Now that you know the basics of how rsu’s work, you can now confidently use the rsu tax calculator below. We strive to make the calculator perfectly accurate.

Blog Upstart Wealth

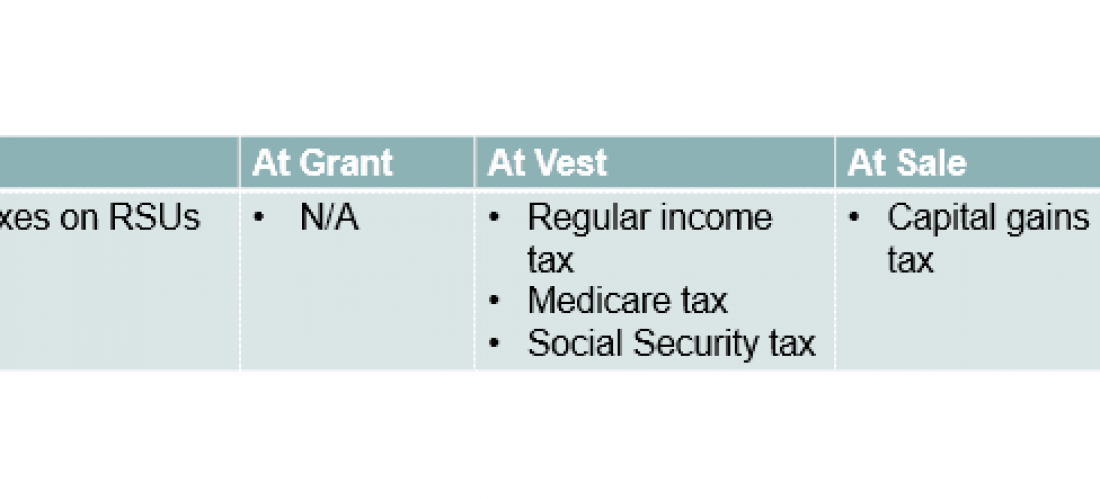

Here is the information you need to know prior to jumping in:

Rsu tax rate calculator. 195,000 + 17.5% of the amount exceeding rs. The beauty of rsus is in the simplicity of the way they get taxed. On this page is a restricted stock unit projection calculator or rsu calculator.

For a resident senior citizen who is 60 years or more at any time during the previous year. In case the shares are sold with a year of acquiring them, the gains resulting from such a sale. Wil i be taxed on fifo basis or only on espp.

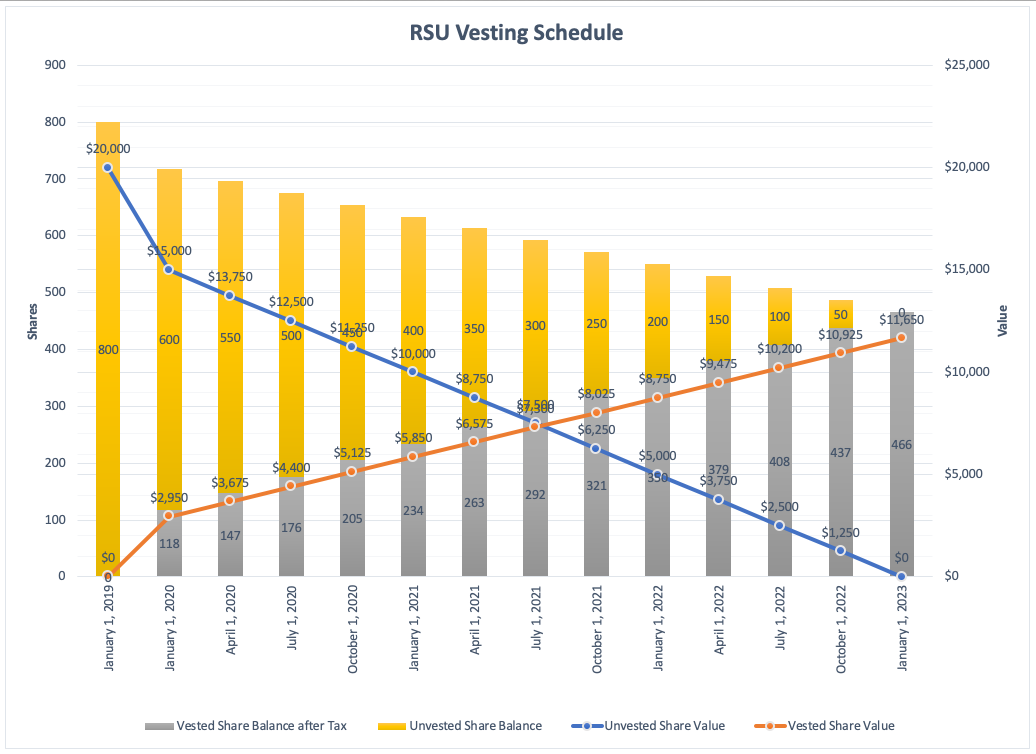

Dividend income (u/s 115bbda) 10%. Enter details of your most recent rsu grant, your company's vesting schedule, and some assumptions about your tax rate and your employer's future returns. Restricted stock units (rsus) tax calculator.

On etrade we have option to sell only espp or only rsu. 90,000 + 15% of the amount exceeding rs. Winnings from lottery, crossword puzzles, etc) 30%.

