6.00% [the total of all income taxes for an area, including state, county and local taxes.federal income taxes are not included.] property tax rate: Missouri allows all state and local sales taxes to be remitted together at the state level.

2

Find sales and use tax rates enter your street address and city or zip code to view the sales and use tax rate information for your address.

Riverside mo sales tax rate. This is the total of state, county and city sales tax rates. The missouri (mo) state sales tax rate is currently 4.225%. The december 2020 total local sales tax rate was also 6.600%.

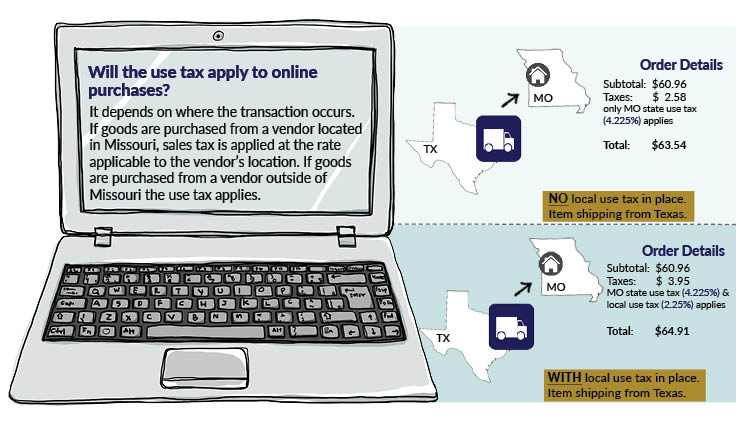

Use tax is imposed on the storage, use or consumption of tangible personal property in this state. Riverside county collects, on average, 0.8% of a property's assessed fair market value as property tax. Depending on local municipalities, the total tax rate can be as high as 10.1%.

Some cities and local governments in riverside county collect additional local sales taxes, which can be as high as 3%. The riverside, missouri sales tax is 6.60%, consisting of 4.23% missouri state sales tax and 2.38% riverside local sales taxes.the local sales tax consists of a. [ 5 ] state sales tax is 4.23%.

Riverside, mo sales tax rate the current total local sales tax rate in riverside, mo is 6.600%. Riverside county has one of the highest median property taxes in the united states, and is ranked 248th of the 3143 counties. The 4.225 percent state sales and use tax is distributed into four funds to finance portions of state.

The riverside sales tax rate is %. The minimum combined 2021 sales tax rate for riverside, missouri is. An alternative sales tax rate of 7.75% applies in the tax region jurupa valley, which appertains to zip codes 92509 and 92519.

6.60% [the total of all sales taxes for an area, including state, county and local taxes.income taxes: Sales tax and use tax rate of zip code 64150 is located in riverside city, clay county, missouri state. Here's how riverside county's maximum sales tax rate of 9.

The riverside county sales tax is 0.25%. Tax rates for riverside, mo. The riverside, missouri, general sales tax rate is 4.225%.

The missouri sales tax rate is currently %. The median property tax in riverside county, california is $2,618 per year for a home worth the median value of $325,300. Remember that zip code boundaries don't always match up with political boundaries (like riverside or platte county ), so you shouldn't always rely on something as imprecise as zip codes to determine the sales tax rates at a given.

With local taxes, the total sales tax rate is between 4.225% and 10.350%. There are approximately 2,249 people living in the riverside area. 92501, 92502, 92503, 92504, 92505, 92506, 92507, 92508, 92513, 92514, 92516, 92517, 92521 and 92522.

$10.63 [the property tax rate shown here is the rate per $1,000 of home value. Missouri (mo) sales tax rates by city (a) the state sales tax rate in missouri is 4.225%. The county sales tax rate is %.

The riverside, missouri sales tax rate of 7.1% applies in the zip code 64150. The sales tax rate is always 6.6% the sales tax rate is always 6.6% every 2021 combined rates mentioned above are the results of missouri state rate (4.225%), the county rate (1.375%), the missouri cities rate (1%). The riverside, california sales tax rate of 8.75% applies to the following fourteen zip codes:

The state’s sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. Estimated combined tax rate 6.60%, estimated county tax rate 1.38%, estimated city tax rate 1.00%, estimated special tax rate 0.00% and vendor discount 0.02.

Quick Tax How-to Videos Kcmogov – City Of Kansas City Mo

2

2

Taxes And Spending In Nebraska

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Sales Tax Rates By City County 2021

2

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2

Local Use Tax Proposal – City Of Rogersville Mo

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

Sales Tax Rates In Major Cities Tax Data Tax Foundation

2

Missouri Car Sales Tax Calculator

Quick Tax How-to Videos Kcmogov – City Of Kansas City Mo

Riverside Missouri Mo 64150 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders