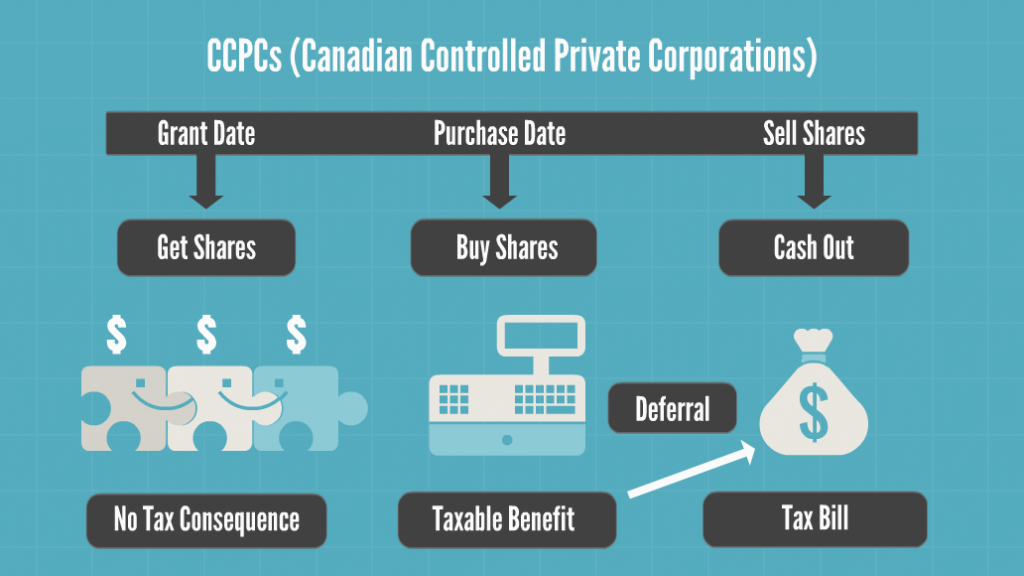

Taxation Of Stock Options For Employees In Canada – Madan Ca

The Blunt Bean Counter Punitive Income Tax Provisions

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

Rsus Can Set You Up For Long-term Financial Success

Taxation Of Stock Options For Employees In Canada – Madan Ca

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Employee Stock Options Taxation Us Is About To Leap-frog Canada By Varun Tools For Entrepreneurs Medium

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Rsa Vs Rsu All You Need To Know Eqvista

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

How To Report Rsus Or Stock Grants On Your Tax Return – Turbotax Tax Tips Videos

Us And Canadian Compensation Issues For Emerging And High Growth Comp

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation – Flow Financial Planning

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

Ca Hybrid Methodology For Sourcing Certain Rsus – Kpmg Global

Rsu Grant Sale To Cover Taxes Ontario Rpersonalfinancecanada