Divide by 2 to calculate each spouse’s portion. Cost of shares;10,000 shares @€1 = €10,000. However, i don't know if these are given to me as stocks, or as a cash value.

Let’s assume the tax rate is 25%. When an employee sells their espp, esop or rsu once the vesting period is complete and receive their money, it is their duty to pay tax on that amount in india. I don't know where the rest is coming from.

Income tax slabs and rates for senior citizen. Emily made an exercised share profit of €20,000. I’ve both rsu and espp of foreign company.

The payments are estimates of what you'll owe in total when you prepare. 1,800,000 but does not exceed rs. Let’s look at how this works with an example.

Short term capital gains (covered u/s 111a ) 15%. Unlike the much more complicated espp, they get taxed the same way as your income. Can't speak to that homie, but i'm told it's 25 fed and 10.23 state.

Interest on deposits (u/s 80ttb ) any other deductions. Here is an article on rsu tax. Thus, the $2,000 was not previously taxed at ordinary income rate.

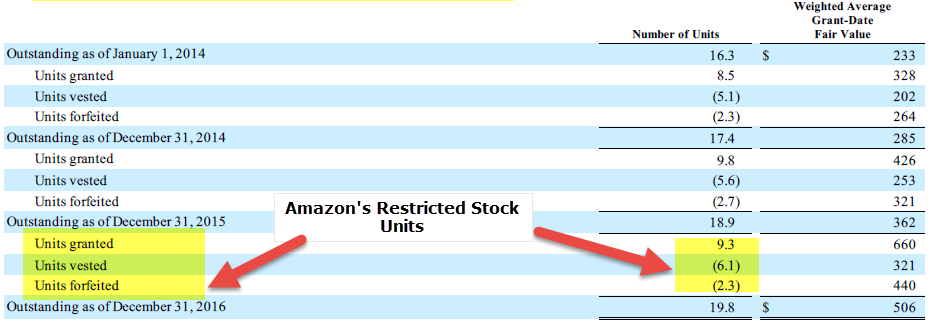

Hope you had a chance to glance over at the official restricted stock unit (rsu) strategy guide. When i sell my espp. Value of shares;10,000 shares @€3 = €30,000.

The provided information does not constitute financial, tax, or legal advice. The stock price is $10 per share. This $2,000 was value created by holding onto the stock and it performing well, and was not value granted in the rsu issuance.

Additionally, health and education cess at 4% are levied on the total tax rate, above the total amount payable. If your employer doesn't withhold tax on your stock grant or rsu, you may be responsible for paying estimated taxes. This is calculated as follows:

Now when i sell 40 espp share on 1nov 2017. Alice is now liable for paying capital gains tax on the $2,000 appreciation. It’s based on your current tax rate and there’s a.

The nature of the gains will determine the amount of tax the employee will have to pay. With estimated taxes, you'll have to send payments to the irs about every quarter, on april 15, june 15, september 15 and january 15 of the following year. Where the taxable salary income exceeds rs.

3,500,000 the rate of income tax is rs. From there, the rsu projection tool will model the total economic value of your grant over the years. Let’s say there are 200 total unvested rsus and 100 of them are community property.

Where the taxable salary income exceeds rs. Ims investment management services pvt. Long term capital gains (covered u/s 112a ) 10%.

If you live in a state where you need to pay state income taxes, repeat steps 2 and 3 using your state marginal tax rate. 20 espp shares vested on 1 jan 2017 20 rsu vested on 30 mar 2017 20 espp shares vested on 30june 2017 20 rsu vested on 30 oct 2017. The rsu’s will vest at the rate of 25% per year beginning on the first anniversary of the grant date. my understanding is this means that i will get 25% every annum starting at my first year anniversary.

Although taxes should be a consideration for future rsu sales, proper asset allocation and stock concentration risk should also be considered. An rsu, or a proportion of an rsu, is liable to income tax under the paye system and is also a income tax in a state with which there is a double taxation agreement. $3170 as net proceeds $4217 as cost basis (112 x $37.66, also shows this.

Want to make sure i am calculating mine right in turbo tax. 2,500,000 the rate of income tax is rs. Received rsu’s jan/2009 jan/2010, 112 vested at $37.66 44 held for taxes may 2010, sold remaining 68 at 47.22 1099b shows $3170 (proceeds minus commission) so in turbotax i have:

2,500,000 but does not exceed rs. Theapayroll operator is satisfied thattaxa foreign income tax applies and has established the effective tax rates on the doubly taxed amount.

Equity Compensation 101 Rsus Restricted Stock Units

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Calculator Projecting Your Grants Future Value

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu And Taxes Restricted Stock Tax Implications

Rtm Rsu Calculator Sheet – Rent The Mortgage

Restricted Stock Units Rsus Tax Calculator Level Up Financial Planning

Restricted Stock Units Definition Examples How It Works

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Rsus Facts

Rsus – A Tech Employees Guide To Restricted Stock Units

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation – Flow Financial Planning

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Blog Upstart Wealth

The Mystockoptions Blog Pre-ipo Companies

Are Rsus Taxed Twice – Rent The Mortgage

Rsu Tax Rate Is Exactly The Same As Your Paycheck

A Tech Employees Guide To Rsus – Cordant Wealth Partners

Tax Planning For Stock Options