Property tax unclaimed refunds p.o. Riverside county annual property tax bills are mailed each year on or before november 1.

Office Of The Treasurer-tax Collector Message From Matthew Jennings

The riverside county tax collector is a state mandated function that is governed by the california revenue & taxation code, government code, and, the code of civil procedures.

Riverside county tax collector payment address. Do not enter ave, rd, cir, etc. Completed claim forms and supporting documentation should be emailed to proptaxunclaimed@rivco.org or mailed to the following address. 877.829.4732 | pay by phone:

4080 lemon street, 11th floor. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. The following types of payments will be accepted at this office:

Payments mailed to an address other than the address listed below, including any assessor office, that are received by the los angeles county tax collector after the delinquency date are delinquent and penalties will be imposed. They are a valuable tool for the real estate industry, offering both. Payments can be made by the following methods:

However, in the event that you do not retrieve or cannot view your tax bill, the tax collector will not be held liable. Los angeles county tax collector p.o. Tax collector, a treasurer & tax collector office, at lemon street, riverside ca.

Address, phone number, and fax number for county of riverside: Please search using one of the following methods, pin, property address or bill number. You will need your assessment number, which you can find on a previous year's tax bill, or the address of the property.

Debit card , credit card, personal checks, money orders and cashier's checks. Welcome to the riverside county property tax portal. Rcttc@rivco.org if available, please include the pin in your message.

The responsibility of paying your tax bill in a timely manner remains yours. The tax collector is responsible for the billing and collection of secured, unsecured, supplemental, transient occupancy tax as well as various other special assessments for the county, school. Office locations downtown riverside appointment only beginning 03/22/2021 desert office appointment only beginning 05/03/2021 temecula appointment only beginning 05/03/2021 :

They are maintained by various government offices in riverside county, california state, and at the federal level. [123 main] enter street number and name only. After entering your search, please scroll down for the results.

To add more items to your payment list, click last search results for the last assessment or new search for a new assessment. It is our hope that this directory will assist in locating the site.

Senior Management

Auditor-controllertreasurertax Collector County Of San Bernardino Countywire

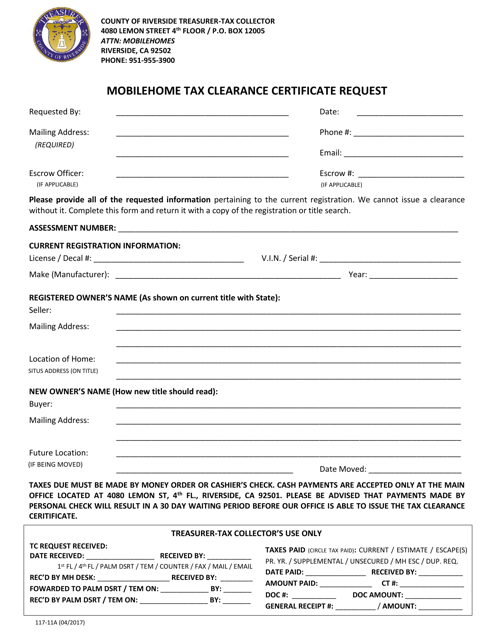

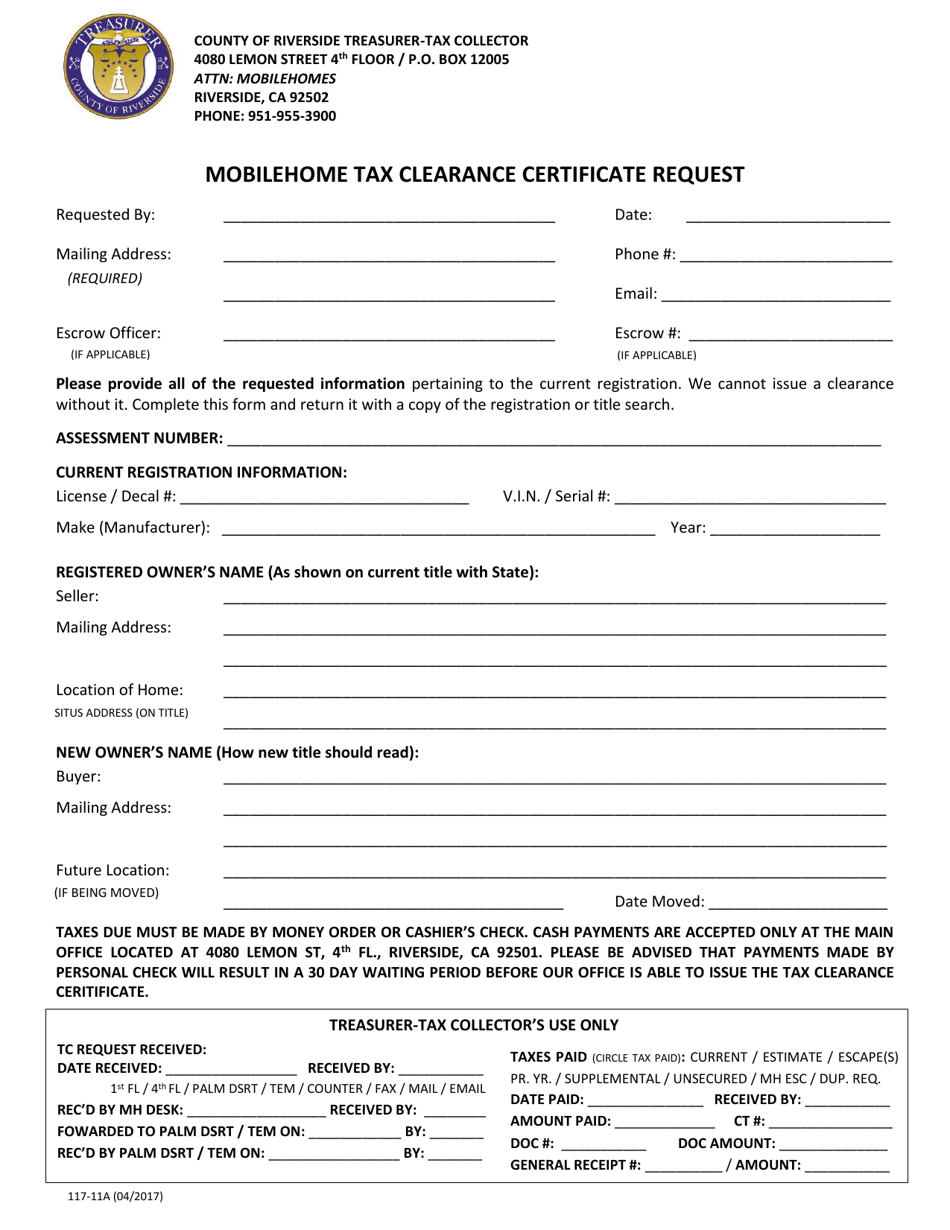

Form 117-11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

2

Form 117-11a Download Fillable Pdf Or Fill Online Mobilehome Tax Clearance Certificate Request Riverside County California Templateroller

Pay Your Property Taxes Treasurer And Tax Collector

The Cook County Property Tax System Cook County Assessors Office

Senior Management

Help – Taxsys – Osceola County Tax Collector

Bid4assets To Hold Tax-defaulted Property Online Auction On Behalf Of Riverside County Treasurer-tax Collectors Office Newswire

Pay Your Property Taxes Treasurer And Tax Collector

Property Tax Division

Understanding Californias Property Taxes

Tax Collector – Volusia County Motorist Services Locations

Senior Management

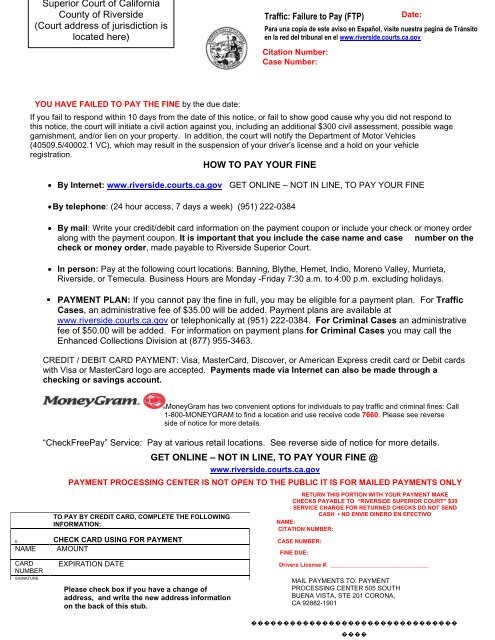

Failure To Pay Ftp – Superior Court Riverside

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments – County Of San Luis Obispo

San Bernardino County Auditor-controllertreasurertax Collector – Home Facebook

The Cook County Property Tax System Cook County Assessors Office